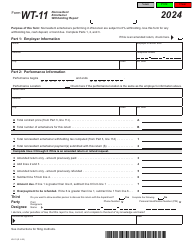

This version of the form is not currently in use and is provided for reference only. Download this version of

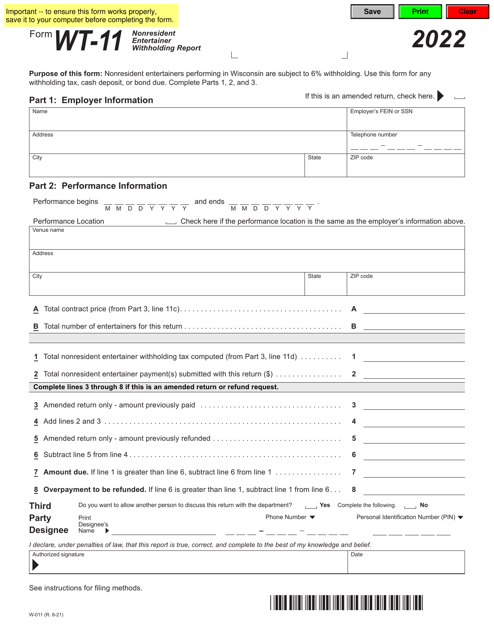

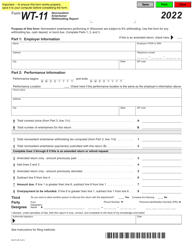

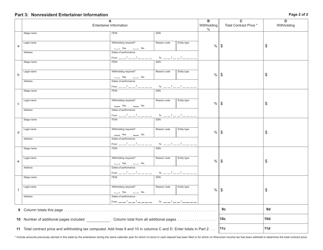

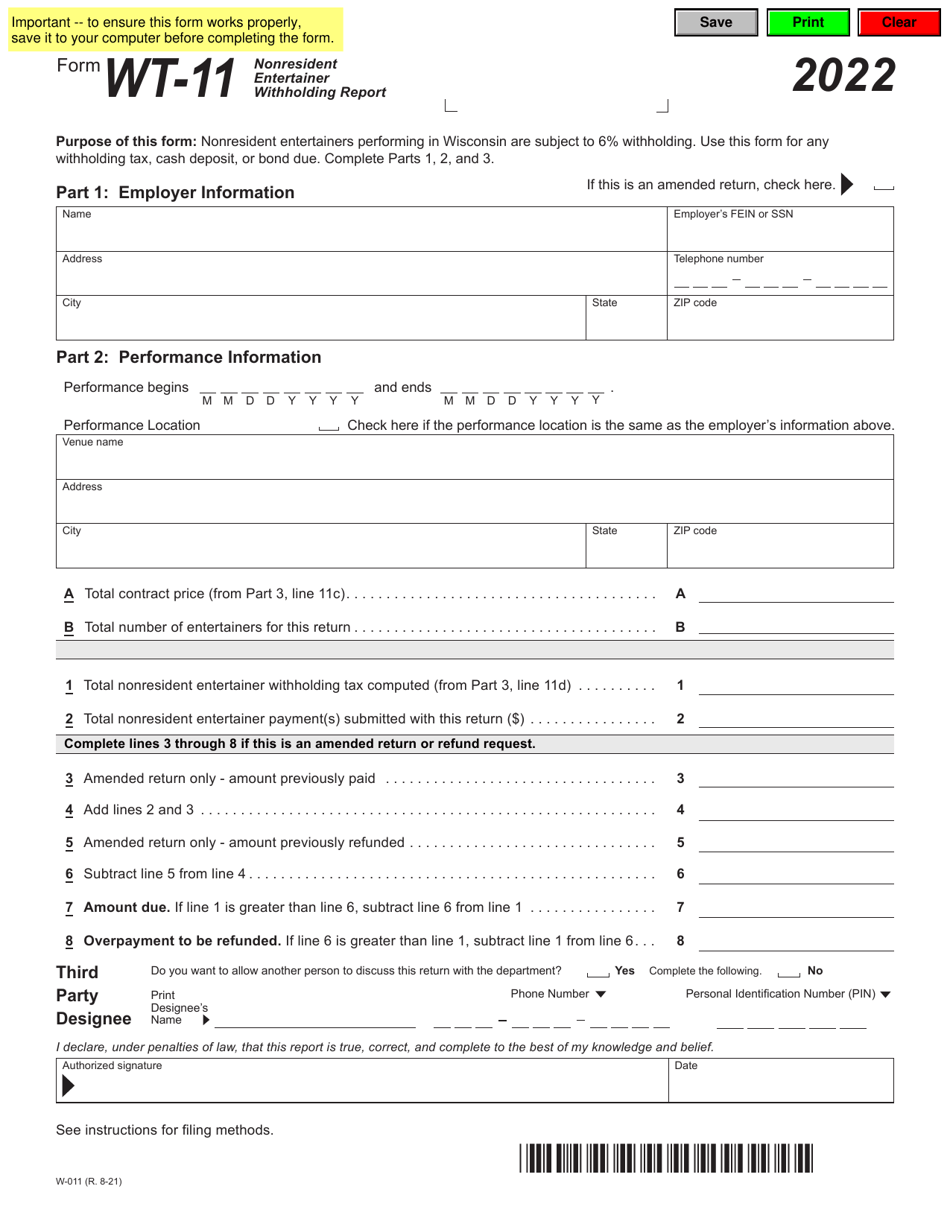

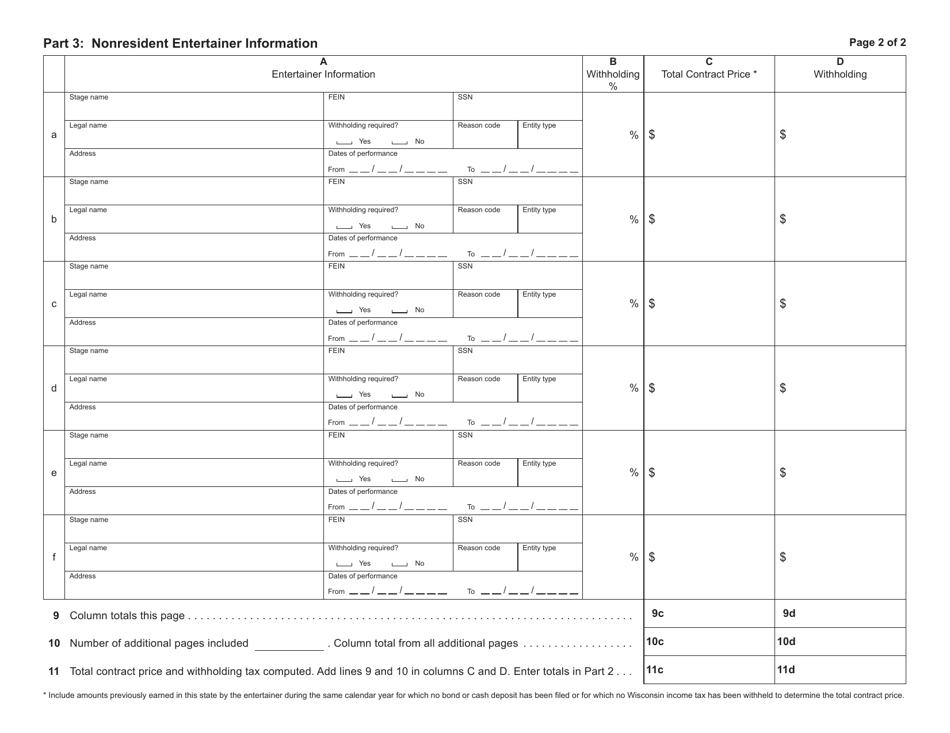

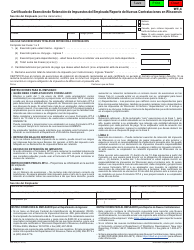

Form WT-11 (W-011)

for the current year.

Form WT-11 (W-011) Nonresident Entertainer Withholding Report - Wisconsin

What Is Form WT-11 (W-011)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form WT-11?

A: Form WT-11, also known as W-011, is the Nonresident Entertainer Withholding Report for Wisconsin.

Q: Who needs to file Form WT-11?

A: Nonresident entertainers who performed in Wisconsin and had Wisconsin income tax withheld need to file Form WT-11.

Q: What is the purpose of Form WT-11?

A: Form WT-11 is used to report and remit the Wisconsin income tax withheld from nonresident entertainer's earnings.

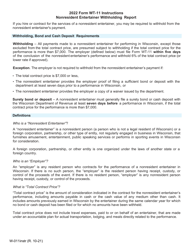

Q: When is Form WT-11 due?

A: Form WT-11 is due by January 31st of the following year.

Q: Is Form WT-11 the same as Form W-2?

A: No, Form WT-11 is a separate form specifically for nonresident entertainers, while Form W-2 is used to report wages and withholdings for employees.

Q: What should I do if I did not have any income tax withheld?

A: If you did not have any Wisconsin income tax withheld as a nonresident entertainer, you are not required to file Form WT-11.

Q: What happens if I don't file Form WT-11?

A: Failure to file Form WT-11 or pay the required withholding tax may result in penalties and interest.

Q: Is Form WT-11 used for state income tax purposes only?

A: Yes, Form WT-11 is specifically for reporting Wisconsin income tax withholding and does not cover federal income tax obligations.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WT-11 (W-011) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.