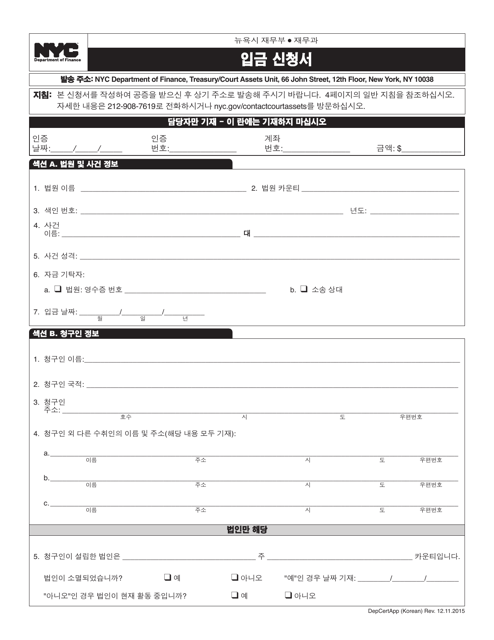

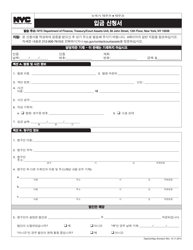

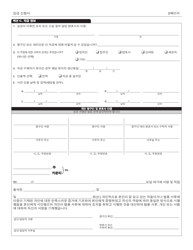

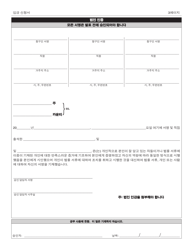

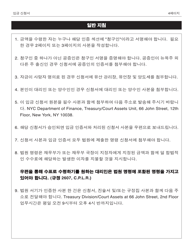

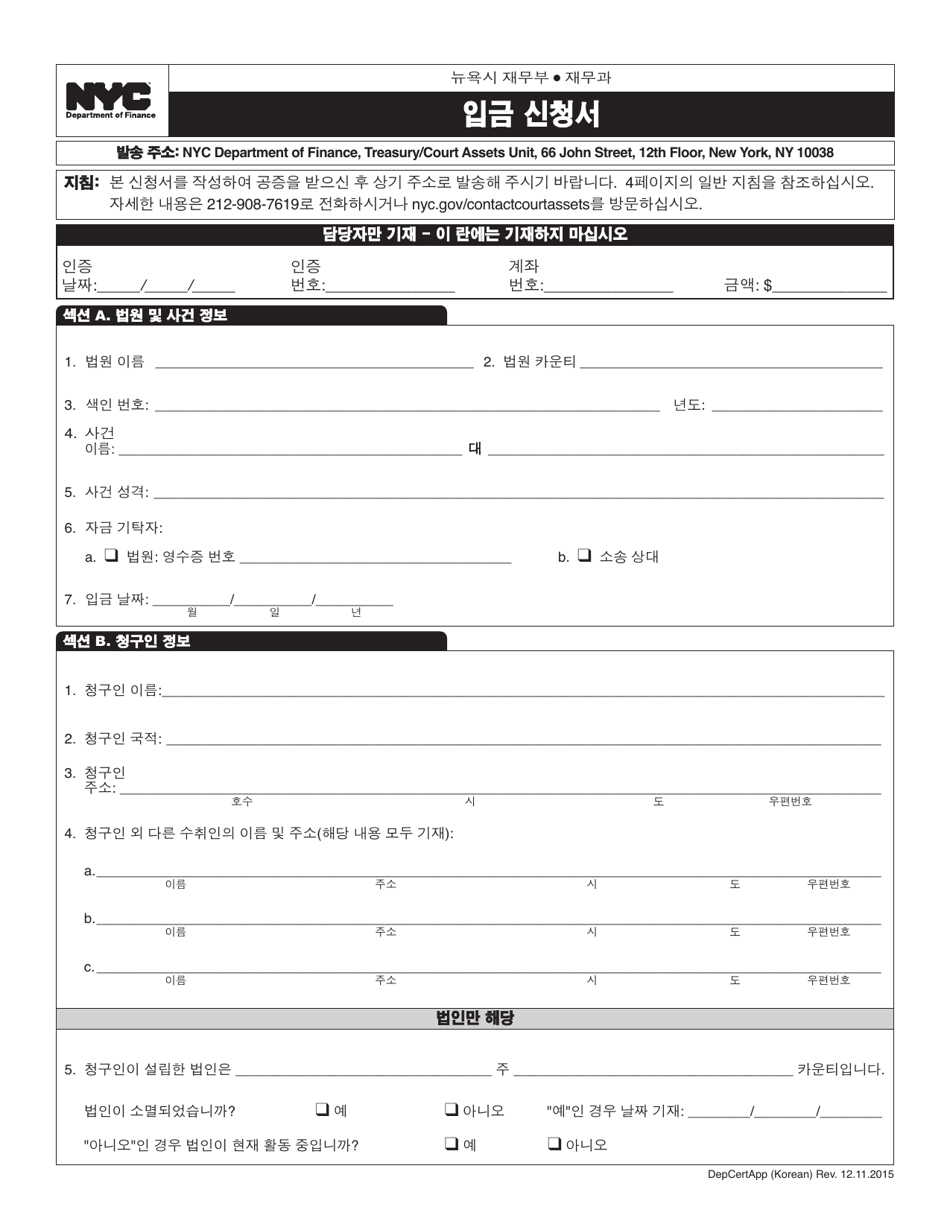

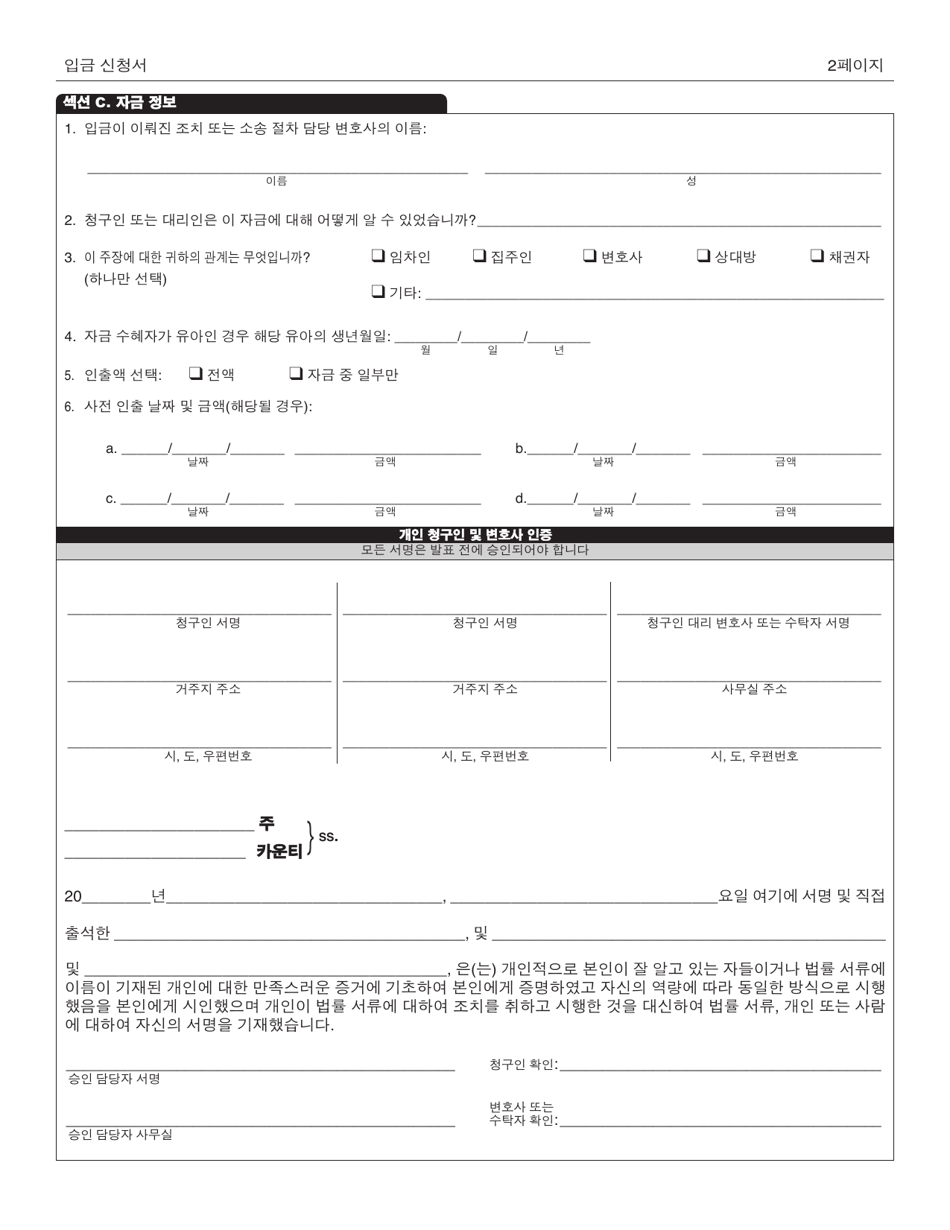

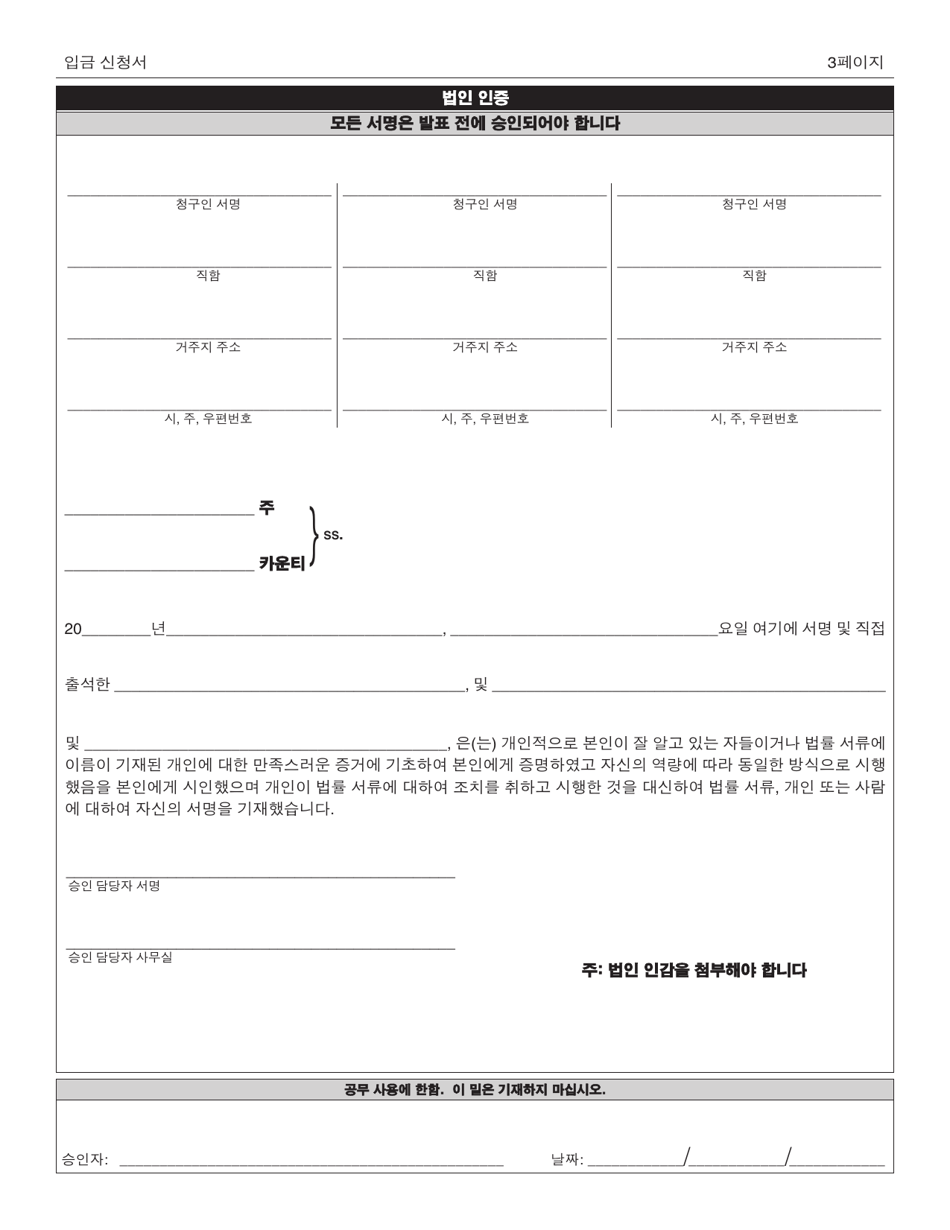

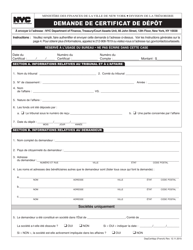

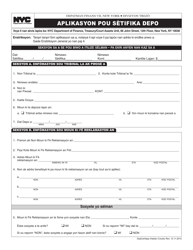

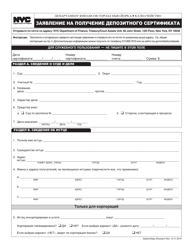

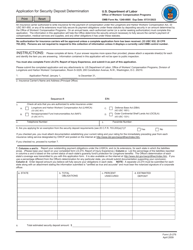

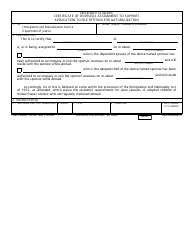

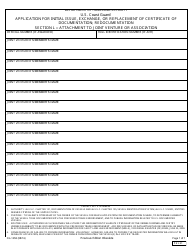

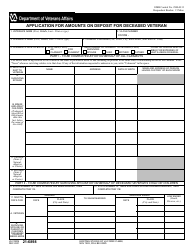

Application for Certificate of Deposit - New York City (Korean)

This is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in Korean.

FAQ

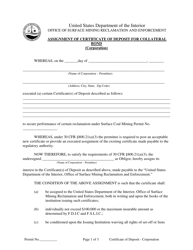

Q: What is a Certificate of Deposit?

A: A Certificate of Deposit (CD) is a type of savings account that typically offers a higher interest rate and a fixed term.

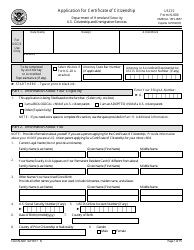

Q: How do I apply for a Certificate of Deposit in New York City?

A: To apply for a Certificate of Deposit in New York City, you can visit your local bank or financial institution and speak to a representative to open an account.

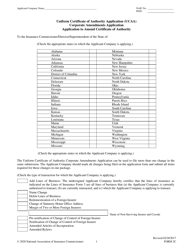

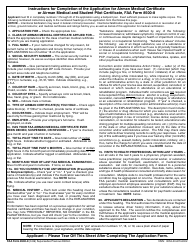

Q: What documents do I need to apply for a Certificate of Deposit?

A: You will typically need to provide your identification documents, such as a driver's license or passport, as well as your Social Security number or Tax Identification number.

Q: What are the benefits of a Certificate of Deposit?

A: Some benefits of a Certificate of Deposit include a higher interest rate compared to regular savings accounts, a fixed term for your investment, and the security of FDIC insurance for up to $250,000.

Q: Can I withdraw money from a Certificate of Deposit before the term ends?

A: Yes, but there may be penalties for early withdrawal, such as a loss of accrued interest.

Q: Are Certificate of Deposits insured by the FDIC?

A: Yes, Certificate of Deposits are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, per bank.

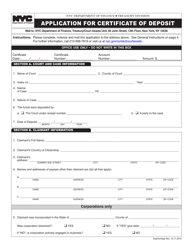

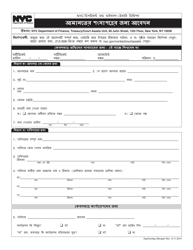

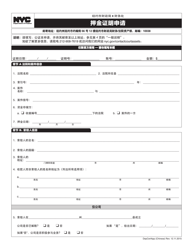

Form Details:

- Released on December 11, 2015;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.