This version of the form is not currently in use and is provided for reference only. Download this version of

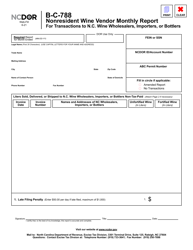

Form B-C-784

for the current year.

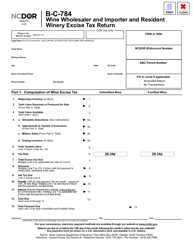

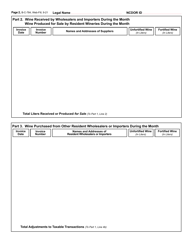

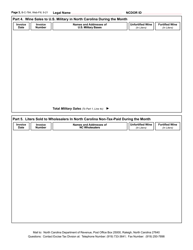

Form B-C-784 Wine Wholesaler and Importer and Resident Winery Excise Tax Return - North Carolina

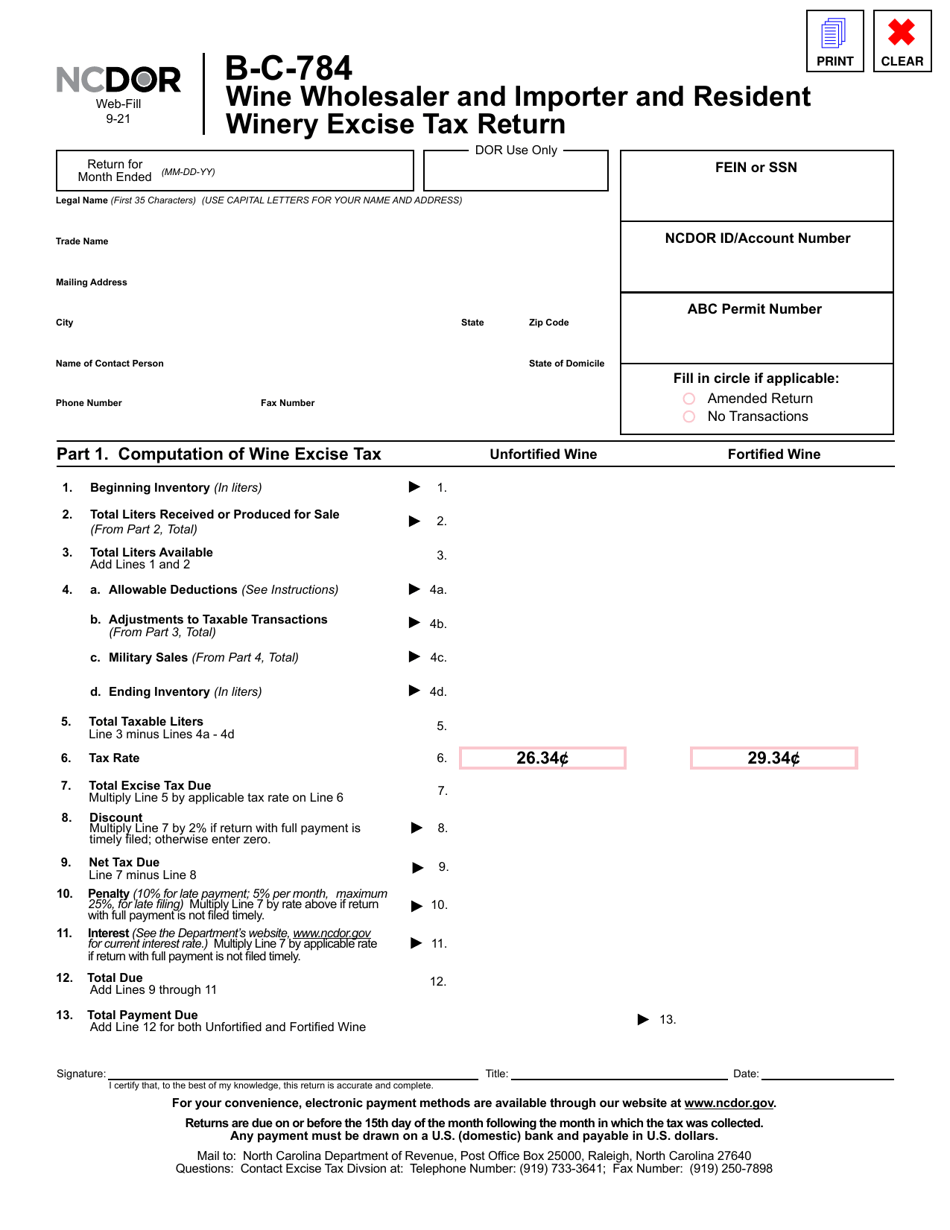

What Is Form B-C-784?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form B-C-784?

A: Form B-C-784 is the Wine Wholesaler and Importer and Resident Winery Excise Tax Return for North Carolina.

Q: Who needs to file Form B-C-784?

A: Wine wholesalers, importers, and resident wineries in North Carolina need to file Form B-C-784.

Q: What is the purpose of Form B-C-784?

A: The purpose of Form B-C-784 is to report and pay excise taxes on wine sales in North Carolina.

Q: When is the deadline for filing Form B-C-784?

A: The deadline for filing Form B-C-784 is the 20th day of the month following the close of the reporting period.

Q: Are there any penalties for late filing of Form B-C-784?

A: Yes, there are penalties for late filing of Form B-C-784, including interest charges and possible license revocation.

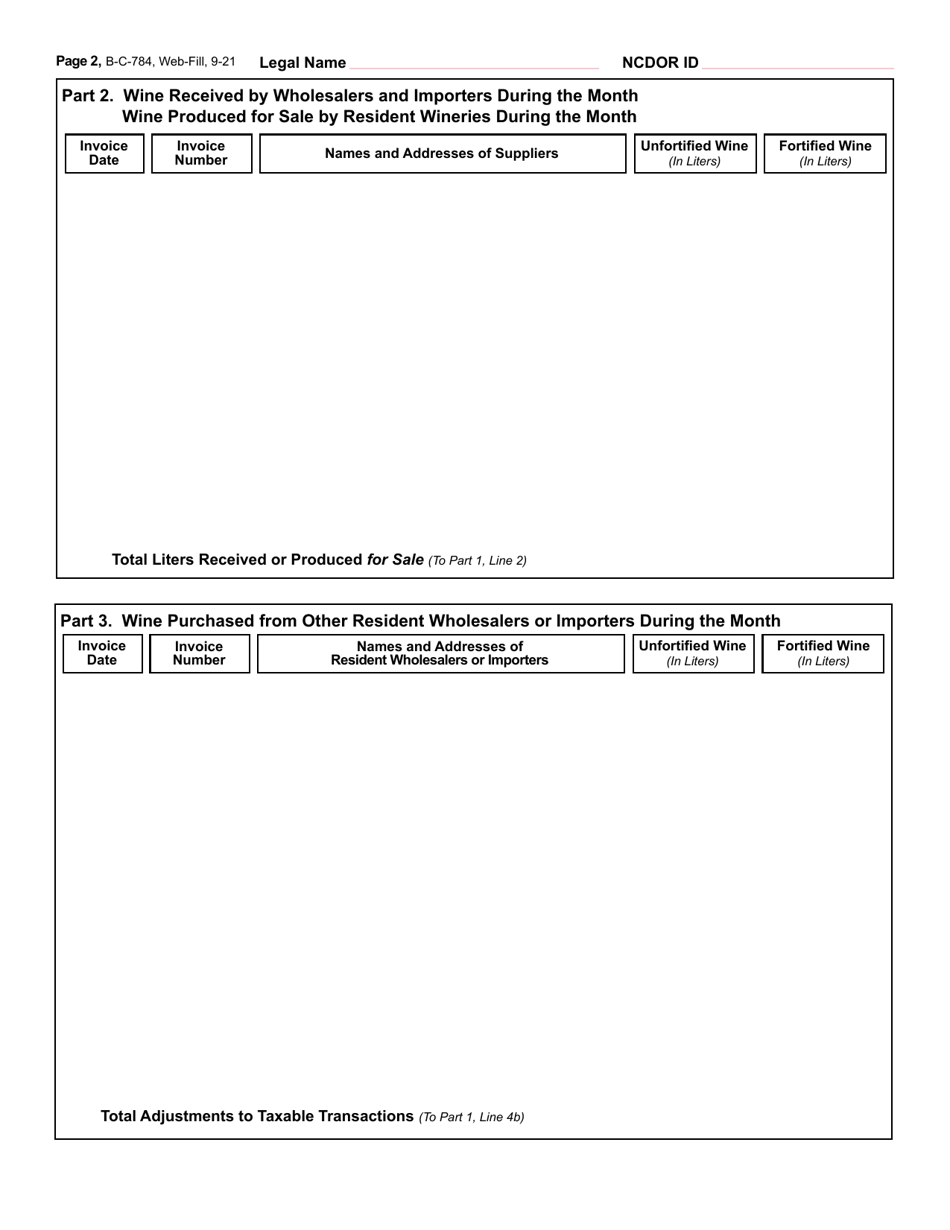

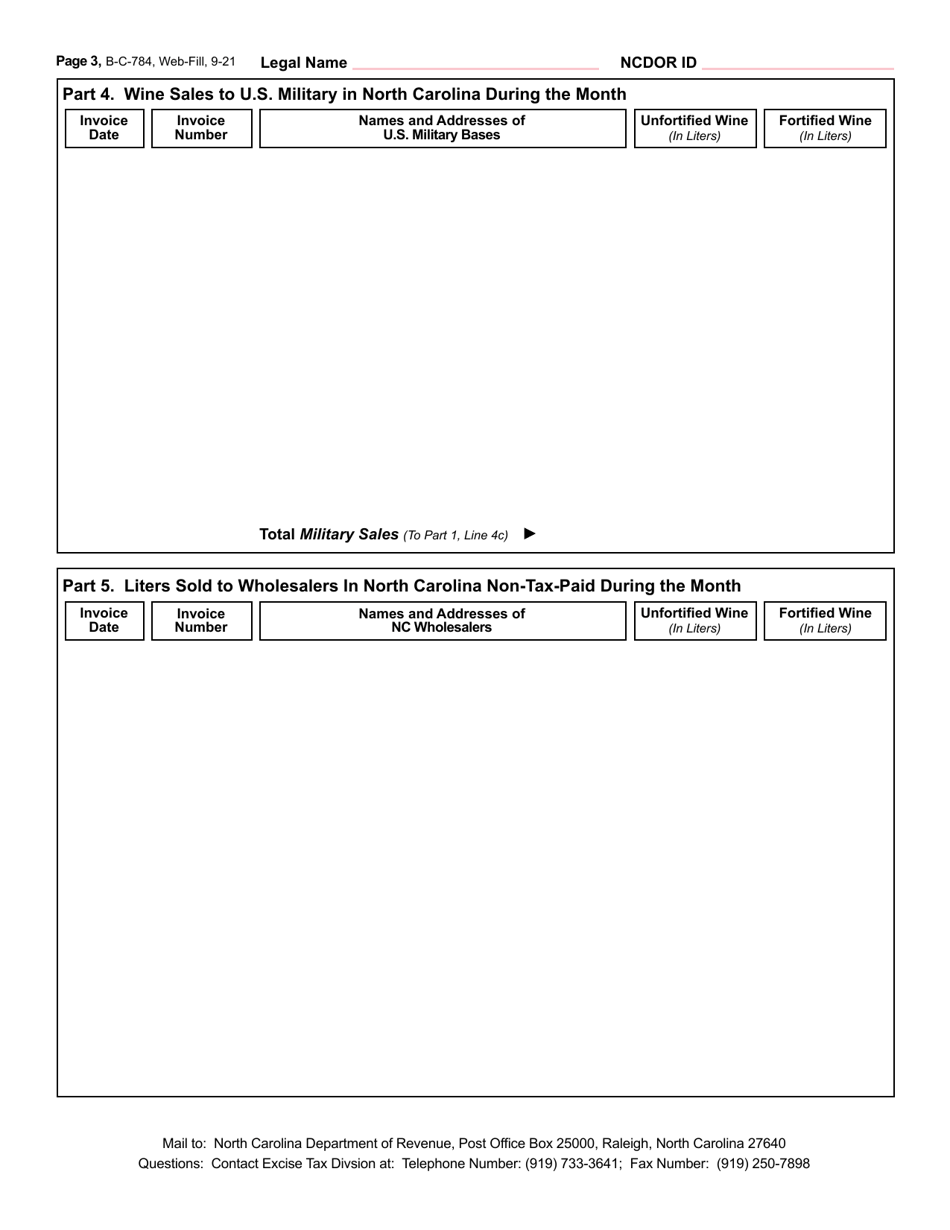

Q: What information do I need to complete Form B-C-784?

A: To complete Form B-C-784, you will need information about your wine sales, excise tax owed, and any credits or deductions applicable to your business.

Q: Can I amend a previously filed Form B-C-784?

A: Yes, you can amend a previously filed Form B-C-784 by filing a corrected version of the form with the North Carolina Department of Revenue.

Form Details:

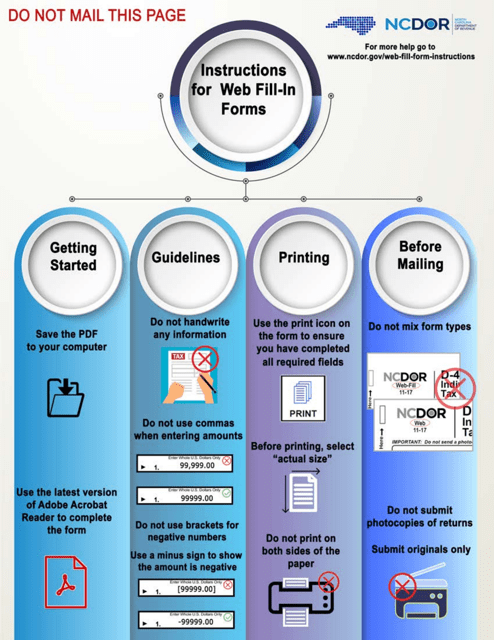

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

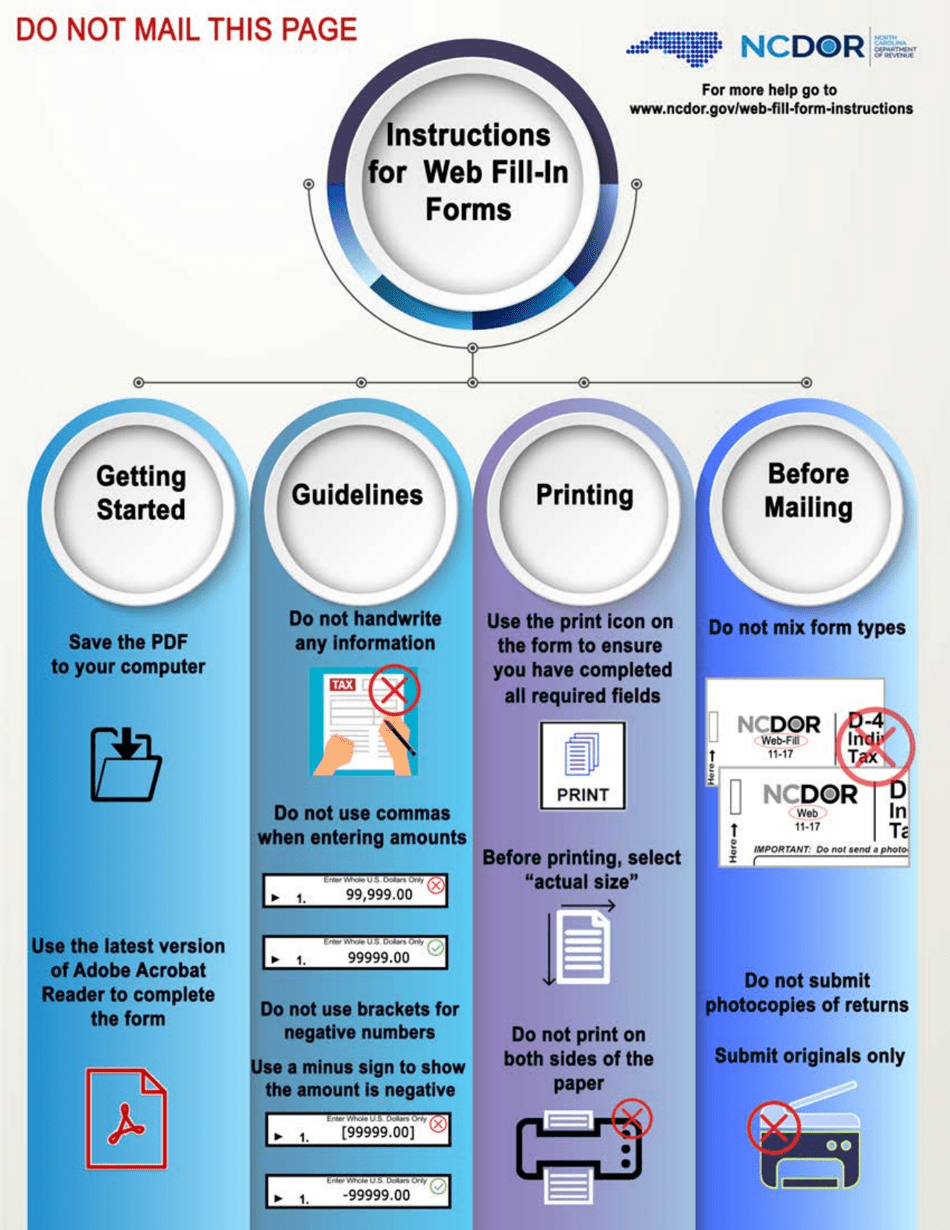

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-C-784 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.