This version of the form is not currently in use and is provided for reference only. Download this version of

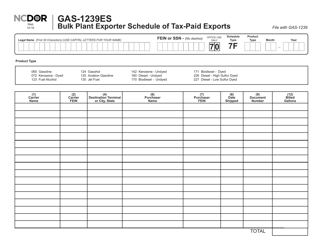

Form GAS-1239

for the current year.

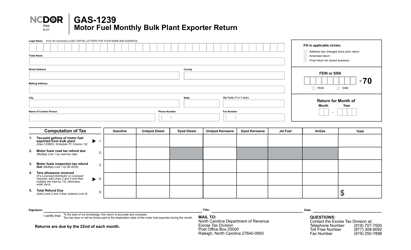

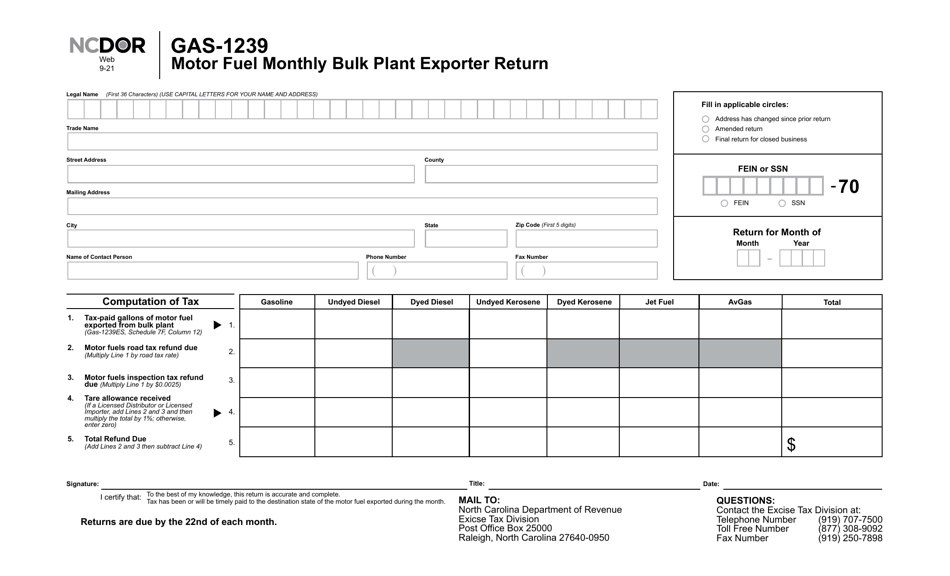

Form GAS-1239 Motor Fuel Monthly Bulk Plant Exporter Return - North Carolina

What Is Form GAS-1239?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GAS-1239?

A: Form GAS-1239 is the Motor Fuel Monthly Bulk Plant Exporter Return specific to North Carolina.

Q: Who needs to file Form GAS-1239?

A: Motor Fuel Monthly Bulk Plant Exporters in North Carolina need to file Form GAS-1239.

Q: What information is required on Form GAS-1239?

A: Form GAS-1239 requires information about the quantity and type of motor fuel exported from the bulk plant.

Q: When is Form GAS-1239 due?

A: Form GAS-1239 is due by the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form GAS-1239?

A: Yes, failure to file or late filing of Form GAS-1239 may result in penalties and interest.

Q: Are there any exemptions or deductions available on Form GAS-1239?

A: Specific exemptions or deductions may be available for certain types of motor fuel exports, consult the instructions for Form GAS-1239 for more information.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

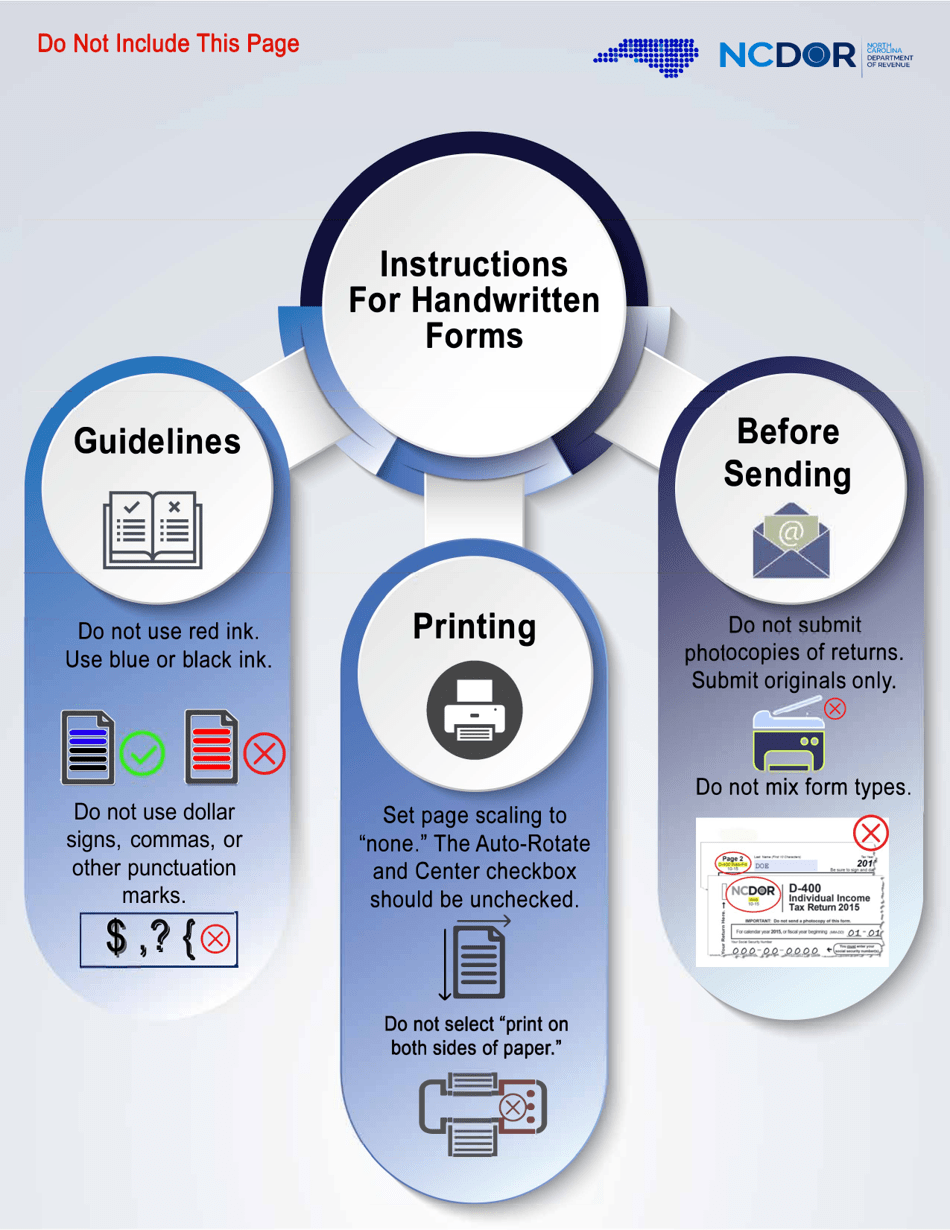

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1239 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.