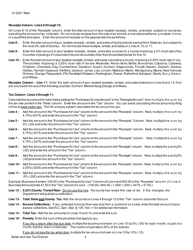

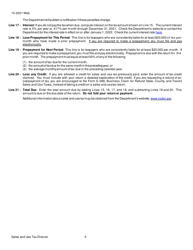

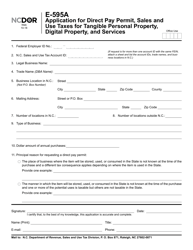

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form E-500

for the current year.

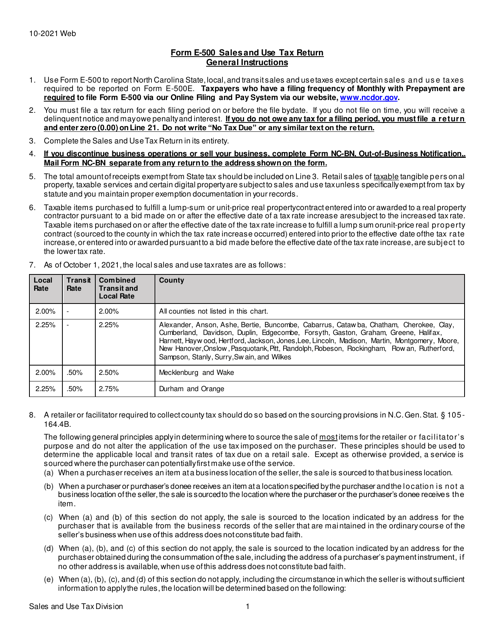

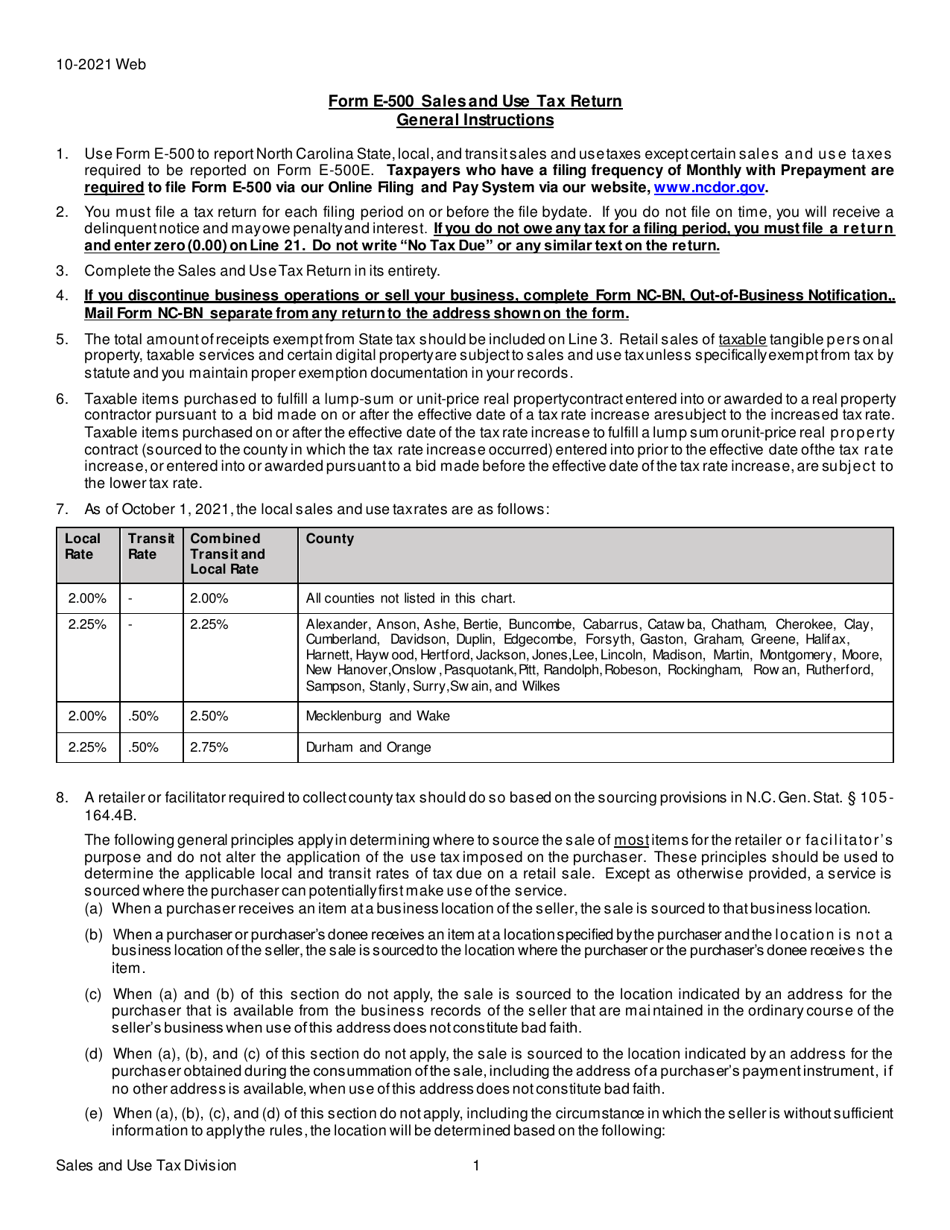

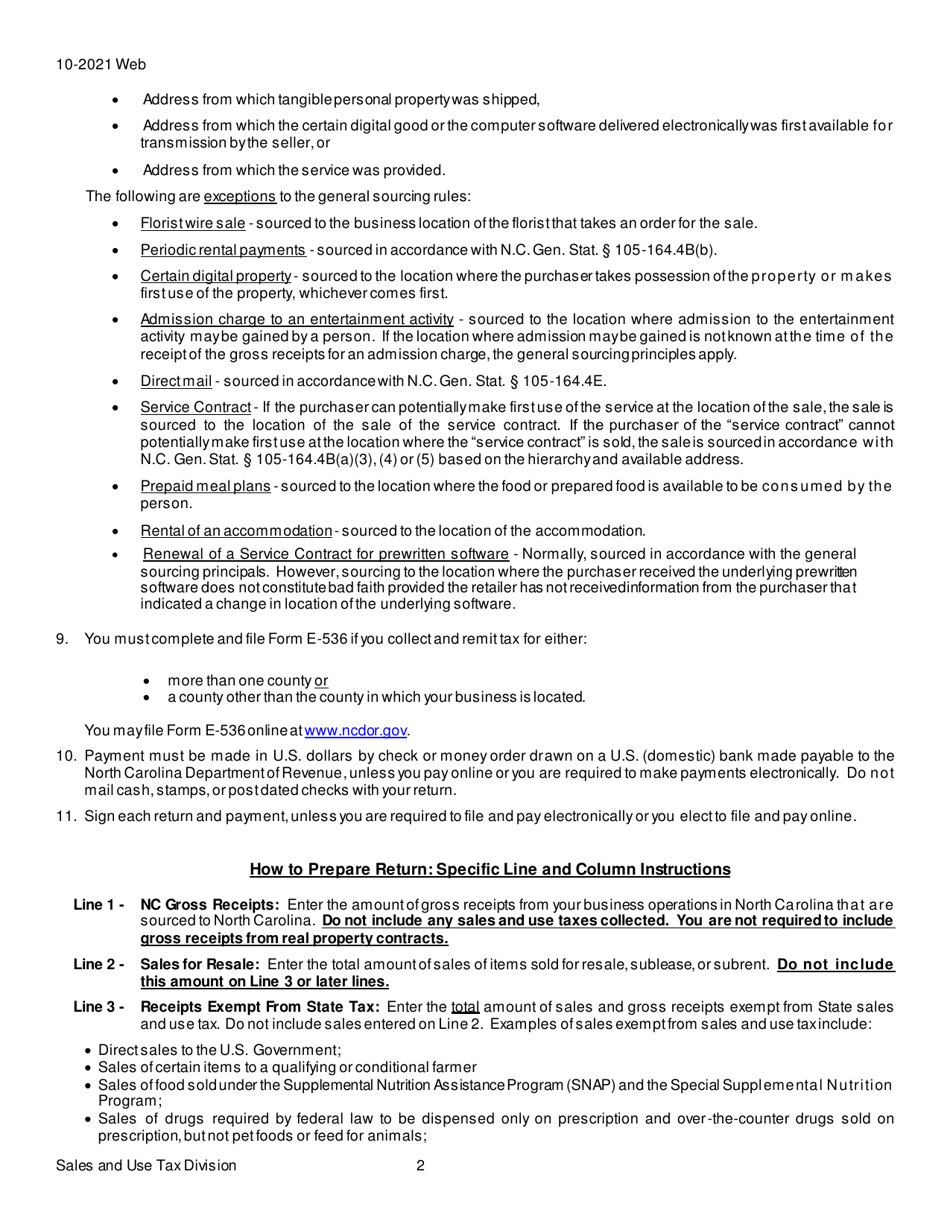

Instructions for Form E-500 Sales and Use Tax Return - North Carolina

This document contains official instructions for Form E-500 , Sales and Use Tax Return - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form E-500 is available for download through this link.

FAQ

Q: What is Form E-500?

A: Form E-500 is the Sales and Use Tax Return for North Carolina.

Q: Who needs to file Form E-500?

A: Anyone engaged in retail or wholesale sales, leases, or rental of tangible personal property or digital property in North Carolina must file Form E-500.

Q: How often should Form E-500 be filed?

A: Form E-500 is generally filed on a monthly basis. However, if the total amount of tax due in a calendar quarter is less than $100, the return can be filed on a quarterly basis.

Q: What information is required on Form E-500?

A: Form E-500 requires information such as total taxable sales, total nontaxable sales, and total tax collected.

Q: Are there any exemptions or deductions available?

A: Yes, there are certain exemptions and deductions available. These include exemptions for certain types of sales and deductions for certain business expenses.

Q: Is there a penalty for late filing or non-filing?

A: Yes, there are penalties for late filing or non-filing of Form E-500. The penalty amount varies depending on the length of the delay and the amount of tax due.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.