This version of the form is not currently in use and is provided for reference only. Download this version of

Form B-C-710

for the current year.

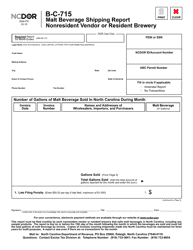

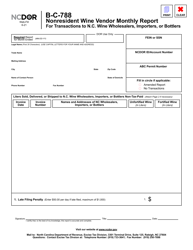

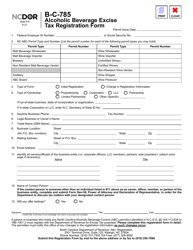

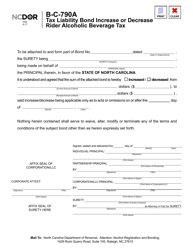

Form B-C-710 Malt Beverages Wholesaler and Importer and Resident Brewery Excise Tax Return - North Carolina

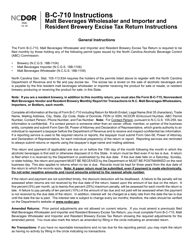

What Is Form B-C-710?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

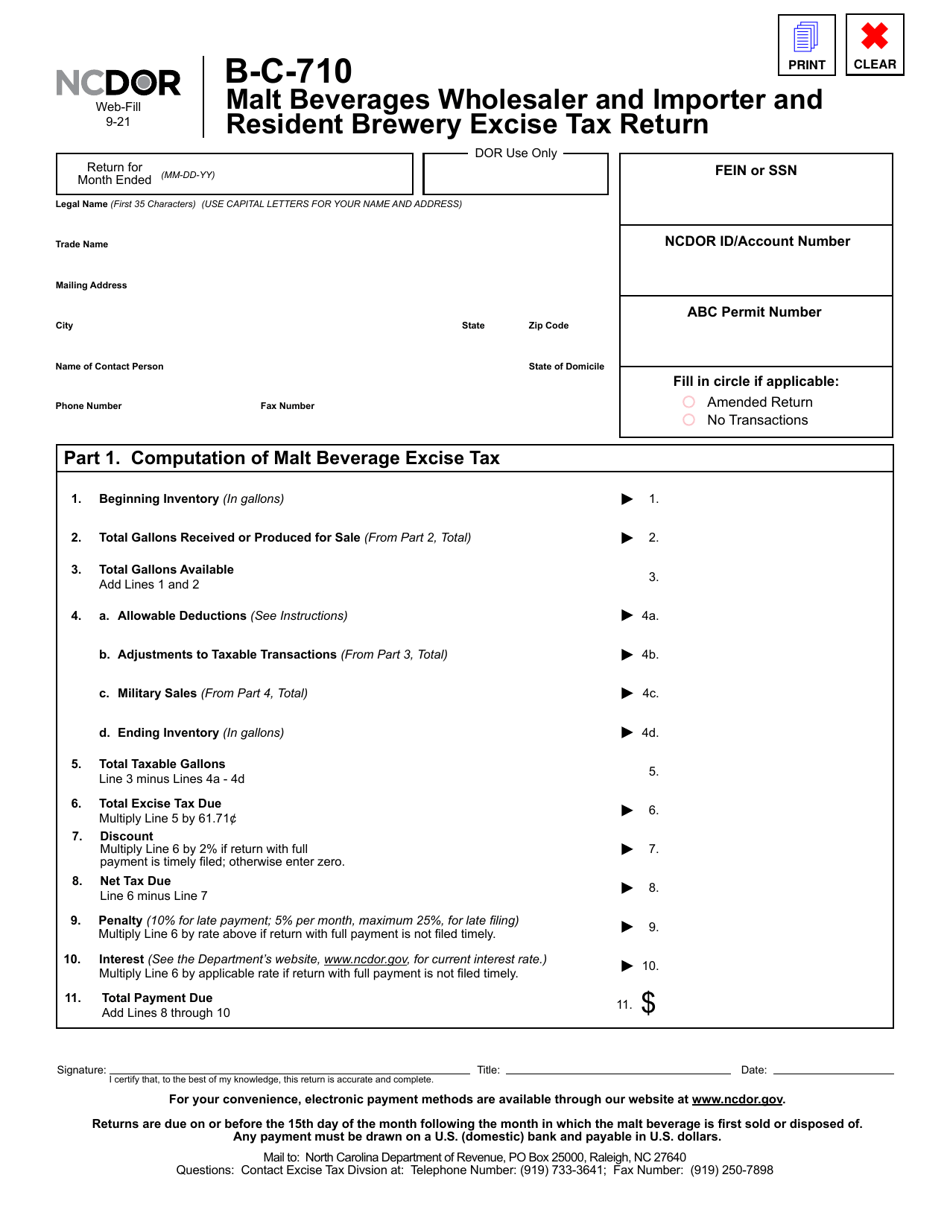

Q: What is Form B-C-710?

A: Form B-C-710 is a tax return form for malt beverages wholesalers, importers, and resident breweries in North Carolina.

Q: Who needs to file Form B-C-710?

A: Malt beverages wholesalers, importers, and resident breweries in North Carolina need to file Form B-C-710.

Q: What is the purpose of Form B-C-710?

A: The purpose of Form B-C-710 is to report and pay excise taxes on malt beverages in North Carolina.

Q: How often do I need to file Form B-C-710?

A: Form B-C-710 needs to be filed monthly by malt beverages wholesalers, importers, and resident breweries.

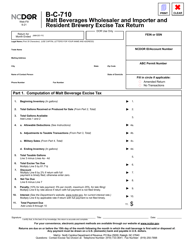

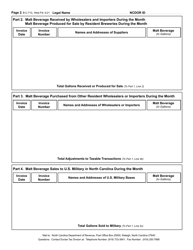

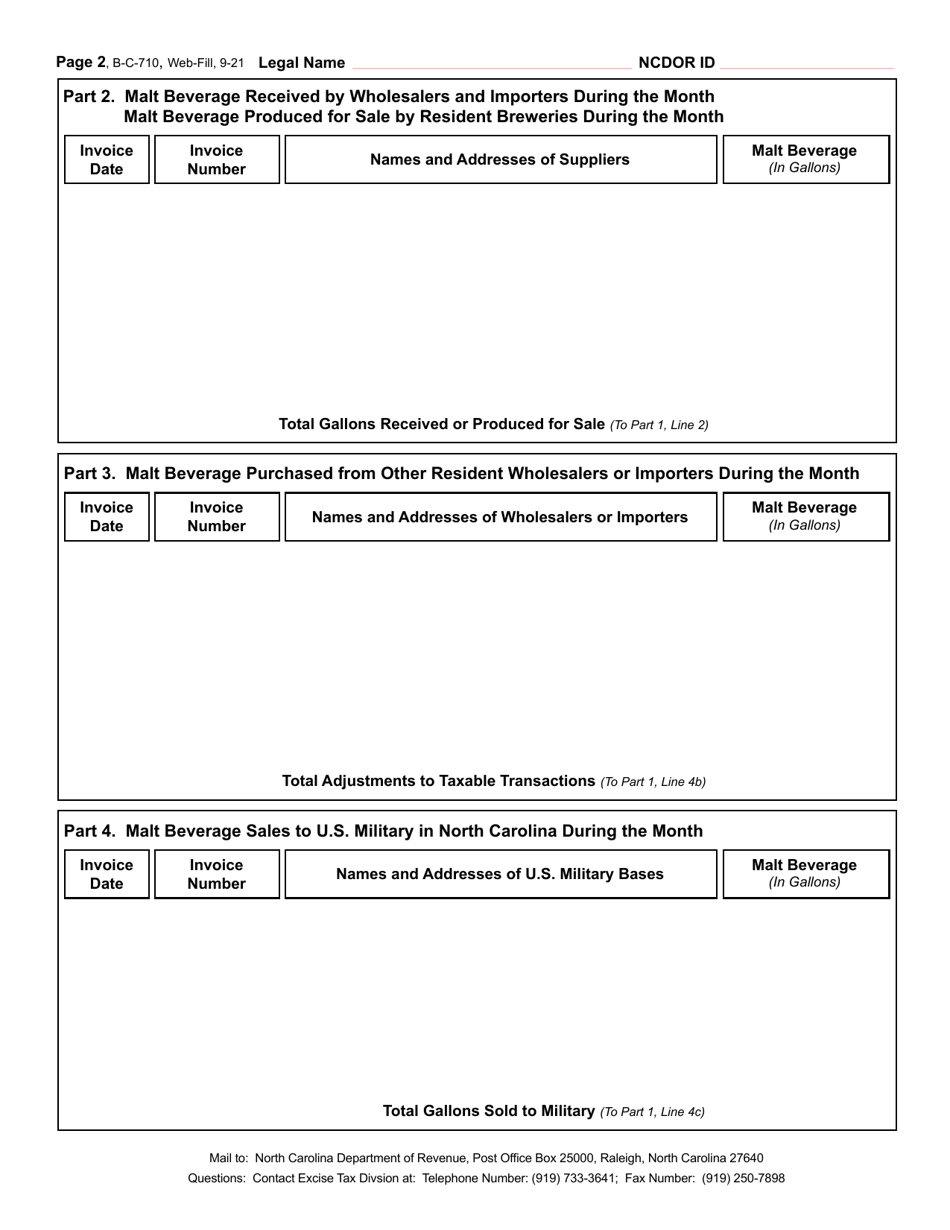

Q: What information do I need to provide on Form B-C-710?

A: You need to provide information about the quantity and value of malt beverages sold or imported, and calculate the applicable excise tax.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

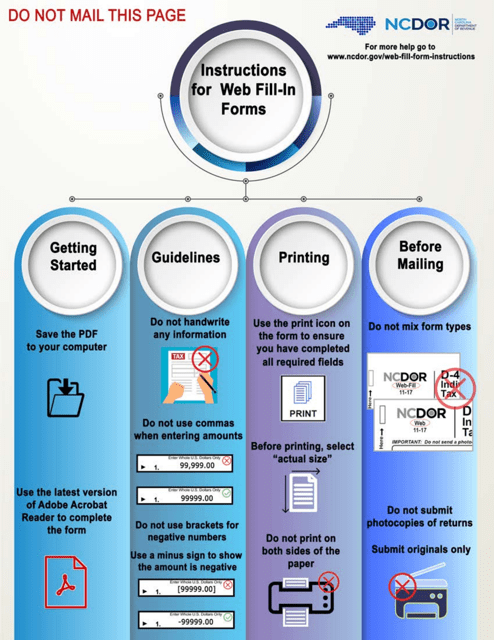

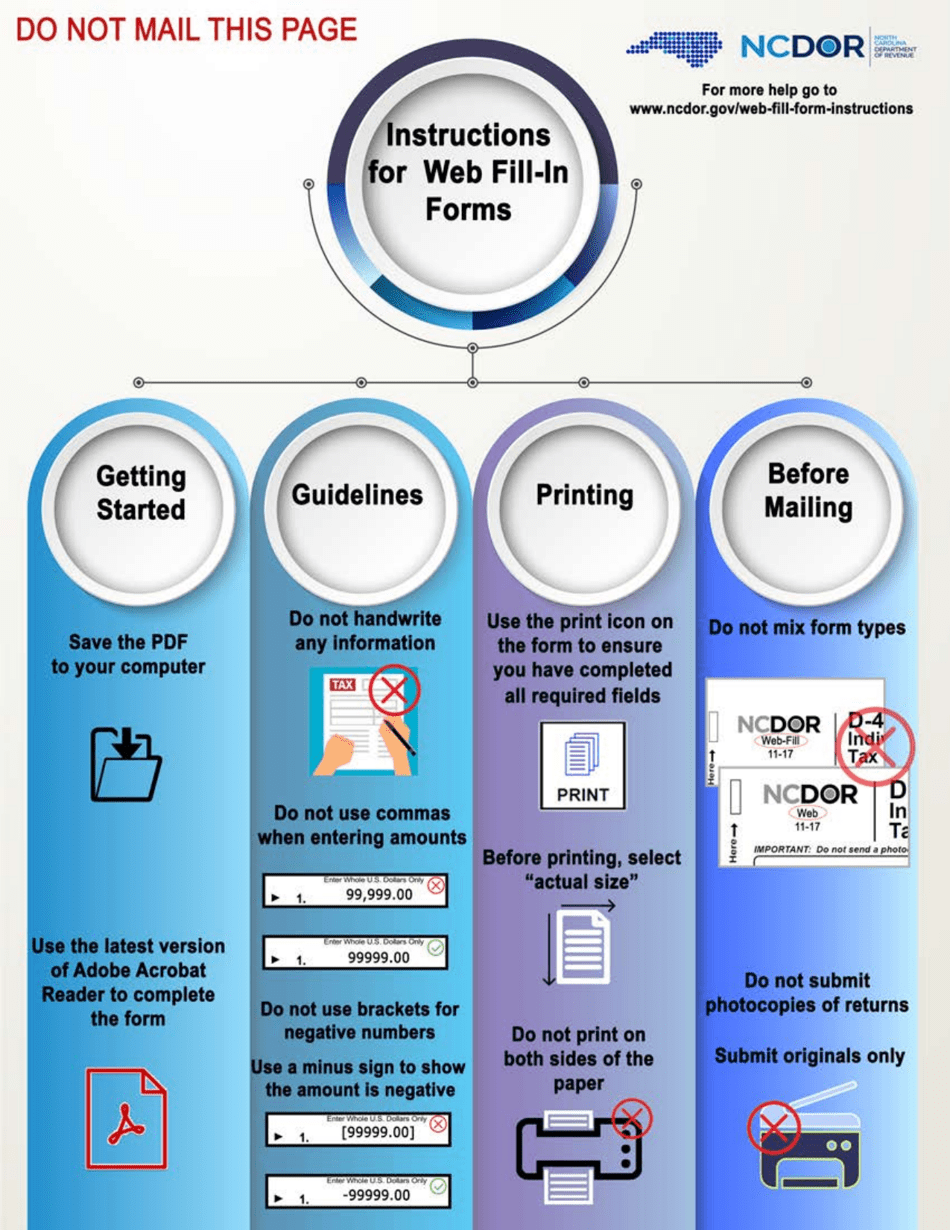

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-C-710 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.