This version of the form is not currently in use and is provided for reference only. Download this version of

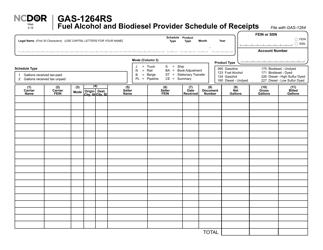

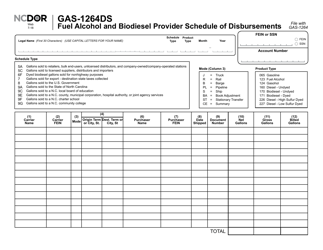

Form GAS-1264

for the current year.

Form GAS-1264 Fuel Alcohol and Biodiesel Provider Return (For October 2018 and After) - North Carolina

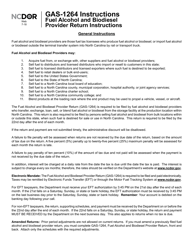

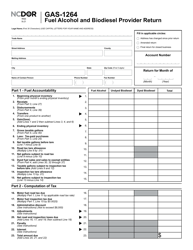

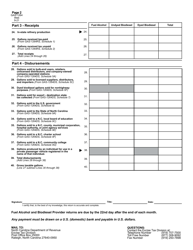

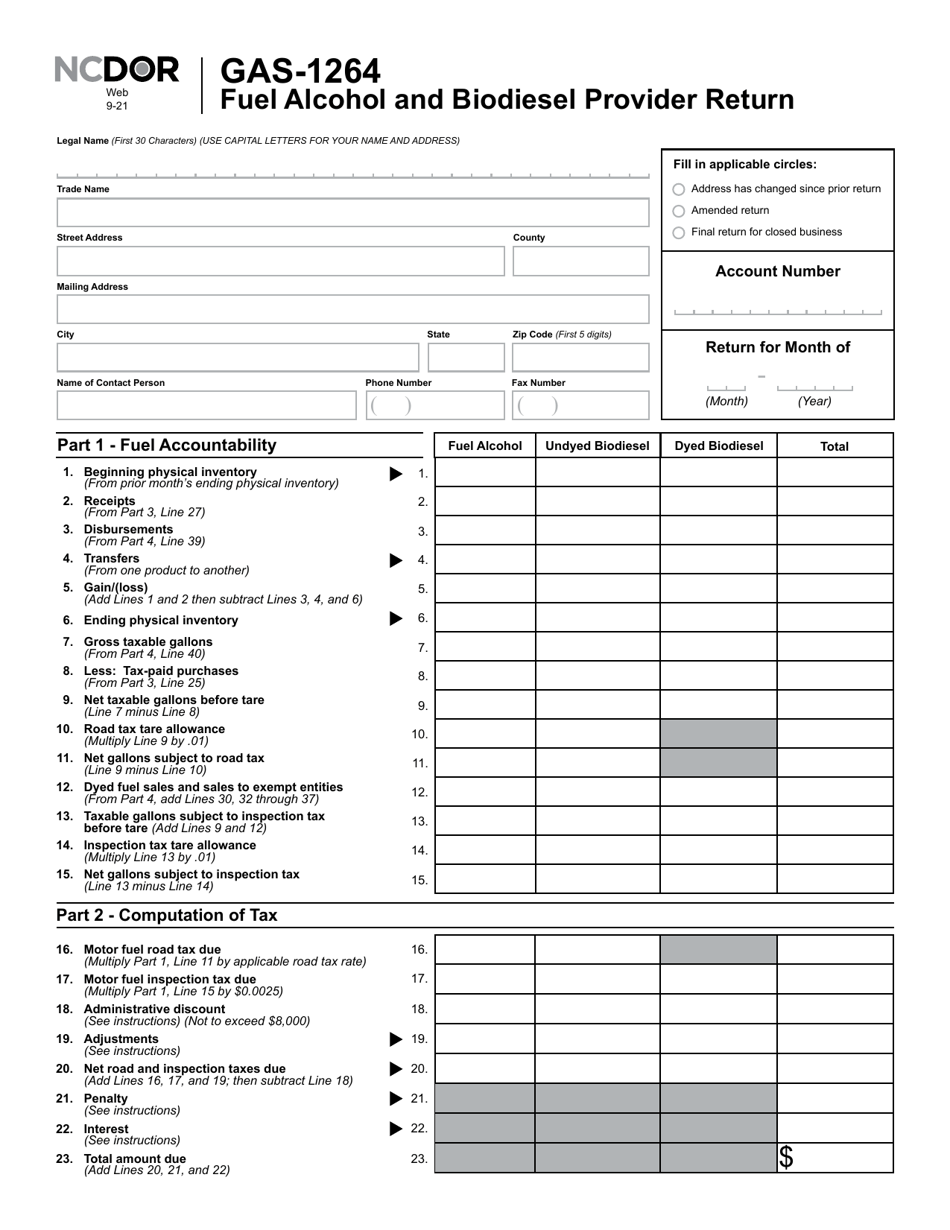

What Is Form GAS-1264?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is GAS-1264?

A: GAS-1264 is a fuel alcohol and biodiesel provider return form.

Q: Who should file GAS-1264?

A: Fuel alcohol and biodiesel providers in North Carolina.

Q: What is the purpose of GAS-1264?

A: To report fuel alcohol and biodiesel sales and taxes in North Carolina.

Q: When should GAS-1264 be filed?

A: For October 2018 and after.

Q: Is GAS-1264 specific to North Carolina?

A: Yes, it is used only in North Carolina.

Q: What period does GAS-1264 cover?

A: It covers the month of October 2018 and later.

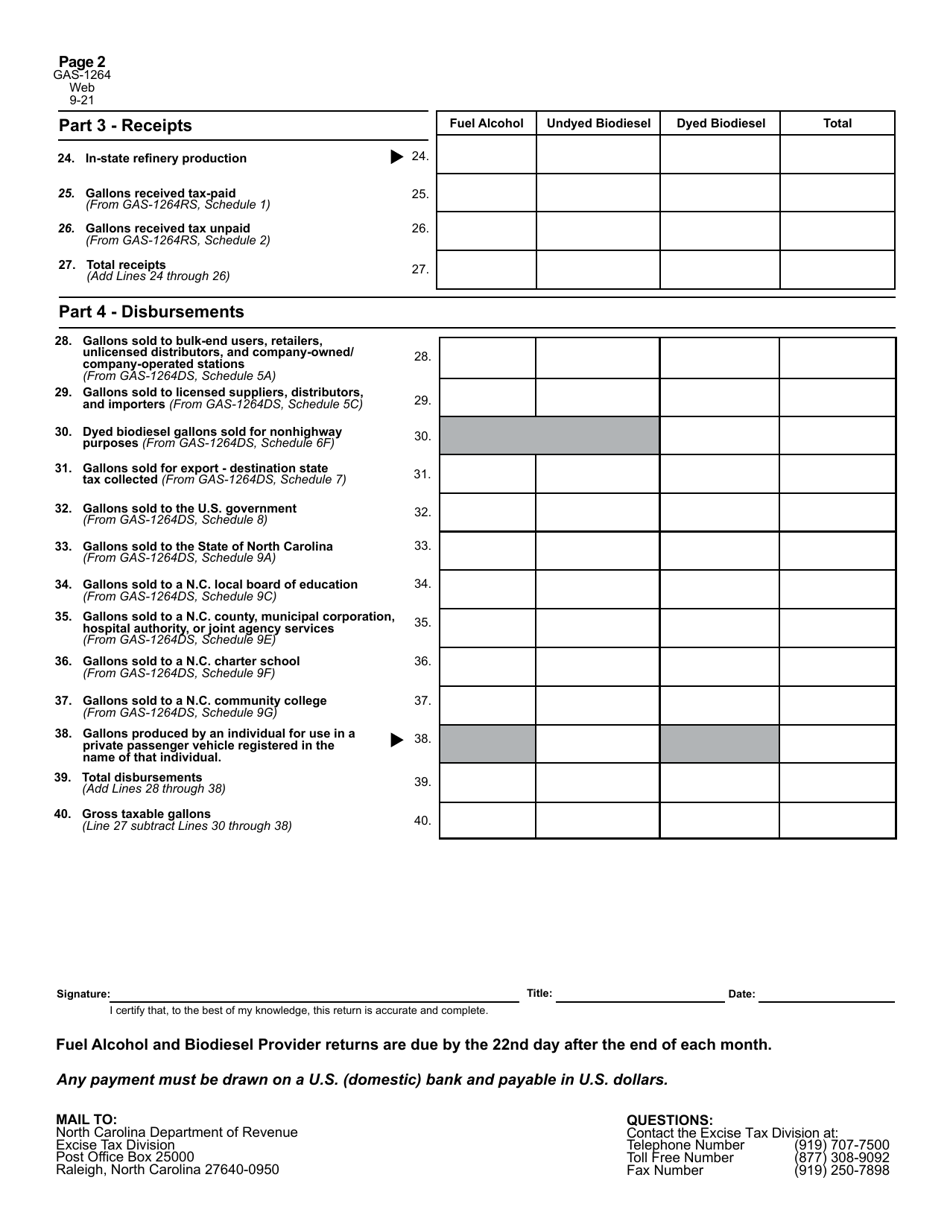

Q: Is there a deadline for filing GAS-1264?

A: Yes, the specific deadline can be found on the form or from the North Carolina Department of Revenue.

Q: What information do I need to complete a GAS-1264?

A: You will need to provide details of fuel alcohol and biodiesel sales and taxes.

Q: Are there any penalties for late filing of GAS-1264?

A: Yes, late filing may result in penalties and interest charges. Please refer to the form or contact the North Carolina Department of Revenue for details.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

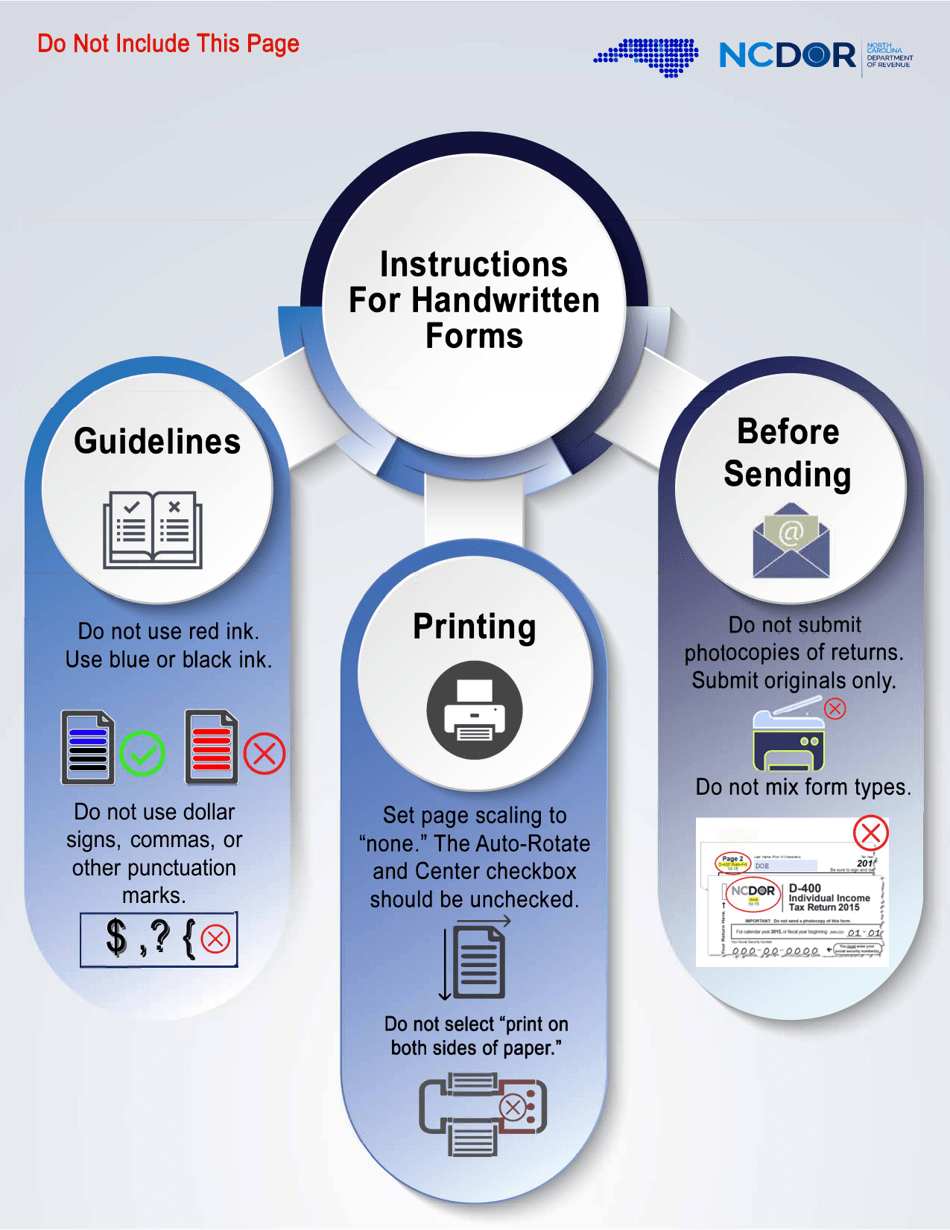

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1264 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.