This version of the form is not currently in use and is provided for reference only. Download this version of

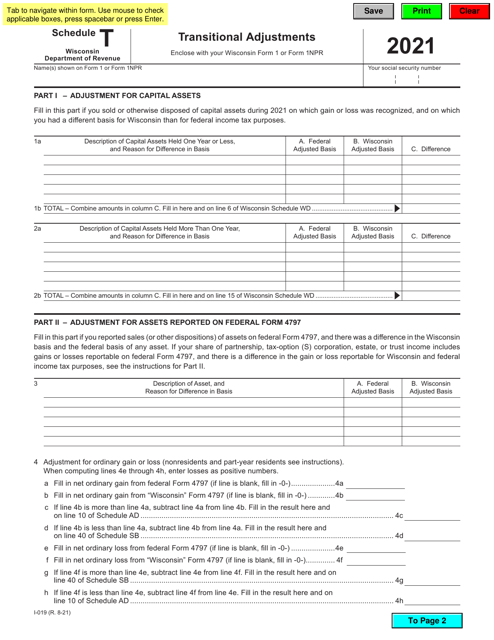

Form I-019 Schedule T

for the current year.

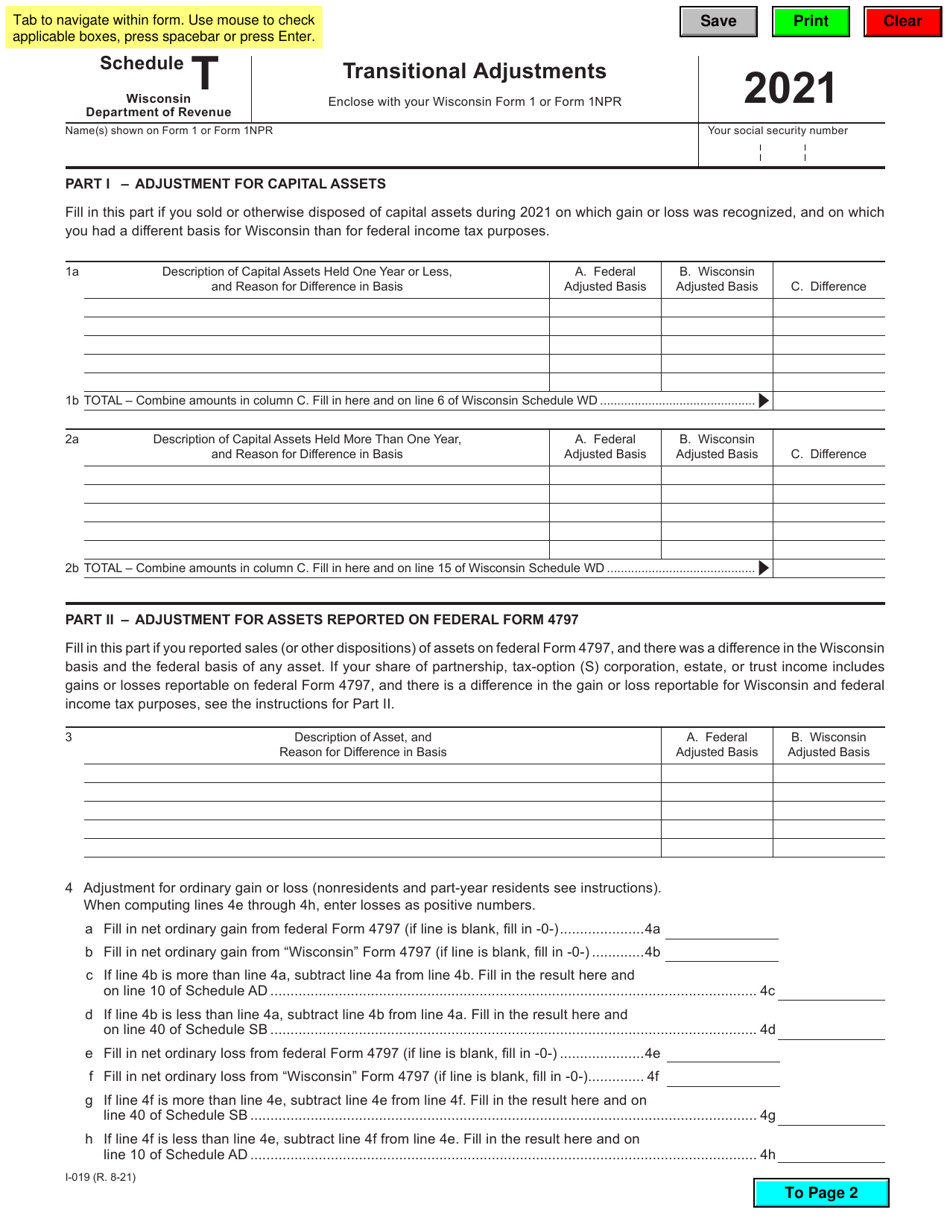

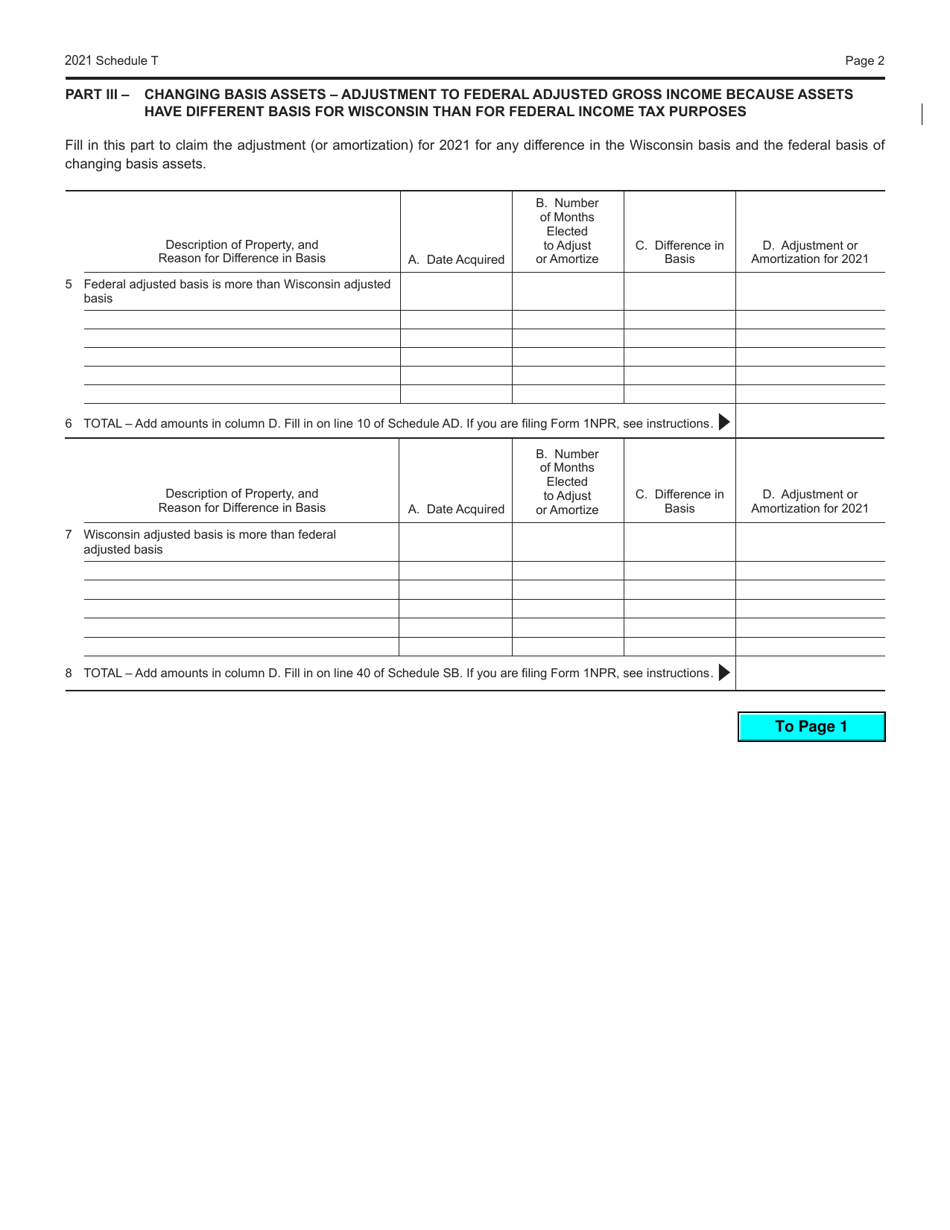

Form I-019 Schedule T Transitional Adjustments - Wisconsin

What Is Form I-019 Schedule T?

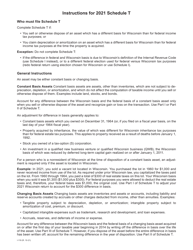

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-019 Schedule T?

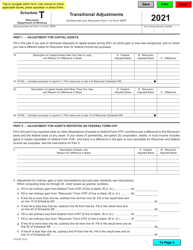

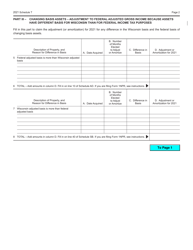

A: Form I-019 Schedule T is a form used in Wisconsin to report the transitional adjustments for use in determining Wisconsin net income.

Q: What are transitional adjustments?

A: Transitional adjustments are specific adjustments made to income or expenses for tax purposes in Wisconsin.

Q: Who needs to file Form I-019 Schedule T?

A: Form I-019 Schedule T must be filed by taxpayers in Wisconsin who have transitional adjustments.

Q: How do I fill out Form I-019 Schedule T?

A: You must provide the necessary information about the transitional adjustments on the form, including the description, amount, and the appropriate box to indicate the type of adjustment.

Q: When is the deadline to file Form I-019 Schedule T?

A: The deadline to file Form I-019 Schedule T is the same as the deadline for filing the Wisconsin income tax return, which is typically April 15th of each year.

Q: What happens if I don't file Form I-019 Schedule T?

A: If you have transitional adjustments and fail to file Form I-019 Schedule T, you may be subject to penalties and interest on the unreported adjustments.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-019 Schedule T by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.