This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-071 Schedule CG

for the current year.

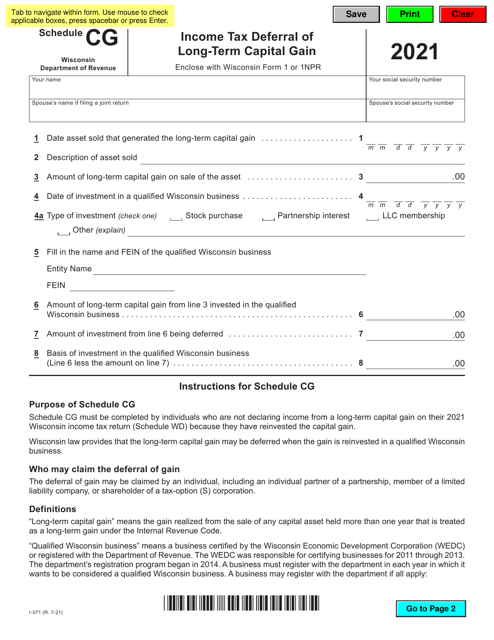

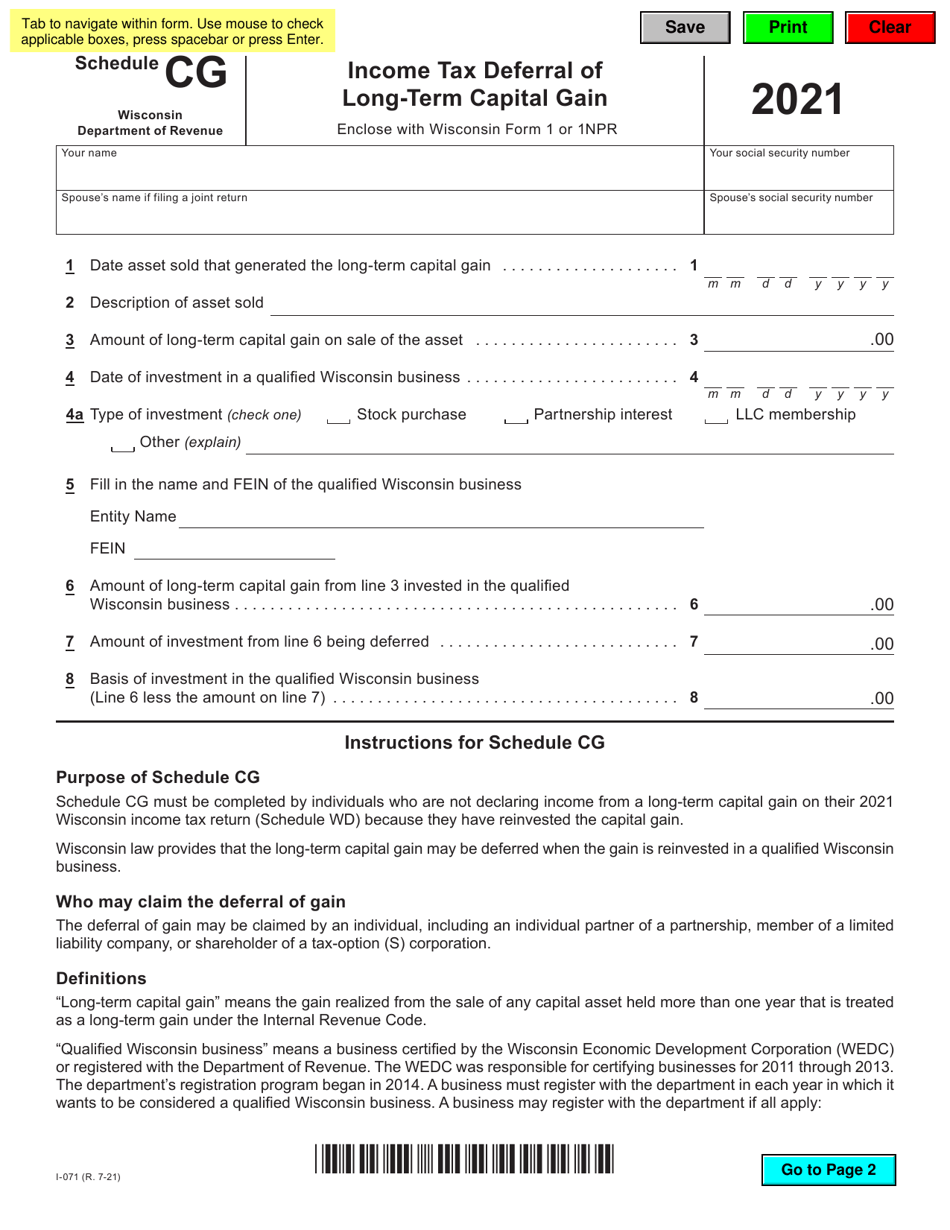

Form I-071 Schedule CG Income Tax Deferral of Long-Term Capital Gain - Wisconsin

What Is Form I-071 Schedule CG?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-071 Schedule CG?

A: Form I-071 Schedule CG is a document used in Wisconsin to request income tax deferral on long-term capital gains.

Q: Who can use Form I-071 Schedule CG?

A: Form I-071 Schedule CG can be used by individuals who meet certain criteria and want to defer payment of income tax on long-term capital gains.

Q: What is the purpose of Form I-071 Schedule CG?

A: The purpose of Form I-071 Schedule CG is to allow eligible individuals to defer payment of income tax on long-term capital gains for a specific period of time.

Q: How do I use Form I-071 Schedule CG?

A: To use Form I-071 Schedule CG, you need to complete the form and submit it along with your Wisconsin income tax return.

Q: What are the eligibility criteria for using Form I-071 Schedule CG?

A: To be eligible to use Form I-071 Schedule CG, you must meet certain criteria such as being an individual taxpayer, having a minimum amount of long-term capital gains, and meeting the residency requirements of Wisconsin.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-071 Schedule CG by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.