This version of the form is not currently in use and is provided for reference only. Download this version of

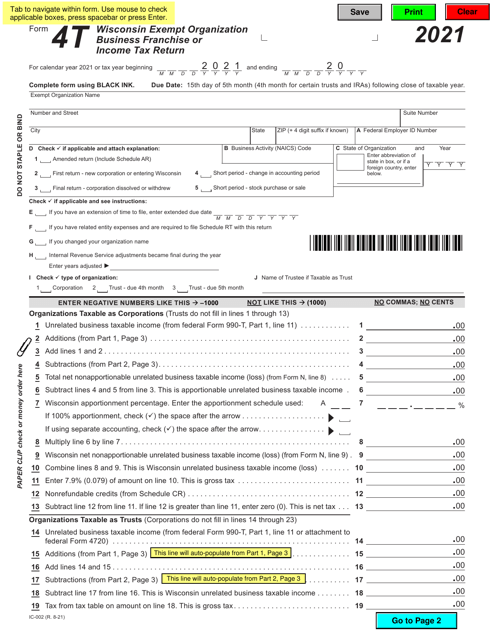

Form 4T (IC-002)

for the current year.

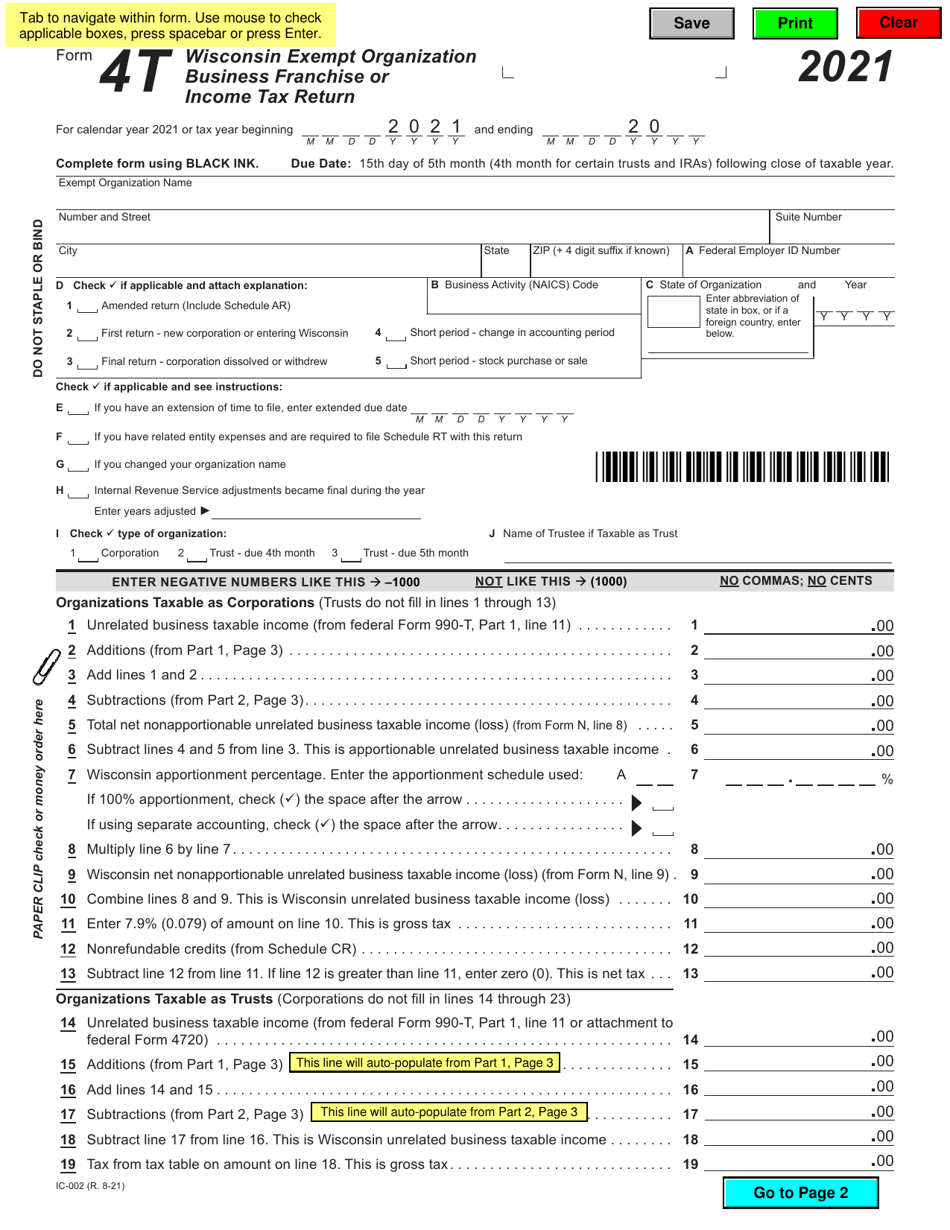

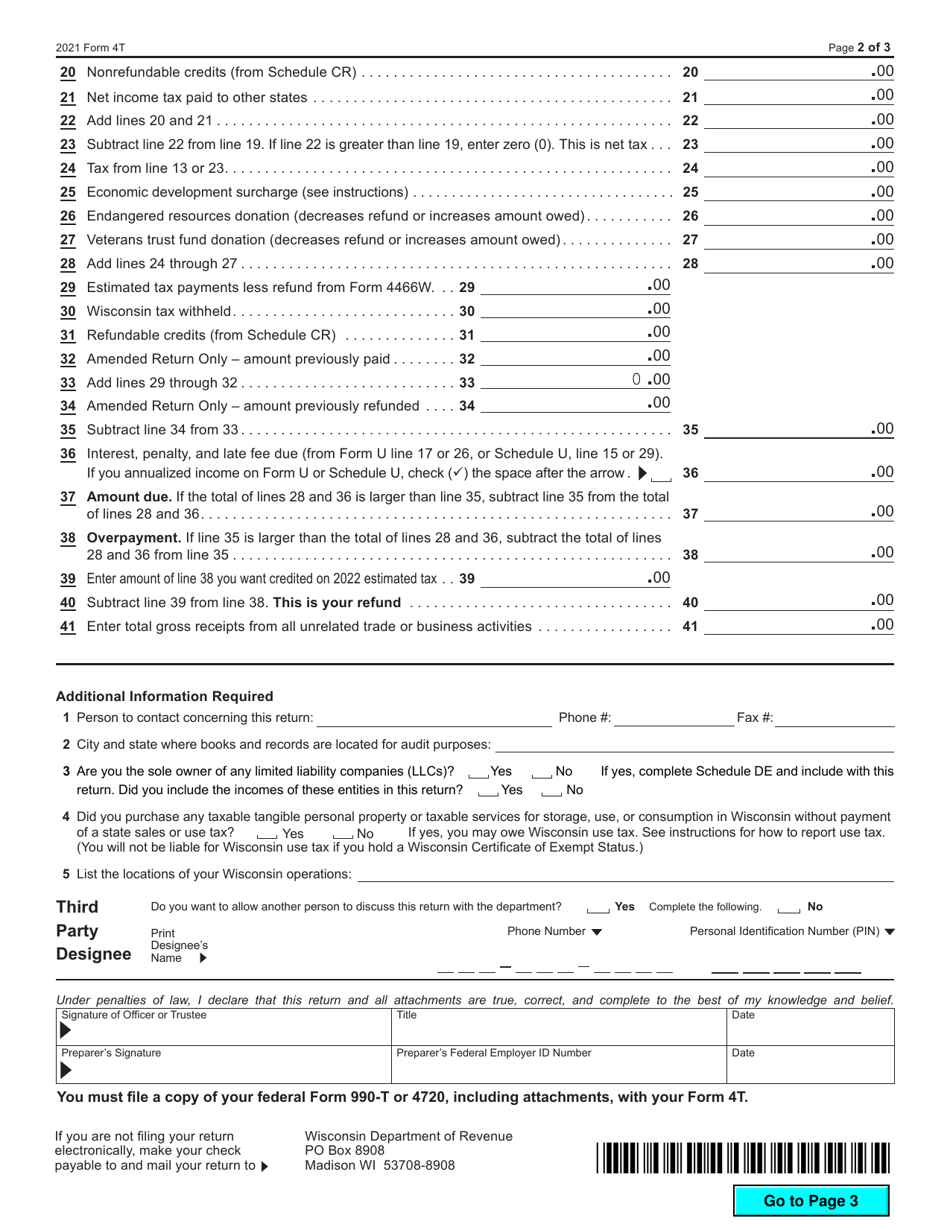

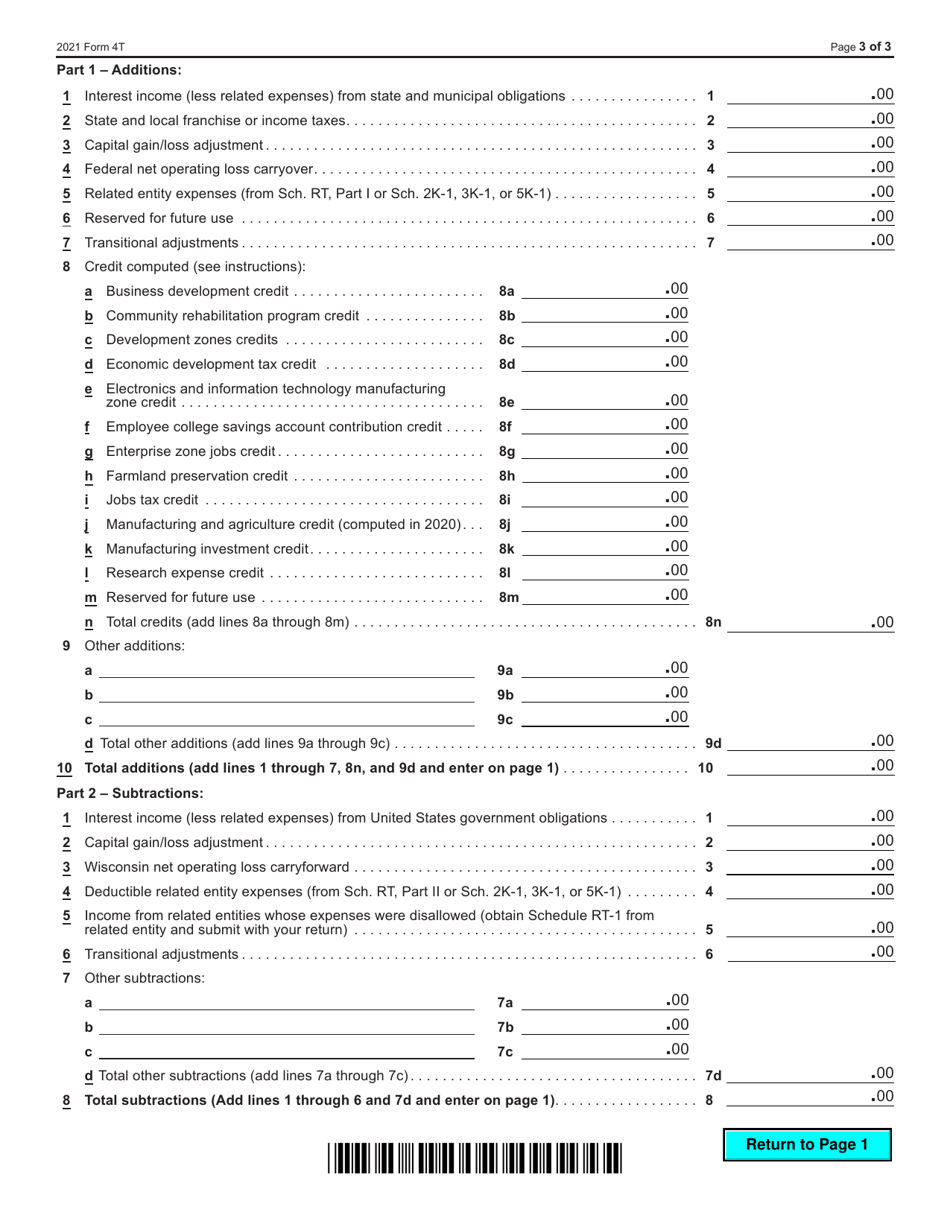

Form 4T (IC-002) Wisconsin Exempt Organization Business Franchise or Income Tax Return - Wisconsin

What Is Form 4T (IC-002)?

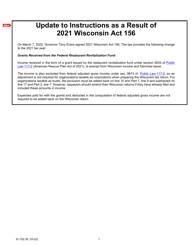

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 4T (IC-002)?

A: Form 4T (IC-002) is the Wisconsin Exempt Organization Business Franchise or Income Tax Return.

Q: Who needs to file Form 4T (IC-002)?

A: Exempt organizations in Wisconsin that have business franchise or income tax obligations need to file Form 4T (IC-002).

Q: What is the purpose of Form 4T (IC-002)?

A: The purpose of this form is for exempt organizations in Wisconsin to report their business franchise or income tax information.

Q: When is the deadline to file Form 4T (IC-002)?

A: The deadline to file Form 4T (IC-002) is generally the same as the federal income tax deadline, which is April 15th, unless it falls on a weekend or holiday.

Q: Are there any extensions available for filing Form 4T (IC-002)?

A: Yes, you can request an extension to file your Form 4T (IC-002) by submitting a written request to the Wisconsin Department of Revenue.

Q: Is there a fee to file Form 4T (IC-002)?

A: There is no fee to file Form 4T (IC-002).

Q: Is Form 4T (IC-002) only for Wisconsin resident organizations?

A: No, any exempt organizationdoing business in Wisconsin, even if it is not a resident, must file Form 4T (IC-002).

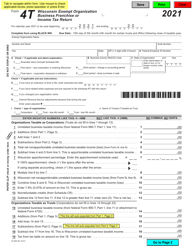

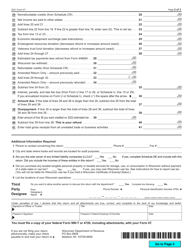

Q: What information do I need to complete Form 4T (IC-002)?

A: You will need to provide information about your exempt organization's income, deductions, credits, and other relevant financial data.

Q: Can I file Form 4T (IC-002) electronically?

A: Yes, you can file Form 4T (IC-002) electronically through the Wisconsin Department of Revenue's e-file system or other approved software providers.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4T (IC-002) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.