This version of the form is not currently in use and is provided for reference only. Download this version of

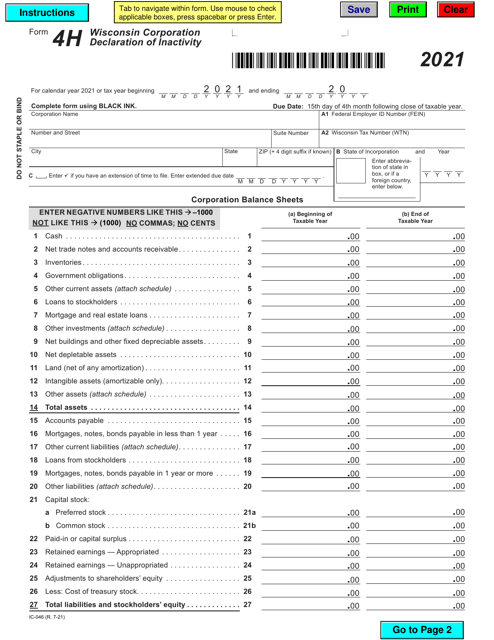

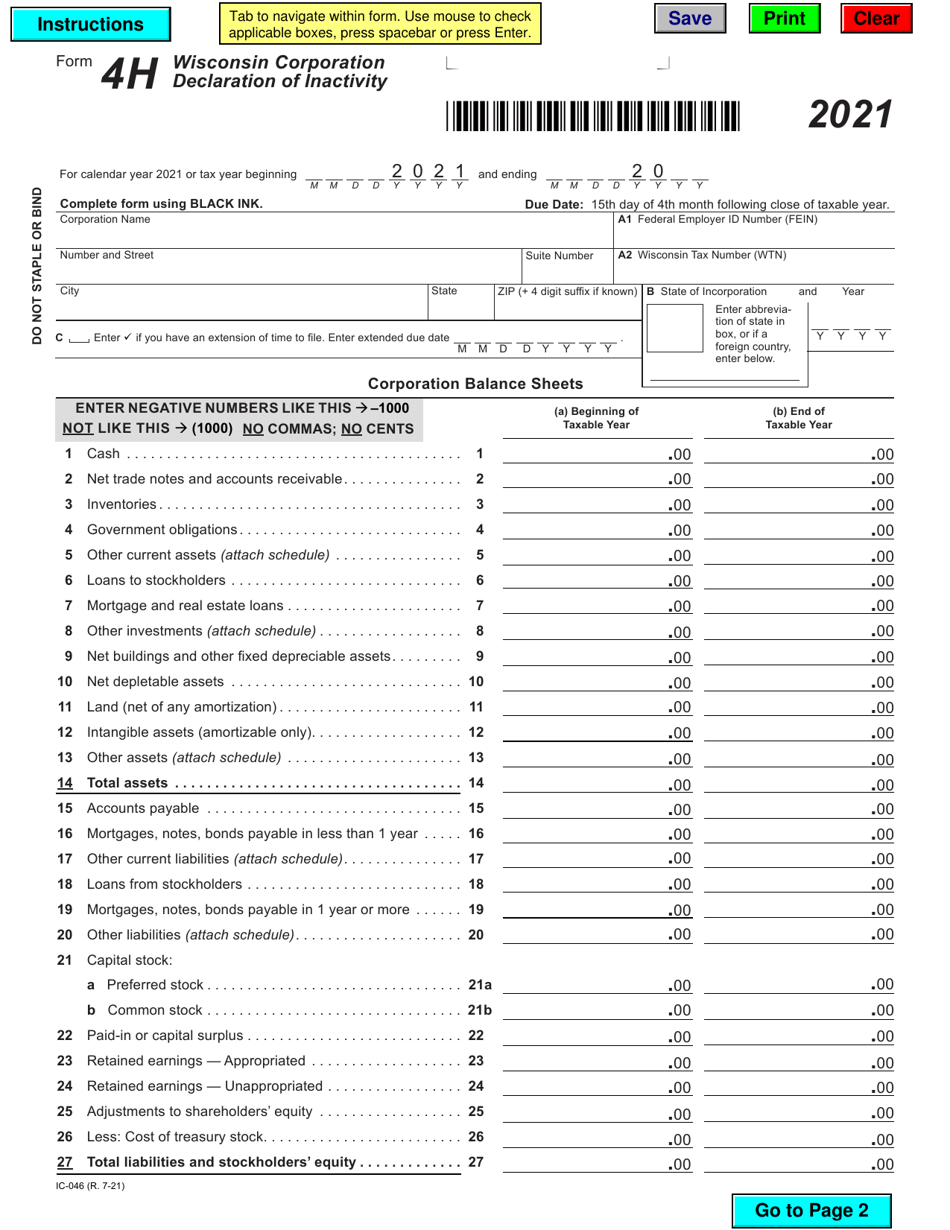

Form 4H (IC-046)

for the current year.

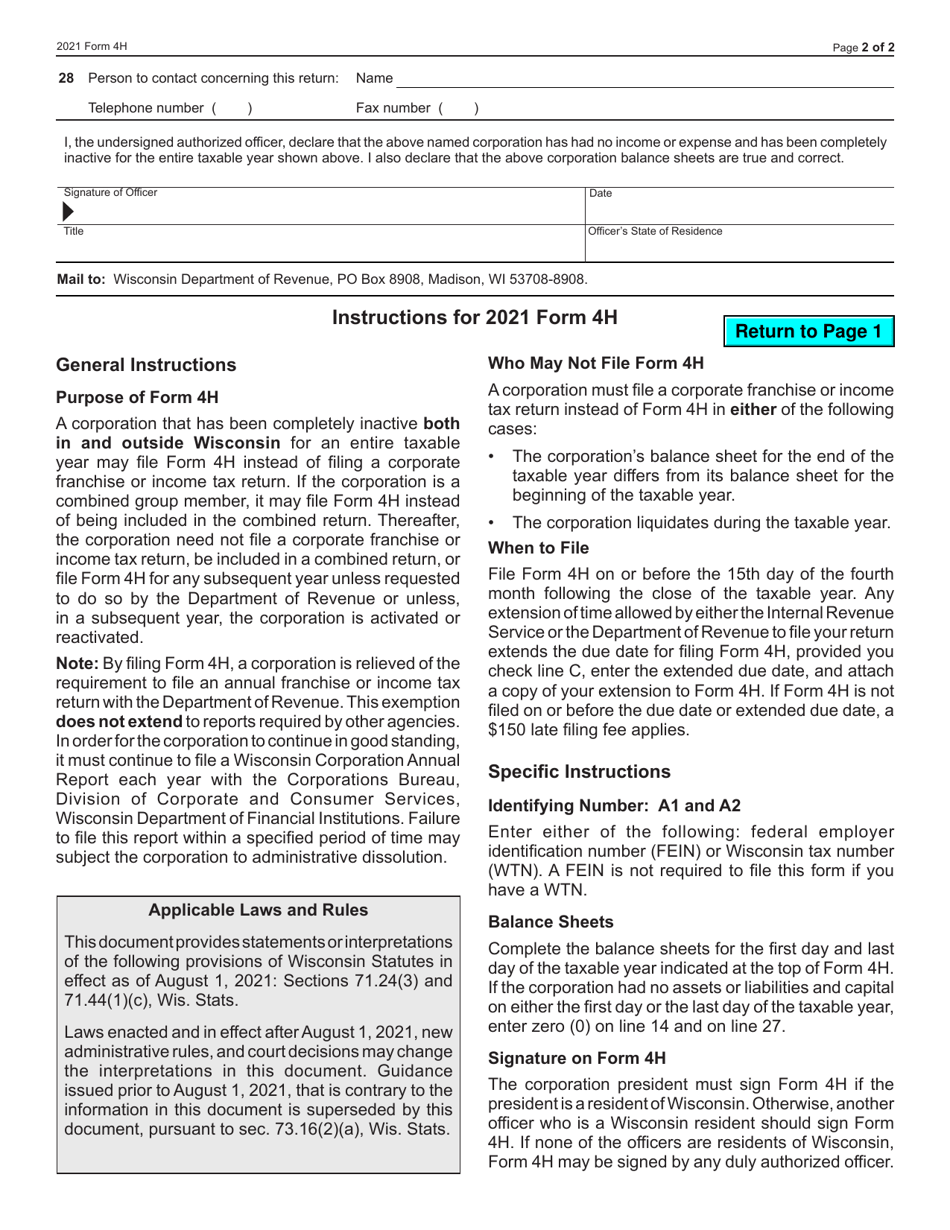

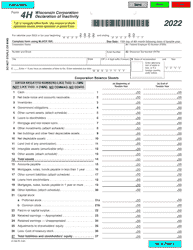

Form 4H (IC-046) Wisconsin Corporation Declaration of Inactivity - Wisconsin

What Is Form 4H (IC-046)?

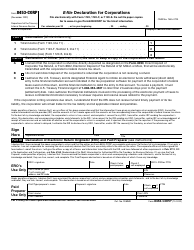

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4H?

A: Form 4H is the Wisconsin Corporation Declaration of Inactivity.

Q: What is the purpose of Form 4H?

A: The purpose of Form 4H is to declare that a corporation in Wisconsin is inactive.

Q: Who needs to file Form 4H?

A: Corporations in Wisconsin that have no business activity or income need to file Form 4H.

Q: When should Form 4H be filed?

A: Form 4H should be filed when a corporation becomes inactive in Wisconsin.

Q: Is there a fee to file Form 4H?

A: No, there is no fee to file Form 4H.

Q: Are there any penalties for not filing Form 4H?

A: There are no penalties for not filing Form 4H, but it is important to keep the corporation's status updated.

Q: Can a corporation become active again after filing Form 4H?

A: Yes, a corporation can become active again by filing the appropriate forms and paying any necessary fees.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4H (IC-046) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.