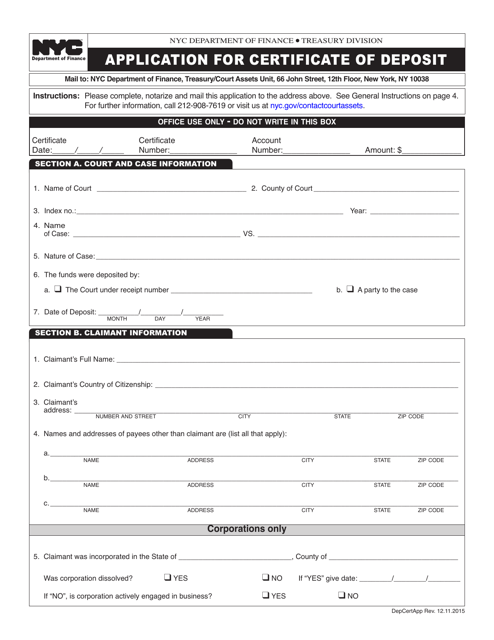

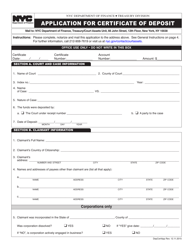

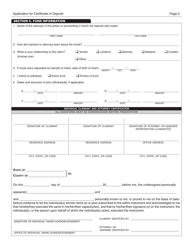

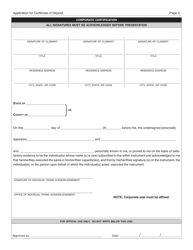

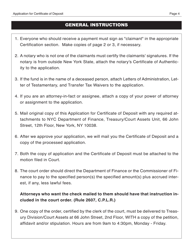

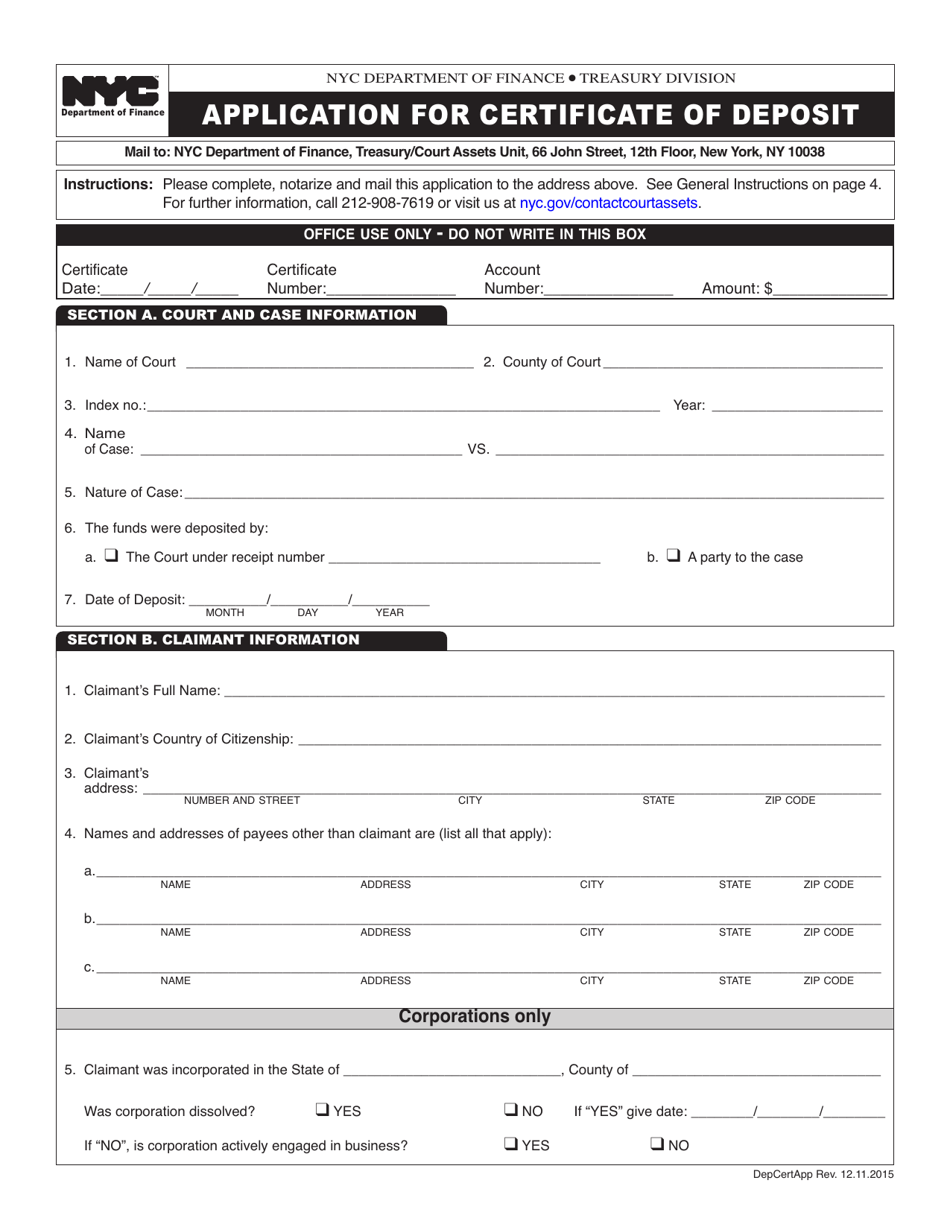

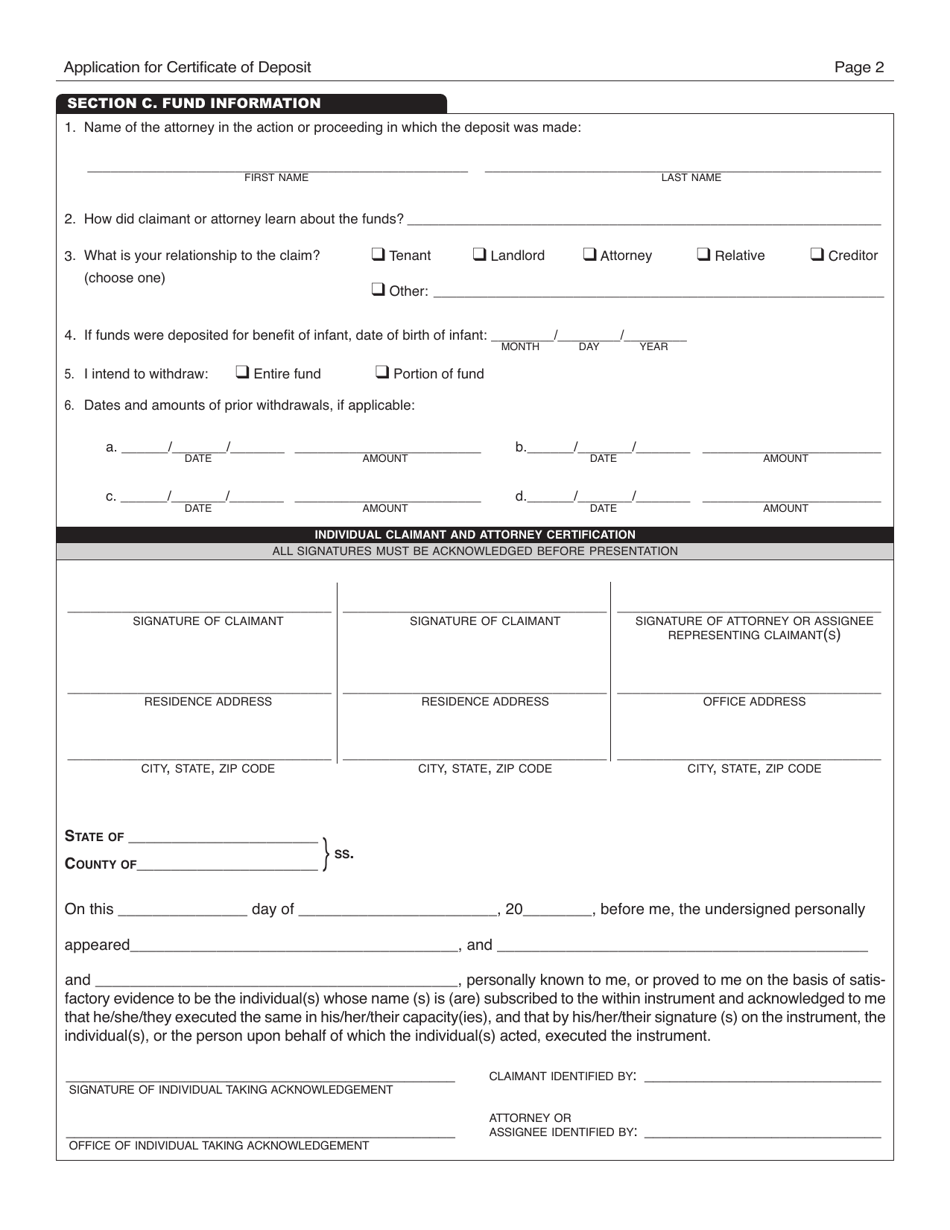

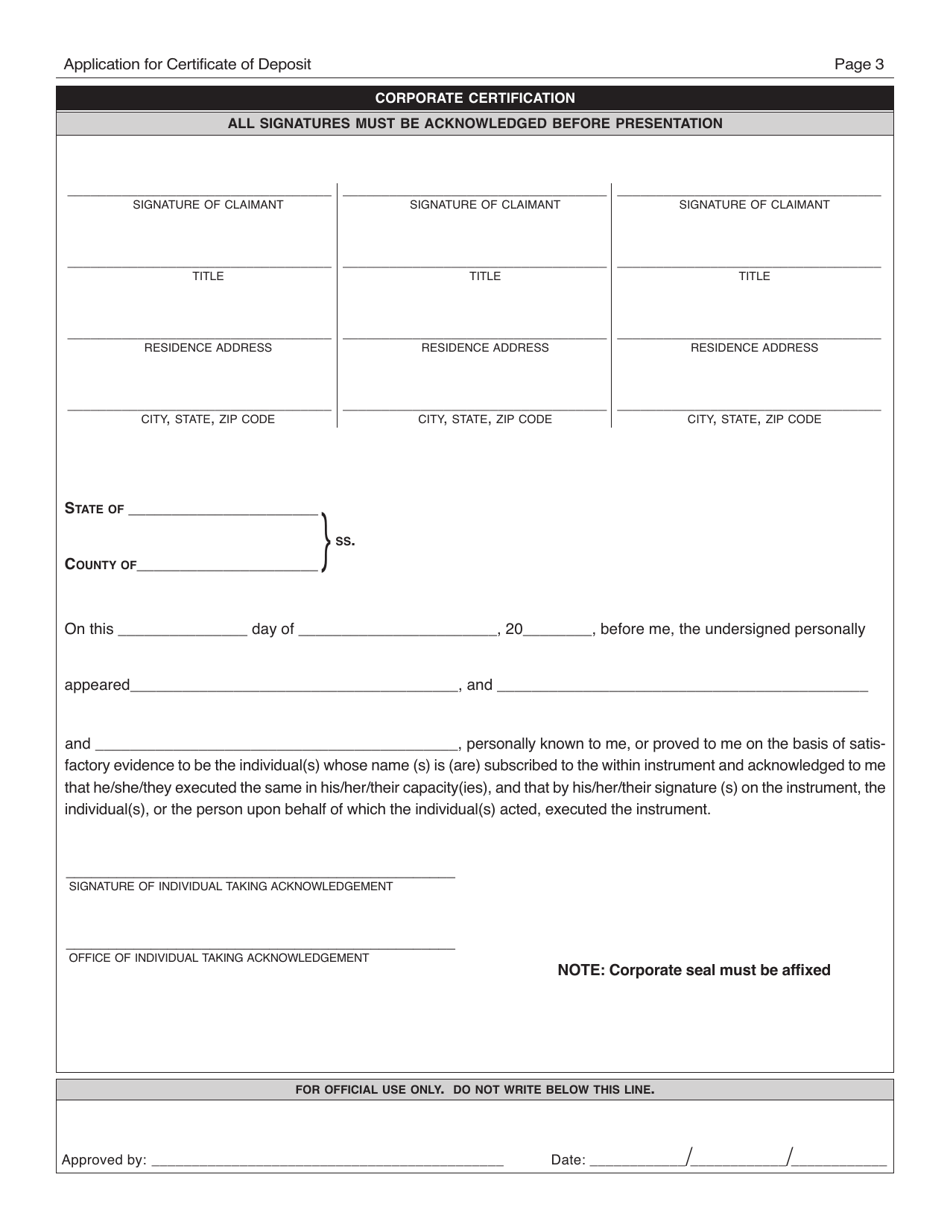

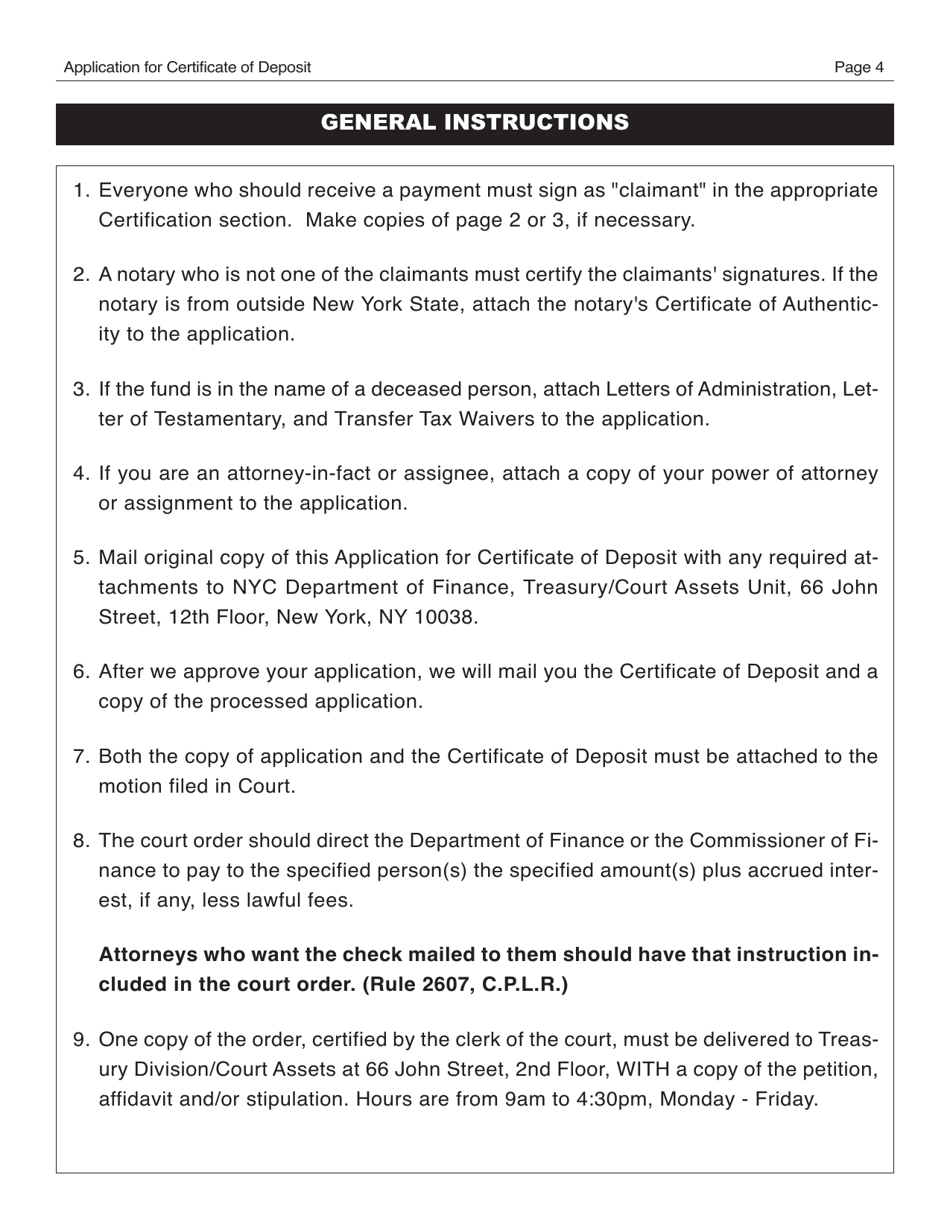

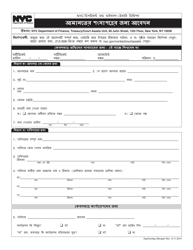

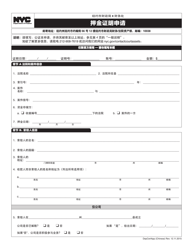

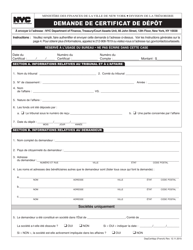

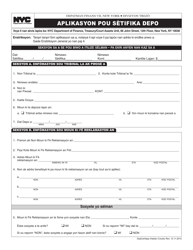

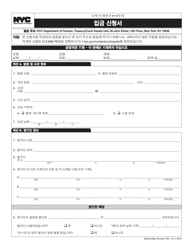

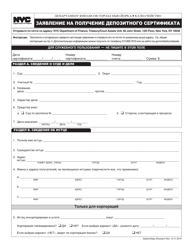

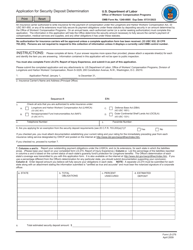

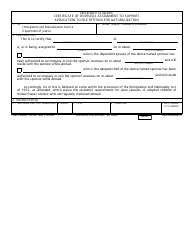

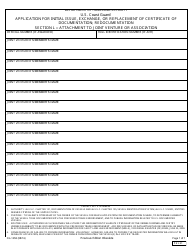

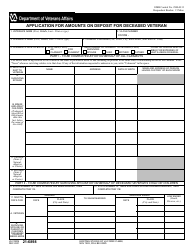

Application for Certificate of Deposit - New York City

Application for Certificate of Deposit is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

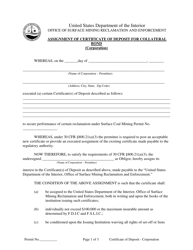

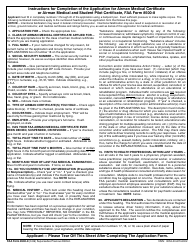

Q: What is a Certificate of Deposit (CD)?

A: A Certificate of Deposit (CD) is a financial instrument that allows you to deposit a specific amount of money with a bank for a fixed period of time, in return for earning interest on your deposit.

Q: What are the benefits of having a Certificate of Deposit?

A: Some benefits of having a Certificate of Deposit include higher interest rates compared to regular savings accounts, a guaranteed return on your investment, and the ability to choose a term that fits your financial goals.

Q: What is the minimum deposit amount for a Certificate of Deposit?

A: The minimum deposit amount for a Certificate of Deposit can vary depending on the bank, but it is typically around $1,000 or more.

Q: Can I withdraw money from my Certificate of Deposit before the maturity date?

A: Yes, it is possible to withdraw money from your Certificate of Deposit before the maturity date, but you may face penalties or loss of interest depending on the terms and conditions set by the bank.

Q: Is my Certificate of Deposit insured?

A: Yes, most Certificate of Deposits are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per bank.

Q: What happens when my Certificate of Deposit matures?

A: When your Certificate of Deposit matures, you have the option to renew it for another term, withdraw the funds, or transfer them to another account.

Q: Are there any taxes on the interest earned from a Certificate of Deposit?

A: Yes, the interest earned from a Certificate of Deposit is generally subject to federal and state income taxes.

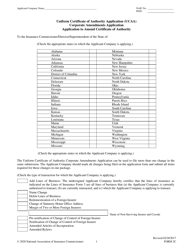

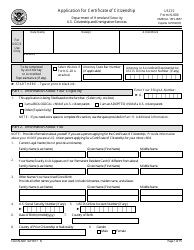

Q: Can I open a Certificate of Deposit jointly with another person?

A: Yes, it is possible to open a Certificate of Deposit jointly with another person. This allows both parties to share ownership and access to the funds in the CD.

Q: What is the difference between a fixed-rate CD and a variable-rate CD?

A: A fixed-rate CD has an interest rate that remains constant throughout the term, while a variable-rate CD has an interest rate that can fluctuate based on market conditions.

Form Details:

- Released on December 11, 2015;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.