This version of the form is not currently in use and is provided for reference only. Download this version of

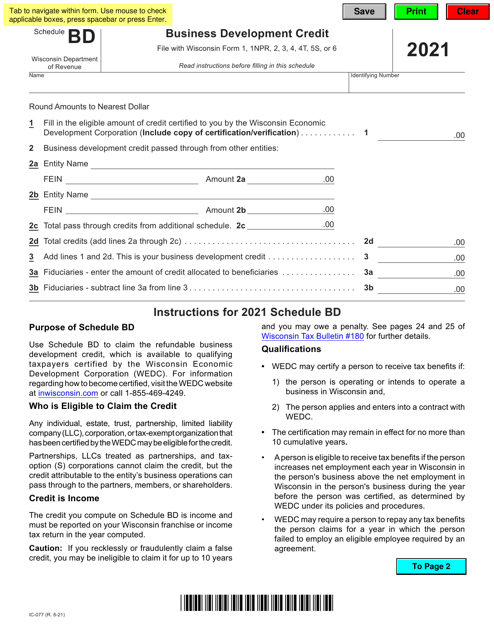

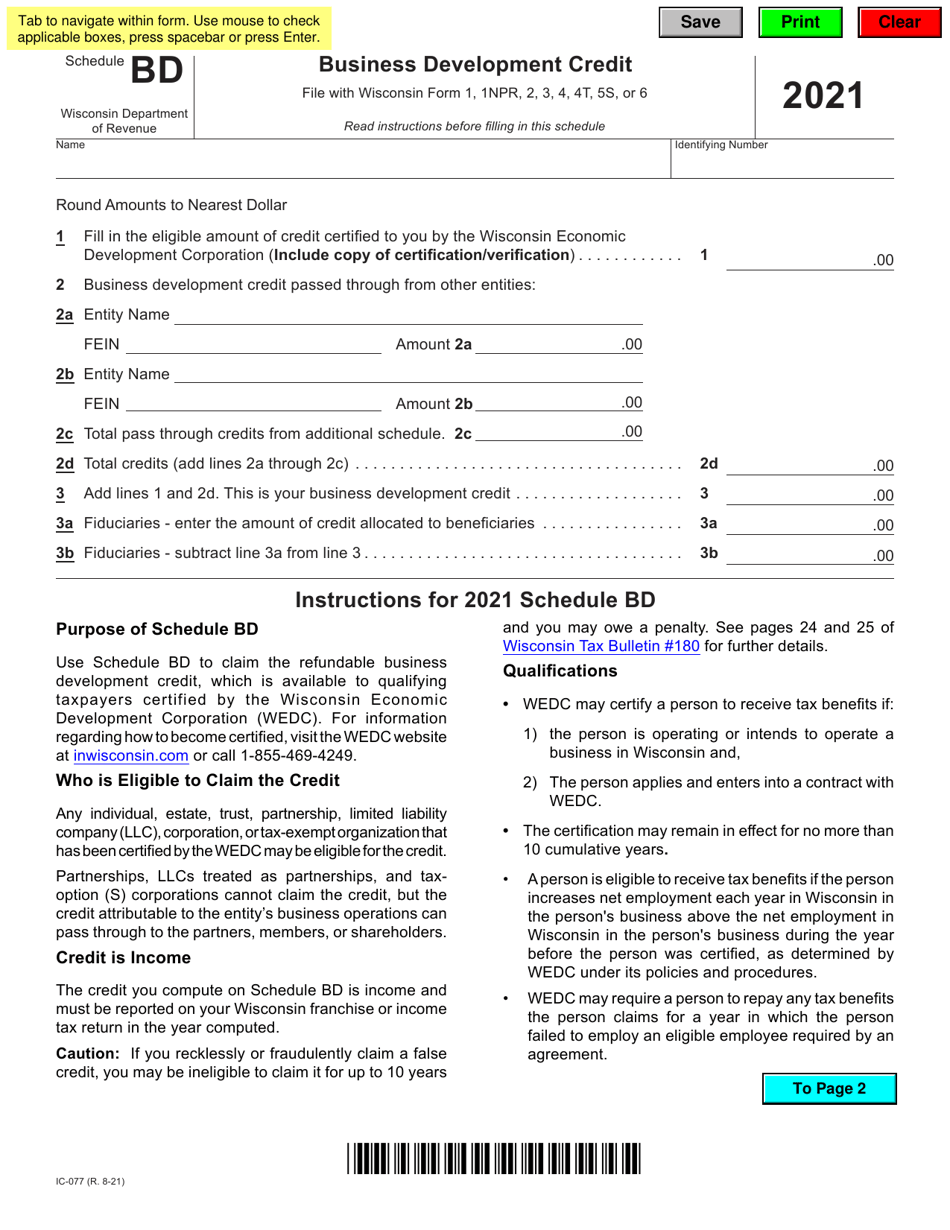

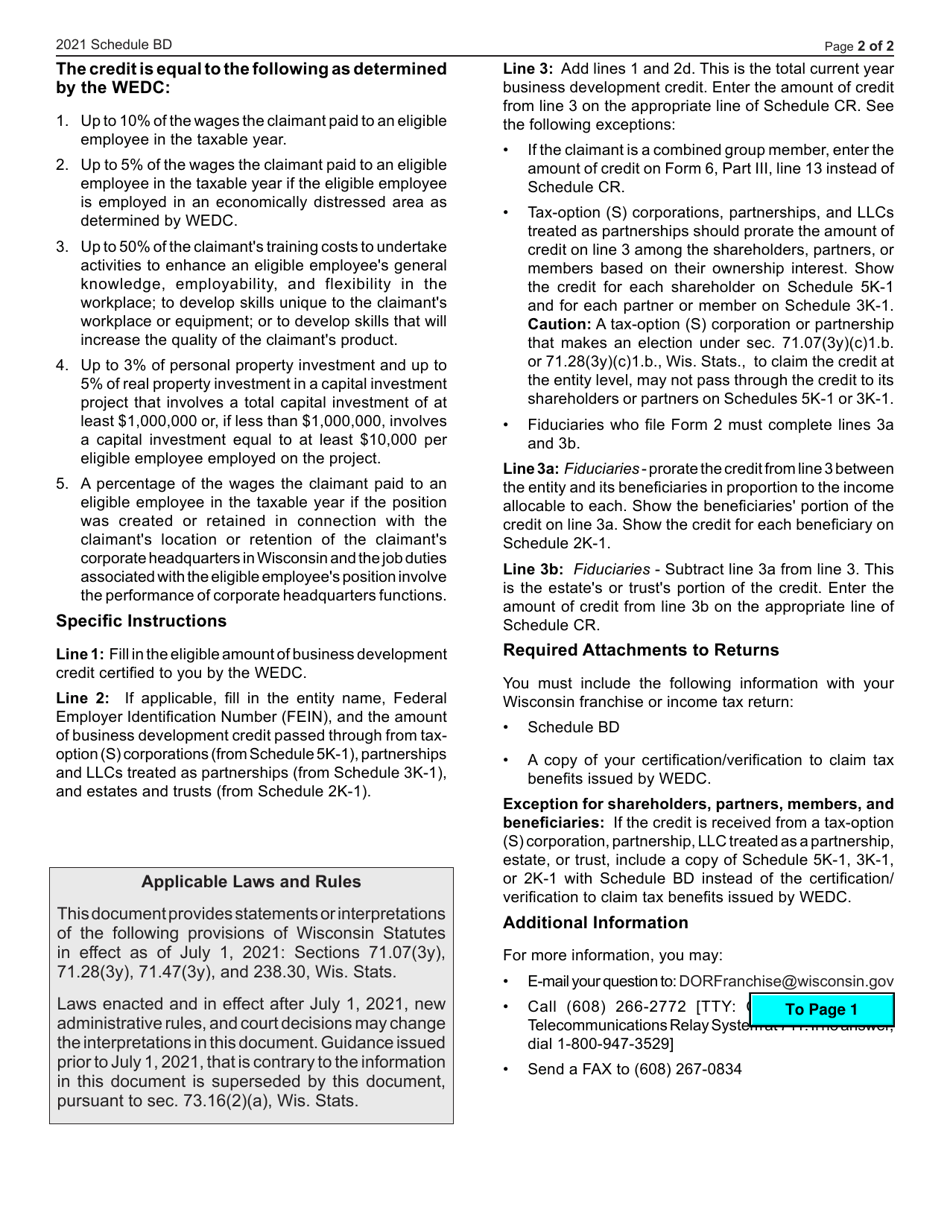

Form IC-077 Schedule BD

for the current year.

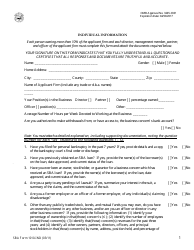

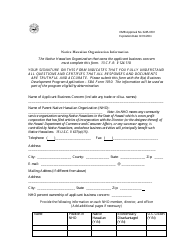

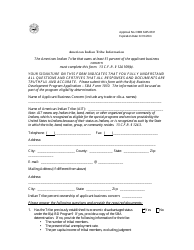

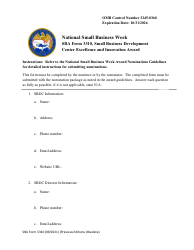

Form IC-077 Schedule BD Business Development Credit - Wisconsin

What Is Form IC-077 Schedule BD?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IC-077 Schedule BD?

A: Form IC-077 Schedule BD is a tax form specific to the state of Wisconsin that is used to claim the Business Development Credit.

Q: What is the Business Development Credit?

A: The Business Development Credit is a tax incentive offered by the state of Wisconsin to encourage businesses to invest in certain eligible development projects. It provides a credit against income or franchise tax liability.

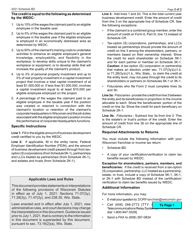

Q: Who is eligible to claim the Business Development Credit?

A: Businesses that meet certain criteria set by the state of Wisconsin, such as making qualified investments in eligible projects, may be eligible to claim the Business Development Credit.

Q: What information is required to complete Form IC-077 Schedule BD?

A: To complete Form IC-077 Schedule BD, you will need to provide information about the qualifying investments made by your business, such as the amount invested and the location of the project.

Q: When is the deadline to file Form IC-077 Schedule BD?

A: The deadline to file Form IC-077 Schedule BD is typically the same as the deadline for filing your Wisconsin income or franchise tax return.

Q: Is the Business Development Credit refundable?

A: No, the Business Development Credit is not refundable. However, any unused credits can be carried forward for up to 15 years.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-077 Schedule BD by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.