This version of the form is not currently in use and is provided for reference only. Download this version of

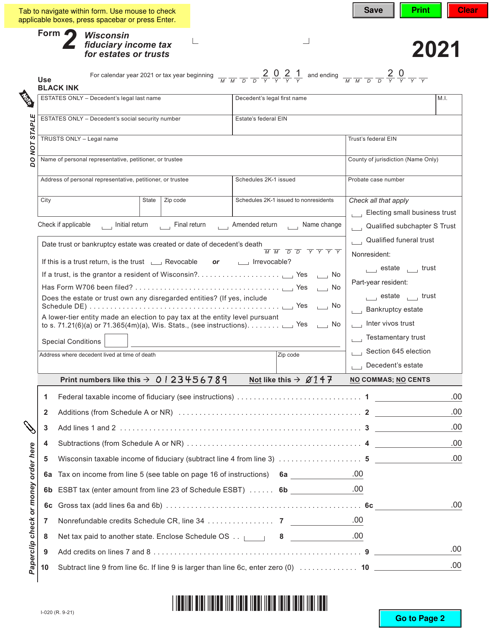

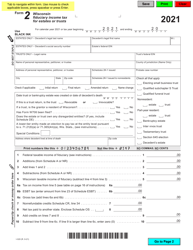

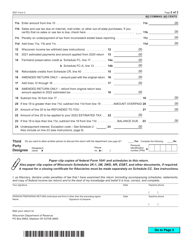

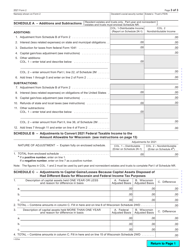

Form 2 (I-020)

for the current year.

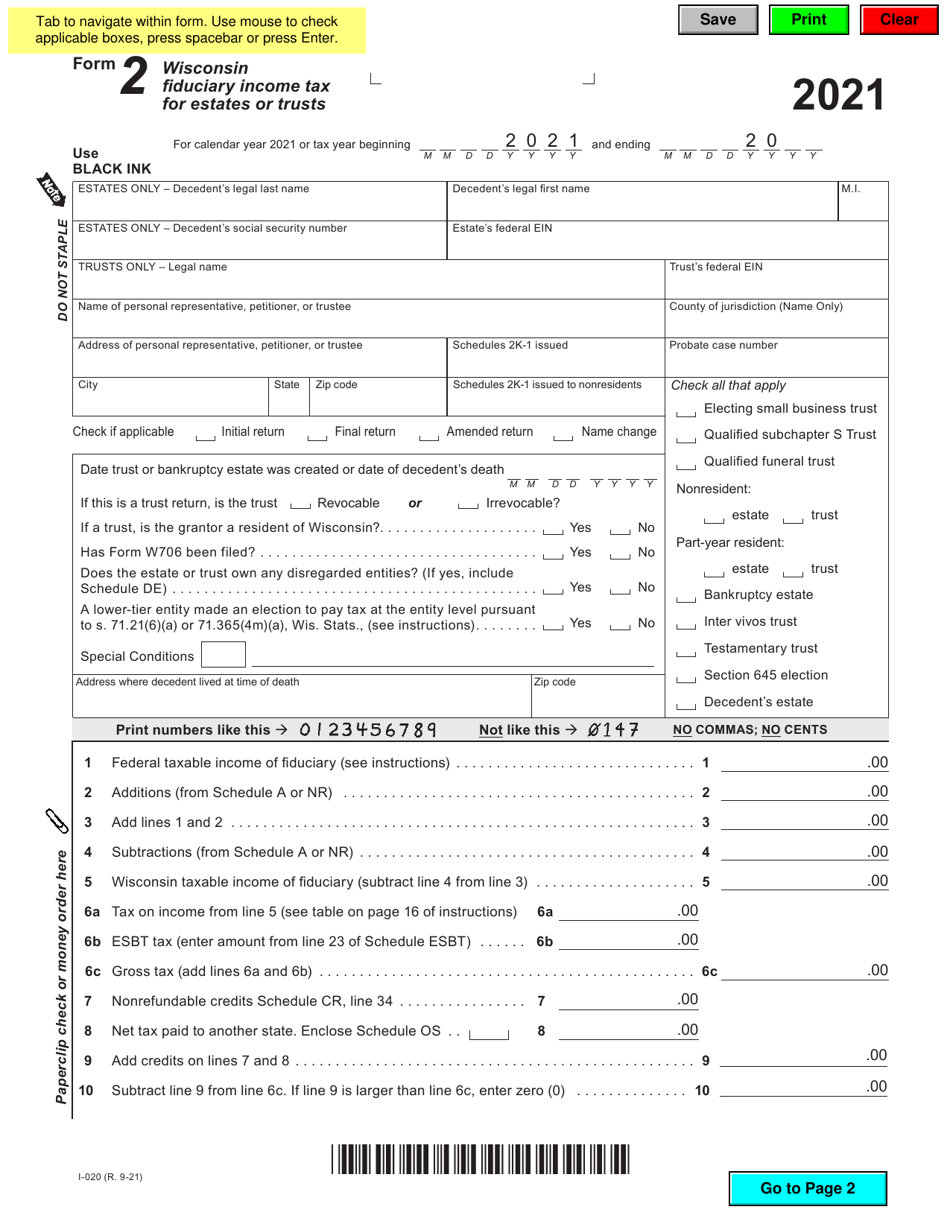

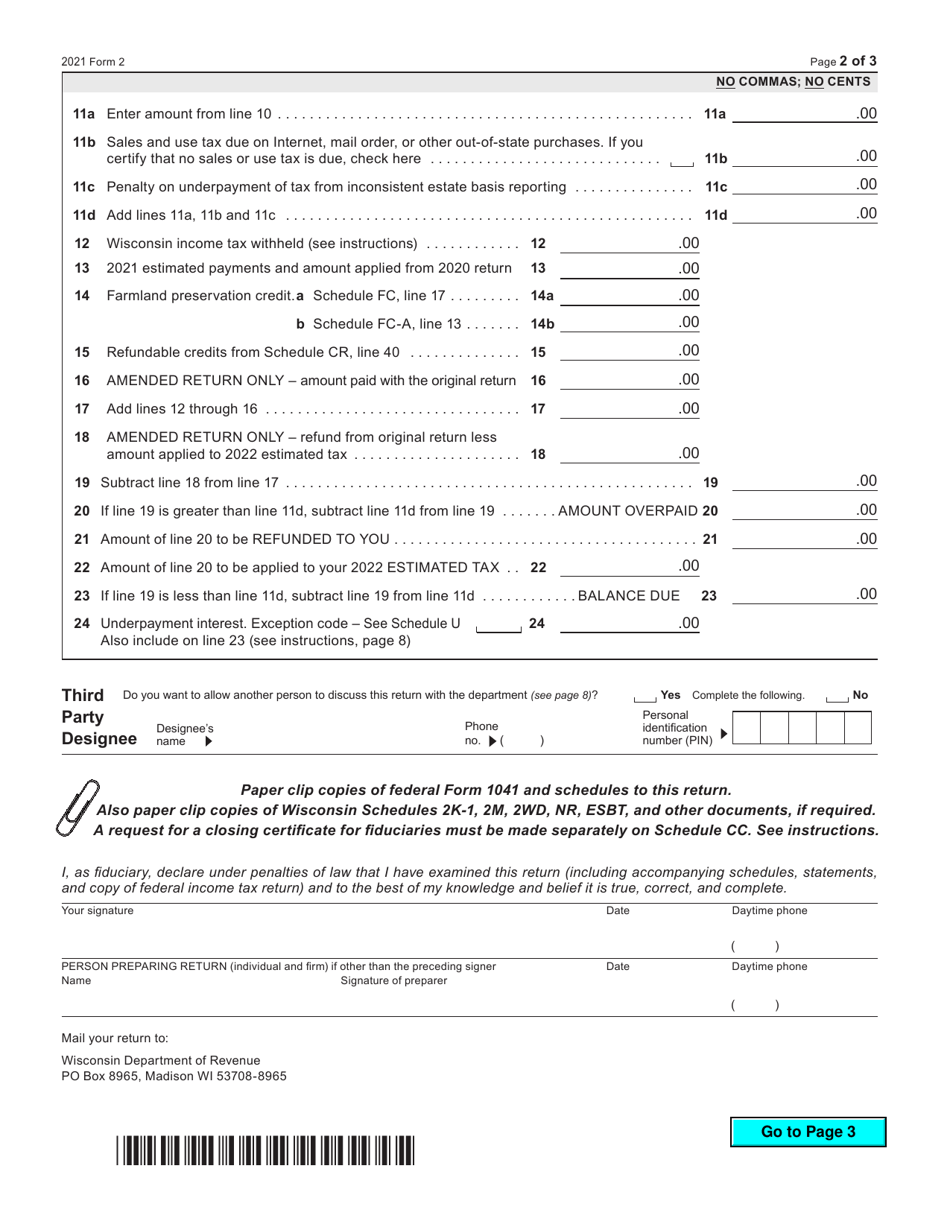

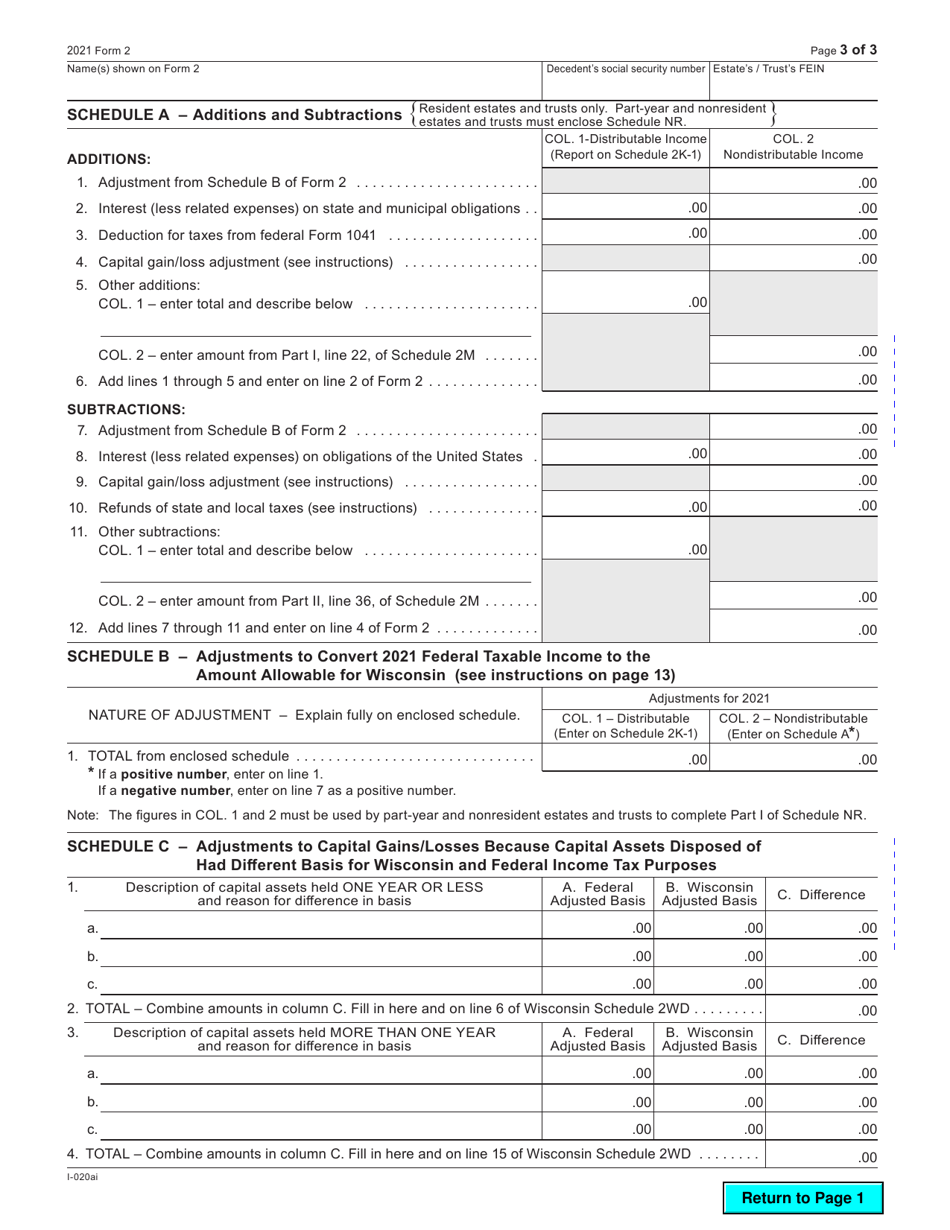

Form 2 (I-020) Wisconsin Fiduciary Income Tax for Estates or Trusts - Wisconsin

What Is Form 2 (I-020)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2 (I-020)?

A: Form 2 (I-020) is the Wisconsin Fiduciary Income Tax form for Estates or Trusts.

Q: Who needs to file Form 2 (I-020)?

A: Estates or Trusts in Wisconsin need to file Form 2 (I-020) for their income tax.

Q: What is the purpose of Form 2 (I-020)?

A: Form 2 (I-020) is used to report and pay the fiduciary income tax for Estates or Trusts in Wisconsin.

Q: When is the deadline to file Form 2 (I-020)?

A: The deadline to file Form 2 (I-020) is on or before the 15th day of the 4th month after the close of the taxable year.

Q: Are there any penalties for late filing of Form 2 (I-020)?

A: Yes, there are penalties for late filing of Form 2 (I-020), including interest charges on any unpaid tax amounts.

Q: Can Form 2 (I-020) be filed electronically?

A: Yes, Form 2 (I-020) can be filed electronically using the Wisconsin e-file system.

Q: What information is required to complete Form 2 (I-020)?

A: To complete Form 2 (I-020), you will need information about the estate or trust's income, deductions, credits, and tax liability.

Q: Are there any exemptions or deductions available for Estates or Trusts?

A: Yes, there are exemptions and deductions available for Estates or Trusts, but they vary depending on the specific circumstances.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 (I-020) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.