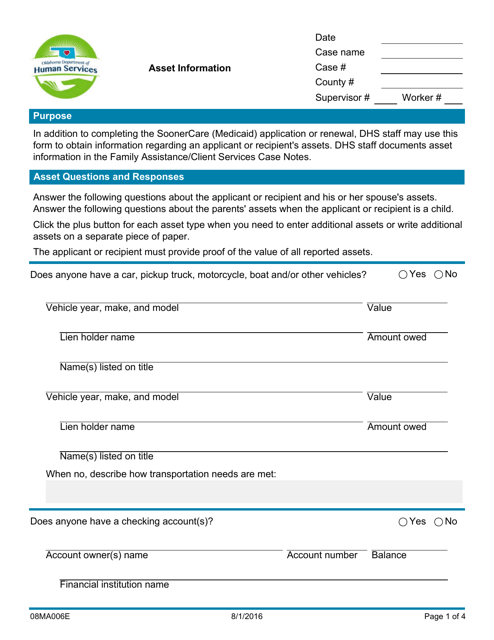

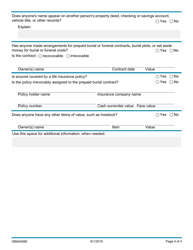

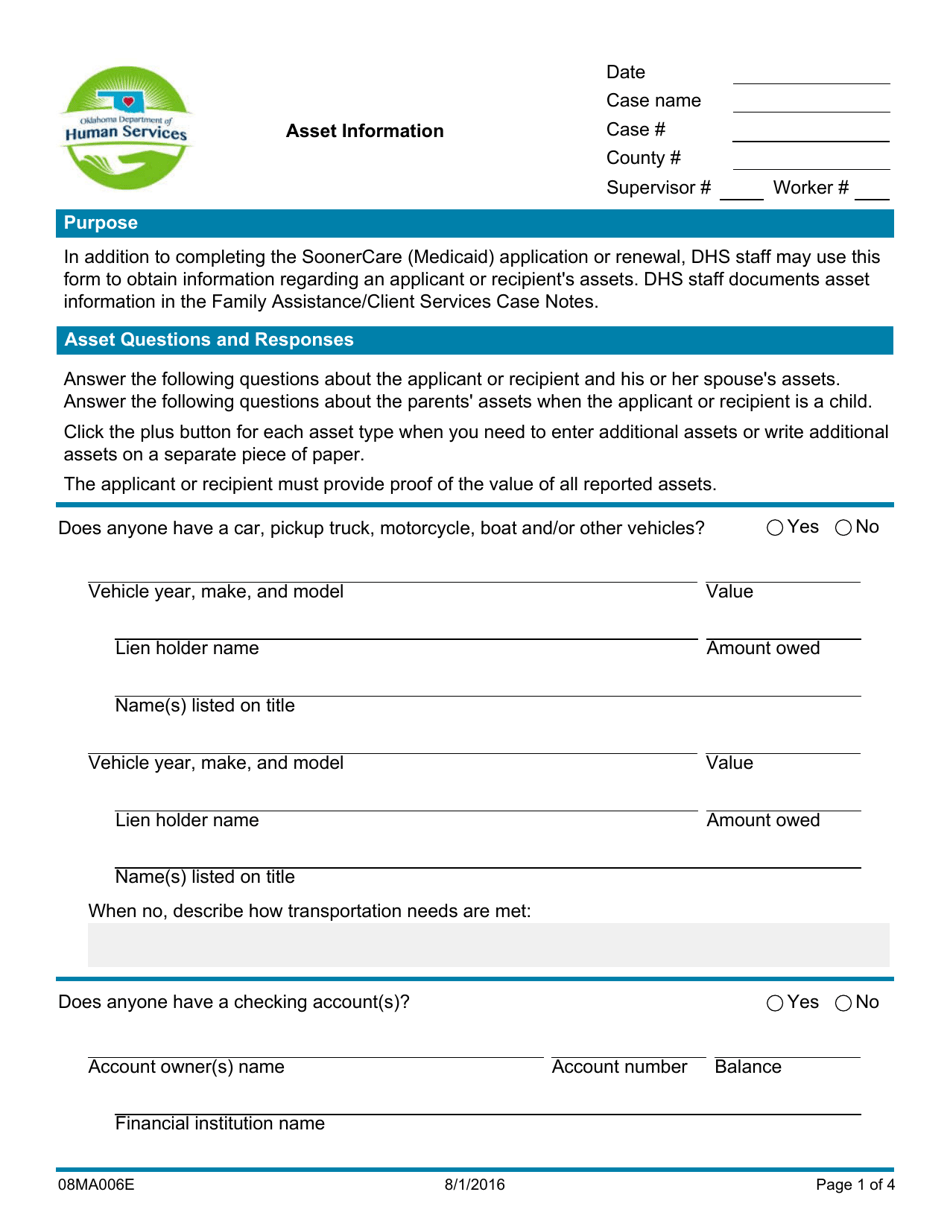

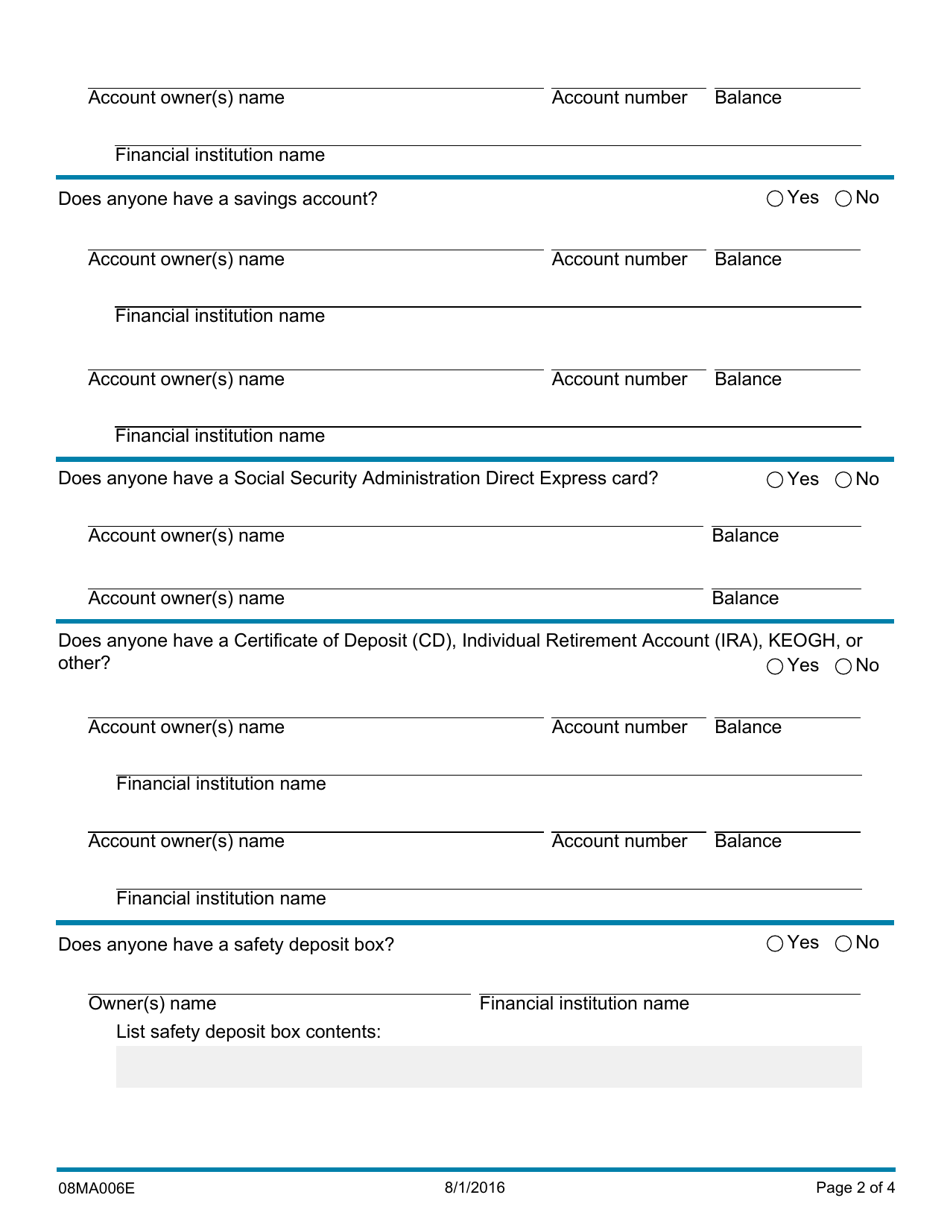

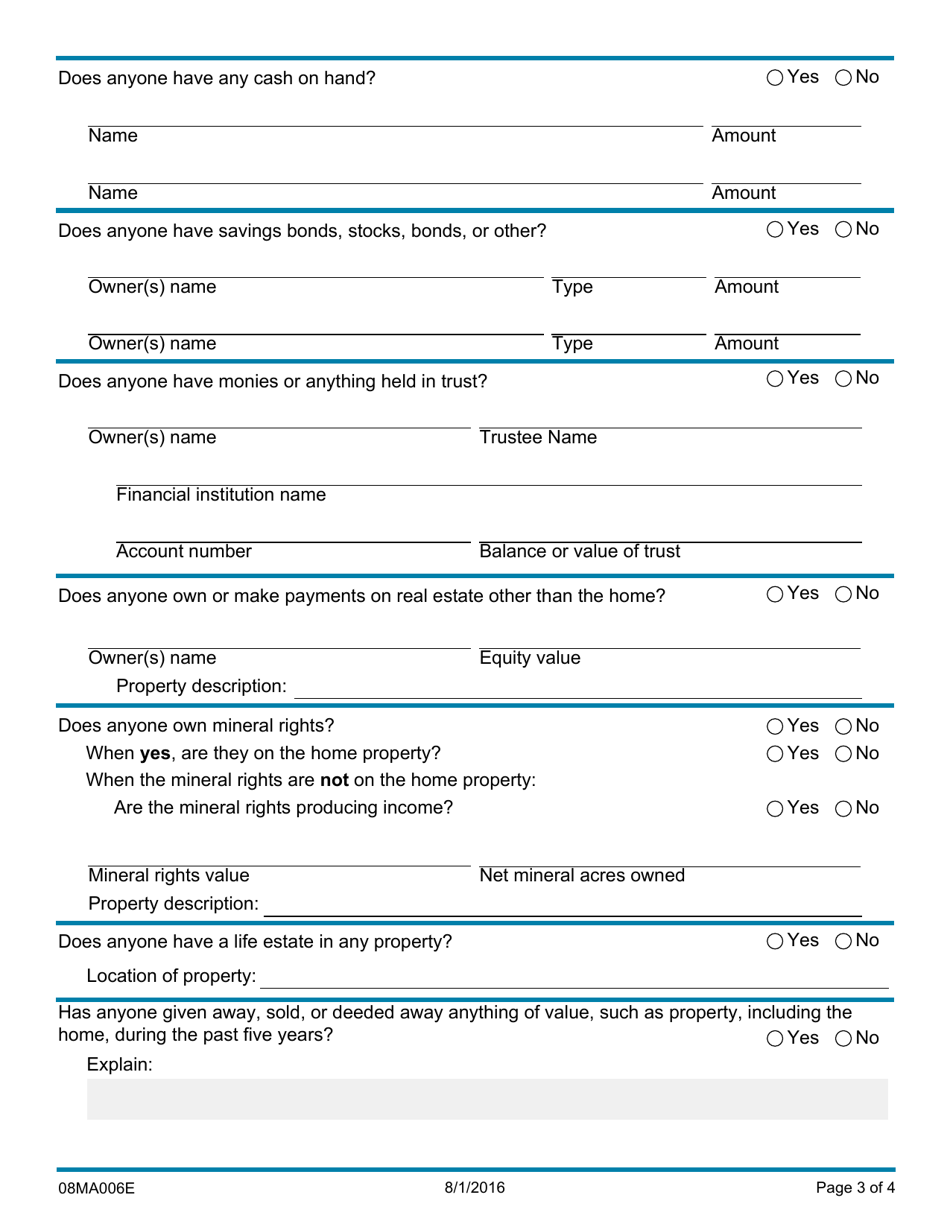

Form 08MA006E Asset Information - Oklahoma

What Is Form 08MA006E?

This is a legal form that was released by the Oklahoma Department of Human Services - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 08MA006E?

A: Form 08MA006E is a document for Asset Information in Oklahoma.

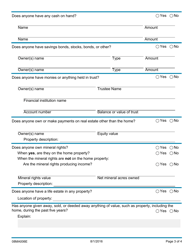

Q: Who needs to fill out Form 08MA006E?

A: Any individual or business entity that owns assets in Oklahoma needs to fill out Form 08MA006E.

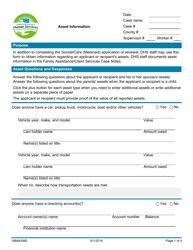

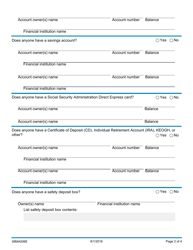

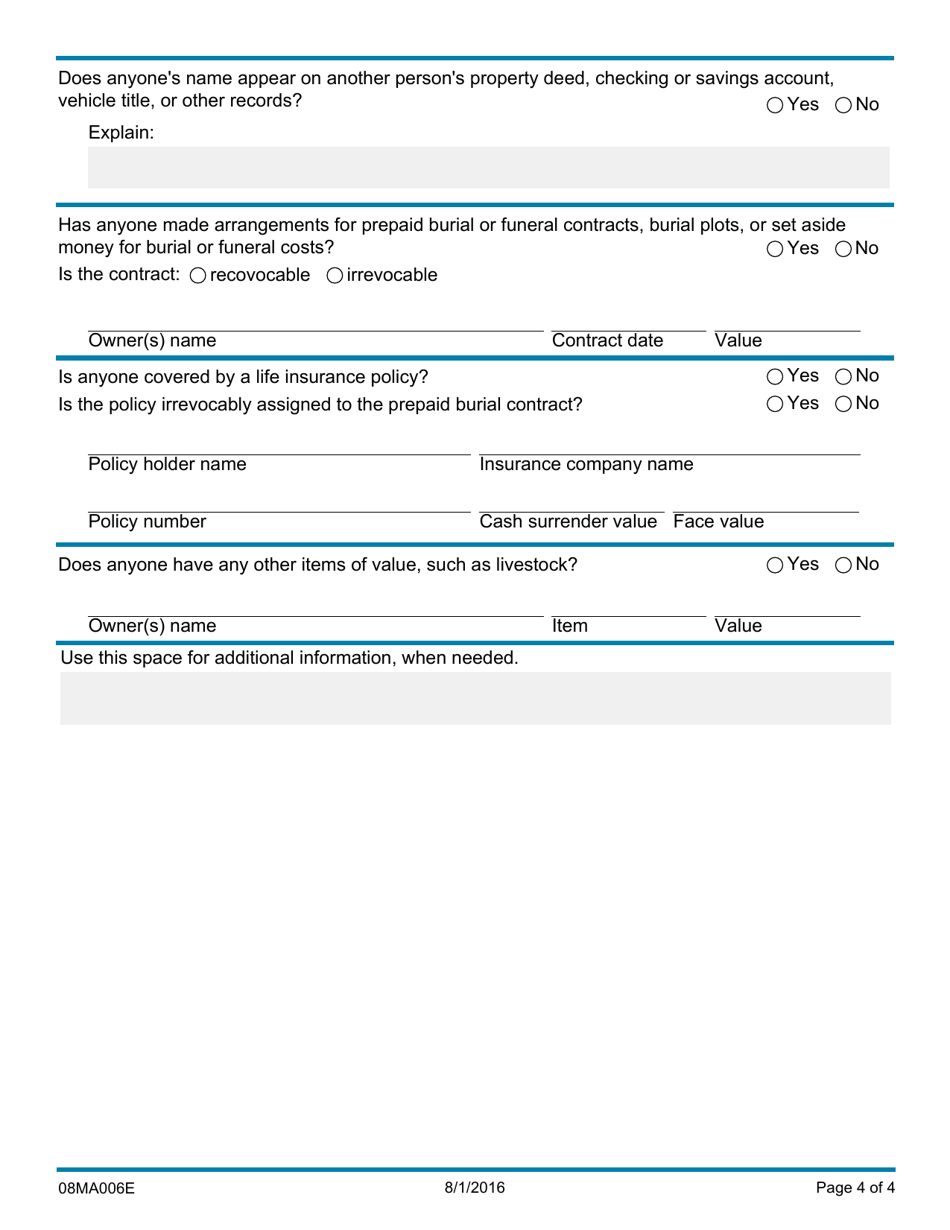

Q: What kind of assets are included in Form 08MA006E?

A: Form 08MA006E includes various types of assets such as real estate, vehicles, boats, aircraft, and livestock.

Q: Why is it important to fill out Form 08MA006E?

A: Filling out Form 08MA006E is important to provide accurate information about assets owned in Oklahoma for tax and assessment purposes.

Q: When is Form 08MA006E due?

A: The due date for Form 08MA006E varies depending on the county, but it is usually due on or before March 15th each year.

Q: Are there any penalties for not filling out Form 08MA006E?

A: Yes, there can be penalties for not filling out Form 08MA006E, including fines and potential legal consequences.

Q: Can I amend Form 08MA006E?

A: Yes, you can amend Form 08MA006E if there are any changes or corrections to the asset information provided.

Q: Who can help me with filling out Form 08MA006E?

A: You can seek assistance from a tax professional or contact the local county assessor's office for help with filling out Form 08MA006E.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Oklahoma Department of Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 08MA006E by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Human Services.