This version of the form is not currently in use and is provided for reference only. Download this version of

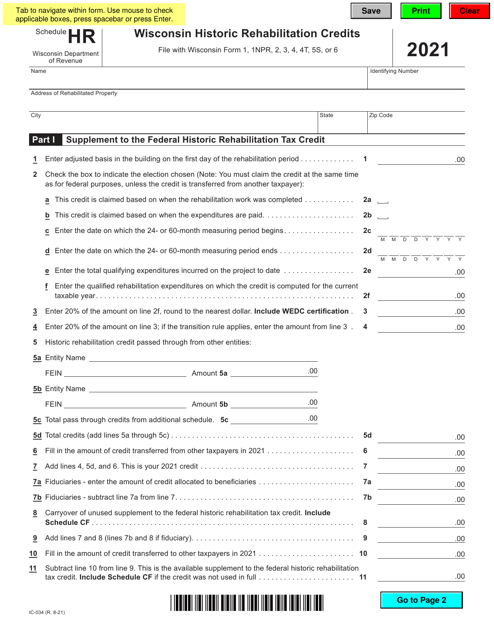

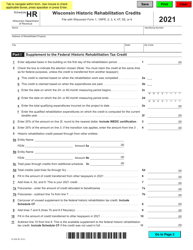

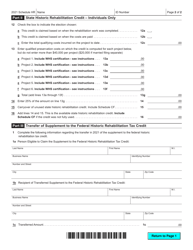

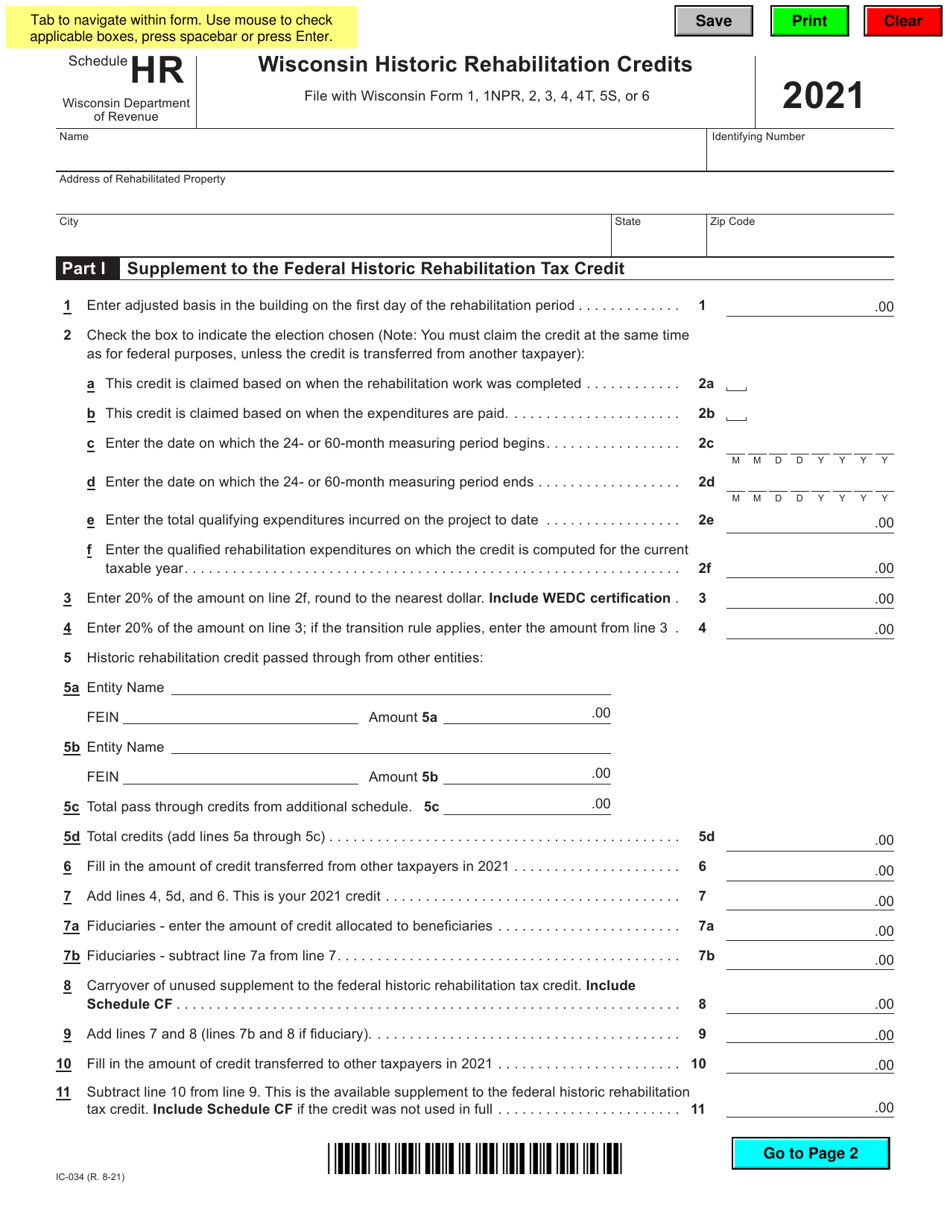

Form IC-034 Schedule HR

for the current year.

Form IC-034 Schedule HR Wisconsin Historic Rehabilitation Credits - Wisconsin

What Is Form IC-034 Schedule HR?

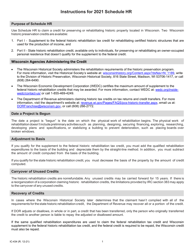

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-034 Schedule HR?

A: Form IC-034 Schedule HR is a specific schedule for claiming historic rehabilitation credits in Wisconsin.

Q: What are Historic Rehabilitation Credits?

A: Historic Rehabilitation Credits are incentives offered by the state of Wisconsin to promote the preservation and rehabilitation of historic buildings.

Q: Who is eligible to claim the Wisconsin Historic Rehabilitation Credits?

A: Owners of qualified historic buildings who have incurred eligible rehabilitation expenses may be eligible to claim the Wisconsin Historic Rehabilitation Credits.

Q: What is the purpose of Form IC-034 Schedule HR?

A: Form IC-034 Schedule HR is used to calculate and report the amount of Wisconsin Historic Rehabilitation Credits that are being claimed.

Q: Are there any specific requirements for claiming Wisconsin Historic Rehabilitation Credits?

A: Yes, there are specific requirements outlined by the Wisconsin Department of Revenue, including the need to meet the criteria for a qualified historic building and eligible rehabilitation expenses.

Q: Is there a deadline for filing Form IC-034 Schedule HR?

A: Yes, the deadline for filing Form IC-034 Schedule HR is typically the same as the deadline for filing the Wisconsin income tax return.

Q: What should I do if I have questions about Form IC-034 Schedule HR?

A: If you have questions about Form IC-034 Schedule HR, you can contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-034 Schedule HR by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.