This version of the form is not currently in use and is provided for reference only. Download this version of

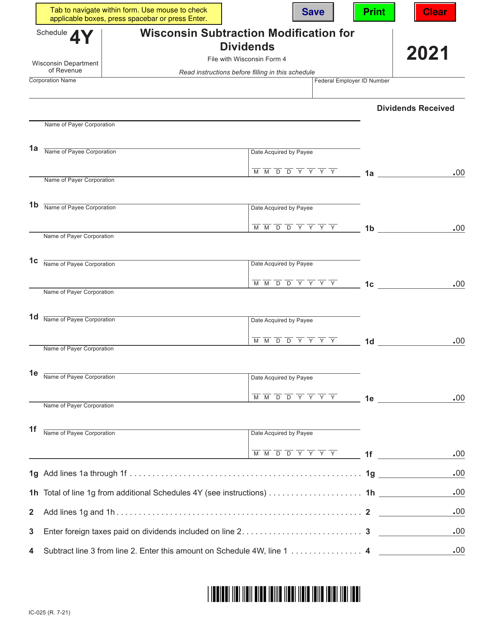

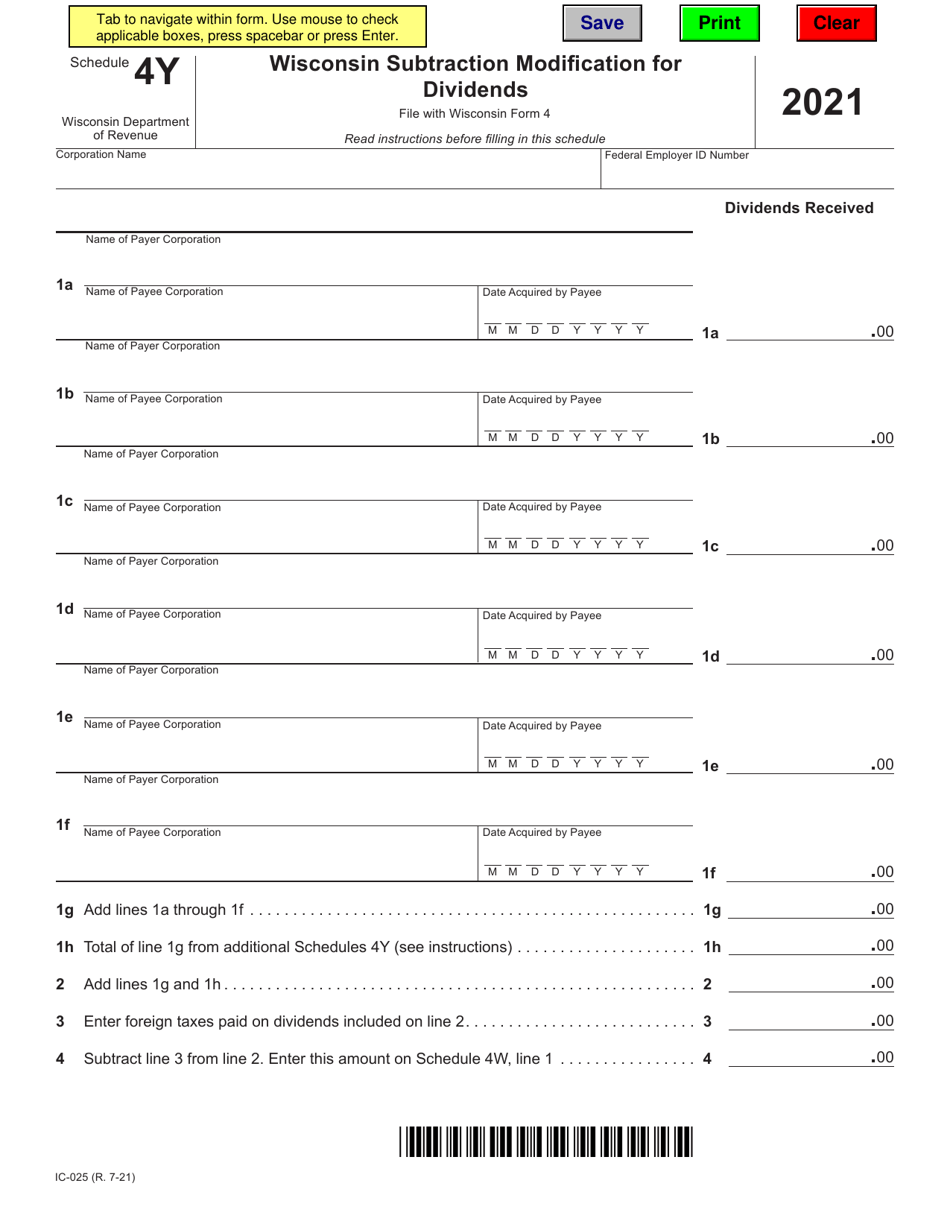

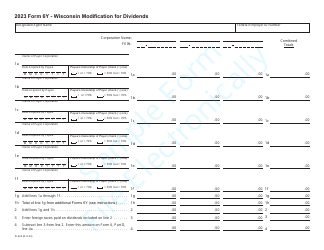

Form IC-025 Schedule 4Y

for the current year.

Form IC-025 Schedule 4Y Wisconsin Subtraction Modification for Dividends - Wisconsin

What Is Form IC-025 Schedule 4Y?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IC-025 Schedule 4Y?

A: Form IC-025 Schedule 4Y is a Wisconsin tax form used for claiming a subtraction modification for dividends in Wisconsin.

Q: What is a subtraction modification for dividends?

A: A subtraction modification for dividends is a tax benefit that allows you to subtract qualifying dividend income from your taxable income.

Q: Who can use Form IC-025 Schedule 4Y?

A: Wisconsin residents who have received qualifying dividend income and are eligible for the subtraction modification can use this form.

Q: How do I qualify for the subtraction modification for dividends?

A: To qualify for the subtraction modification, you must meet certain criteria set by the Wisconsin Department of Revenue. It is advisable to consult the instructions or a tax professional for specific eligibility requirements.

Q: Is there a deadline for filing Form IC-025 Schedule 4Y?

A: Yes, the deadline for filing Form IC-025 Schedule 4Y is the same as the deadline for filing your Wisconsin state tax return. It is typically April 15th, but may vary depending on weekends and holidays.

Q: Can I electronically file Form IC-025 Schedule 4Y?

A: Yes, you can electronically file Form IC-025 Schedule 4Y if you are filing your Wisconsin state tax return electronically. Check with your tax preparation software for the availability of this form.

Q: Do I need to attach any documents to Form IC-025 Schedule 4Y?

A: As per the instructions provided with the form, you may be required to attach certain documents to support your claim for the subtraction modification. It is recommended to review the instructions or consult a tax professional for the specific documentation requirements.

Q: What should I do if I have questions or need assistance with Form IC-025 Schedule 4Y?

A: If you have questions or need assistance with Form IC-025 Schedule 4Y, you can contact the Wisconsin Department of Revenue or seek help from a tax professional.

Q: Can I use Form IC-025 Schedule 4Y if I am not a resident of Wisconsin?

A: No, Form IC-025 Schedule 4Y is specifically designed for Wisconsin residents who have received qualifying dividend income. Non-residents should consult their respective state's tax laws and forms for similar deductions or modifications.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-025 Schedule 4Y by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.