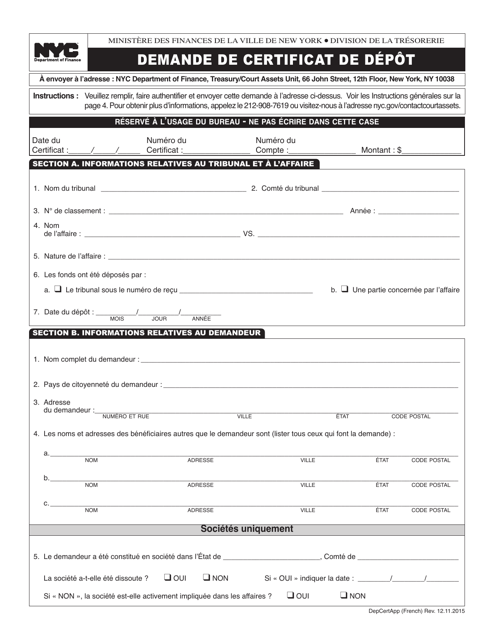

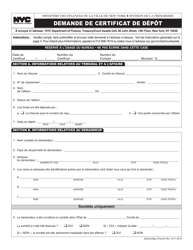

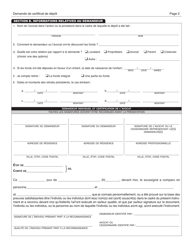

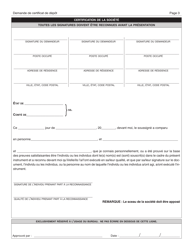

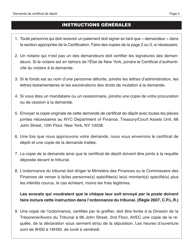

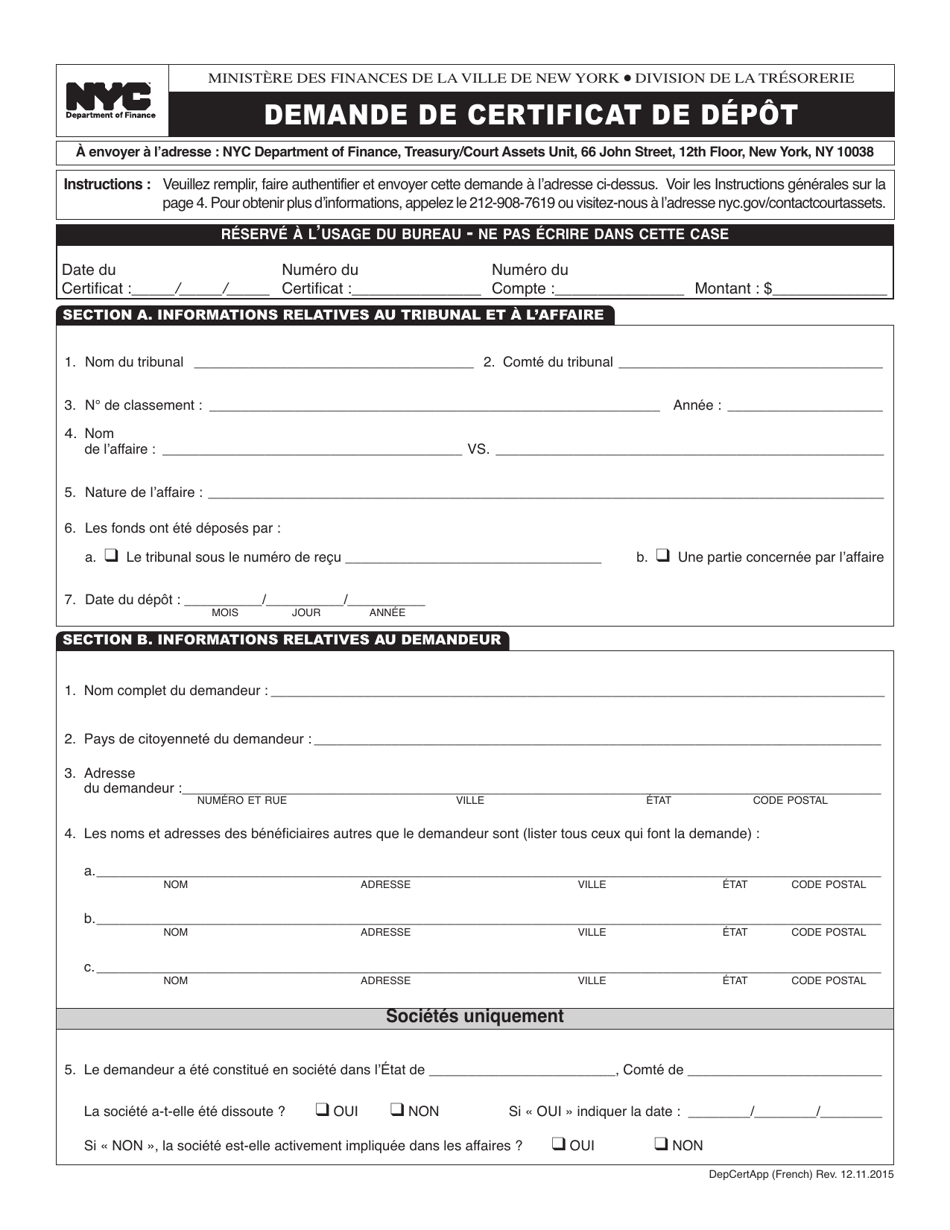

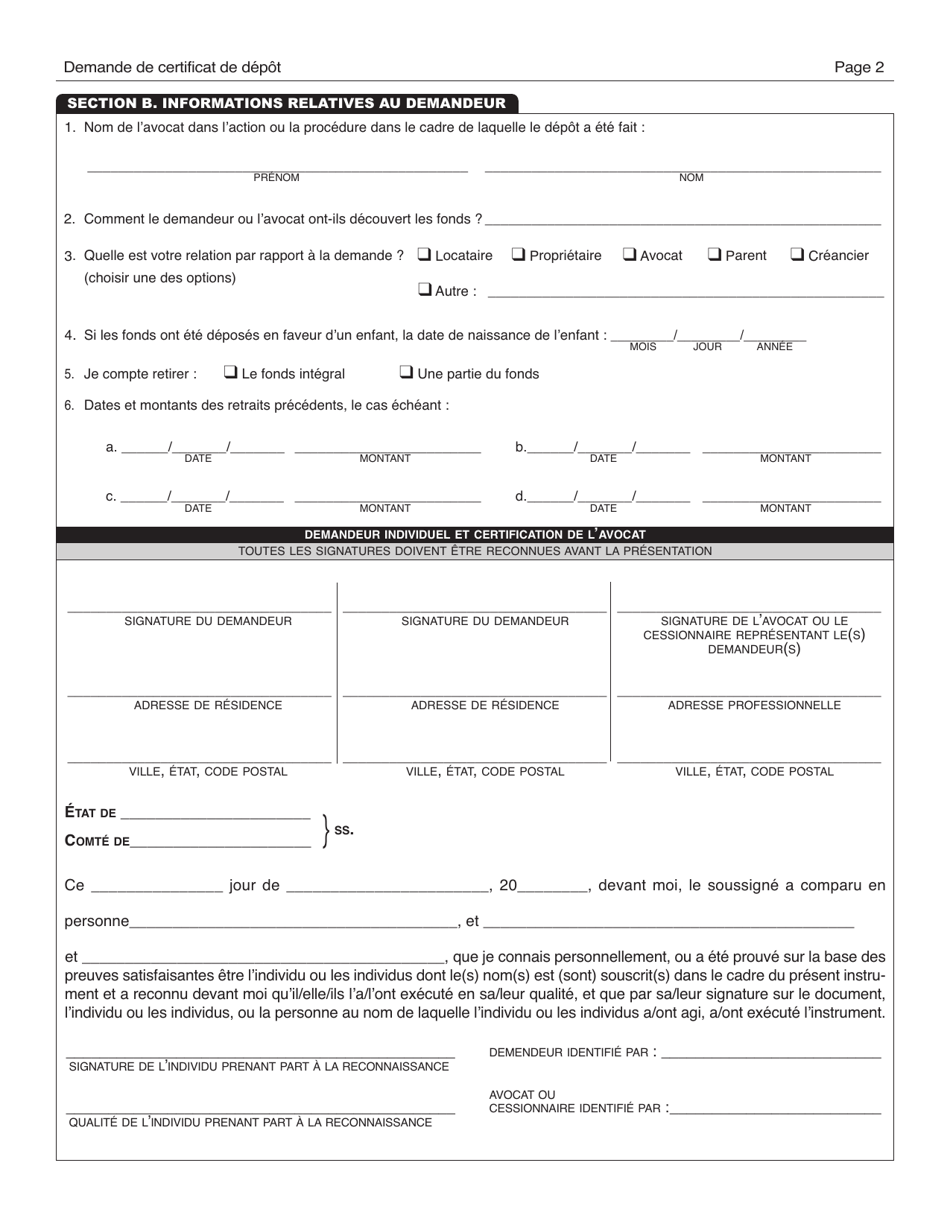

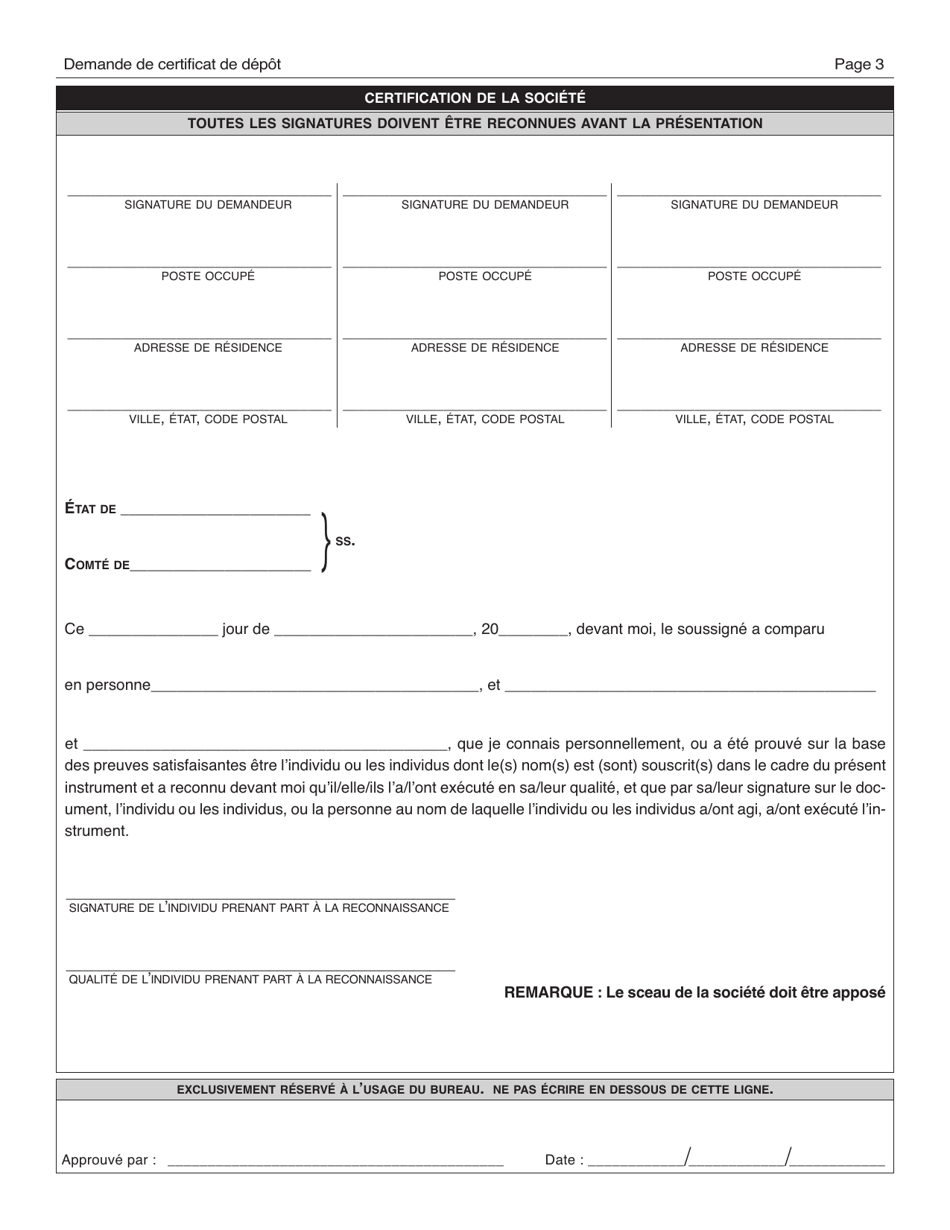

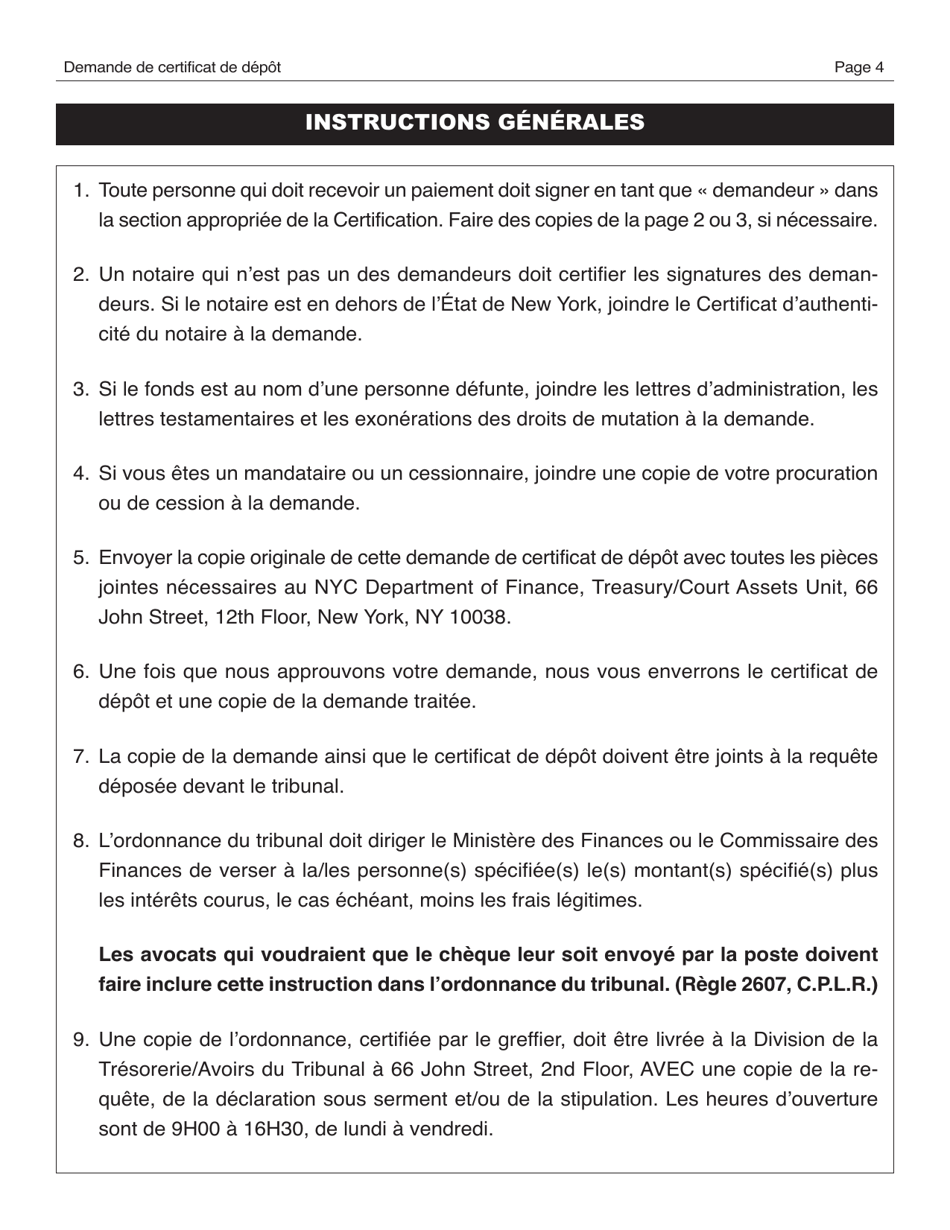

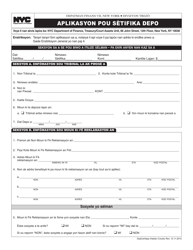

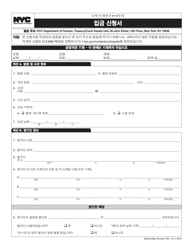

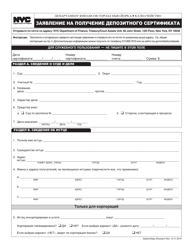

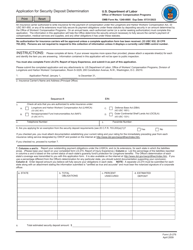

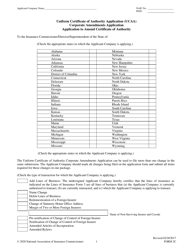

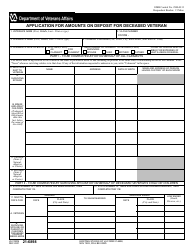

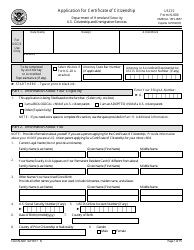

Application for Certificate of Deposit - New York City (French)

This is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in French.

FAQ

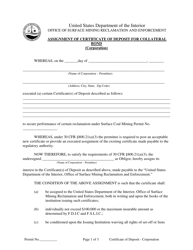

Q: What is a Certificate of Deposit?

A: A Certificate of Deposit (CD) is a time deposit offered by banks that pays a fixed interest rate for a specific period of time.

Q: Why would someone apply for a Certificate of Deposit?

A: People often apply for a CD to earn higher interest rates compared to regular savings accounts and to have a safe and secure investment option.

Q: How does a Certificate of Deposit work?

A: When you open a CD, you deposit a certain amount of money for a fixed period with the bank. The bank pays you interest on that money until the CD matures.

Q: What are the benefits of a Certificate of Deposit?

A: Some benefits of a CD include higher interest rates, safety of the investment, and the ability to plan and earn a fixed return on your money.

Q: Can I withdraw my money from a Certificate of Deposit before it matures?

A: Yes, but it may come with penalties or fees. It's important to check the terms and conditions of the CD before opening one.

Q: Is my money insured if I have a Certificate of Deposit?

A: Yes, if your CD is held at a bank insured by the Federal Deposit Insurance Corporation (FDIC), your money is insured up to $250,000 per depositor, per bank.

Q: Is a Certificate of Deposit a good investment for me?

A: A CD can be a good investment option if you are looking for a safe and predictable return on your money. However, it may not be ideal if you need quick access to your funds or if you want higher potential returns.

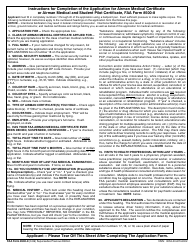

Q: What documents do I need to apply for a Certificate of Deposit?

A: The exact documents required may vary by bank, but generally you will need to provide identification, such as a valid ID or passport, and your Social Security number or Tax ID number.

Q: How much money do I need to open a Certificate of Deposit?

A: The minimum deposit required to open a CD varies by bank. It can range from as low as $500 to several thousand dollars. Contact your bank for their specific requirements.

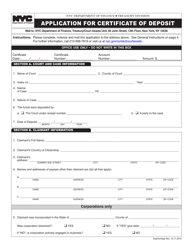

Form Details:

- Released on December 11, 2015;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.