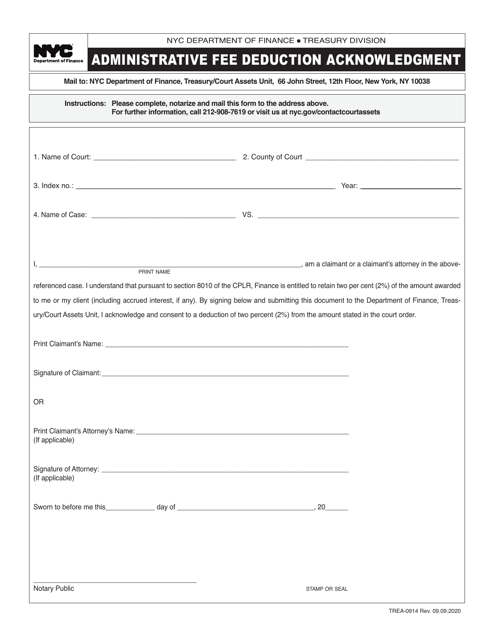

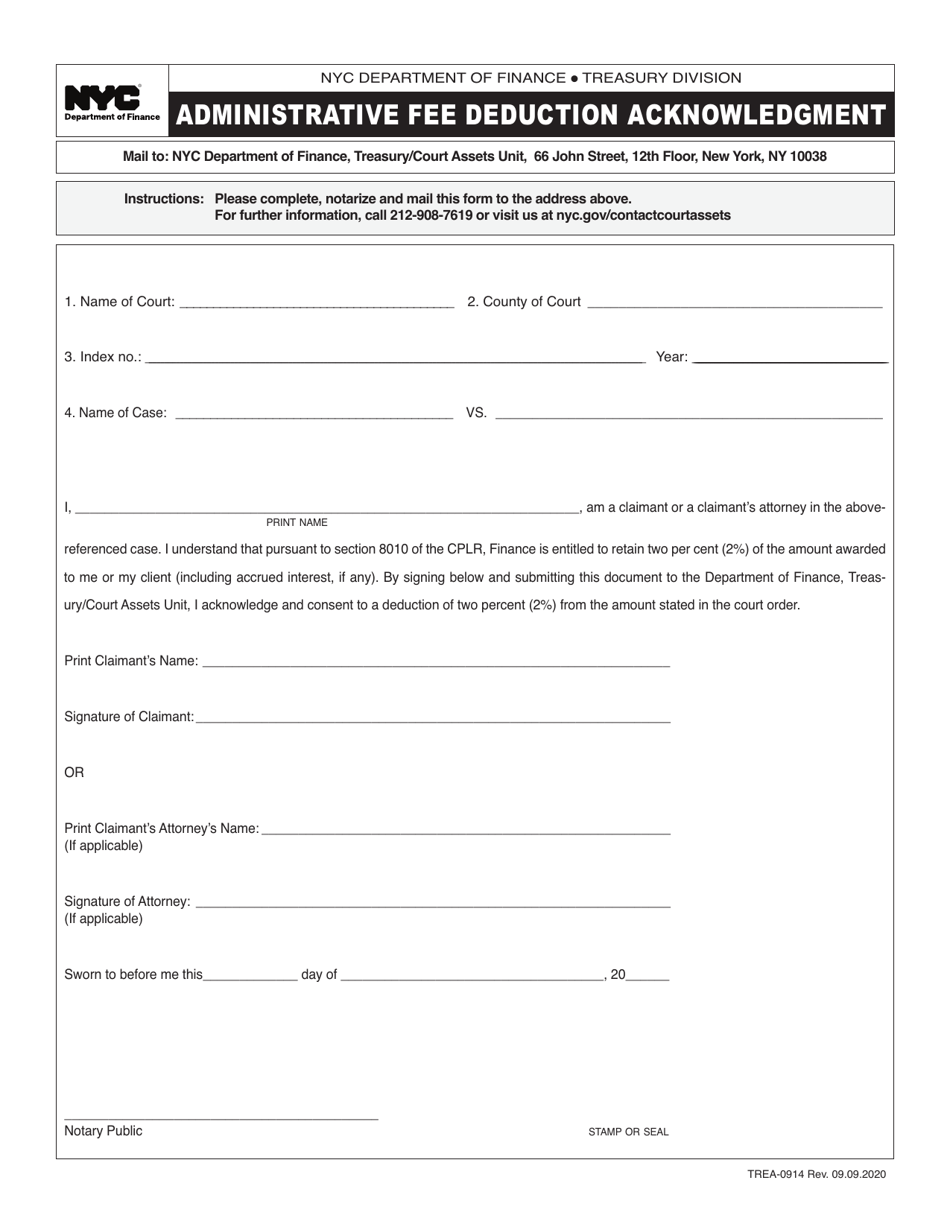

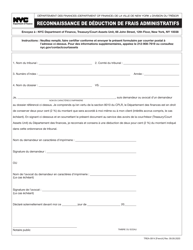

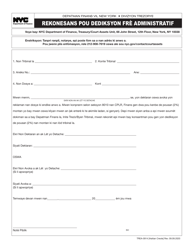

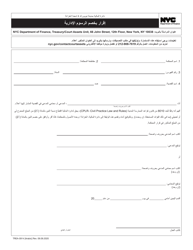

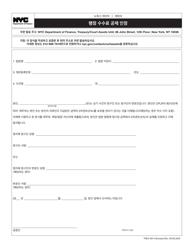

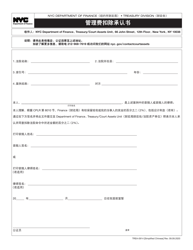

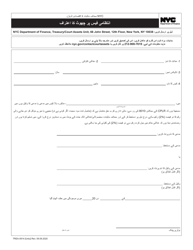

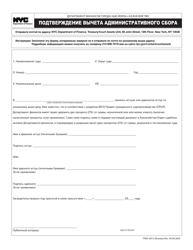

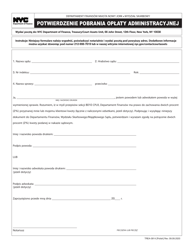

Form TREA-0914 Administrative Fee Deduction Acknowledgment - New York City

What Is Form TREA-0914?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TREA-0914?

A: Form TREA-0914 is an Administrative Fee Deduction Acknowledgment form.

Q: What is the purpose of Form TREA-0914?

A: The purpose of Form TREA-0914 is to acknowledge the deduction of administrative fees in New York City.

Q: Who needs to fill out Form TREA-0914?

A: Anyone who is deducting administrative fees in New York City needs to fill out Form TREA-0914.

Q: What is an administrative fee deduction?

A: An administrative fee deduction is a deduction taken on taxes for eligible expenses related to renting residential real property.

Q: Are there any specific instructions for filling out Form TREA-0914?

A: Yes, there are specific instructions provided on the form. Make sure to read and follow them carefully.

Q: Is there a deadline for submitting Form TREA-0914?

A: Yes, the form must be submitted by the due date specified by the New York City Department of Finance.

Q: What happens if I don't fill out Form TREA-0914?

A: If you don't fill out Form TREA-0914, you may not be able to deduct administrative fees on your taxes.

Q: Is Form TREA-0914 only applicable to residents of New York City?

A: Yes, Form TREA-0914 is only applicable to residents of New York City.

Form Details:

- Released on September 9, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

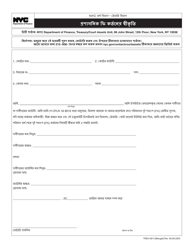

- Available in Bengali;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TREA-0914 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.