This version of the form is not currently in use and is provided for reference only. Download this version of

Form C (IC-044)

for the current year.

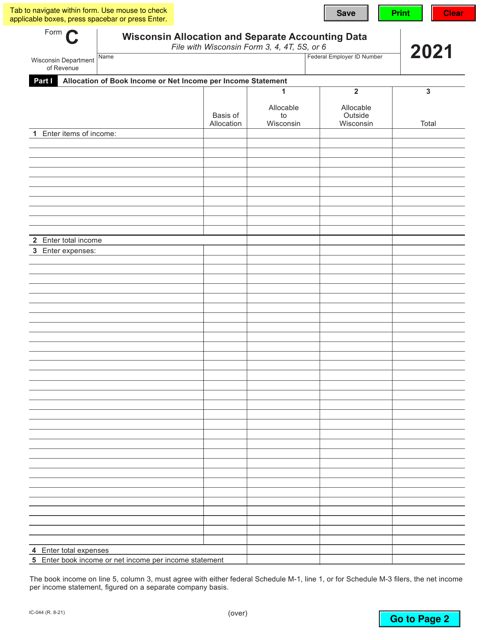

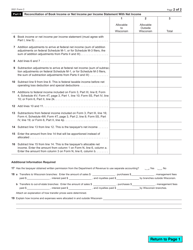

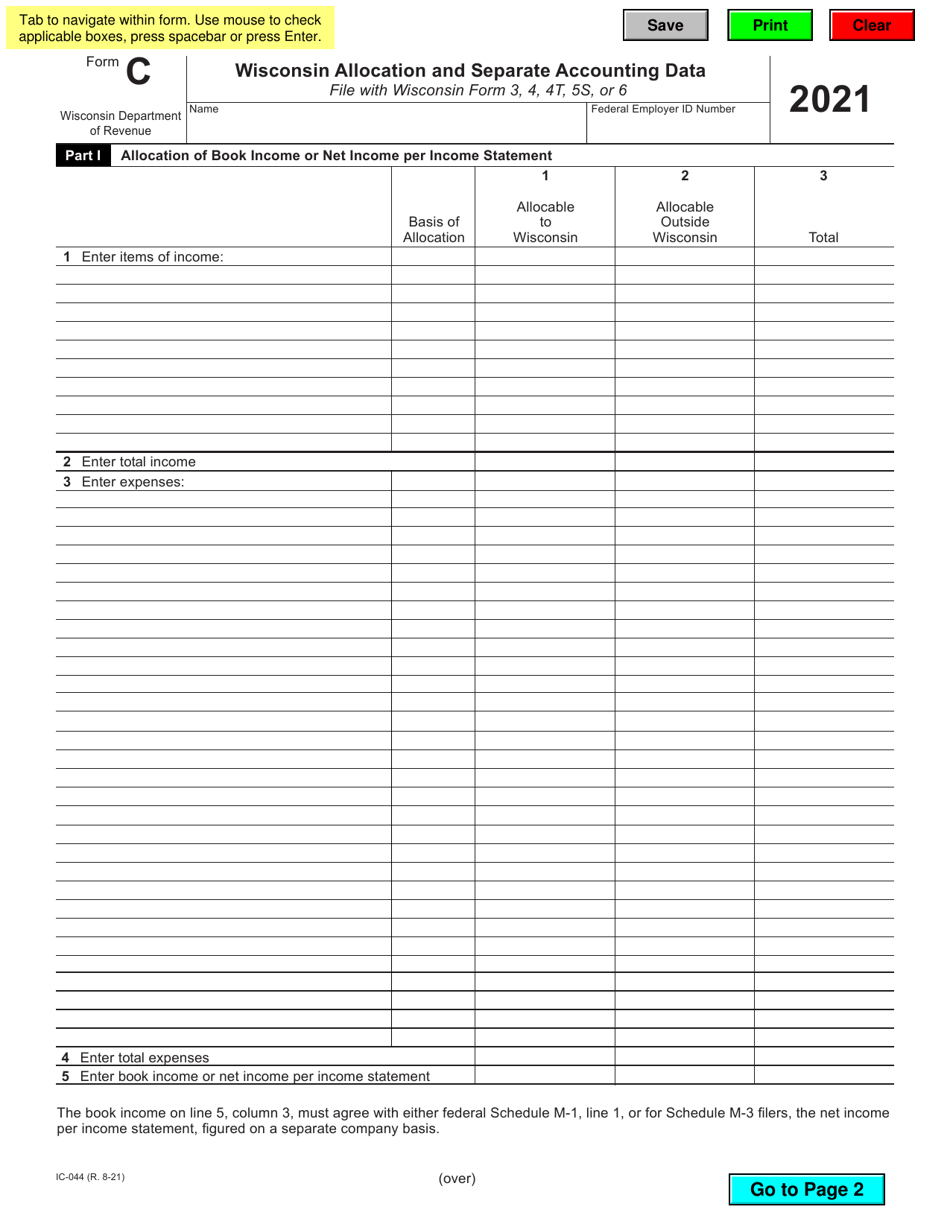

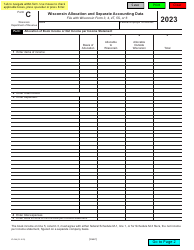

Form C (IC-044) Wisconsin Allocation and Separate Accounting Data - Wisconsin

What Is Form C (IC-044)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form C (IC-044) Wisconsin Allocation and Separate Accounting Data?

A: Form C (IC-044) is a document used in Wisconsin for allocation and separate accounting purposes.

Q: What is the purpose of Form C (IC-044) Wisconsin Allocation and Separate Accounting Data?

A: The purpose of Form C (IC-044) is to provide information for allocation and separate accounting of income in Wisconsin.

Q: Who needs to file Form C (IC-044) Wisconsin Allocation and Separate Accounting Data?

A: Entities and individuals who have income in Wisconsin that needs to be allocated and accounted separately may need to file Form C (IC-044).

Q: When is the deadline for filing Form C (IC-044) Wisconsin Allocation and Separate Accounting Data?

A: The deadline for filing Form C (IC-044) in Wisconsin is typically the same as the deadline for filing the state income tax return, which is April 15th.

Q: Are there any penalties for not filing Form C (IC-044) Wisconsin Allocation and Separate Accounting Data?

A: Yes, there may be penalties for failing to file Form C (IC-044) in Wisconsin, so it is important to submit the form on time if required.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C (IC-044) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.