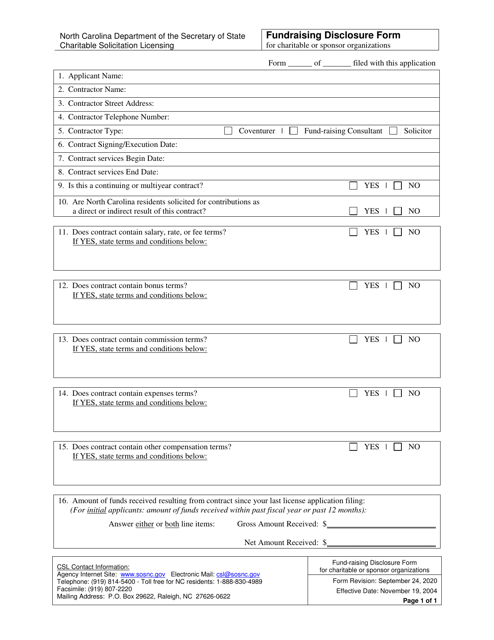

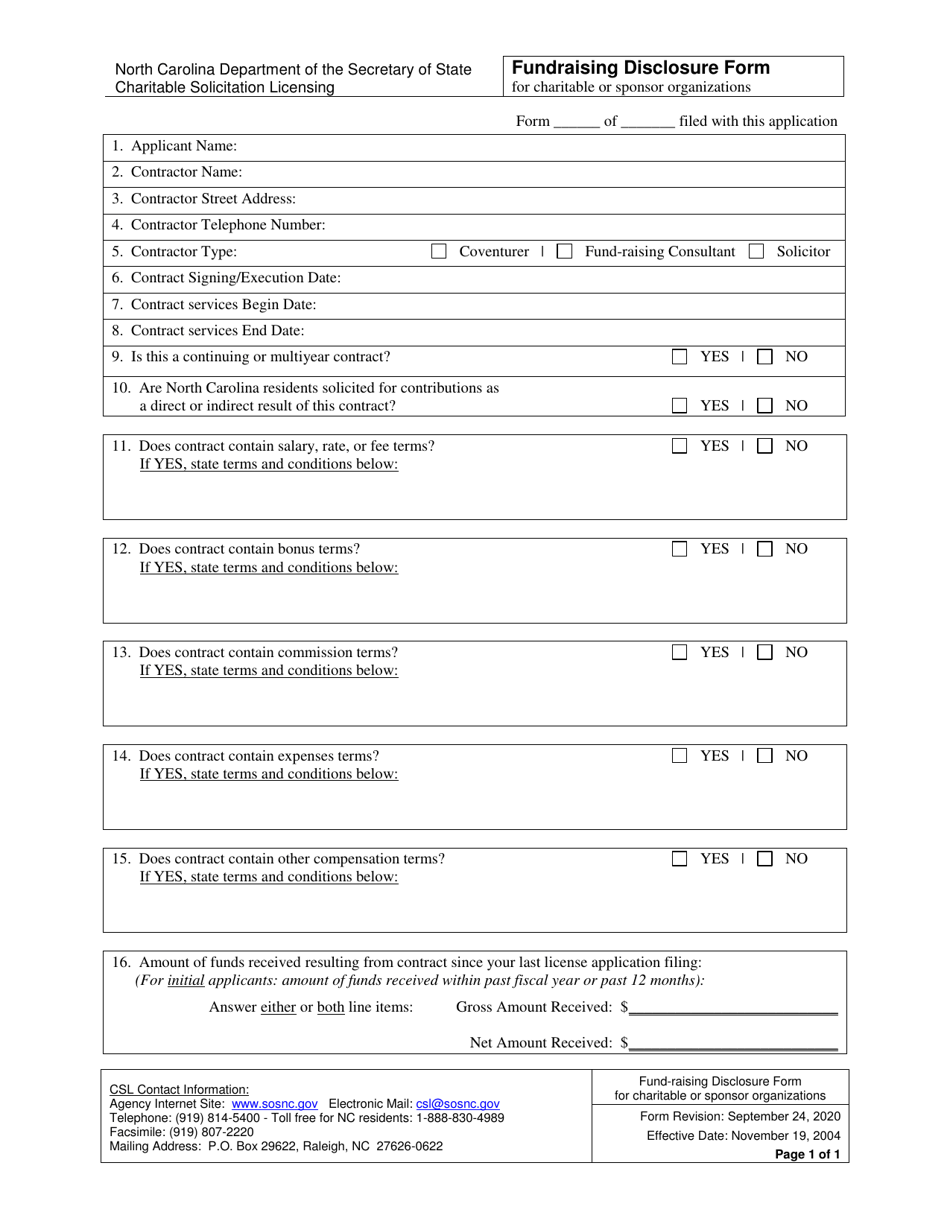

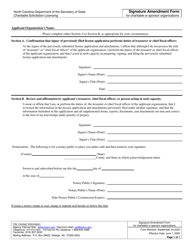

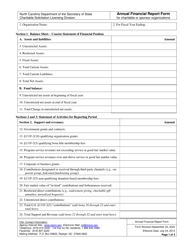

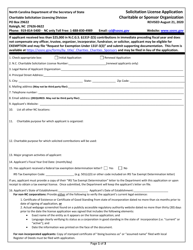

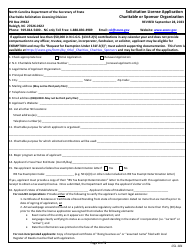

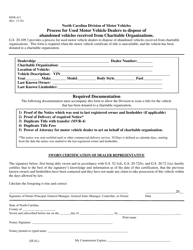

Fundraising Disclosure Form for Charitable or Sponsor Organizations - North Carolina

Fundraising Disclosure Form for Charitable or Sponsor Organizations is a legal document that was released by the North Carolina Secretary of State - a government authority operating within North Carolina.

FAQ

Q: What is a fundraising disclosure form?

A: A fundraising disclosure form is a document required by North Carolina law for charitable or sponsor organizations that engage in fundraising activities.

Q: Who needs to file a fundraising disclosure form in North Carolina?

A: Charitable or sponsor organizations that engage in fundraising activities need to file a fundraising disclosure form in North Carolina.

Q: What information is typically included in a fundraising disclosure form?

A: A fundraising disclosure form typically includes information about the organization, its purpose, financial statements, fundraising activities, and any fees or charges associated with the fundraising.

Q: Why is a fundraising disclosure form required?

A: A fundraising disclosure form is required to ensure transparency and accountability in fundraising activities and to protect donors from potential fraudulent or misleading practices.

Q: Are there any penalties for not filing a fundraising disclosure form in North Carolina?

A: Yes, there may be penalties for not filing a fundraising disclosure form in North Carolina, including fines and potential loss of fundraising privileges.

Q: Is there a deadline for filing a fundraising disclosure form in North Carolina?

A: Yes, there is a deadline for filing a fundraising disclosure form in North Carolina, typically within a specified period after the end of the organization's fiscal year.

Q: What happens after I file a fundraising disclosure form in North Carolina?

A: After filing a fundraising disclosure form in North Carolina, the information will be reviewed by the Charitable Solicitation Licensing Division and may be made available to the public.

Q: Are there any exemptions from filing a fundraising disclosure form in North Carolina?

A: Yes, certain religious, educational, and governmental organizations may be exempt from filing a fundraising disclosure form in North Carolina. However, it is recommended to check with the Charitable Solicitation Licensing Division for specific exemption criteria.

Form Details:

- Released on September 24, 2020;

- The latest edition currently provided by the North Carolina Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Secretary of State.