This version of the form is not currently in use and is provided for reference only. Download this version of

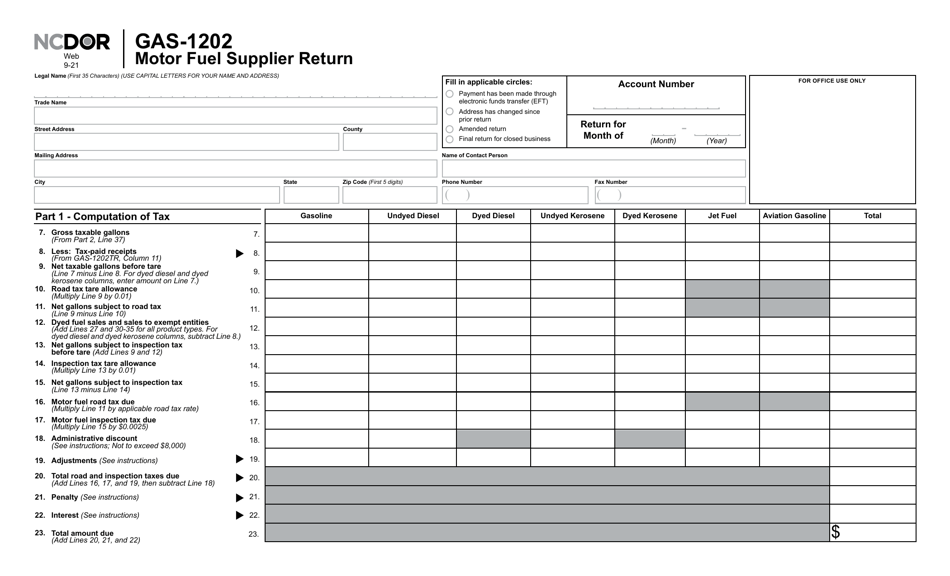

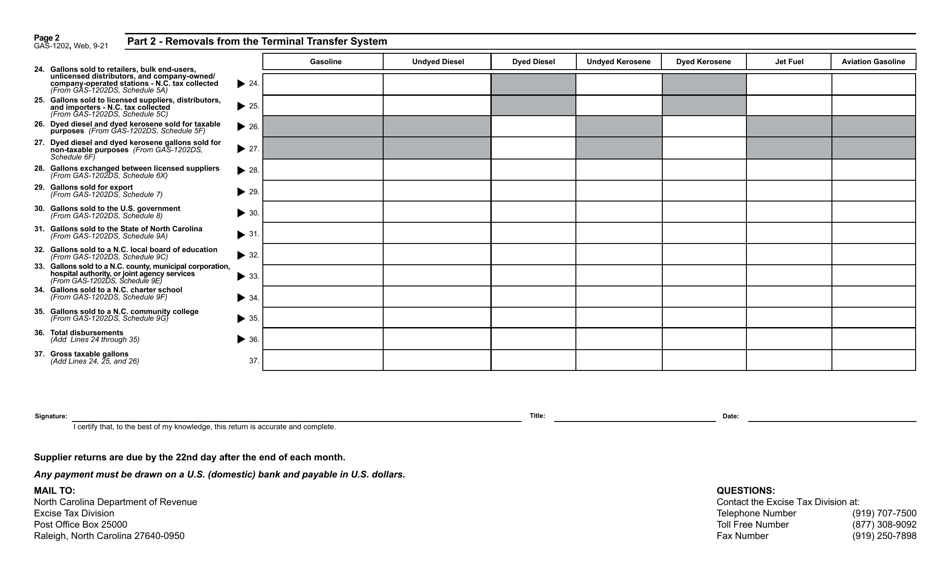

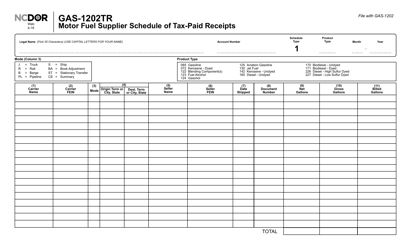

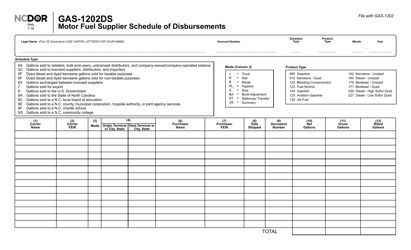

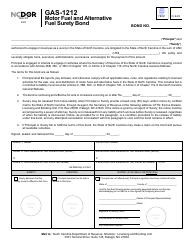

Form GAS-1202

for the current year.

Form GAS-1202 Motor Fuel Supplier Return (For October 2018 and After) - North Carolina

What Is Form GAS-1202?

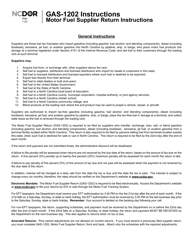

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

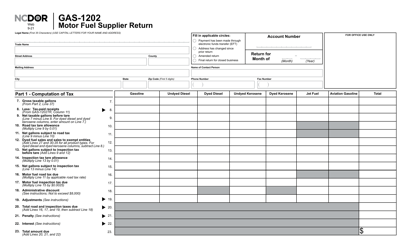

Q: What is Form GAS-1202 Motor Fuel Supplier Return?

A: Form GAS-1202 Motor Fuel Supplier Return is a tax return form for motor fuel suppliers in North Carolina.

Q: Who needs to file Form GAS-1202?

A: Motor fuel suppliers in North Carolina need to file Form GAS-1202.

Q: What is the purpose of Form GAS-1202?

A: The purpose of Form GAS-1202 is to report and pay motor fuel taxes in North Carolina.

Q: When is Form GAS-1202 due?

A: Form GAS-1202 is due on a monthly basis.

Q: What is the timeframe for Form GAS-1202?

A: Form GAS-1202 is for the period of October 2018 and after.

Q: How do I file Form GAS-1202?

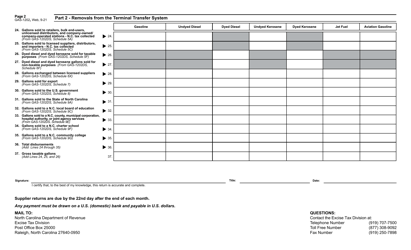

A: Form GAS-1202 can be filed electronically or by mail.

Q: Are there any penalties for late filing of Form GAS-1202?

A: Yes, there are penalties for late filing of Form GAS-1202. It is important to file the form on time to avoid penalties and interest.

Q: What taxes are reported on Form GAS-1202?

A: Form GAS-1202 is used to report motor fuel taxes in North Carolina.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

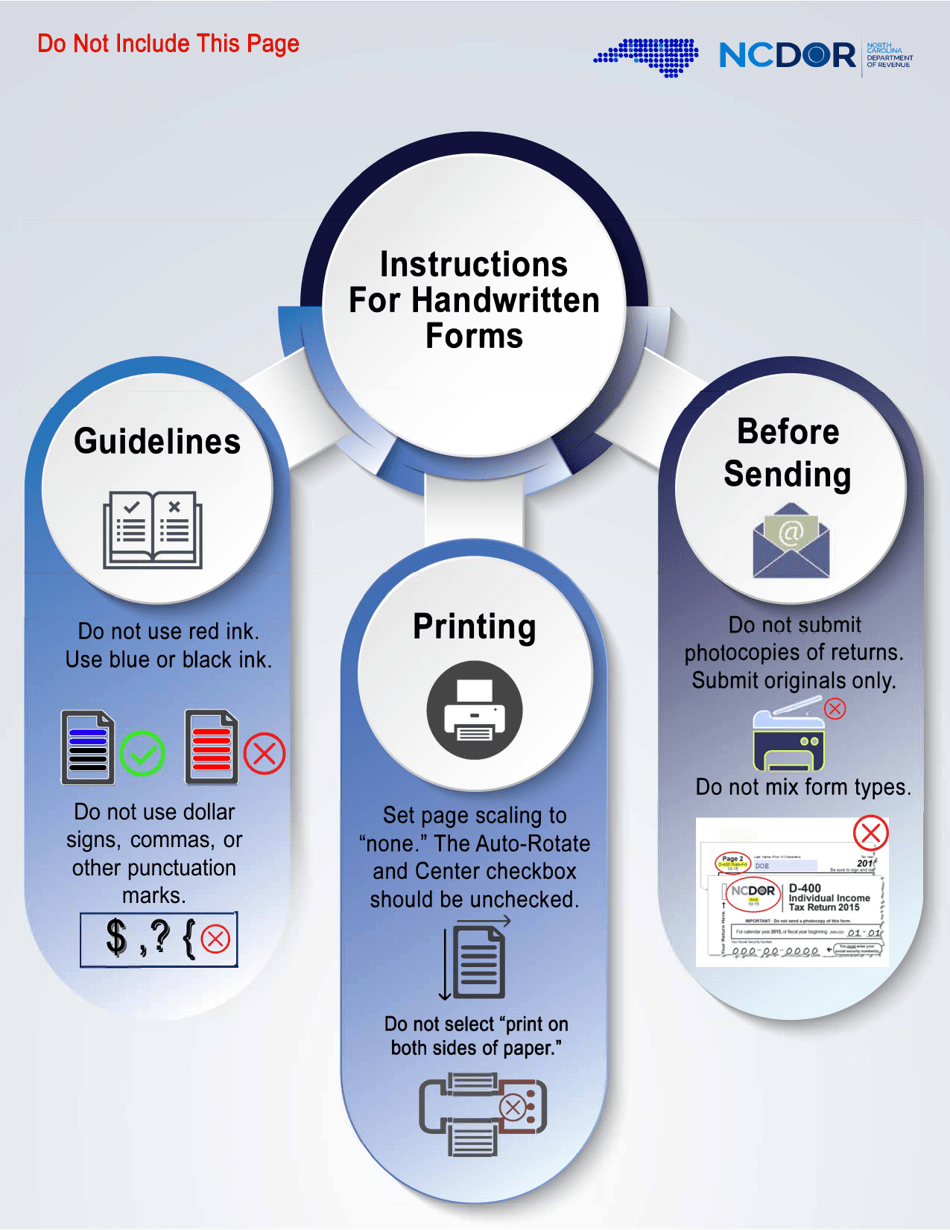

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1202 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.