This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form GAS-1254

for the current year.

Instructions for Form GAS-1254 Bulk End-User of Alternative Fuel Return - North Carolina

This document contains official instructions for Form GAS-1254 , Bulk End-User of Alternative Fuel Return - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form GAS-1254 is available for download through this link.

FAQ

Q: What is Form GAS-1254?

A: Form GAS-1254 is the Bulk End-User of Alternative Fuel Return form.

Q: Who is required to file Form GAS-1254?

A: Bulk end-users of alternative fuel in North Carolina are required to file Form GAS-1254.

Q: What is considered an alternative fuel?

A: Alternative fuel includes propane, liquefied natural gas, compressed natural gas, and any other fuel that can be used as a substitute for gasoline or diesel fuel.

Q: How often should Form GAS-1254 be filed?

A: Form GAS-1254 should be filed on a quarterly basis.

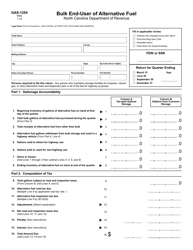

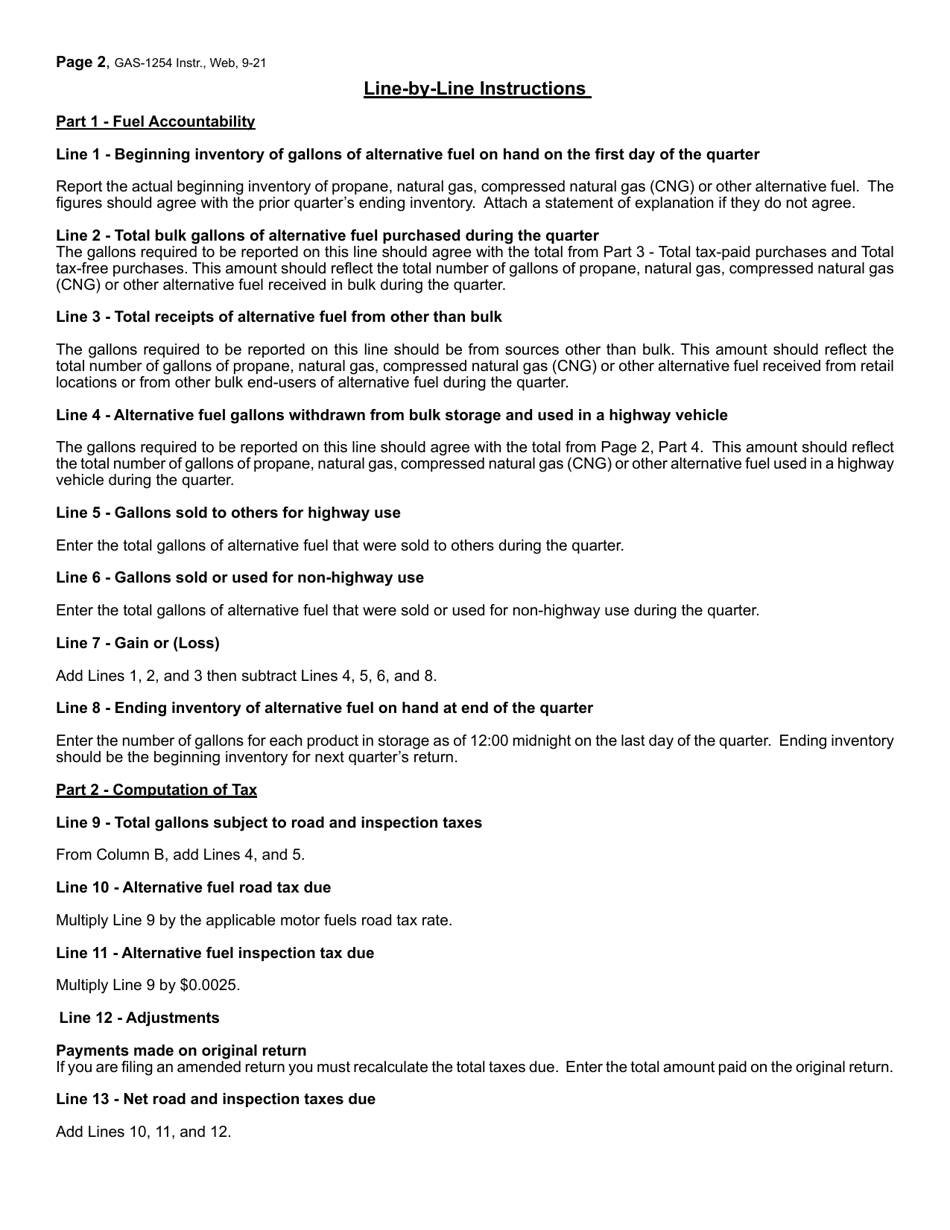

Q: What information is required to be reported on Form GAS-1254?

A: Form GAS-1254 requires reporting of the quantity of alternative fuel received, the quantity sold or used, the location where the alternative fuel is stored, and other relevant details.

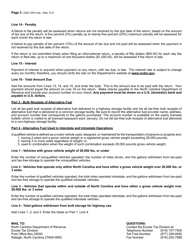

Q: Are there any penalties for not filing Form GAS-1254?

A: Yes, there are penalties for not filing Form GAS-1254, including monetary fines and other enforcement actions.

Q: Can Form GAS-1254 be filed electronically?

A: Yes, Form GAS-1254 can be filed electronically through the North Carolina Department of Revenue's eFile system.

Q: Can I seek assistance in filling out Form GAS-1254?

A: Yes, you can seek assistance from the North Carolina Department of Revenue or consult a tax professional for help with filling out Form GAS-1254.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.