This version of the form is not currently in use and is provided for reference only. Download this version of

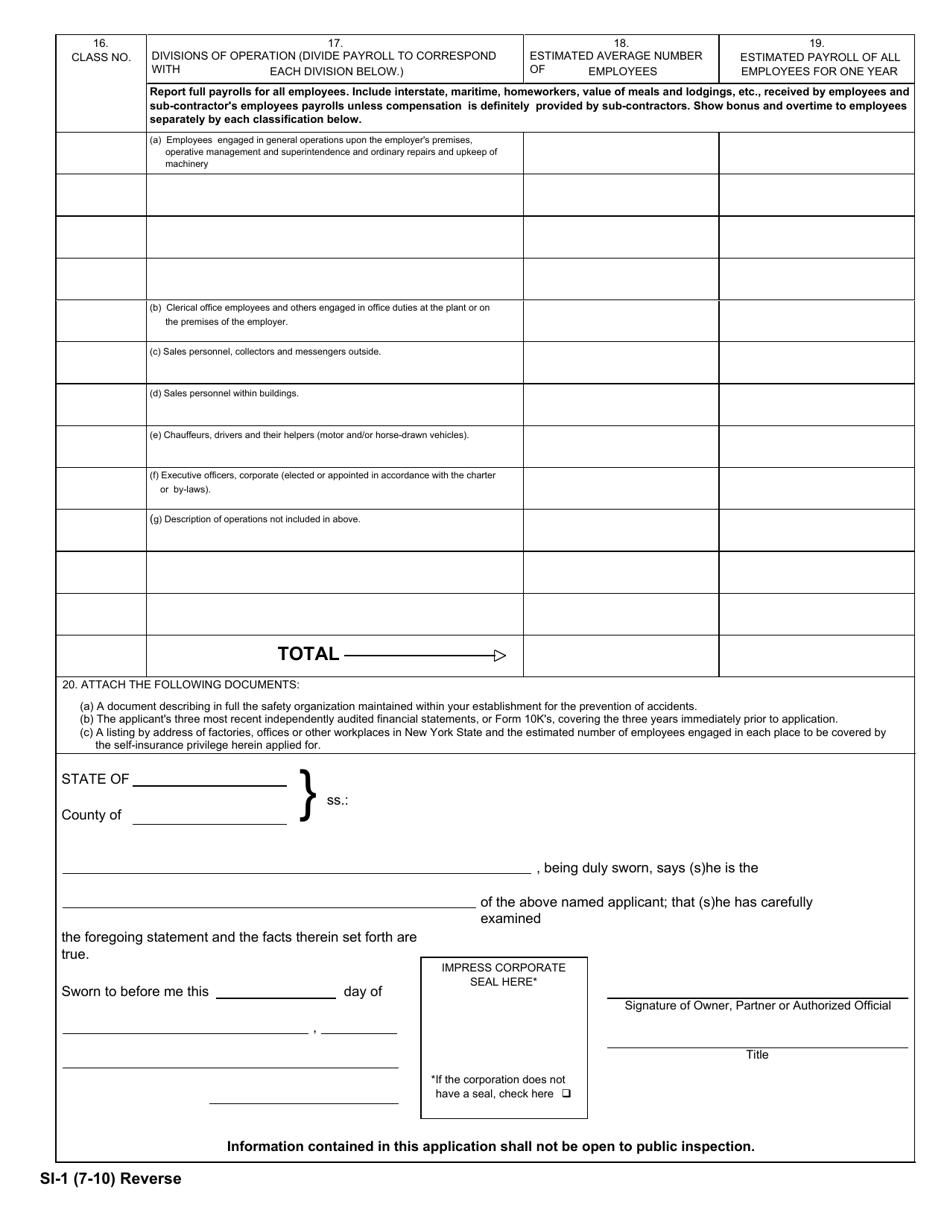

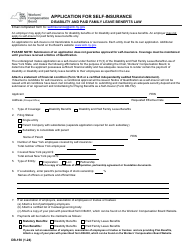

Form SI-1

for the current year.

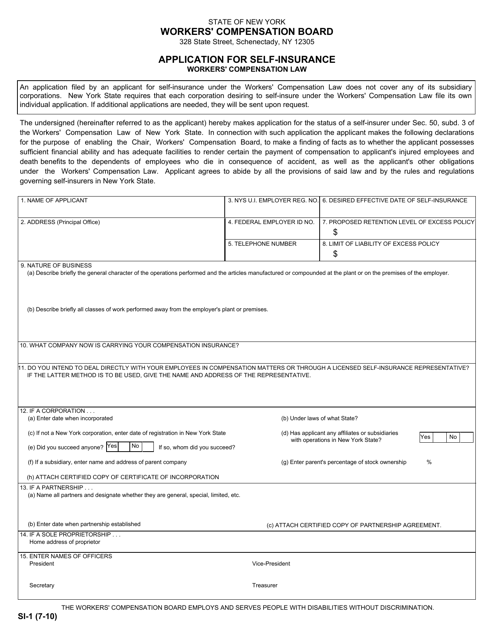

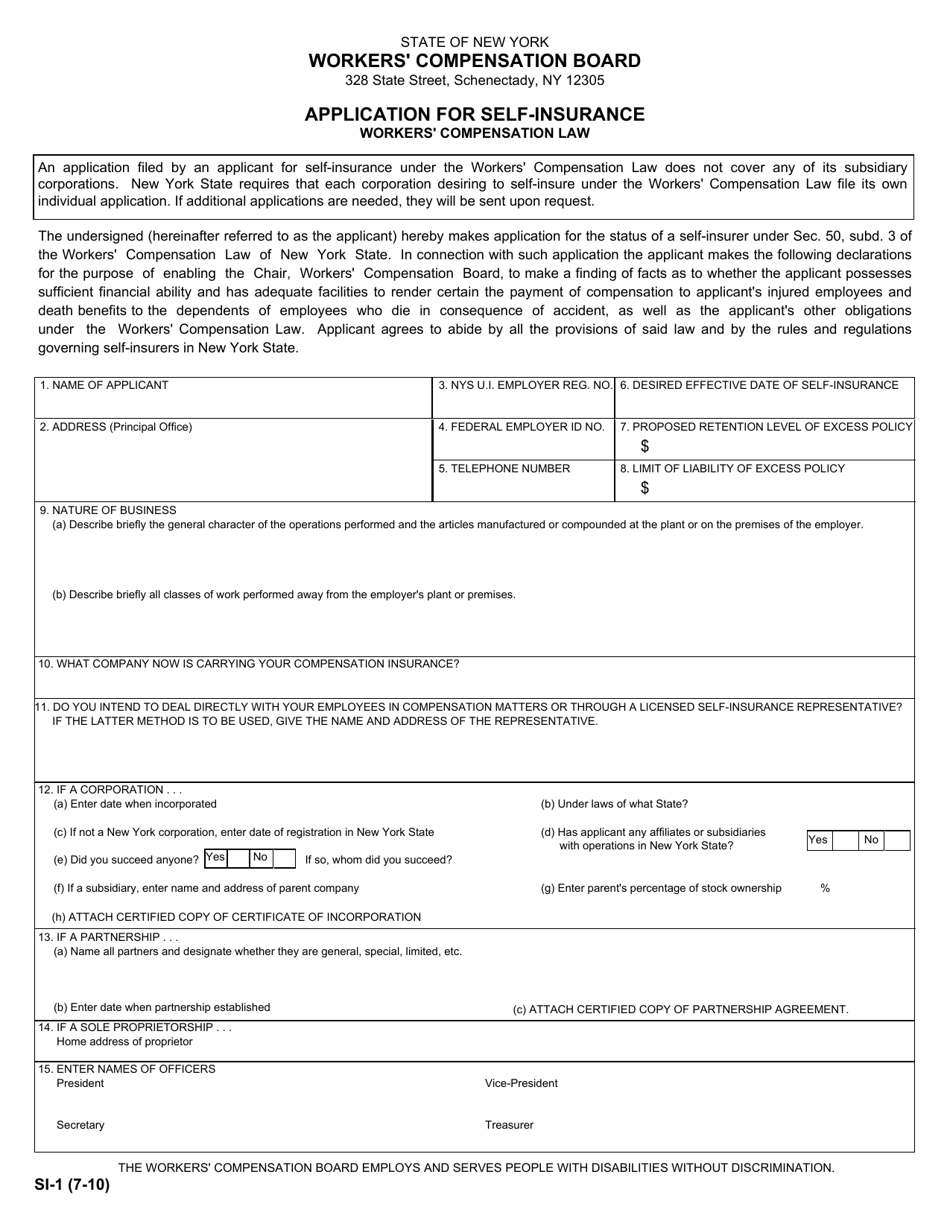

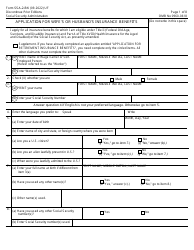

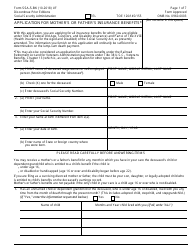

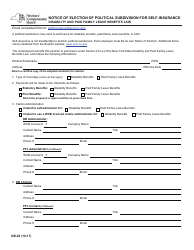

Form SI-1 Application for Self-insurance - New York

What Is Form SI-1?

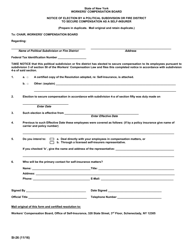

This is a legal form that was released by the New York State Workers' Compensation Board - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SI-1?

A: Form SI-1 is the application form for self-insurance in New York.

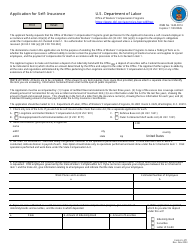

Q: What is self-insurance?

A: Self-insurance is a mechanism whereby an individual or organization assumes the financial risk for potential losses instead of purchasing insurance.

Q: Who can apply for self-insurance in New York?

A: Any individual or organization that meets the eligibility criteria set by the New York State Department of Financial Services can apply for self-insurance.

Q: What are the benefits of self-insurance?

A: The benefits of self-insurance include potential cost savings, increased control over insurance programs, and the ability to customize coverage to specific needs.

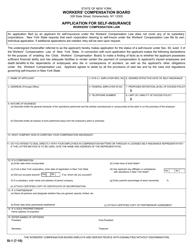

Q: What information is required on Form SI-1?

A: Form SI-1 requires information such as the applicant's name, address, financial information, and details about the type of self-insurance being sought.

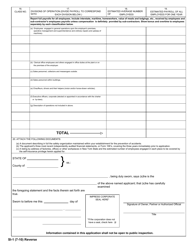

Q: Are there any fees associated with the application?

A: Yes, there are fees associated with the application. The exact fee amount can be found in the instructions accompanying Form SI-1.

Q: How long does it take to process the application?

A: The processing time for Form SI-1 varies depending on the complexity of the application. It is advisable to submit the application well in advance to allow for sufficient processing time.

Q: What happens after the application is approved?

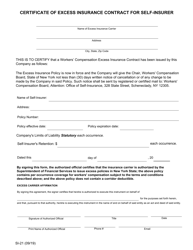

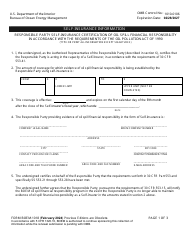

A: Once the application is approved, the applicant will be issued a certificate of self-insurance, allowing them to operate as a self-insured entity in New York.

Q: Can a self-insured entity revert to traditional insurance?

A: Yes, a self-insured entity has the option to revert to traditional insurance if they choose to do so, subject to the rules and regulations of the applicable insurance authority.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the New York State Workers' Compensation Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-1 by clicking the link below or browse more documents and templates provided by the New York State Workers' Compensation Board.