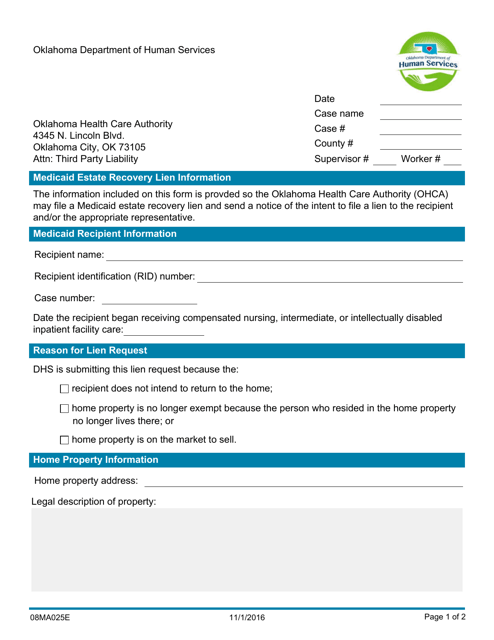

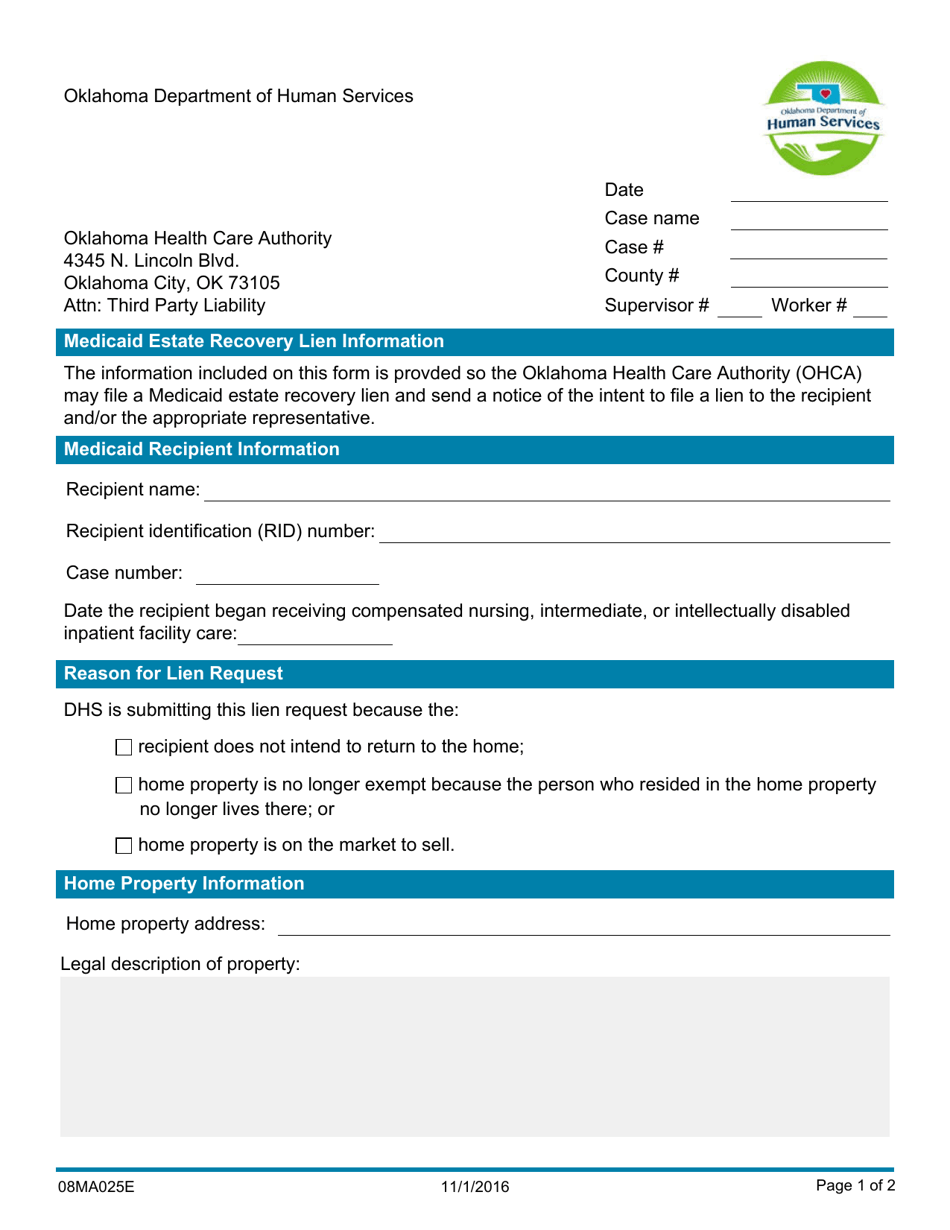

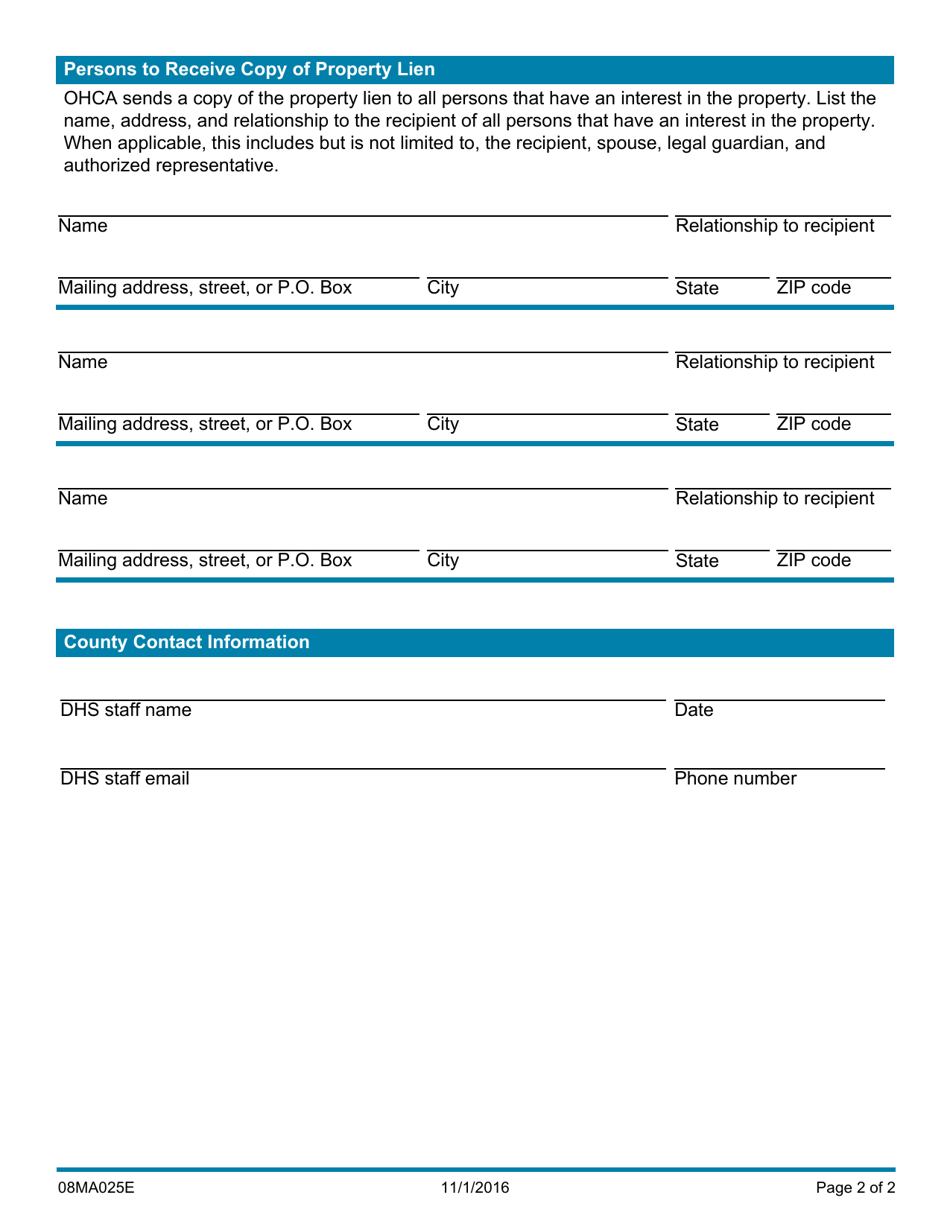

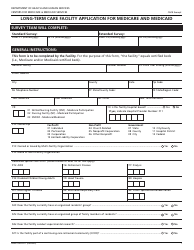

Form 08MA025E Medicaid Estate Recovery Lien Information - Oklahoma

What Is Form 08MA025E?

This is a legal form that was released by the Oklahoma Department of Human Services - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 08MA025E?

A: Form 08MA025E is a Medicaid Estate Recovery Lien Information form in Oklahoma.

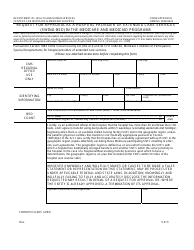

Q: What is Medicaid Estate Recovery?

A: Medicaid Estate Recovery is a process where states seek reimbursement for the costs of long-term care services provided to Medicaid recipients.

Q: What is a lien?

A: A lien is a legal claim on a property that allows the holder of the lien to obtain repayment when the property is sold or transferred.

Q: Why is the Medicaid Estate Recovery Lien Information form required?

A: The form is required to determine if a Medicaid recipient has any assets that may be subject to recovery by the state.

Q: Who needs to complete Form 08MA025E?

A: The form needs to be completed by the representative of the deceased Medicaid recipient's estate.

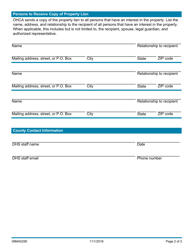

Q: What information is needed to complete the form?

A: The form requires information about the Medicaid recipient, the deceased person, and their assets.

Q: What happens after the form is submitted?

A: Once the form is submitted, the Oklahoma Health Care Authority will review the information and determine if a recovery lien should be placed on the estate.

Q: Can the estate avoid Medicaid Estate Recovery?

A: There are certain situations where the estate may be exempt from Medicaid Estate Recovery, such as if there is a surviving spouse or a dependent child.

Q: Is Medicaid Estate Recovery the same in every state?

A: No, each state has its own rules and procedures regarding Medicaid Estate Recovery, so it's important to understand the specific rules in Oklahoma.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Oklahoma Department of Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 08MA025E by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Human Services.