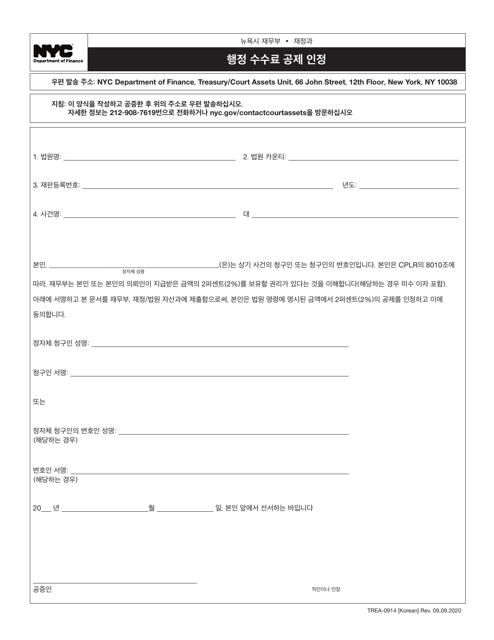

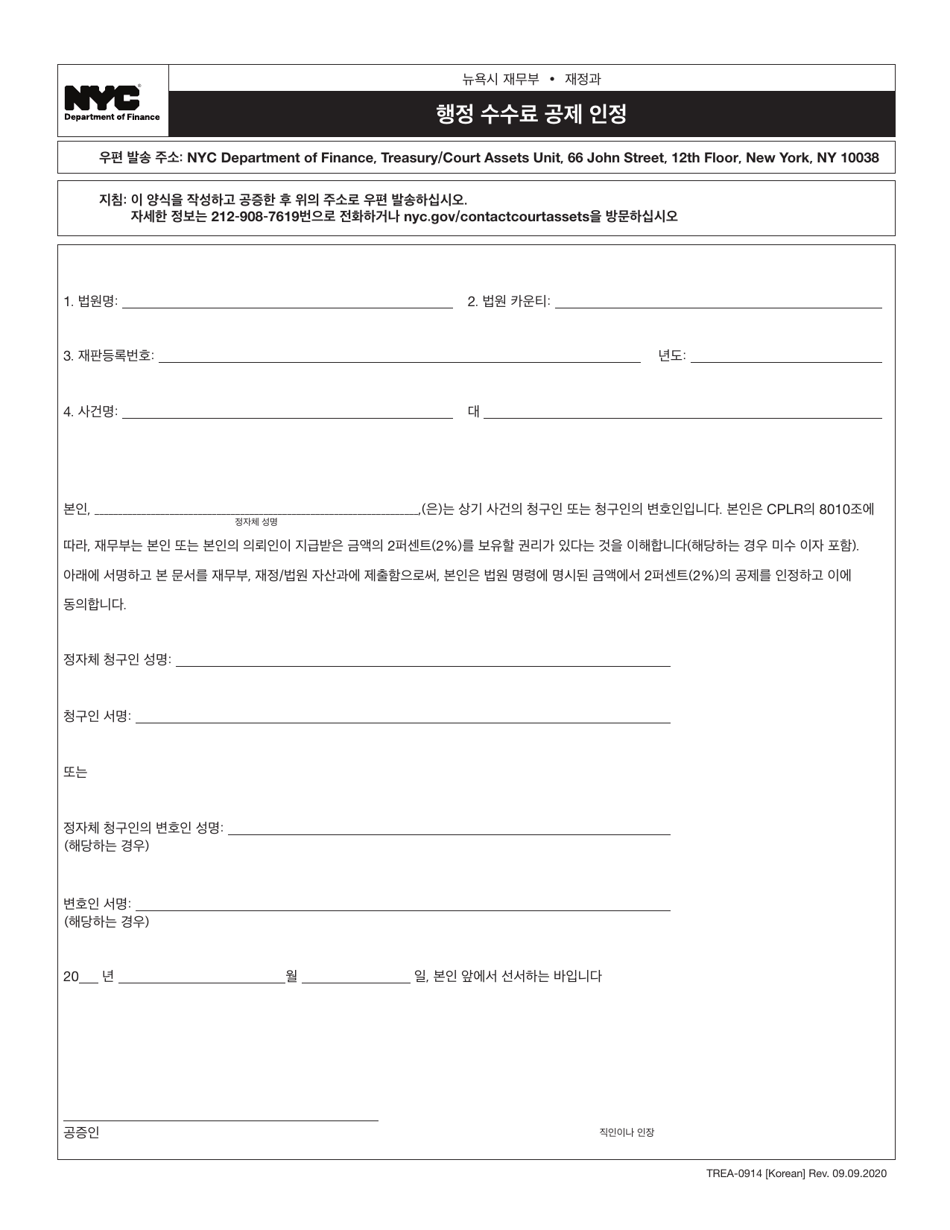

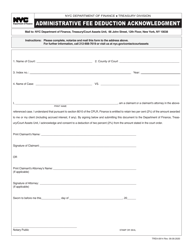

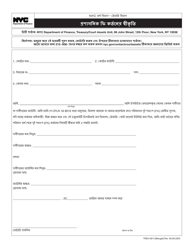

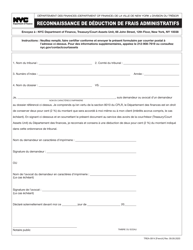

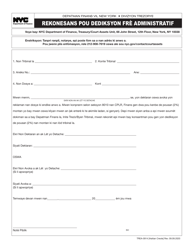

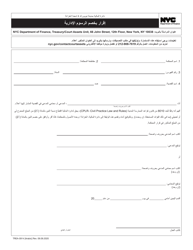

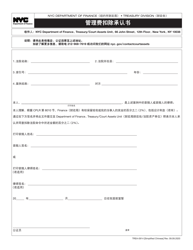

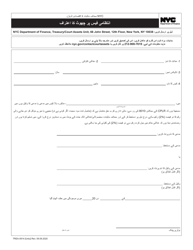

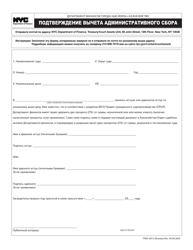

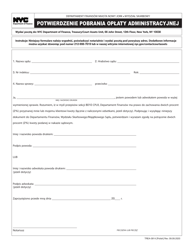

Form TREA-0914 Administrative Fee Deduction Acknowledgment - New York City (Korean)

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in Korean. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TREA-0914?

A: Form TREA-0914 is an administrative fee deduction acknowledgment form.

Q: What is the purpose of Form TREA-0914?

A: The purpose of Form TREA-0914 is to acknowledge the deduction of administrative fees in New York City.

Q: Who needs to fill out Form TREA-0914?

A: This form needs to be filled out by taxpayers in New York City who are claiming a deduction for administrative fees.

Q: Is Form TREA-0914 specific to the Korean language?

A: Yes, Form TREA-0914 is available in Korean.

Q: What is the significance of the administrative fee deduction?

A: The administrative fee deduction allows taxpayers in New York City to deduct certain fees from their taxable income.

Q: Is there a deadline for filing Form TREA-0914?

A: The deadline for filing Form TREA-0914 is usually the same as the deadline for filing your tax return.

Q: Are there any eligibility requirements to claim the administrative fee deduction?

A: Yes, there are eligibility requirements to claim the administrative fee deduction. You must meet certain criteria set by the New York City Department of Finance.

Q: Are there any supporting documents required for Form TREA-0914?

A: No, supporting documents are not required to be submitted with Form TREA-0914. However, you should keep them for your records.

Q: Can I claim the administrative fee deduction if I don't live in New York City?

A: No, the administrative fee deduction is only available to taxpayers residing in New York City.

Form Details:

- Released on September 9, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Available in French;

- Quick to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of Form TREA-0914 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.