This version of the form is not currently in use and is provided for reference only. Download this version of

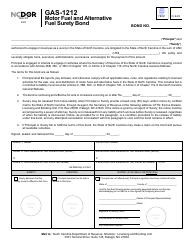

Form GAS-1252

for the current year.

Form GAS-1252 Alternative Fuels Provider Return (For October 2018 and After) - North Carolina

What Is Form GAS-1252?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

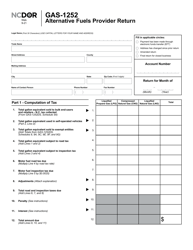

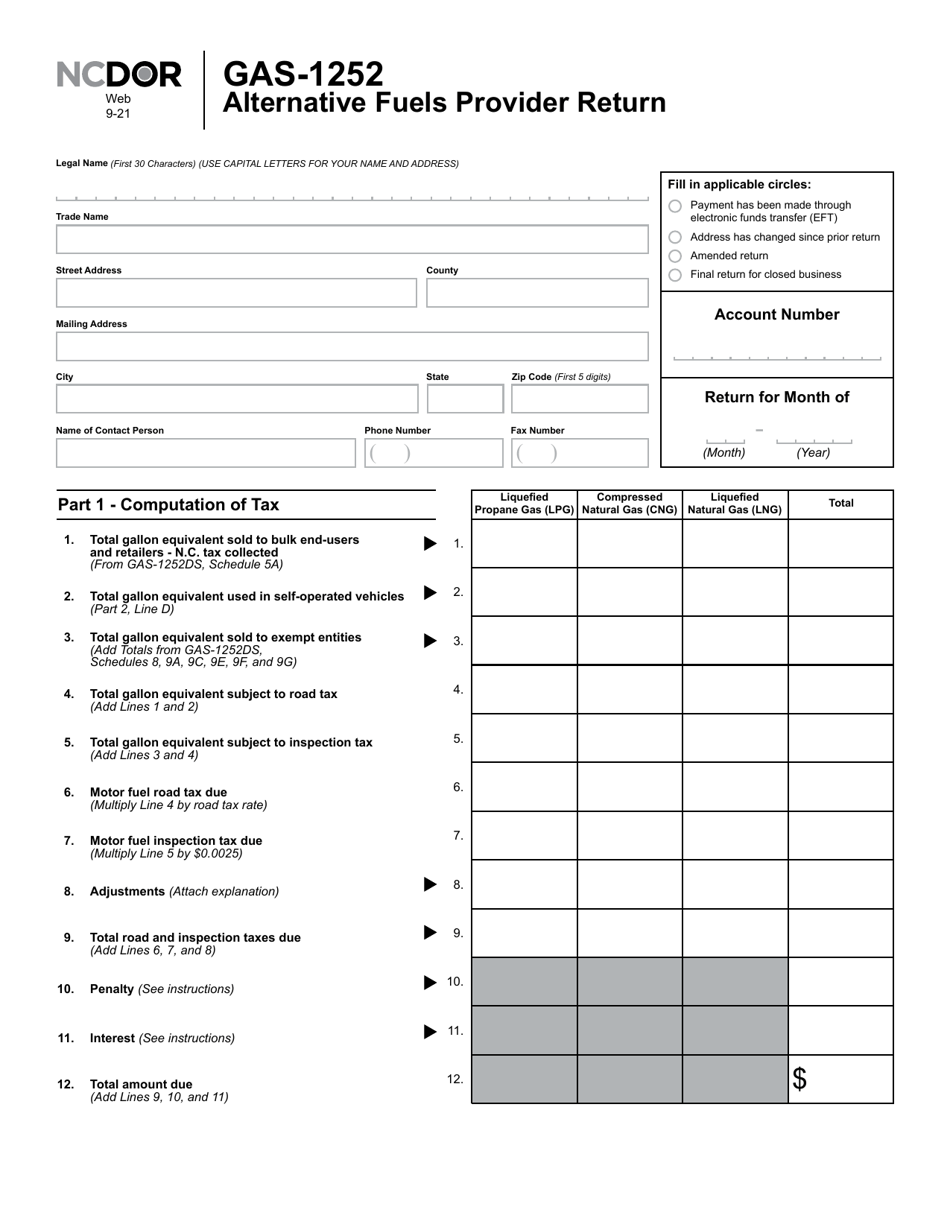

Q: What is GAS-1252?

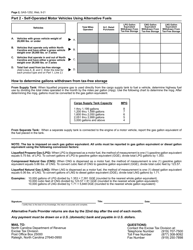

A: GAS-1252 is a form used by alternative fuel providers in North Carolina to report their fuel sales for October 2018 and onwards.

Q: Who needs to file GAS-1252?

A: Alternative fuel providers in North Carolina need to file GAS-1252.

Q: What is the purpose of GAS-1252?

A: The purpose of GAS-1252 is to report alternative fuel sales by providers in North Carolina.

Q: When should GAS-1252 be filed?

A: GAS-1252 should be filed for fuel sales made in October 2018 and afterwards.

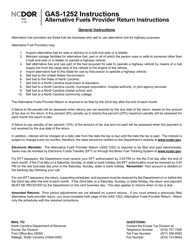

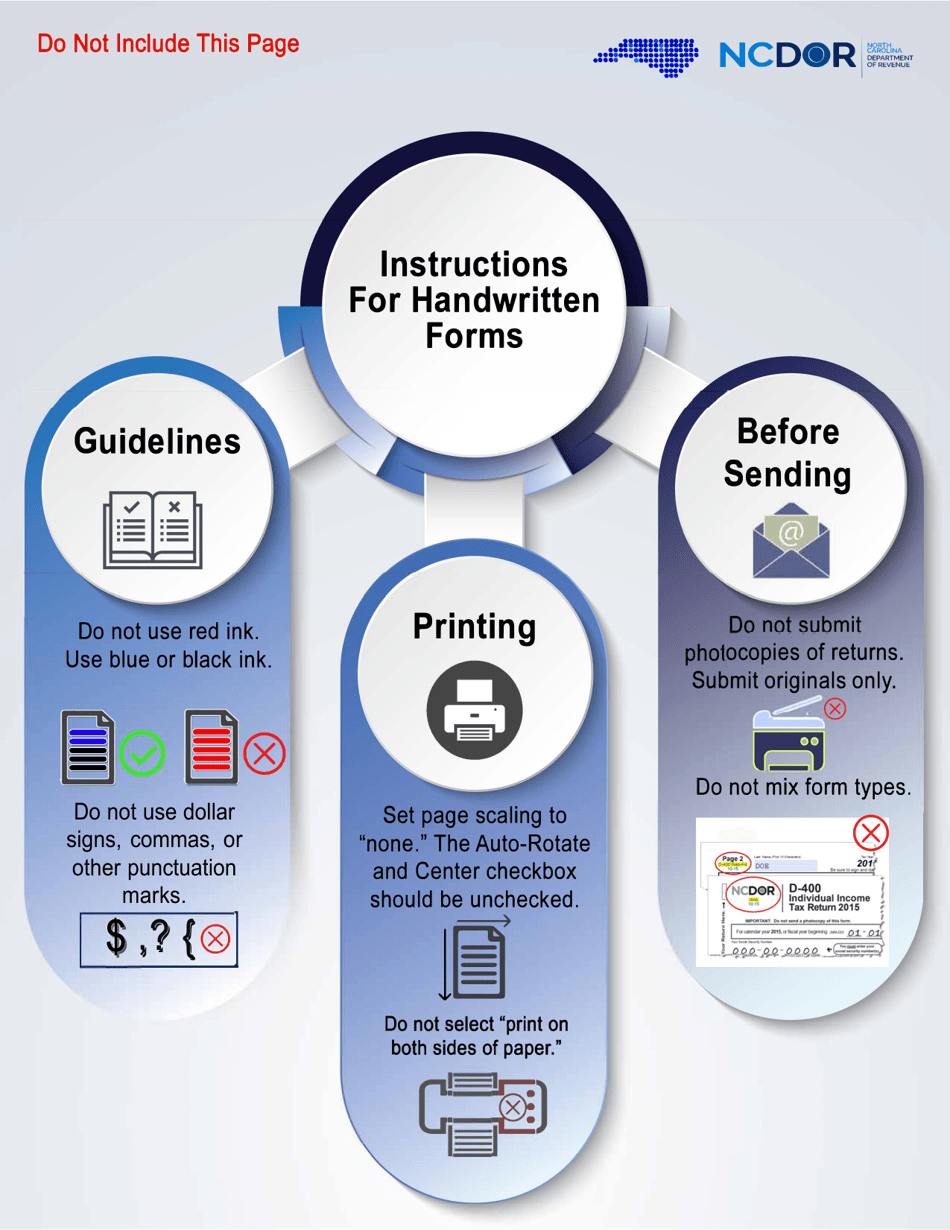

Q: Are there any specific instructions for filling out GAS-1252?

A: Yes, detailed instructions for filling out GAS-1252 can be found in the form itself.

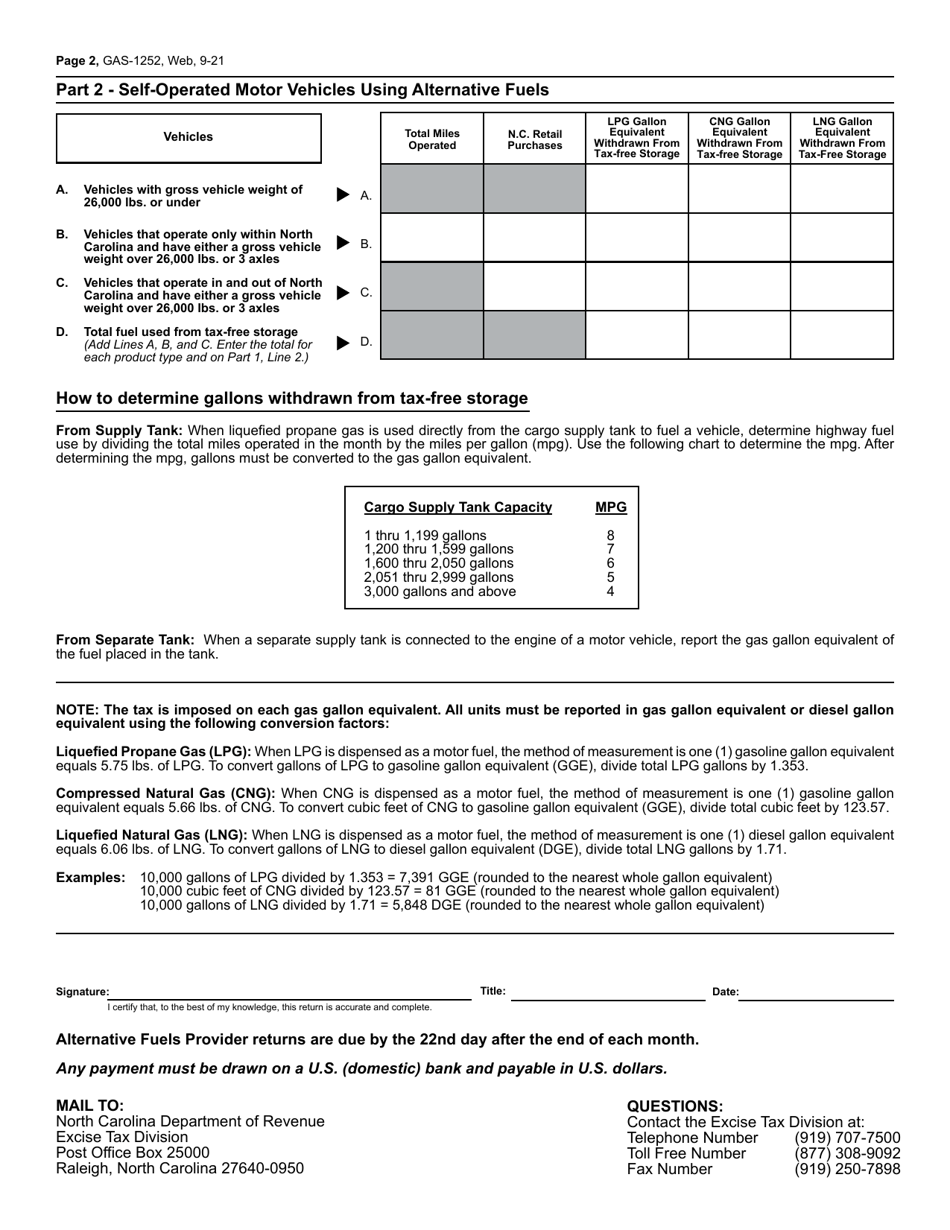

Q: Is there a deadline for filing GAS-1252?

A: Yes, the deadline for filing GAS-1252 is typically the 20th day of the following month.

Q: Are there any penalties for not filing GAS-1252?

A: Yes, failure to file GAS-1252 or filing late may result in penalties and interest.

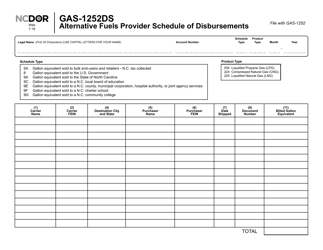

Q: What information do I need to provide on GAS-1252?

A: You will need to provide information such as your business details, fuel sales quantities, and any exemptions or refunds claimed.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1252 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.