This version of the form is not currently in use and is provided for reference only. Download this version of

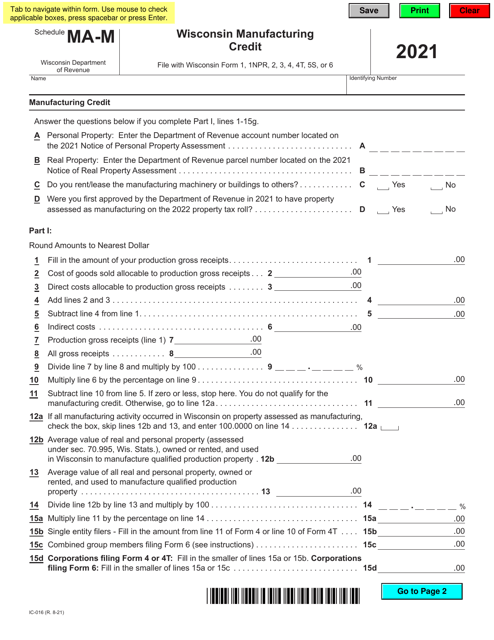

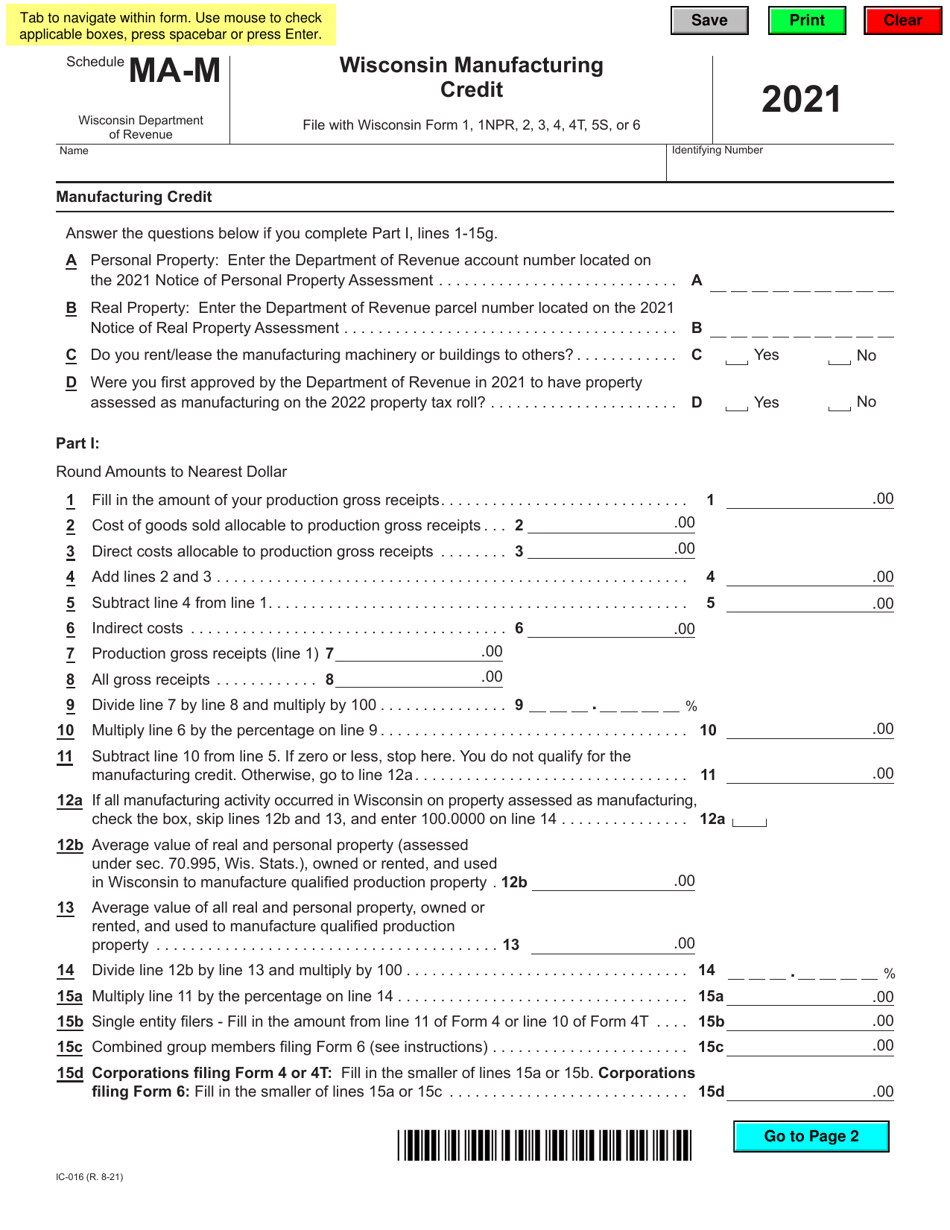

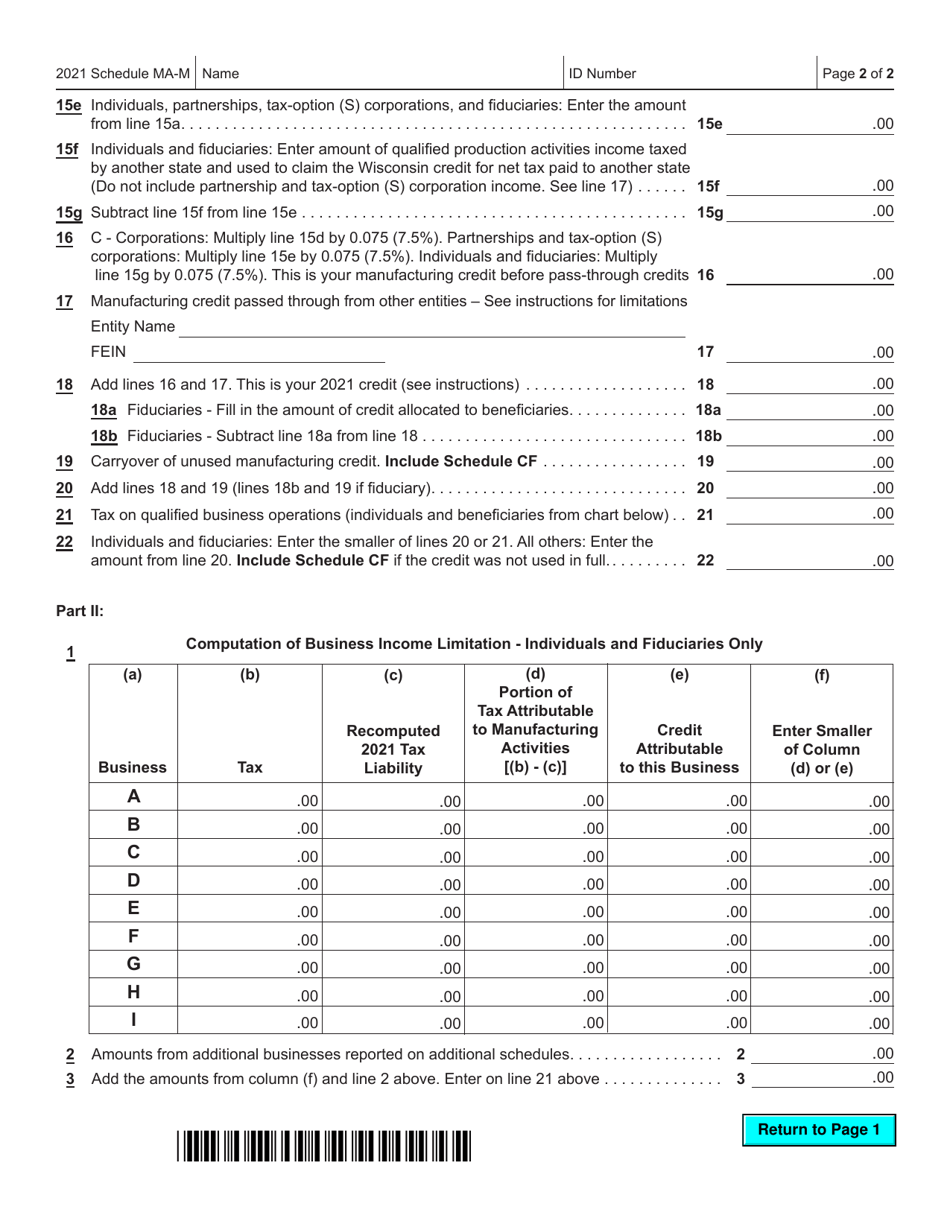

Form IC-016 Schedule MA-M

for the current year.

Form IC-016 Schedule MA-M Wisconsin Manufacturing Credit - Wisconsin

What Is Form IC-016 Schedule MA-M?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-016 Schedule MA-M?

A: Form IC-016 Schedule MA-M is a schedule used in Wisconsin to calculate and claim the Wisconsin Manufacturing Credit.

Q: What is the Wisconsin Manufacturing Credit?

A: The Wisconsin Manufacturing Credit is a tax credit available to eligible manufacturers in Wisconsin. It is designed to support and encourage manufacturing activities in the state.

Q: Who is eligible to claim the Wisconsin Manufacturing Credit?

A: Eligible manufacturers in Wisconsin, defined by certain criteria, are eligible to claim the Wisconsin Manufacturing Credit.

Q: What is the purpose of Form IC-016 Schedule MA-M?

A: The purpose of Form IC-016 Schedule MA-M is to calculate and document the Wisconsin Manufacturing Credit that a manufacturer is eligible to claim.

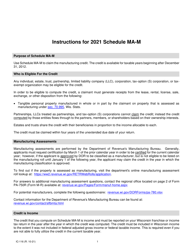

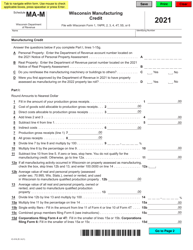

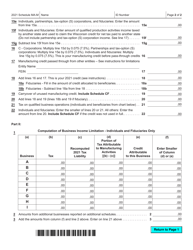

Q: How do I fill out Form IC-016 Schedule MA-M?

A: You should carefully review the instructions provided with the form and enter the required information, such as manufacturing activities, costs, and other relevant details.

Q: When is the deadline to file Form IC-016 Schedule MA-M?

A: The deadline to file Form IC-016 Schedule MA-M is typically the same as the deadline for filing your Wisconsin state tax return, which is usually April 15th or the next business day.

Q: Can I claim the Wisconsin Manufacturing Credit if I am not a manufacturer?

A: No, the Wisconsin Manufacturing Credit is specifically for eligible manufacturers in the state.

Q: What expenses can be claimed for the Wisconsin Manufacturing Credit?

A: Qualified production activities, such as the cost of materials, direct labor, and certain overhead expenses, can generally be claimed for the Wisconsin Manufacturing Credit.

Q: Is there a limit to the amount of credit that can be claimed?

A: Yes, there is a maximum credit amount that can be claimed, based on the eligible manufacturing activities and expenses incurred.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-016 Schedule MA-M by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.