This version of the form is not currently in use and is provided for reference only. Download this version of

Form PW-2 (IC-005)

for the current year.

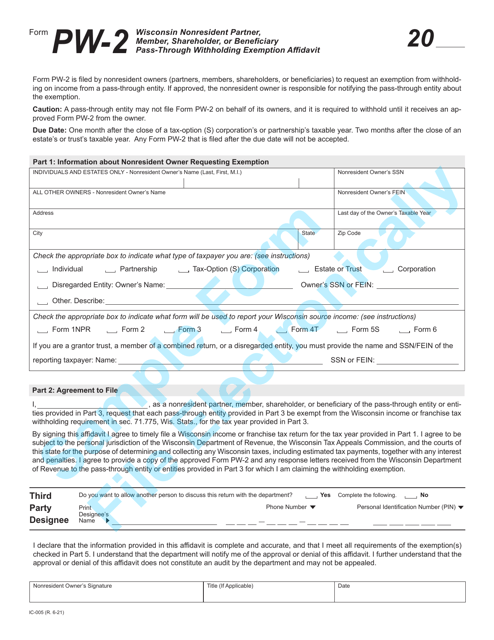

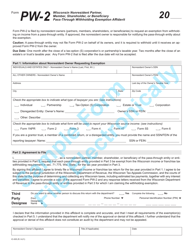

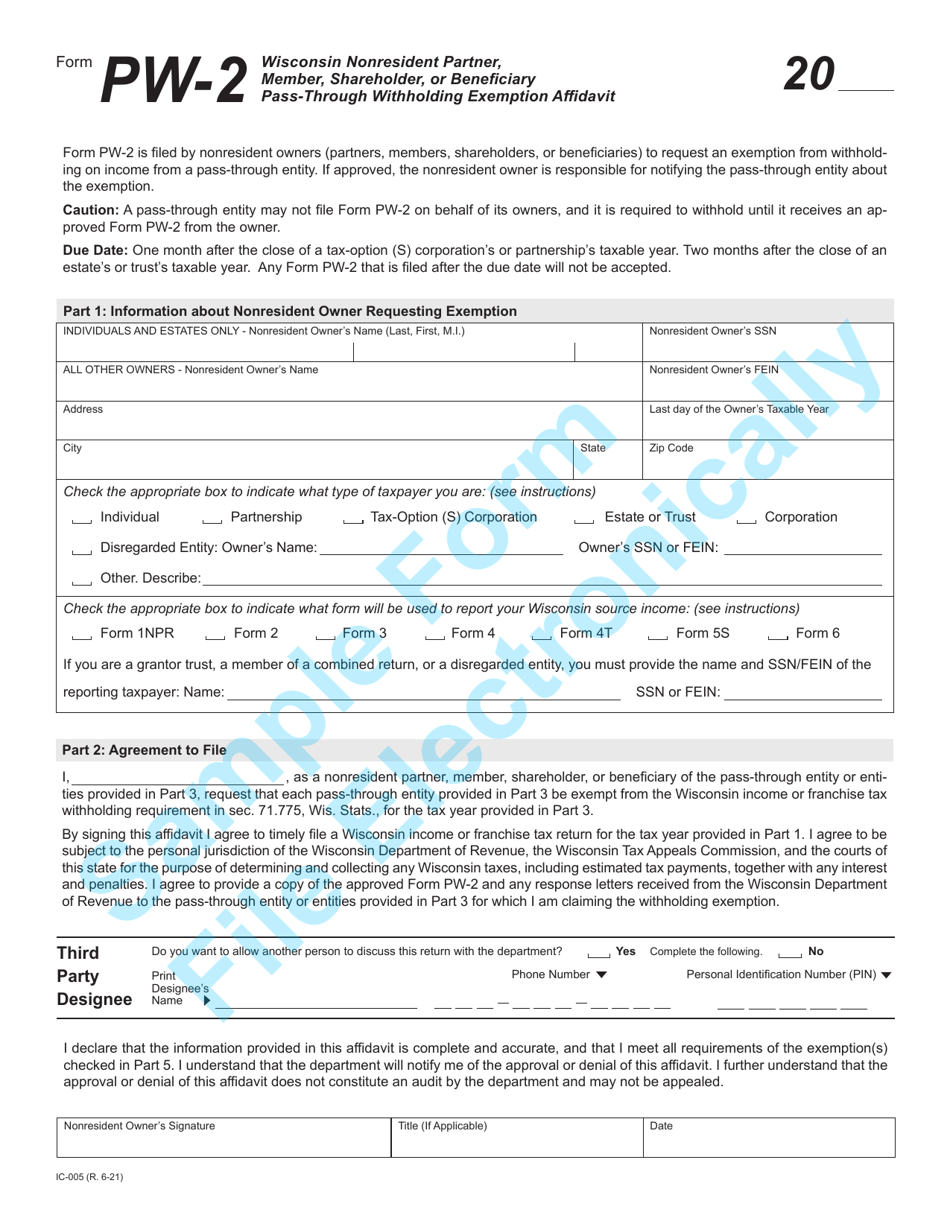

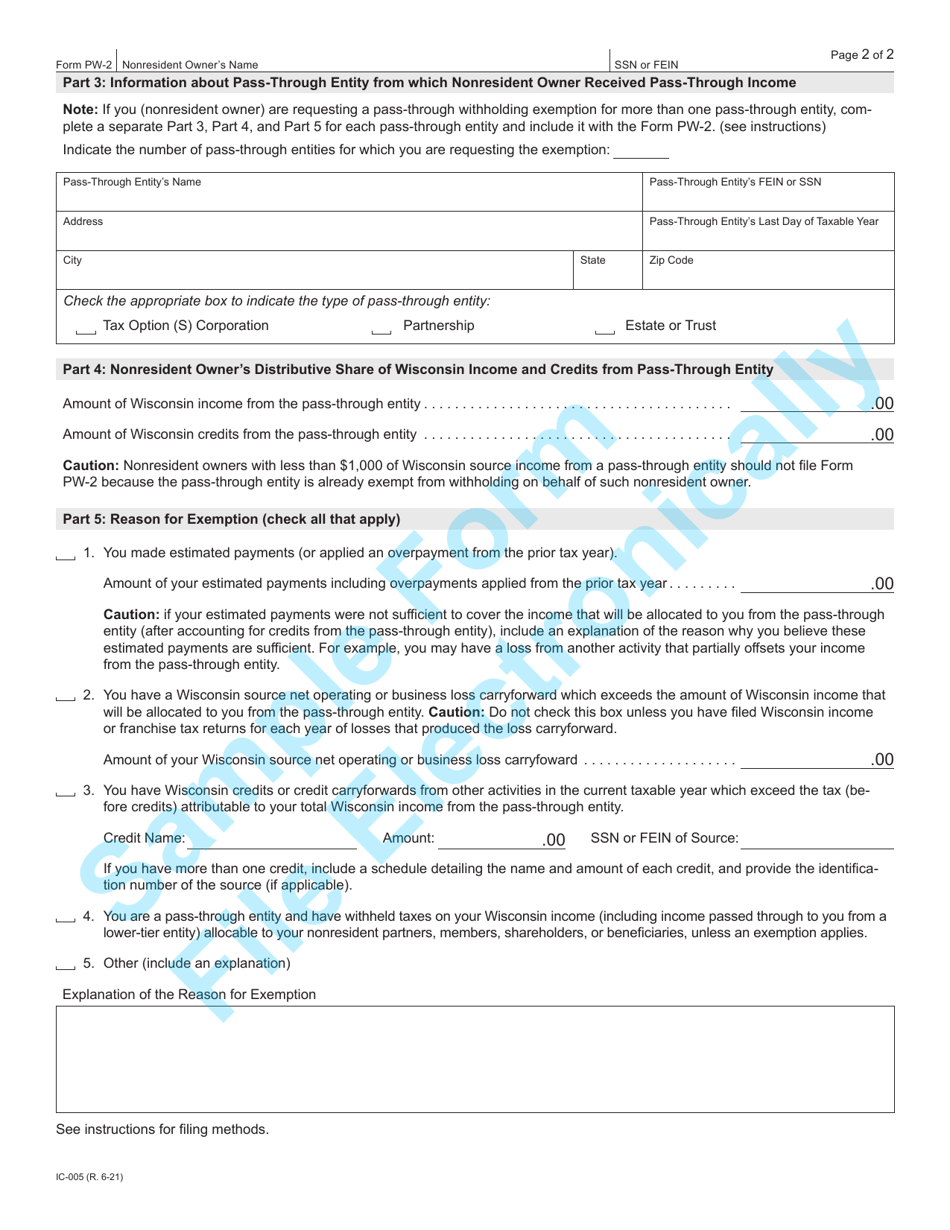

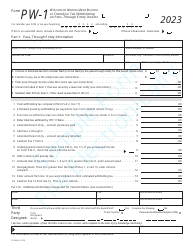

Form PW-2 (IC-005) Wisconsin Nonresident Partner, Member, Shareholder, or Beneficiary Pass-Through Withholding Exemption Affidavit - Sample - Wisconsin

What Is Form PW-2 (IC-005)?

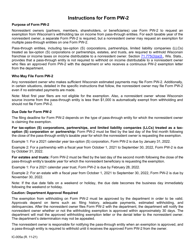

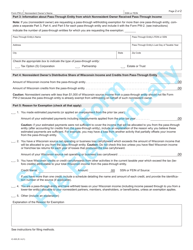

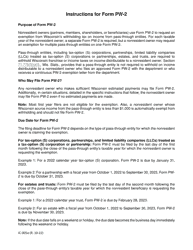

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PW-2?

A: Form PW-2 is the Wisconsin Nonresident Partner, Member, Shareholder, or Beneficiary Pass-Through Withholding Exeption Affidavit.

Q: Who should use Form PW-2?

A: Form PW-2 should be used by nonresident partners, members, shareholders, or beneficiaries who are claiming exemption from pass-through withholding in Wisconsin.

Q: What is pass-through withholding?

A: Pass-through withholding is the withholding of income tax on income that is distributed by a pass-through entity to its partners, members, shareholders, or beneficiaries.

Q: Who is considered a nonresident for purposes of Form PW-2?

A: A nonresident is someone who is not a resident of Wisconsin.

Q: What is the purpose of Form PW-2?

A: The purpose of Form PW-2 is to claim an exemption from pass-through withholding in Wisconsin.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PW-2 (IC-005) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.