This version of the form is not currently in use and is provided for reference only. Download this version of

Form 4466W (IC-831)

for the current year.

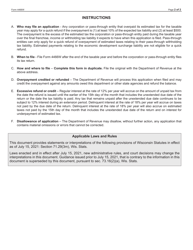

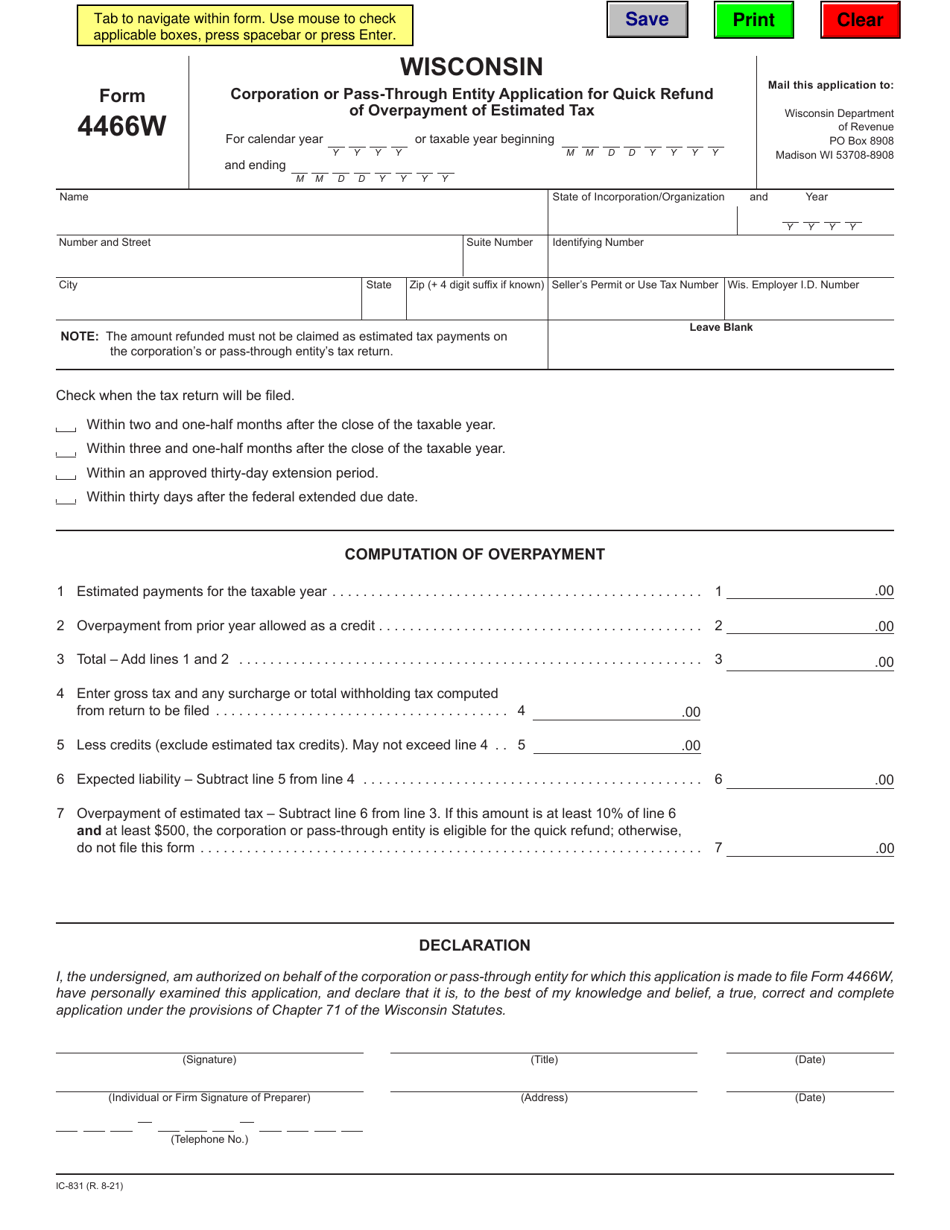

Form 4466W (IC-831) Corporation or Pass-Through Entity Application for Quick Refund of Overpayment of Estimated Tax - Wisconsin

What Is Form 4466W (IC-831)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4466W?

A: Form 4466W is an application used by corporations or pass-through entities in Wisconsin to request a quick refund of overpaid estimated tax.

Q: Who can use Form 4466W?

A: Corporations and pass-through entities in Wisconsin can use Form 4466W.

Q: What is the purpose of Form 4466W?

A: The purpose of Form 4466W is to request a quick refund of overpaid estimated tax.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income tax directly. Instead, the income or losses of the business pass through to its owners, who report them on their individual tax returns.

Q: What is an estimated tax?

A: Estimated tax is the method used to pay tax on income that is not subject to withholding. It is a way for taxpayers to pay their tax liabilities in installments throughout the year.

Q: What is a quick refund?

A: A quick refund is a expedited refund of overpaid estimated tax.

Q: Are there any deadlines for filing Form 4466W?

A: Yes, there are specific deadlines for filing Form 4466W. It is important to check the instructions for the form or consult with the Wisconsin Department of Revenue for the current year's deadlines.

Q: Can I e-file Form 4466W?

A: No, at the moment, Form 4466W cannot be e-filed. It must be filed by mail to the Wisconsin Department of Revenue.

Q: Is Form 4466W used only in Wisconsin?

A: Yes, Form 4466W is specific to Wisconsin. Other states may have their own forms for requesting a quick refund of overpaid estimated tax.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4466W (IC-831) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.