This version of the form is not currently in use and is provided for reference only. Download this version of

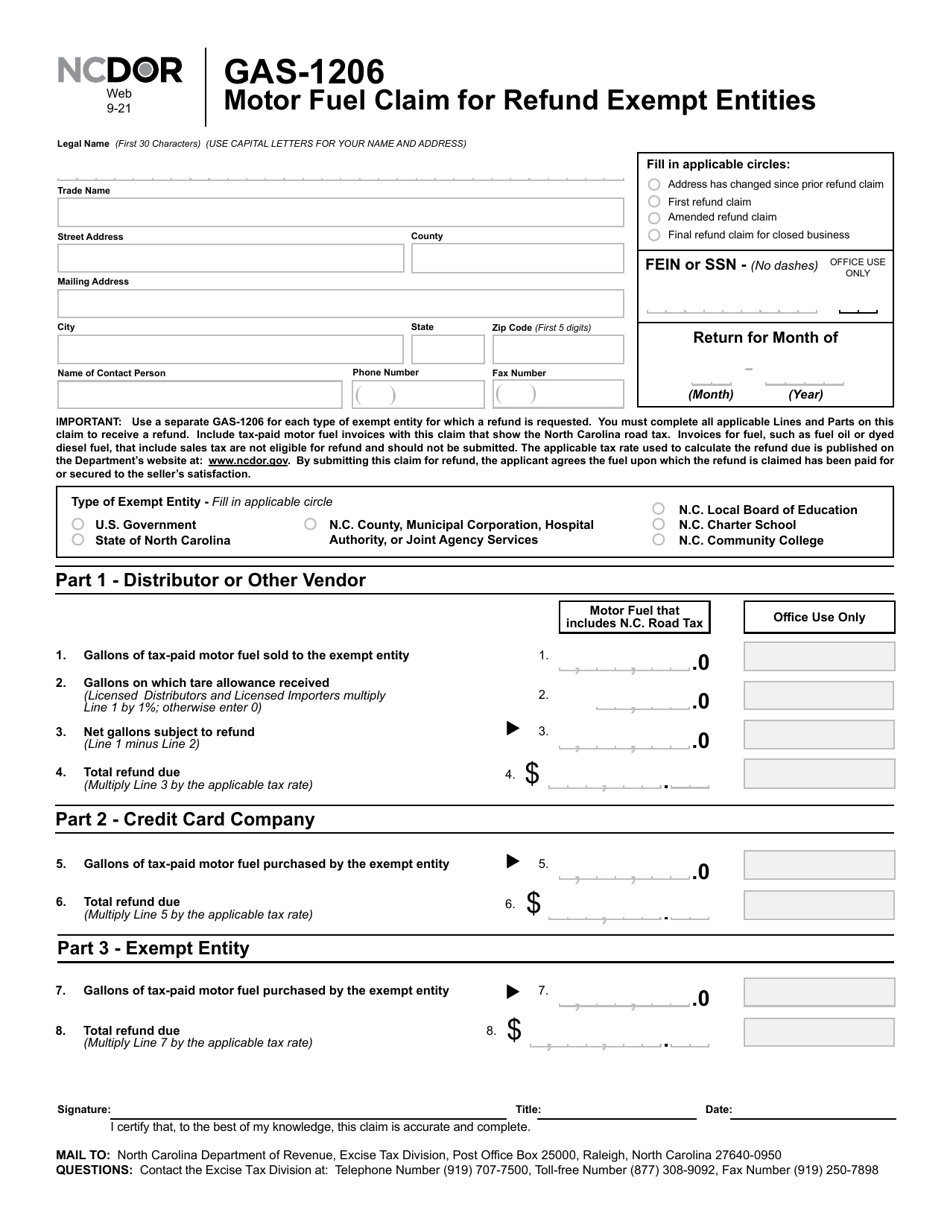

Form GAS-1206

for the current year.

Form GAS-1206 Motor Fuel Claim for Refund Exempt Entities - North Carolina

What Is Form GAS-1206?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

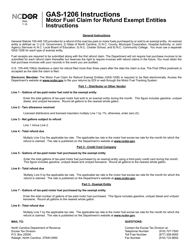

Q: What is Form GAS-1206?

A: Form GAS-1206 is the Motor Fuel Claim for Refund Exempt Entities used in North Carolina.

Q: Who can use Form GAS-1206?

A: Exempt entities in North Carolina can use Form GAS-1206 to claim a refund on motor fuel taxes.

Q: What is an exempt entity?

A: An exempt entity refers to organizations or entities, such as government agencies and certain non-profit organizations, that are exempt from paying motor fuel taxes in North Carolina.

Q: What is the purpose of Form GAS-1206?

A: The purpose of Form GAS-1206 is to allow eligible exempt entities to claim a refund on the motor fuel taxes they paid in North Carolina.

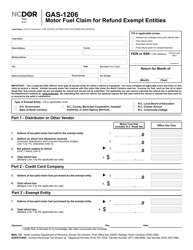

Q: How do I fill out Form GAS-1206?

A: To fill out Form GAS-1206, you will need to provide information such as your entity's name, address, tax exemption number, claim period, and the amount of motor fuel taxes paid.

Q: When should I submit Form GAS-1206?

A: Form GAS-1206 should be submitted within three years from the date the taxes were paid.

Q: Are there any supporting documents required with Form GAS-1206?

A: Yes, you may need to include supporting documents, such as invoices or receipts, to substantiate your claimed refund amount.

Q: How long does it take to process a refund claim with Form GAS-1206?

A: The processing time can vary, but it generally takes around 60 days to process a refund claim with Form GAS-1206.

Q: Can I claim a refund on both gasoline and diesel fuel taxes with Form GAS-1206?

A: Yes, Form GAS-1206 allows you to claim a refund on both gasoline and diesel fuel taxes paid in North Carolina.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

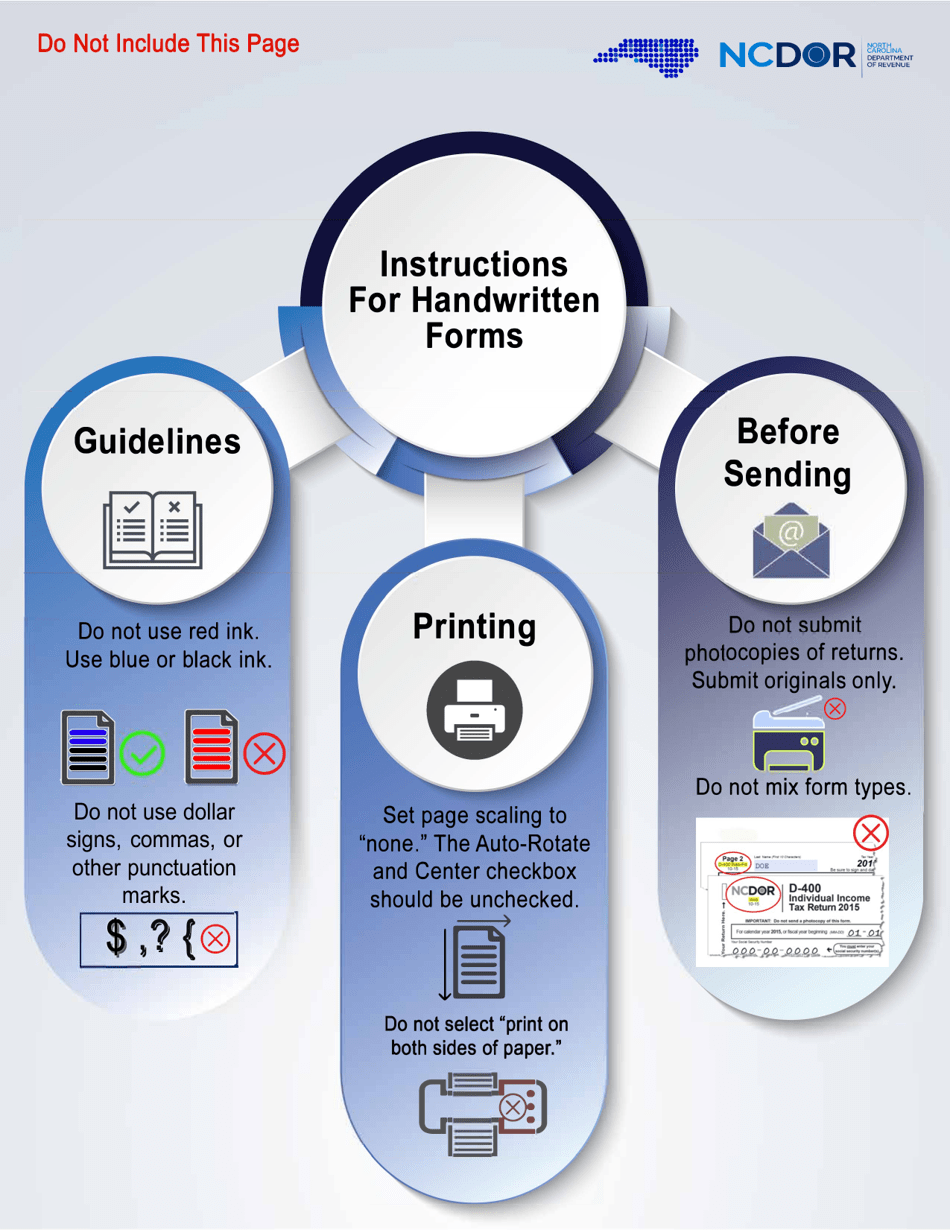

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1206 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.