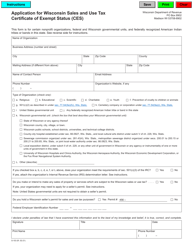

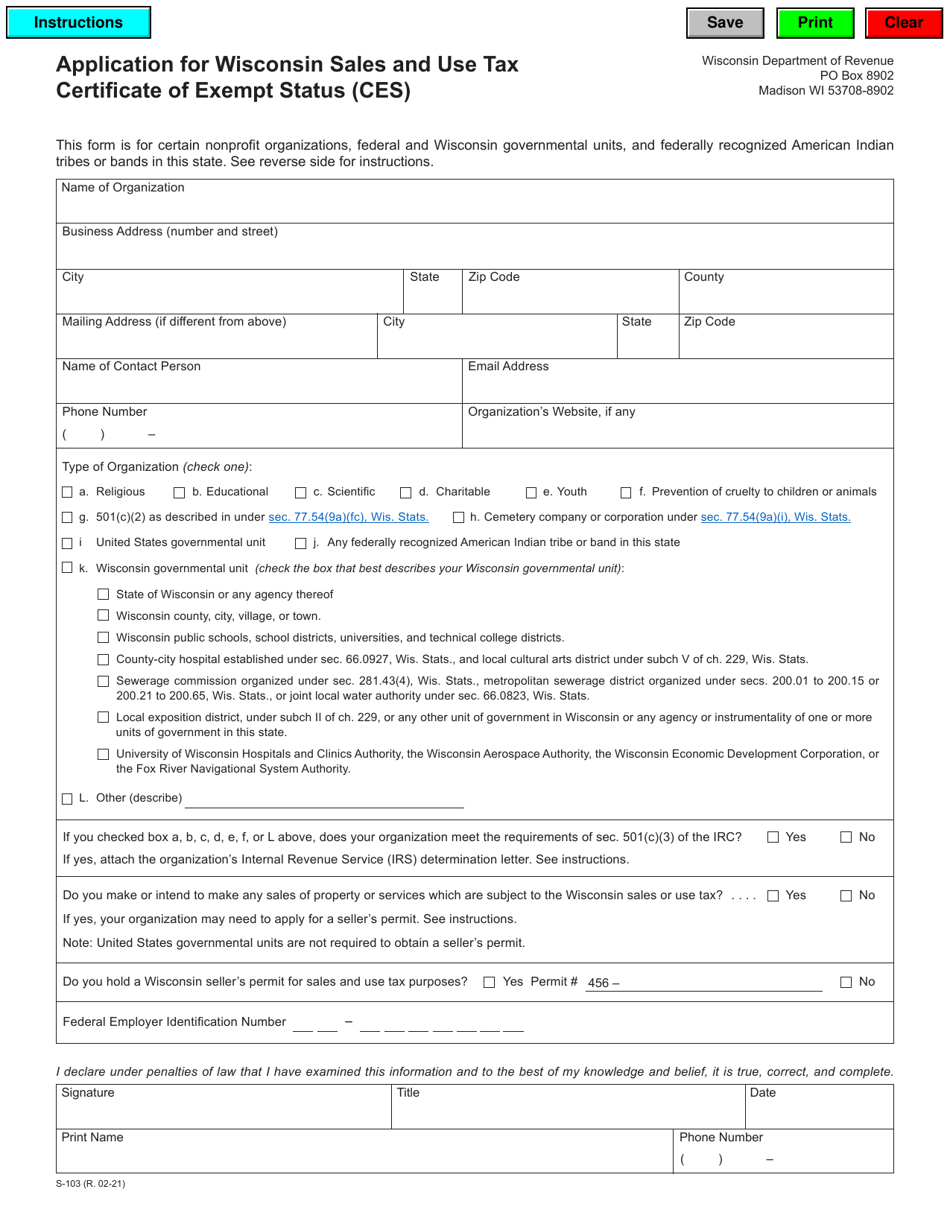

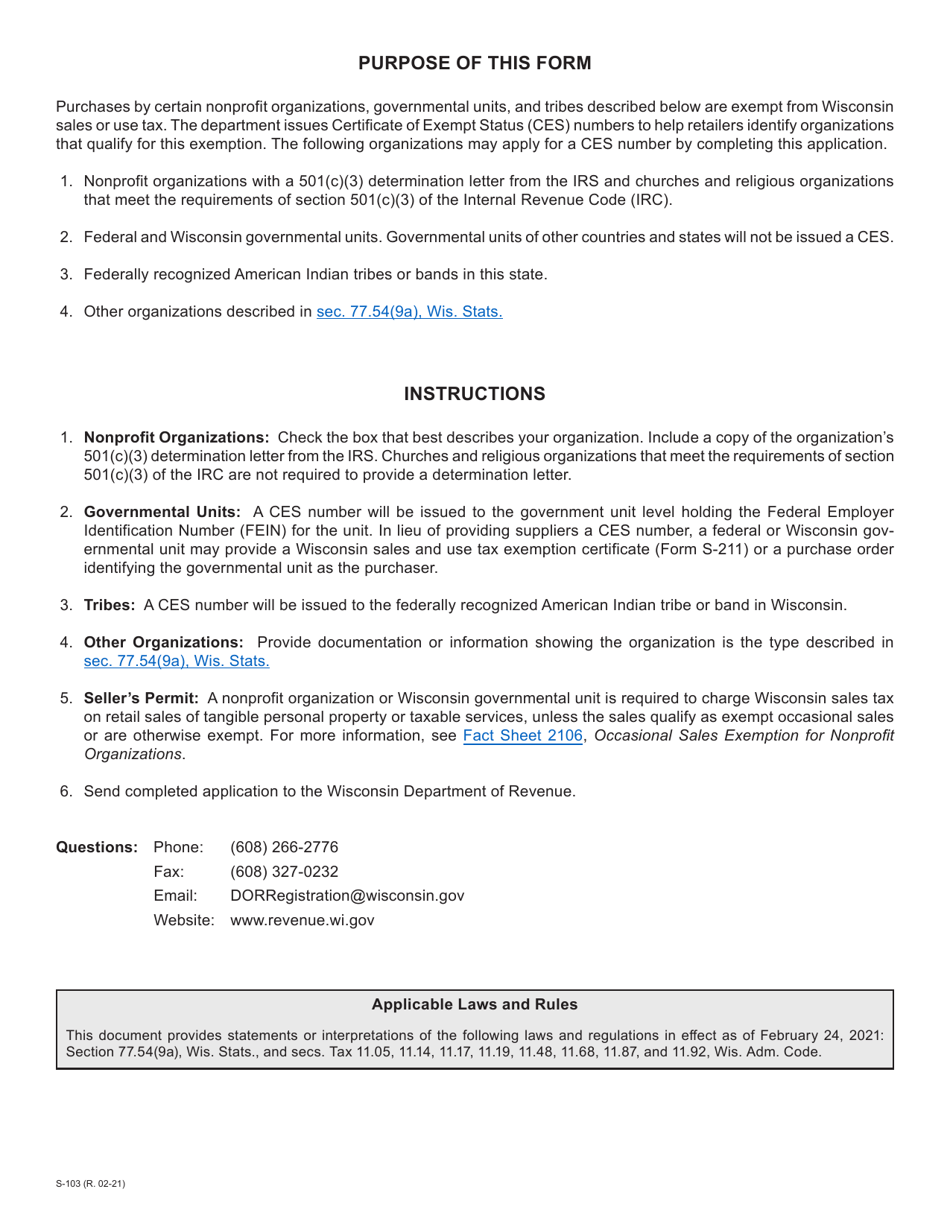

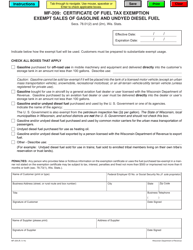

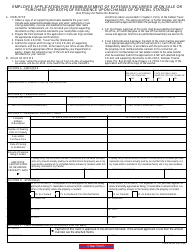

Form S-103 Application for Wisconsin Sales and Use Tax Certificate of Exempt Status (Ces) - Wisconsin

What Is Form S-103?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-103?

A: Form S-103 is an application for the Wisconsin Sales and Use Tax Certificate of Exempt Status (CES) in Wisconsin.

Q: What is the purpose of Form S-103?

A: The purpose of Form S-103 is to apply for the Wisconsin Sales and Use Tax Certificate of Exempt Status (CES) in Wisconsin.

Q: Who should use Form S-103?

A: Form S-103 should be used by individuals or organizations who want to claim exemption from sales and use tax in Wisconsin.

Q: What information is required on Form S-103?

A: Form S-103 requires information such as the applicant's name, address, business activities, and explanation of the claimed exemption.

Q: Is there a fee for submitting Form S-103?

A: No, there is no fee for submitting Form S-103.

Q: How long does it take to process Form S-103?

A: The processing time for Form S-103 can vary, but it typically takes a few weeks.

Q: What should I do if my Form S-103 is denied?

A: If your Form S-103 is denied, you can appeal the decision by contacting the Wisconsin Department of Revenue.

Q: How long is the Wisconsin Sales and Use Tax Certificate of Exempt Status (CES) valid?

A: The Wisconsin Sales and Use Tax Certificate of Exempt Status (CES) is valid for five years unless revoked or canceled.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S-103 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.