This version of the form is not currently in use and is provided for reference only. Download this version of

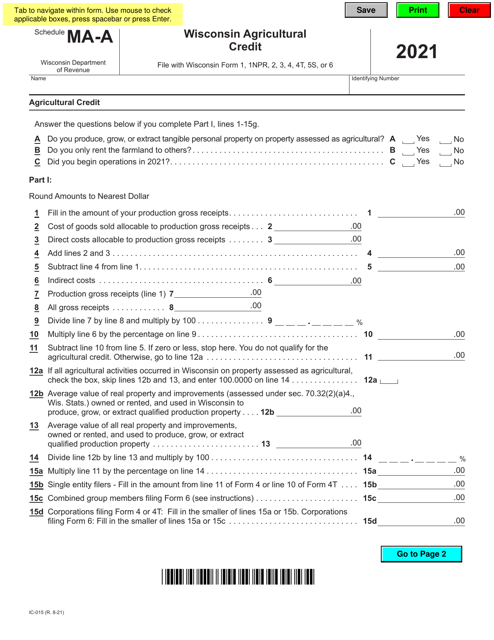

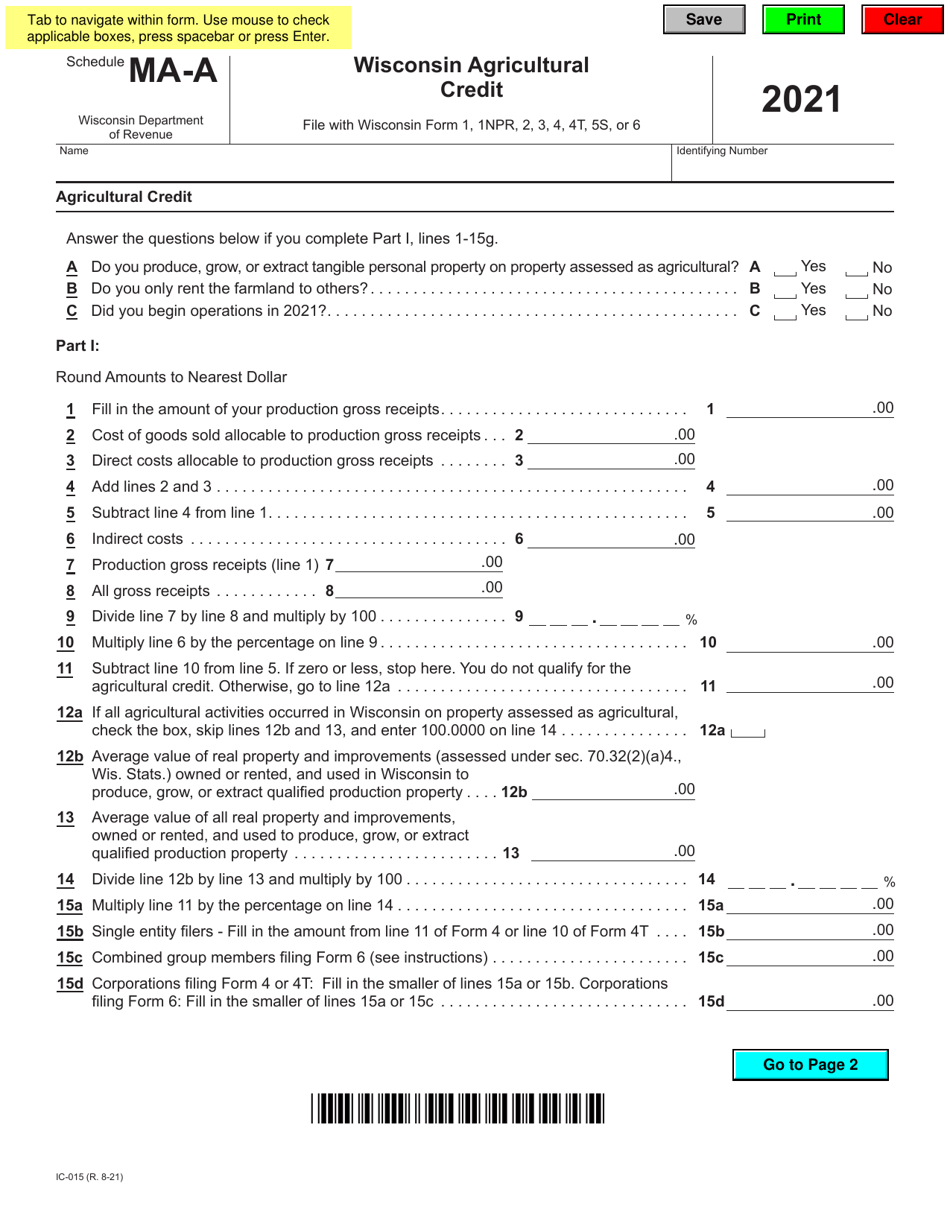

Form IC-015 Schedule MA-A

for the current year.

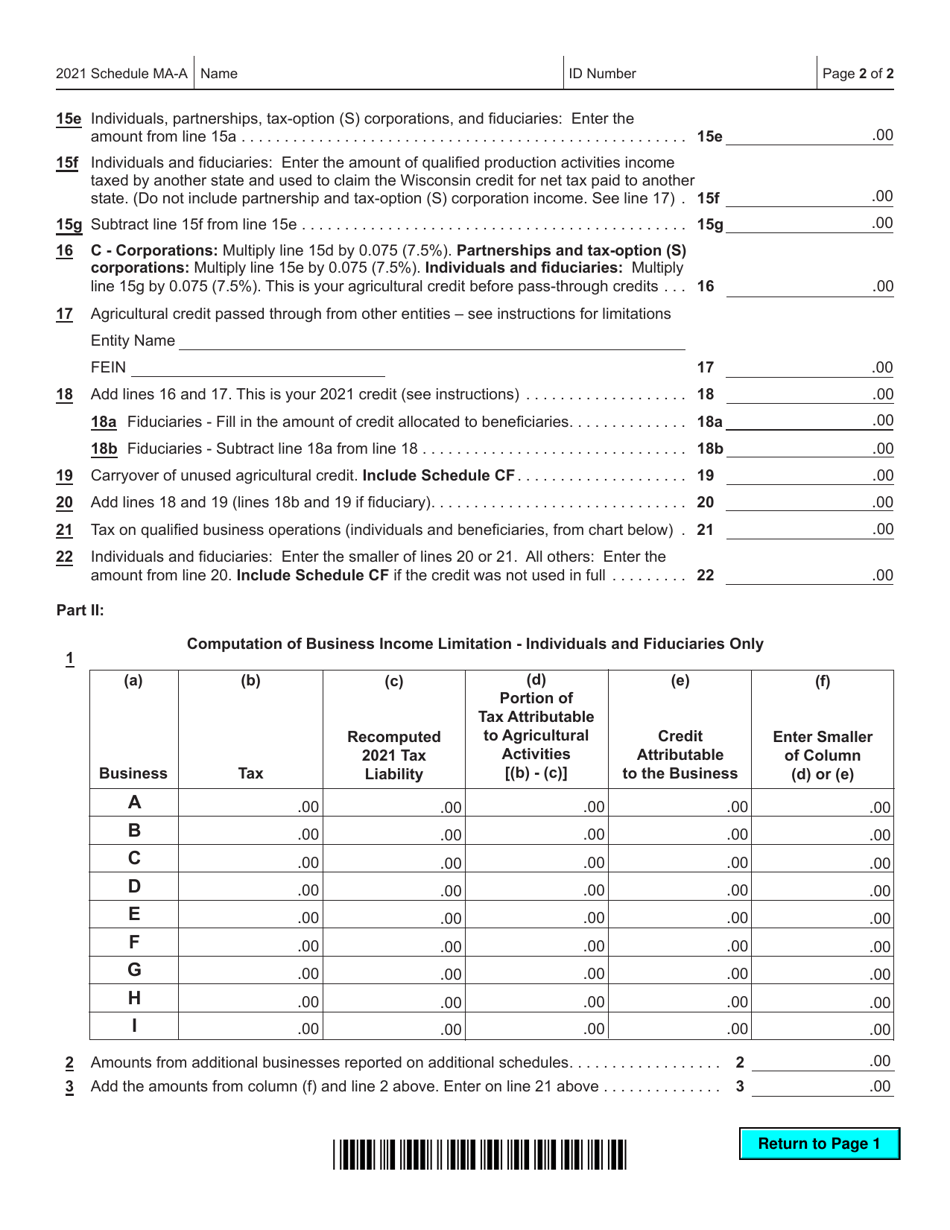

Form IC-015 Schedule MA-A Wisconsin Agricultural Credit - Wisconsin

What Is Form IC-015 Schedule MA-A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IC-015 Schedule MA-A?

A: Form IC-015 Schedule MA-A is the Wisconsin Agricultural Credit form for Wisconsin residents.

Q: Who needs to file Form IC-015 Schedule MA-A?

A: Wisconsin residents who are eligible for the Wisconsin Agricultural Credit should file Form IC-015 Schedule MA-A.

Q: What is the purpose of Form IC-015 Schedule MA-A?

A: The purpose of Form IC-015 Schedule MA-A is to claim the Wisconsin Agricultural Credit, which provides property tax relief for eligible agricultural land.

Q: When is the deadline to file Form IC-015 Schedule MA-A?

A: The deadline to file Form IC-015 Schedule MA-A is the same as the deadline for filing your Wisconsin income tax return, which is usually April 15th.

Q: What documents do I need to complete Form IC-015 Schedule MA-A?

A: To complete Form IC-015 Schedule MA-A, you will need information about your agricultural land, including the parcel number, acreage, and soil productivity rating.

Q: Are there any income limits for the Wisconsin Agricultural Credit?

A: Yes, there are income limits for the Wisconsin Agricultural Credit. You can refer to the instructions for Form IC-015 Schedule MA-A for more information.

Q: Can I e-file Form IC-015 Schedule MA-A?

A: Yes, you can e-file Form IC-015 Schedule MA-A if you are filing your Wisconsin income tax return electronically.

Q: What should I do if I have questions about Form IC-015 Schedule MA-A?

A: If you have questions about Form IC-015 Schedule MA-A, you can contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-015 Schedule MA-A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.