This version of the form is not currently in use and is provided for reference only. Download this version of

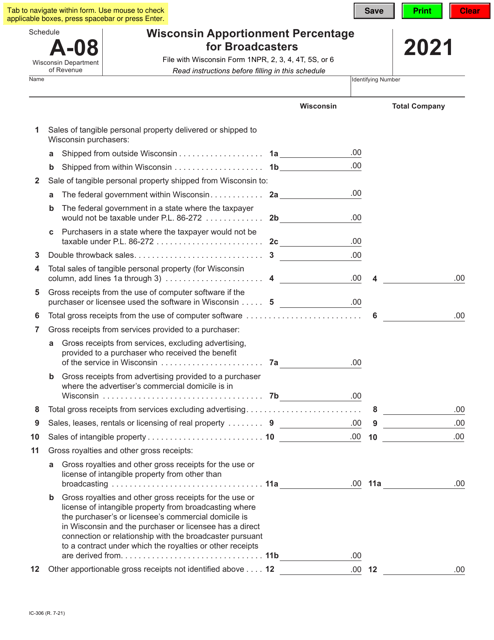

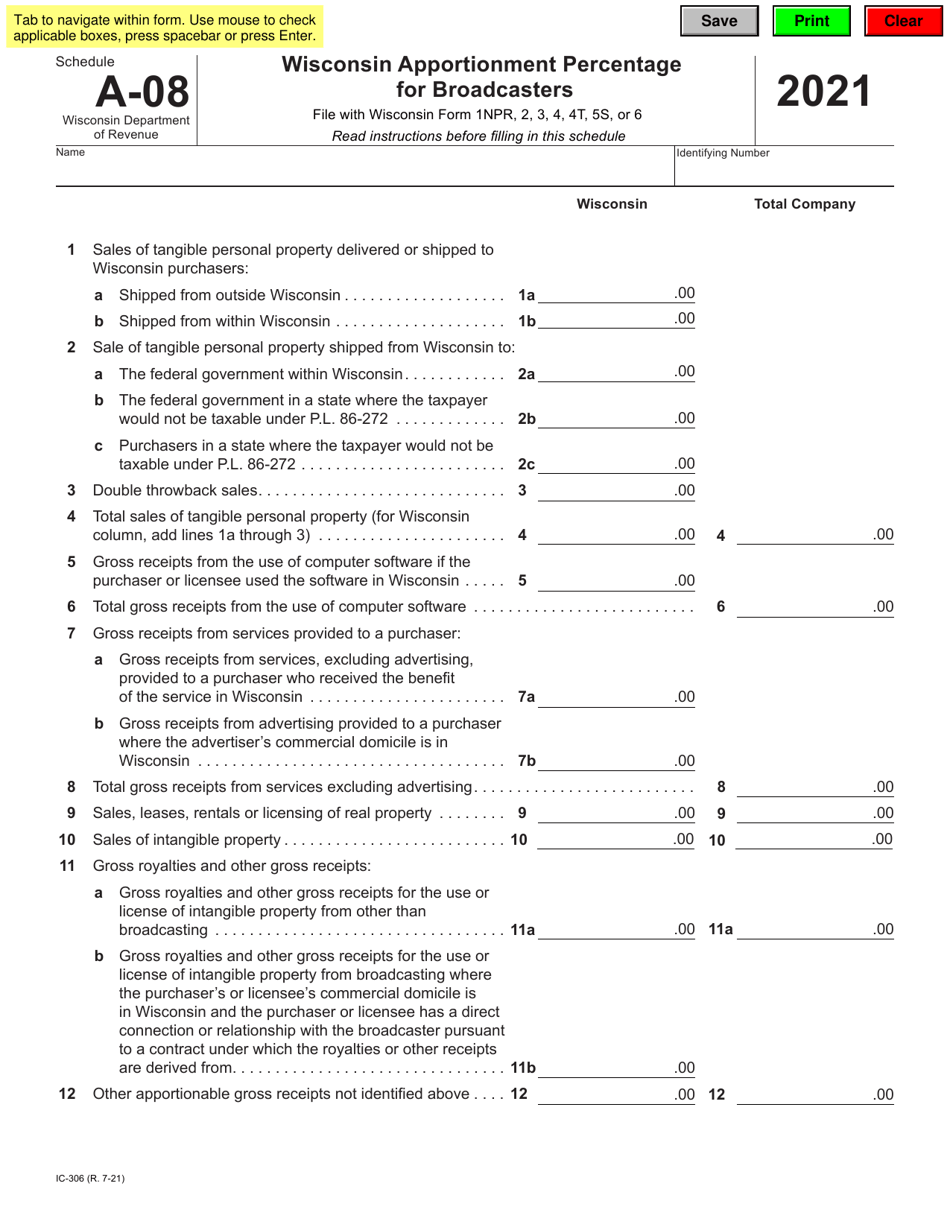

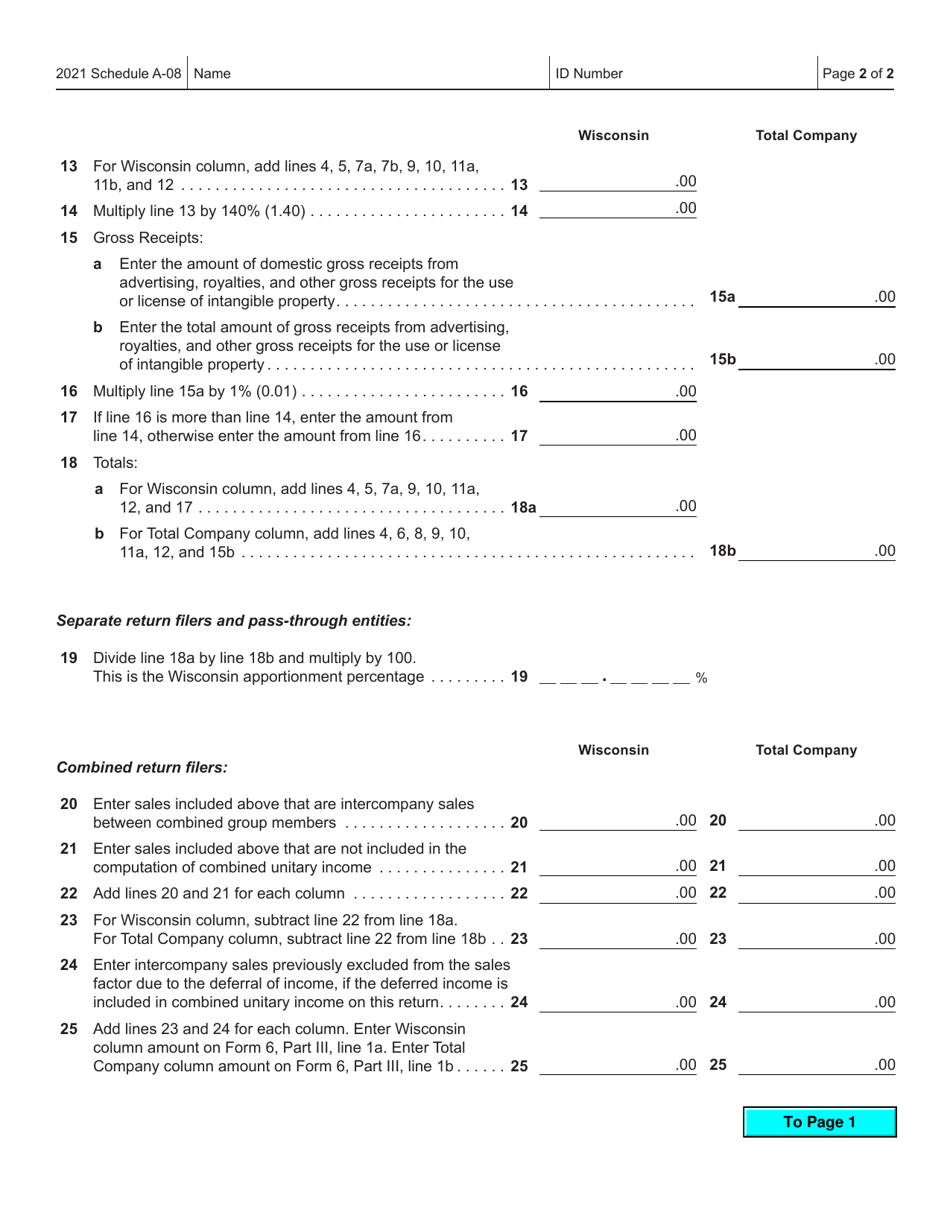

Form IC-306 Schedule A-08

for the current year.

Form IC-306 Schedule A-08 Wisconsin Apportionment Percentage for Broadcasters - Wisconsin

What Is Form IC-306 Schedule A-08?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IC-306?

A: Form IC-306 is the Schedule A-08 Wisconsin Apportionment Percentage for Broadcasters for the state of Wisconsin.

Q: What is the purpose of Form IC-306?

A: The purpose of Form IC-306 is to determine the apportionment percentage for broadcasters in Wisconsin.

Q: Who needs to file Form IC-306?

A: Broadcasters in Wisconsin need to file Form IC-306.

Q: What information is required on Form IC-306?

A: Form IC-306 requires information about the broadcaster's activities, revenues, and expenses in Wisconsin.

Q: When is Form IC-306 due?

A: Form IC-306 is usually due on or before April 15th of each year.

Q: Are there any penalties for late filing of Form IC-306?

A: Yes, there may be penalties for late filing of Form IC-306.

Q: Can Form IC-306 be filed electronically?

A: Yes, Form IC-306 can be filed electronically.

Q: Is Form IC-306 specific to broadcasters?

A: Yes, Form IC-306 is specific to broadcasters in Wisconsin.

Q: What happens after filing Form IC-306?

A: After filing Form IC-306, the Wisconsin Department of Revenue will review the information and determine the broadcaster's apportionment percentage.

Q: How is the apportionment percentage determined?

A: The apportionment percentage is determined based on the broadcaster's activities, revenues, and expenses in Wisconsin compared to their total activities, revenues, and expenses.

Q: Can I amend Form IC-306?

A: Yes, you can amend Form IC-306 if you need to make any changes or corrections to the information provided.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-306 Schedule A-08 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.