This version of the form is not currently in use and is provided for reference only. Download this version of

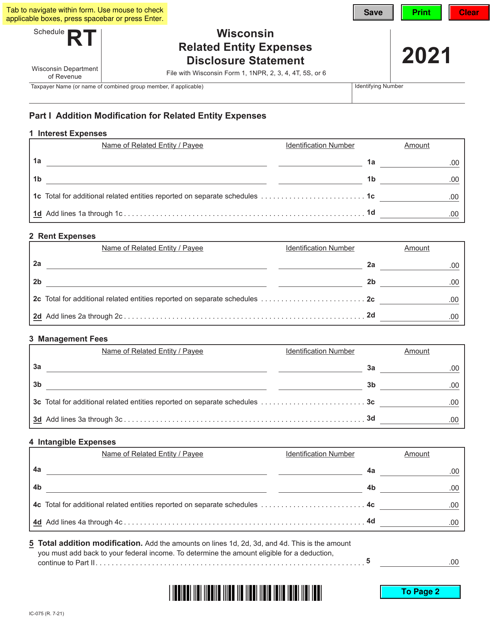

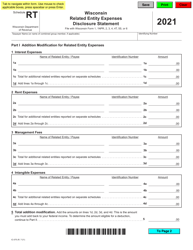

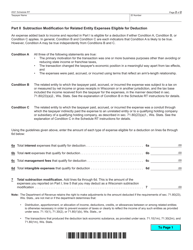

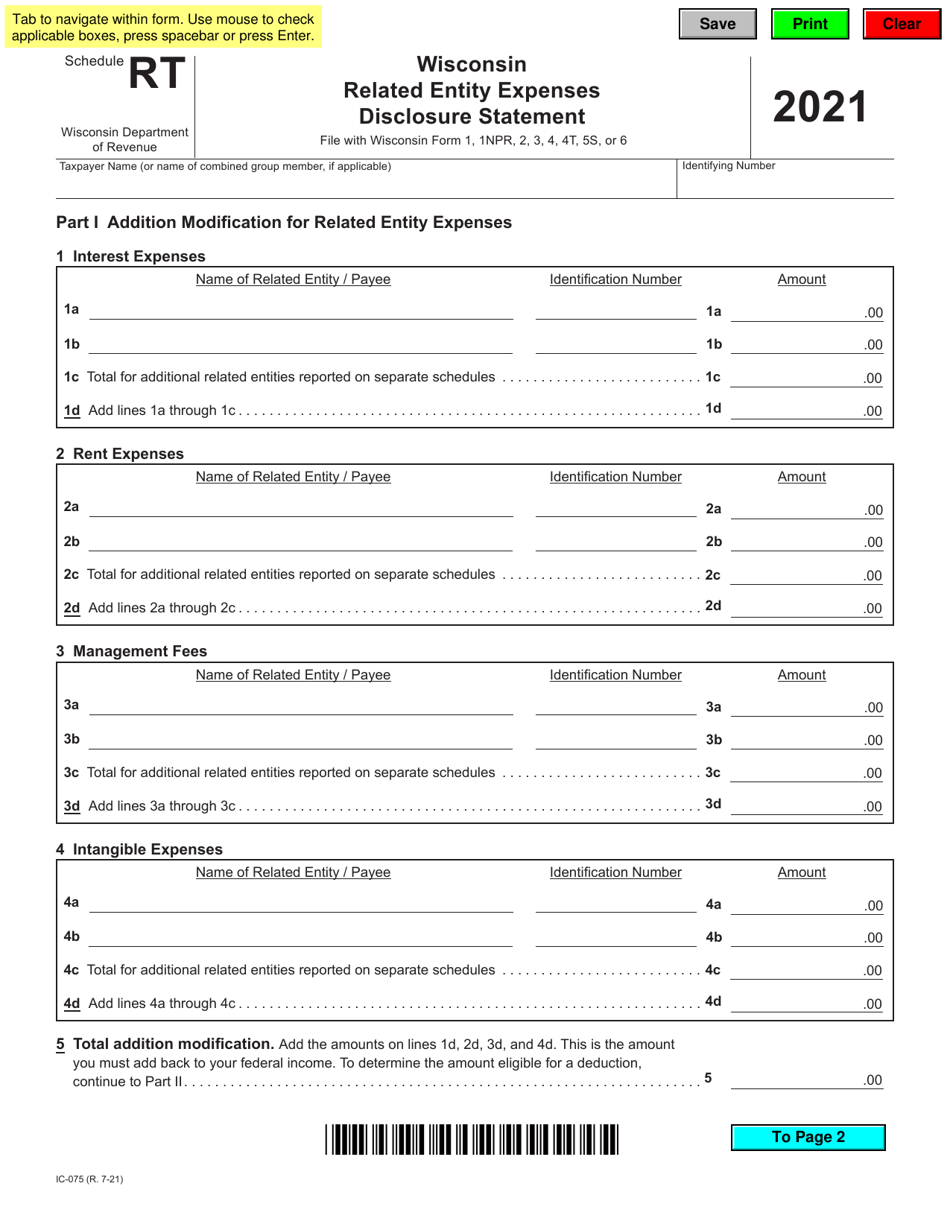

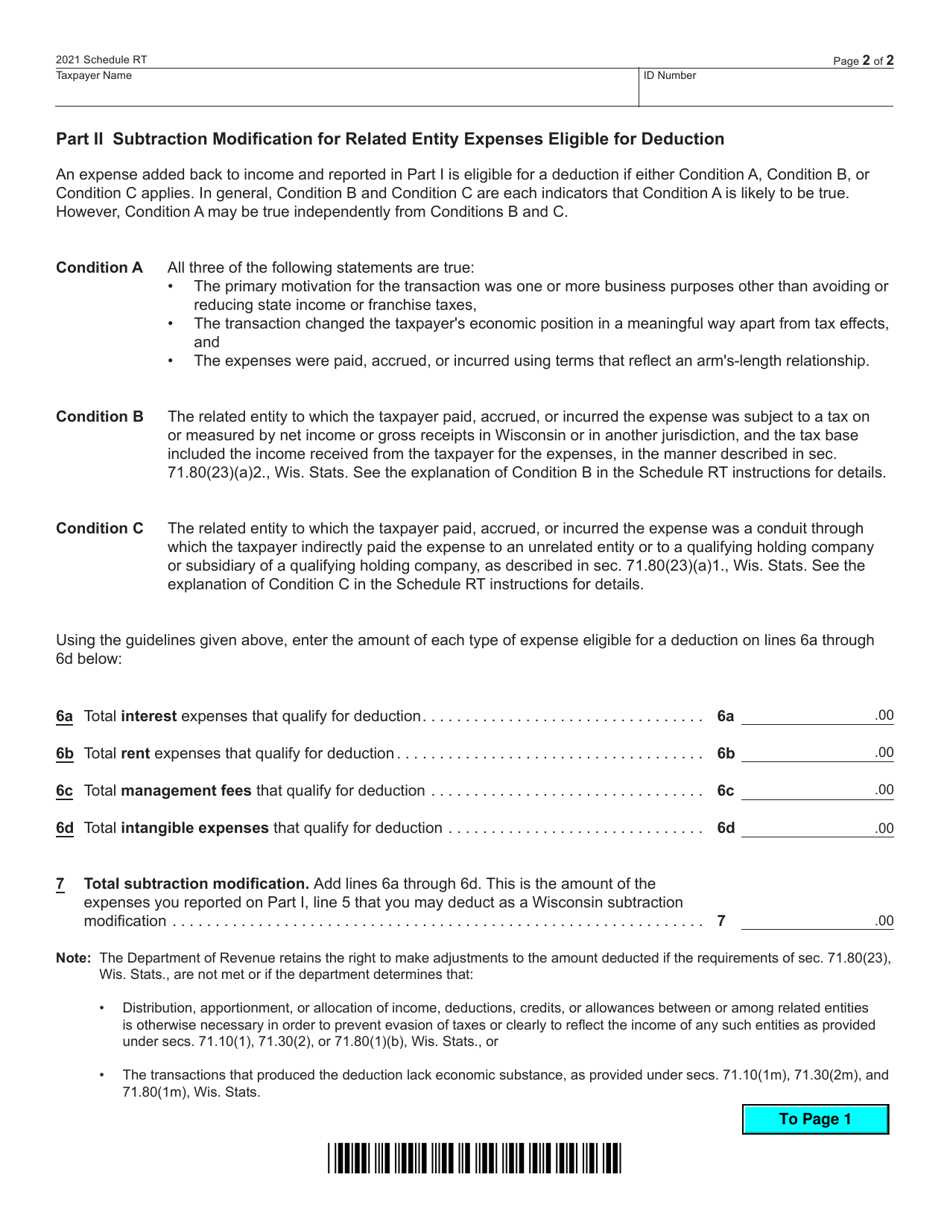

Form IC-075 Schedule RT

for the current year.

Form IC-075 Schedule RT Wisconsin Related Entity Expenses Disclosure Statement - Wisconsin

What Is Form IC-075 Schedule RT?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-075 Schedule RT?

A: Form IC-075 Schedule RT is the Wisconsin Related Entity Expenses Disclosure Statement.

Q: What is the purpose of Form IC-075 Schedule RT?

A: The purpose of Form IC-075 Schedule RT is to disclose Wisconsin related entity expenses.

Q: Who needs to file Form IC-075 Schedule RT?

A: Any entity that has related entity expenses in Wisconsin needs to file Form IC-075 Schedule RT.

Q: When is the deadline to file Form IC-075 Schedule RT?

A: The deadline to file Form IC-075 Schedule RT is the same as the deadline for filing the entity's Wisconsin income tax return.

Q: Are there any penalties for not filing Form IC-075 Schedule RT?

A: Yes, there may be penalties for not filing Form IC-075 Schedule RT or for filing it late.

Q: Is Form IC-075 Schedule RT required for all entities?

A: No, Form IC-075 Schedule RT is only required for entities that have related entity expenses in Wisconsin.

Q: What should I do if I make an error on Form IC-075 Schedule RT?

A: If you make an error on Form IC-075 Schedule RT, you should file an amended form to correct the error.

Q: Can I e-file Form IC-075 Schedule RT?

A: No, Form IC-075 Schedule RT cannot be e-filed and must be filed by mail.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-075 Schedule RT by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.