This version of the form is not currently in use and is provided for reference only. Download this version of

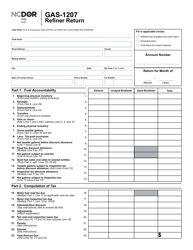

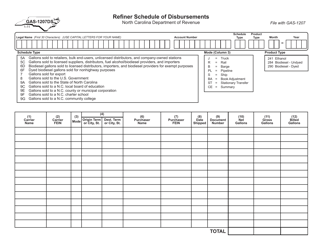

Form GAS-1207

for the current year.

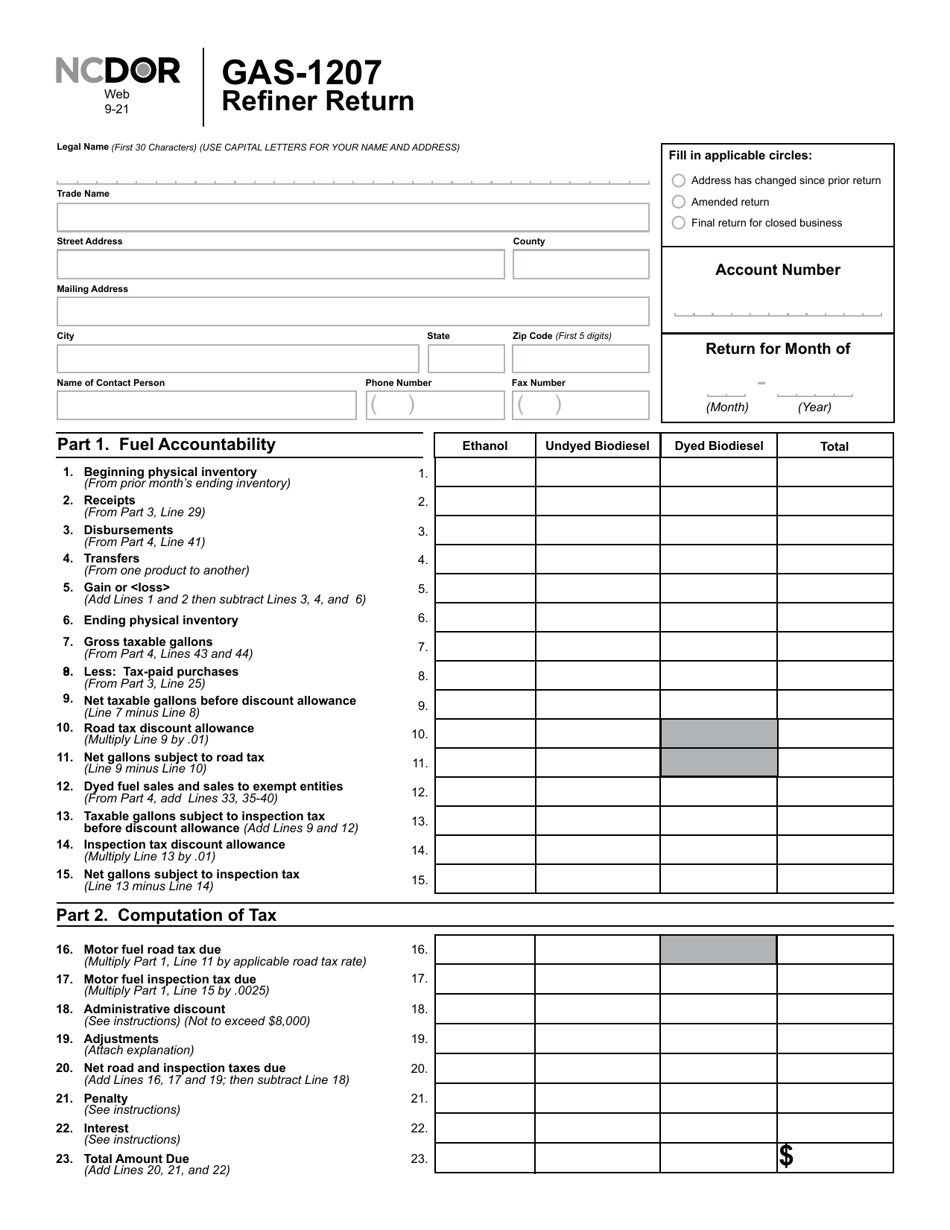

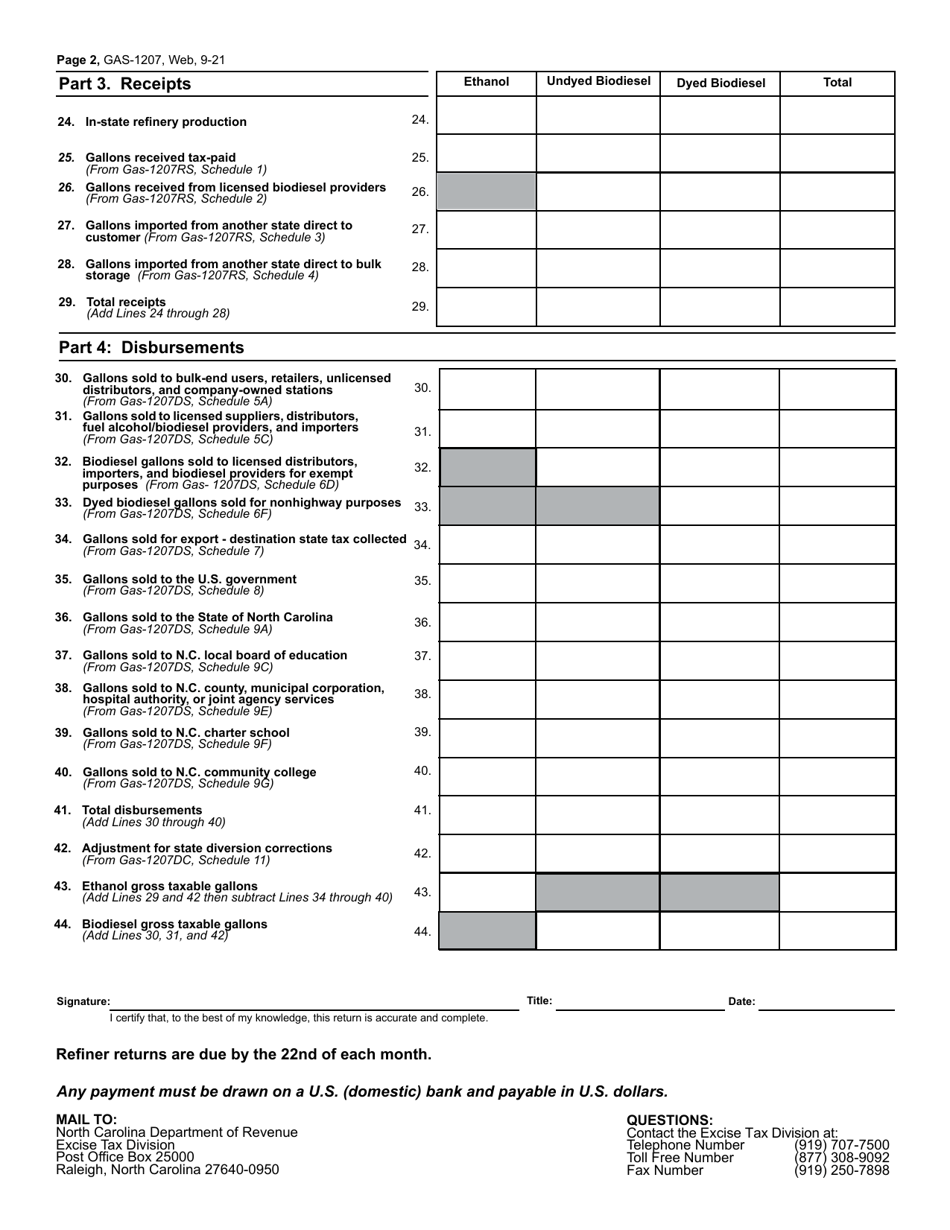

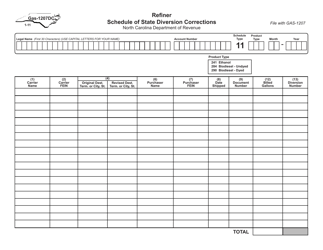

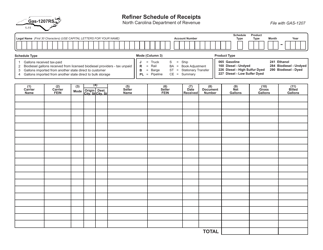

Form GAS-1207 Refiner Return - North Carolina

What Is Form GAS-1207?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form GAS-1207?

A: Form GAS-1207 is a Refiner Return form for the state of North Carolina.

Q: Who needs to file form GAS-1207?

A: Refiners operating in North Carolina are required to file form GAS-1207.

Q: What is the purpose of form GAS-1207?

A: Form GAS-1207 is used to report information related to gasoline and diesel fuel sales, imports, and exports in North Carolina.

Q: When is form GAS-1207 due?

A: Form GAS-1207 is due by the 20th day of the month following the reporting period.

Q: Is there a penalty for late filing of form GAS-1207?

A: Yes, there is a penalty for late filing of form GAS-1207. The penalty is 5% of the tax due for each month or fraction of a month that the return is late, up to a maximum of 25%.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1207 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.