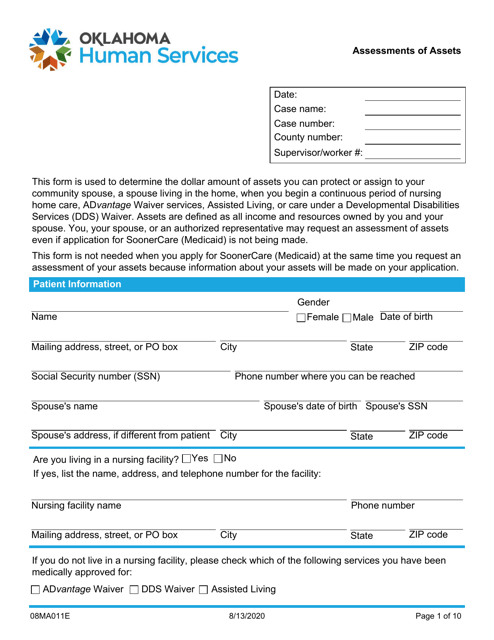

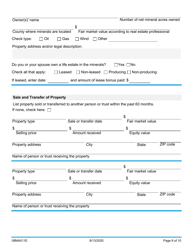

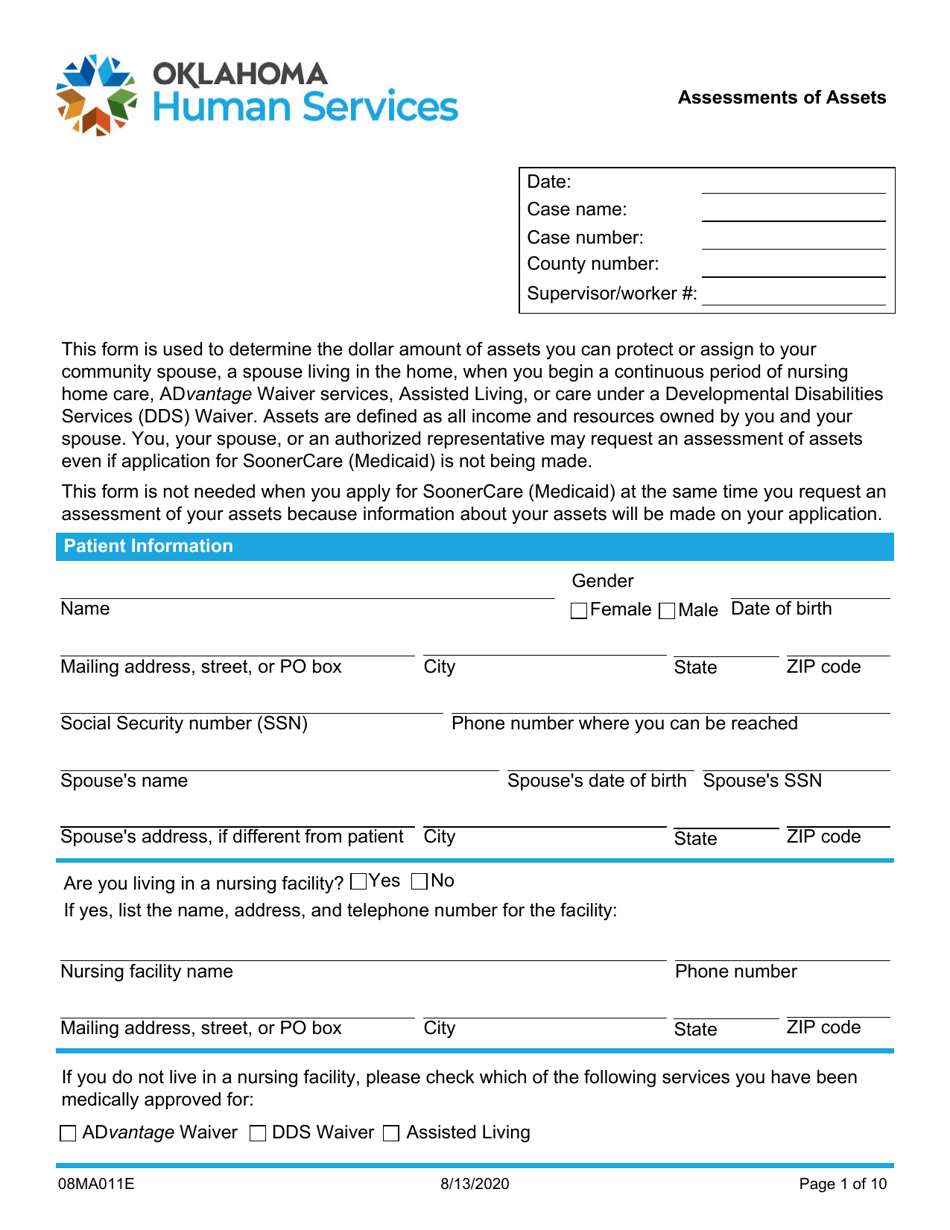

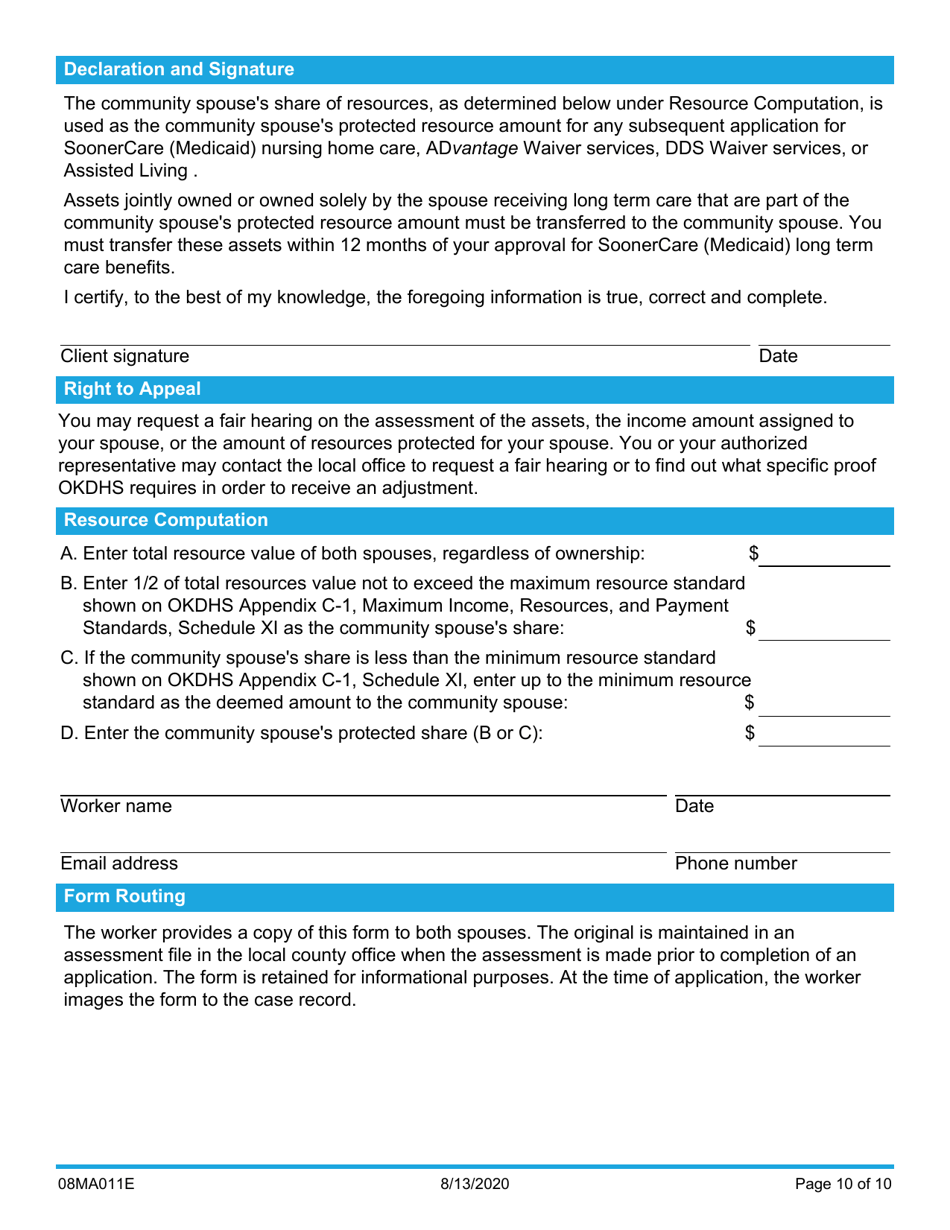

Form 08MA011E Assessment of Assets - Oklahoma

What Is Form 08MA011E?

This is a legal form that was released by the Oklahoma Department of Human Services - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 08MA011E?

A: Form 08MA011E is an Assessment of Assets form for the state of Oklahoma.

Q: Who needs to fill out Form 08MA011E?

A: Property owners in Oklahoma may be required to fill out this form to assess their assets.

Q: What is the purpose of Form 08MA011E?

A: The purpose of Form 08MA011E is to assess the value of assets for tax purposes in Oklahoma.

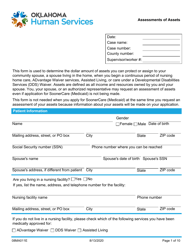

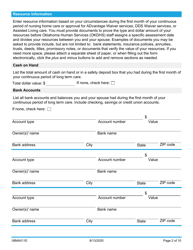

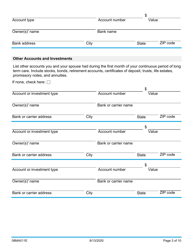

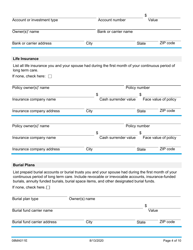

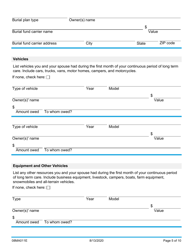

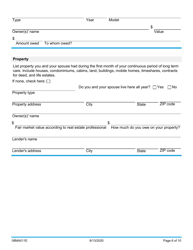

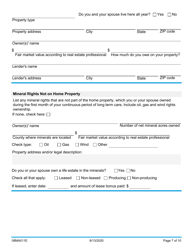

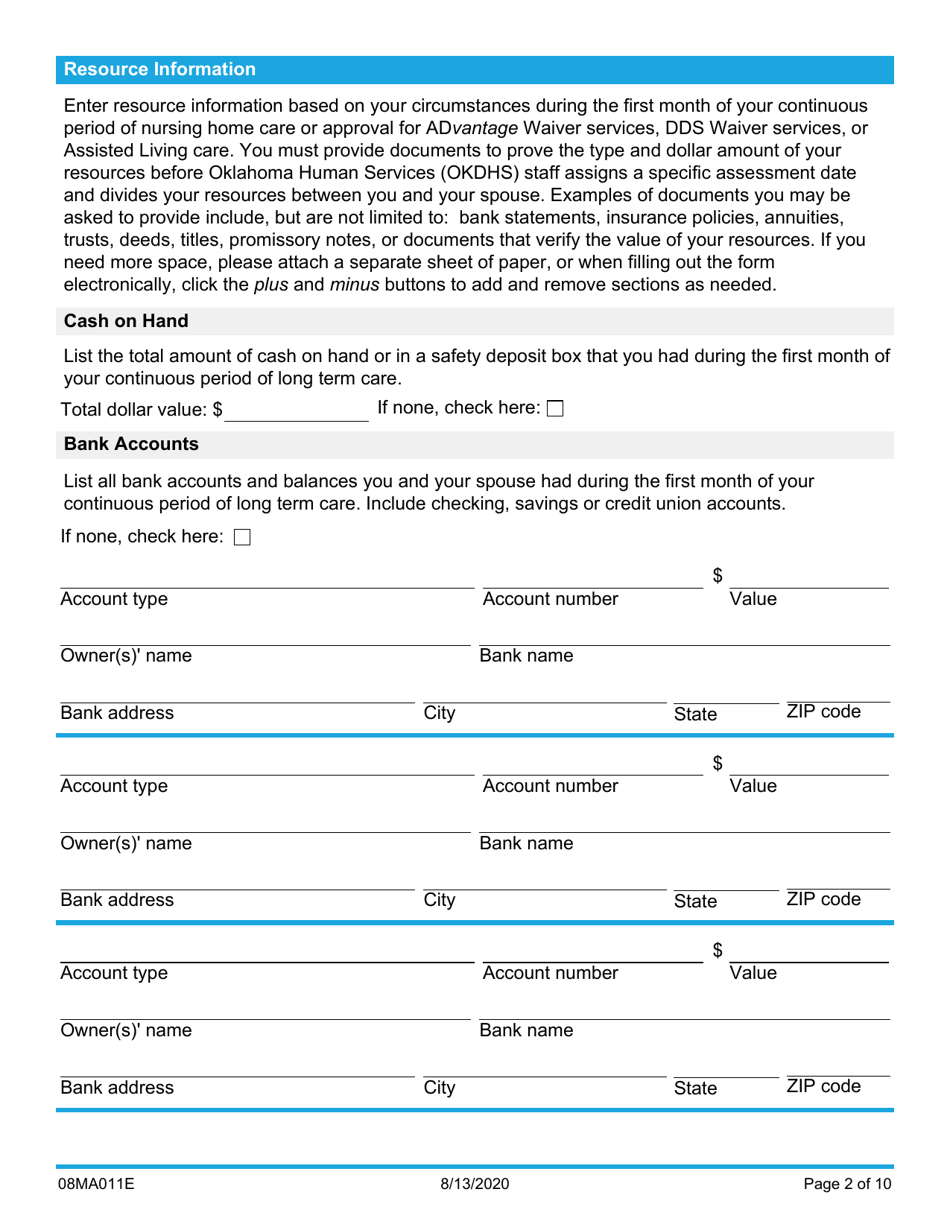

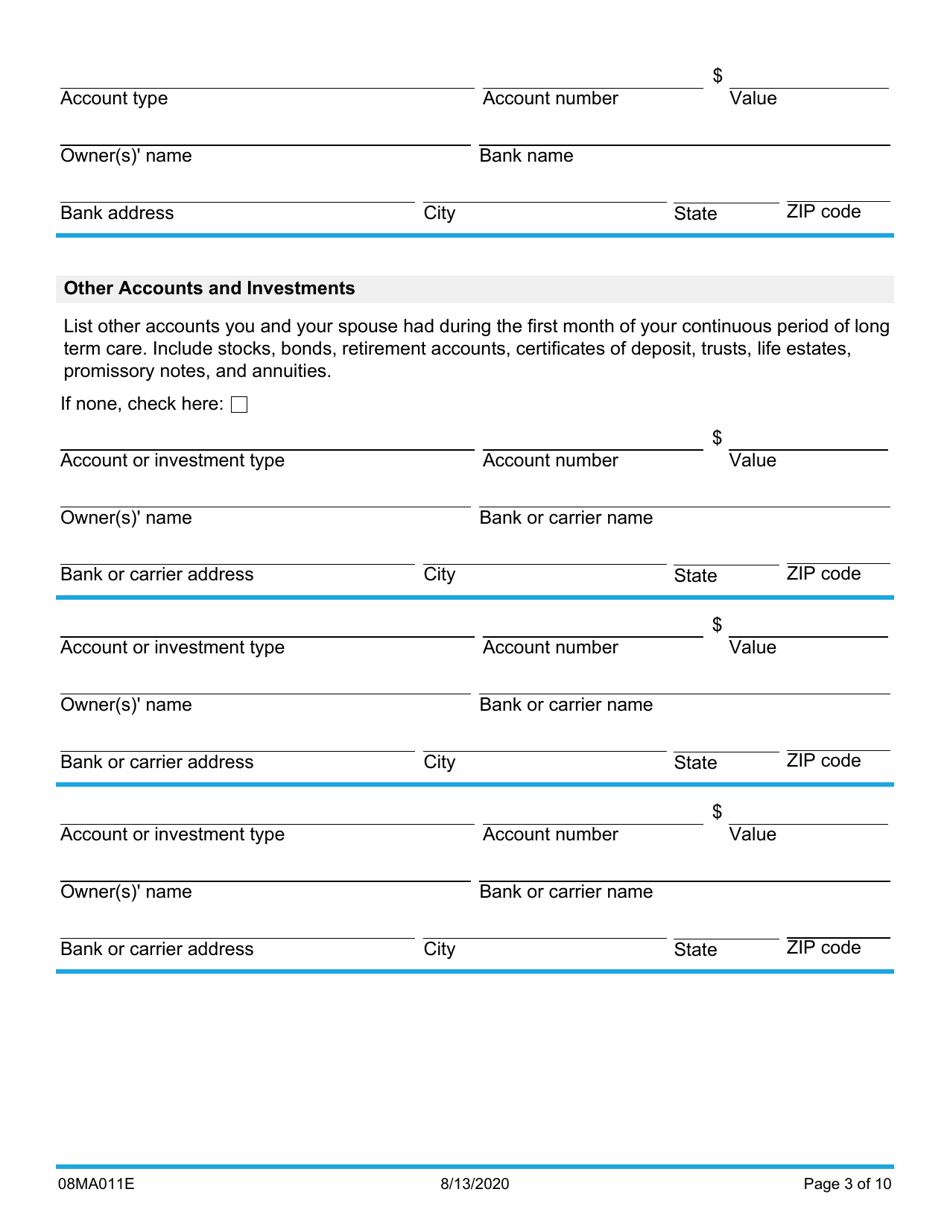

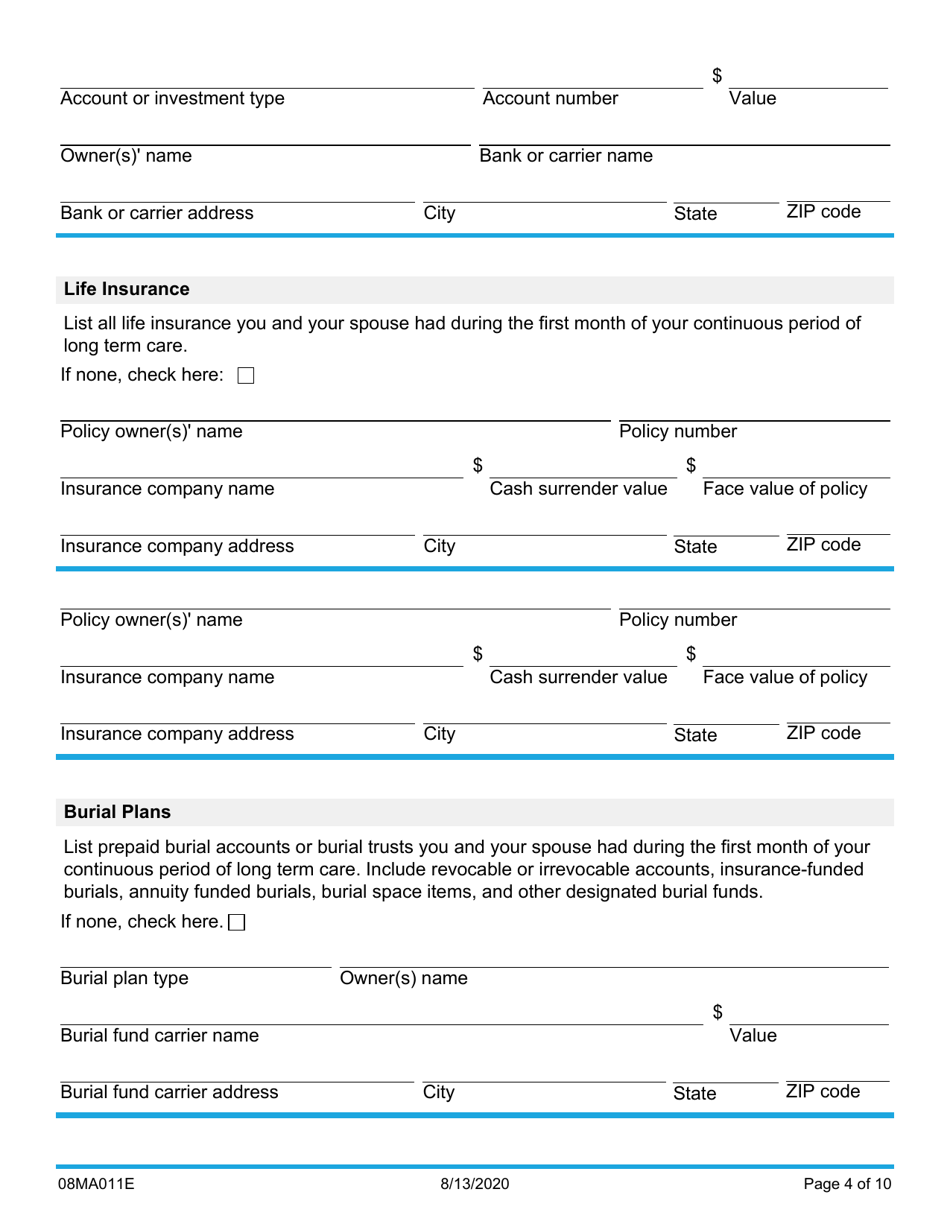

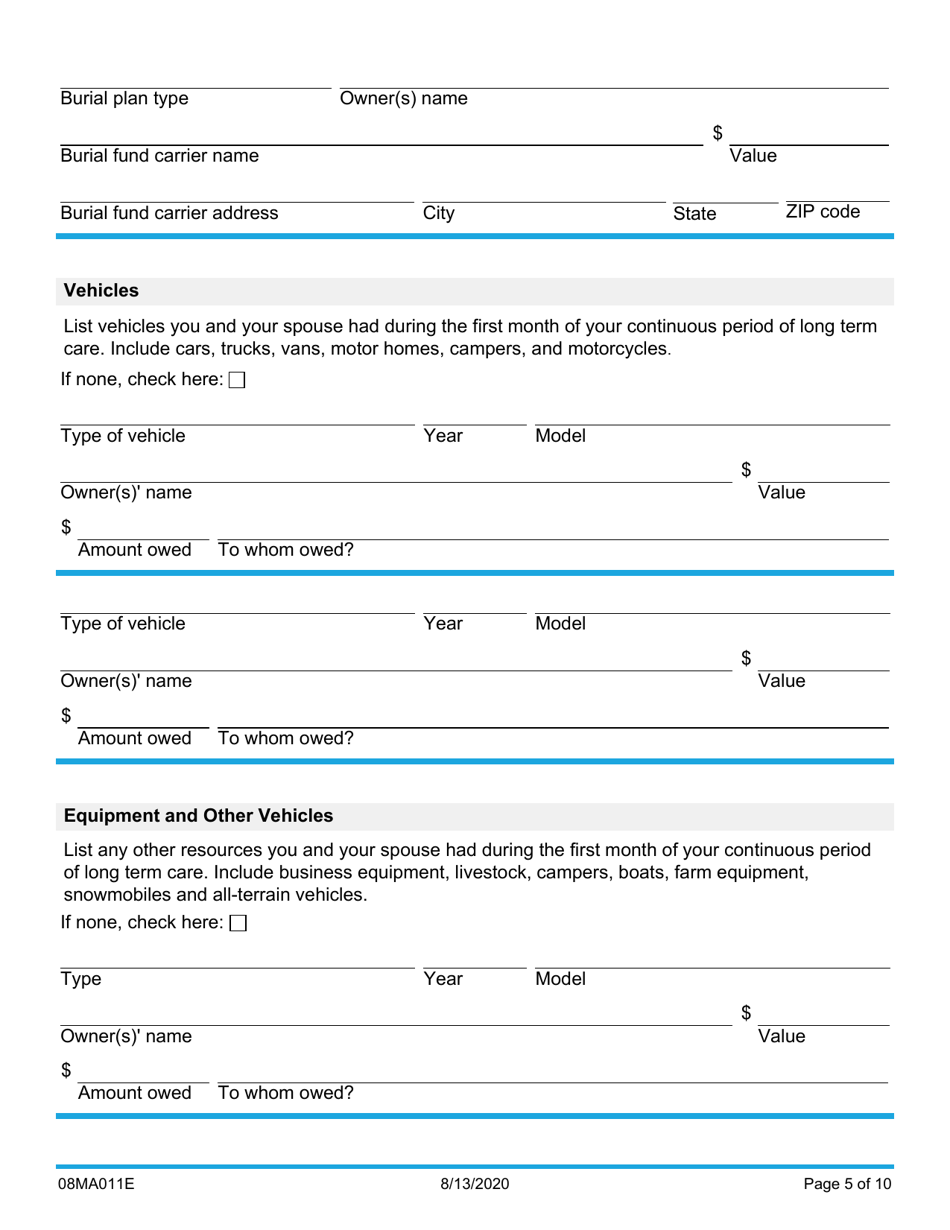

Q: What information is required on Form 08MA011E?

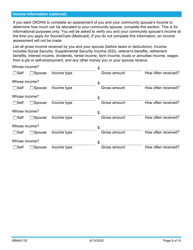

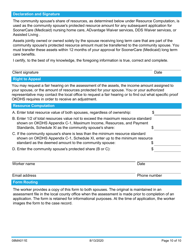

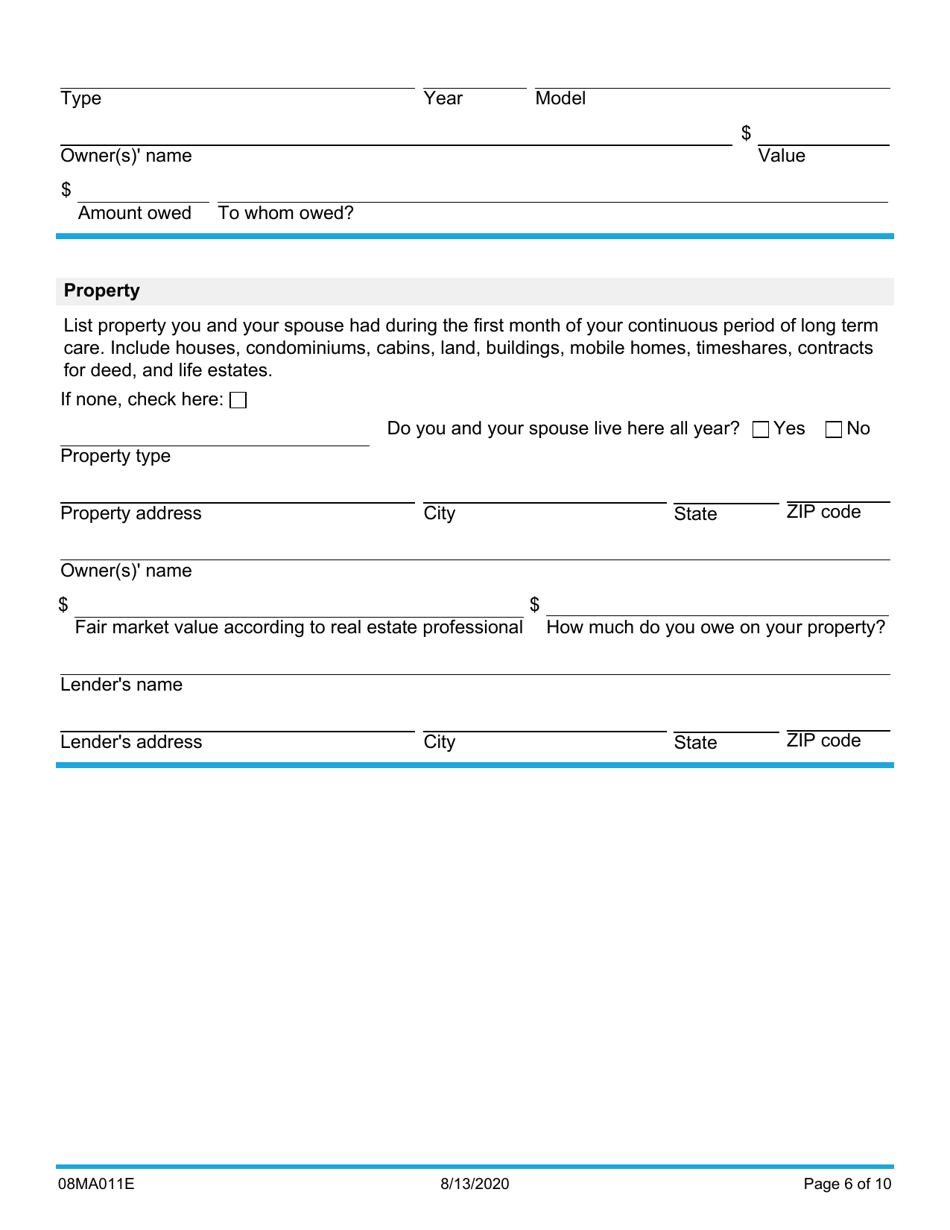

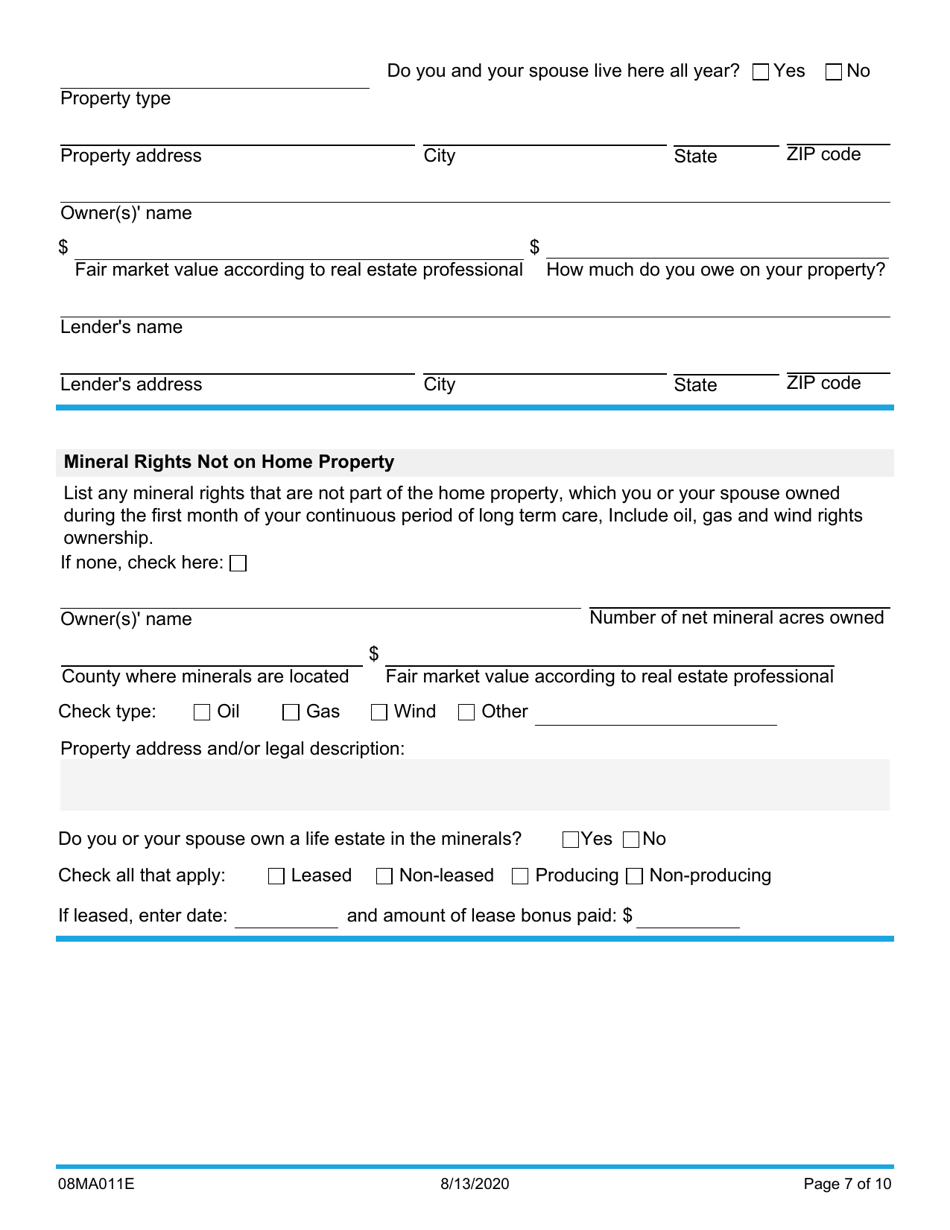

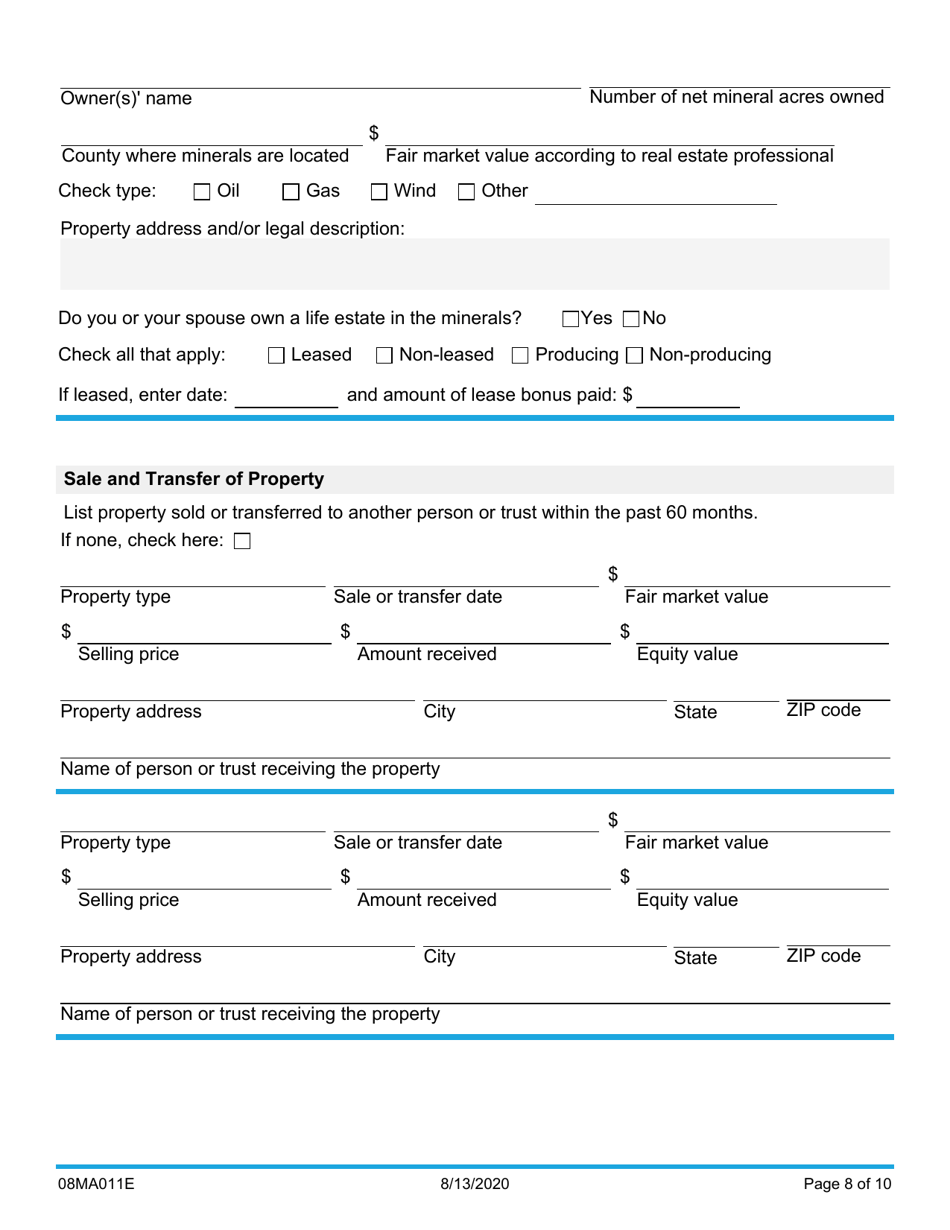

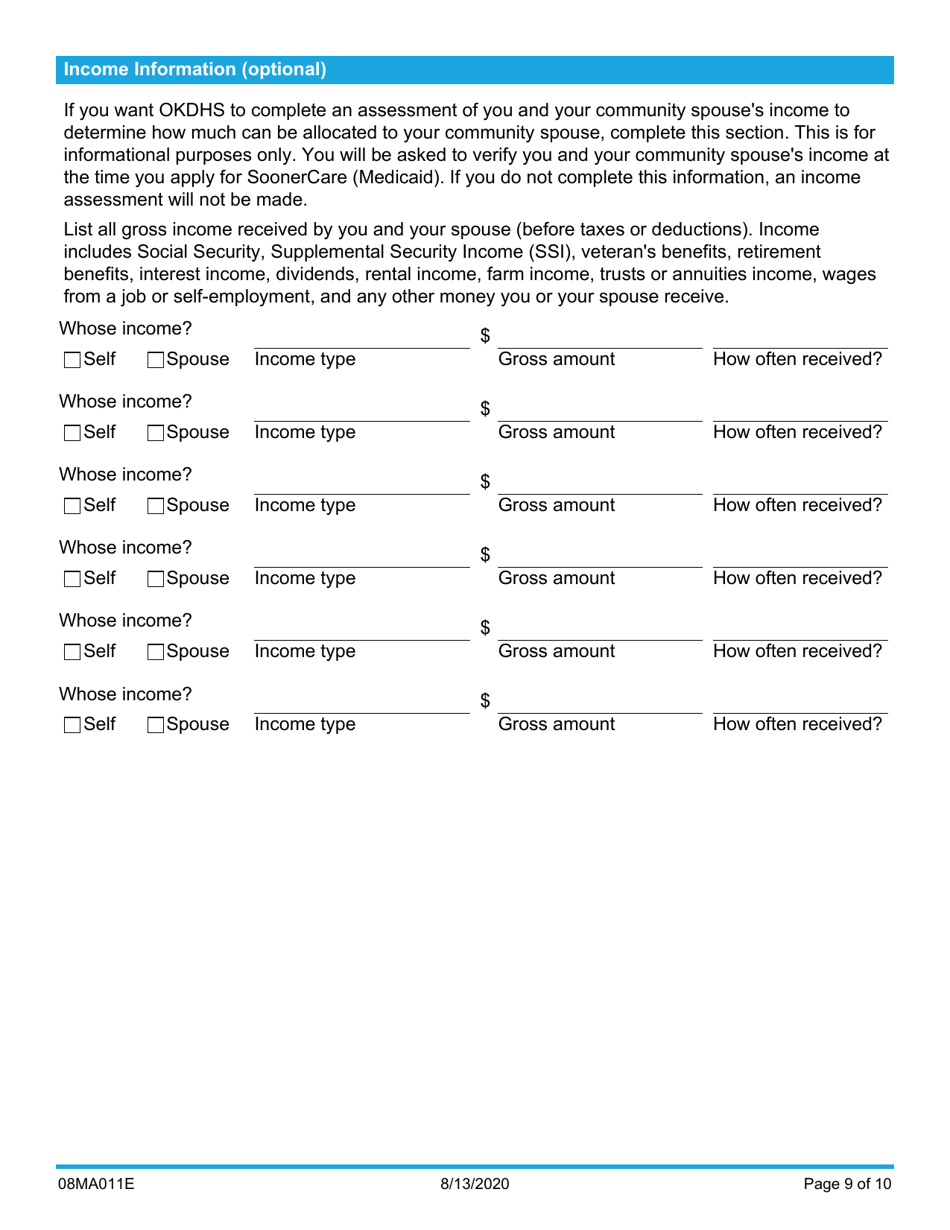

A: Form 08MA011E requires information about your assets, such as real estate, vehicles, and personal property.

Q: When is Form 08MA011E due?

A: Form 08MA011E is typically due by March 15th each year in Oklahoma.

Q: What happens if I don't fill out Form 08MA011E?

A: Failure to fill out Form 08MA011E may result in penalties or additional taxes.

Q: Are there any exemptions or deductions on Form 08MA011E?

A: Yes, there may be exemptions or deductions available for certain types of assets on Form 08MA011E. Consult the instructions for more information.

Form Details:

- Released on August 13, 2020;

- The latest edition provided by the Oklahoma Department of Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 08MA011E by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Human Services.