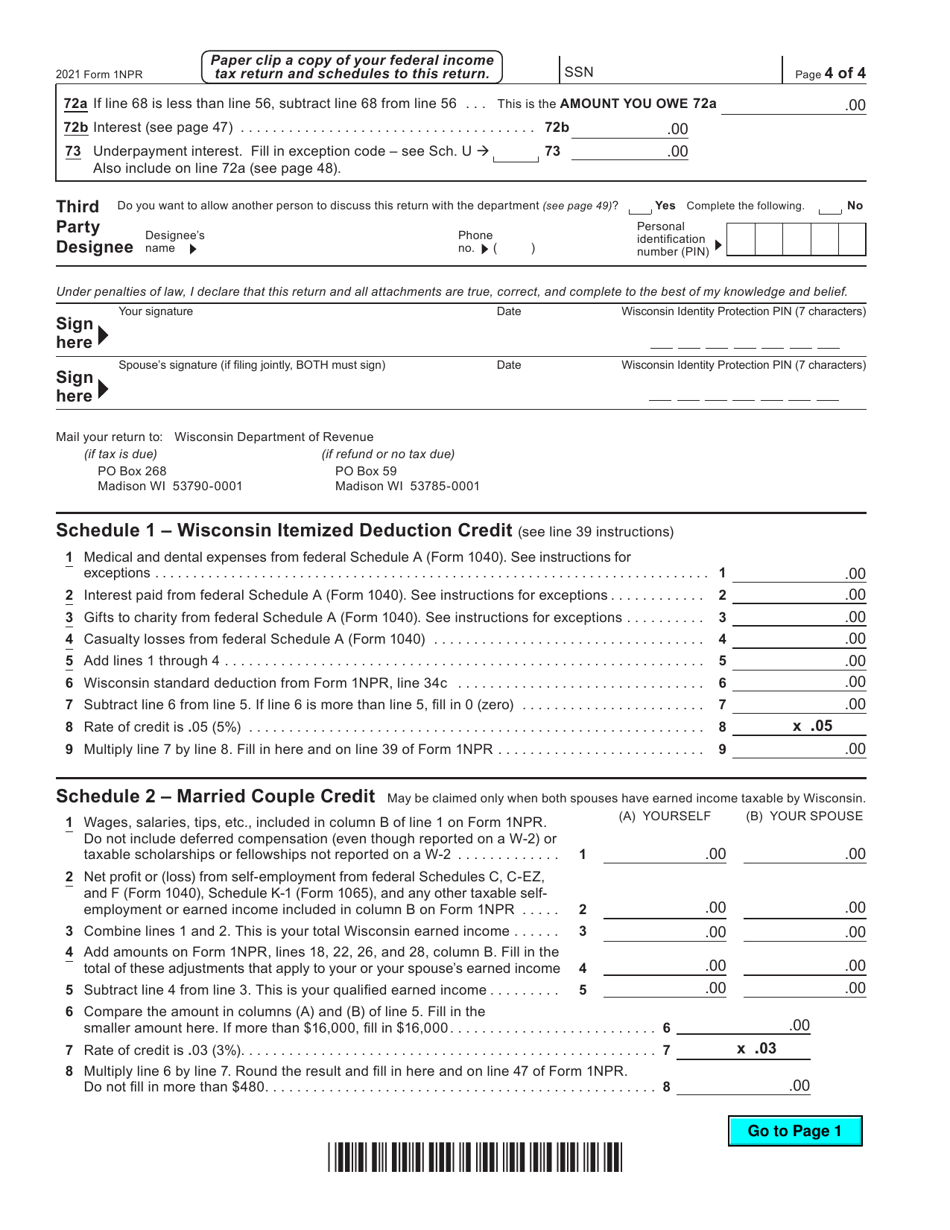

This version of the form is not currently in use and is provided for reference only. Download this version of

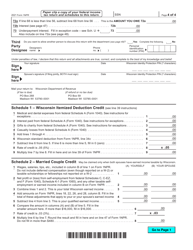

Form 1NPR (I-050I)

for the current year.

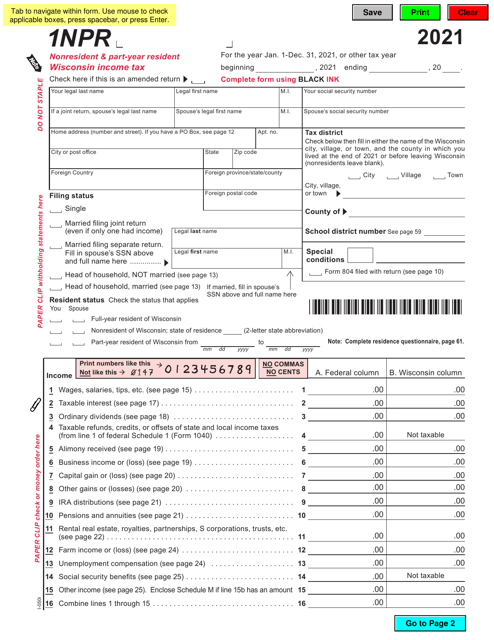

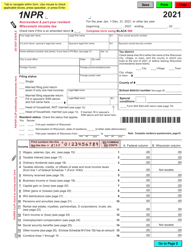

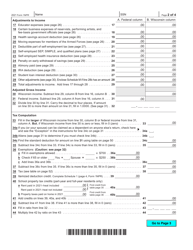

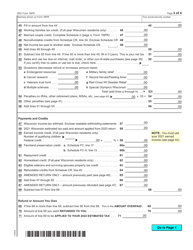

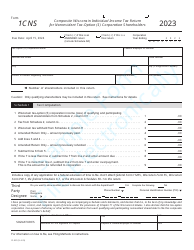

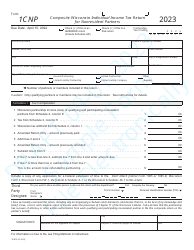

Form 1NPR (I-050I) Nonresident & Part-Year Resident Wisconsin Income Tax - Wisconsin

What Is Form 1NPR (I-050I)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1NPR?

A: Form 1NPR is the Wisconsin Income Tax form for Nonresident and Part-Year Resident taxpayers.

Q: Who should file Form 1NPR?

A: Form 1NPR should be filed by individuals who are nonresidents or part-year residents of Wisconsin.

Q: What types of income should be reported on Form 1NPR?

A: All income earned in Wisconsin, as well as income earned outside of Wisconsin while you were a resident, should be reported on Form 1NPR.

Q: Are there any exceptions to filing Form 1NPR?

A: Yes, there are certain exceptions for individuals who had no Wisconsin income or who qualify for a reciprocity agreement.

Q: When is the deadline for filing Form 1NPR?

A: Form 1NPR must be filed by April 15th of the following year, or by the due date of the federal income tax return, whichever is later.

Form Details:

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1NPR (I-050I) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.