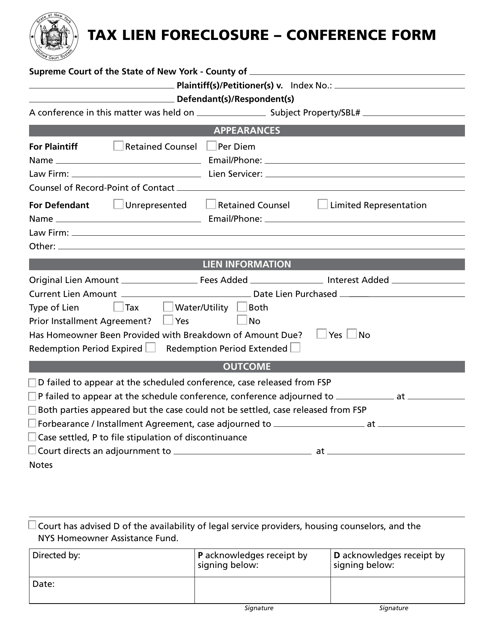

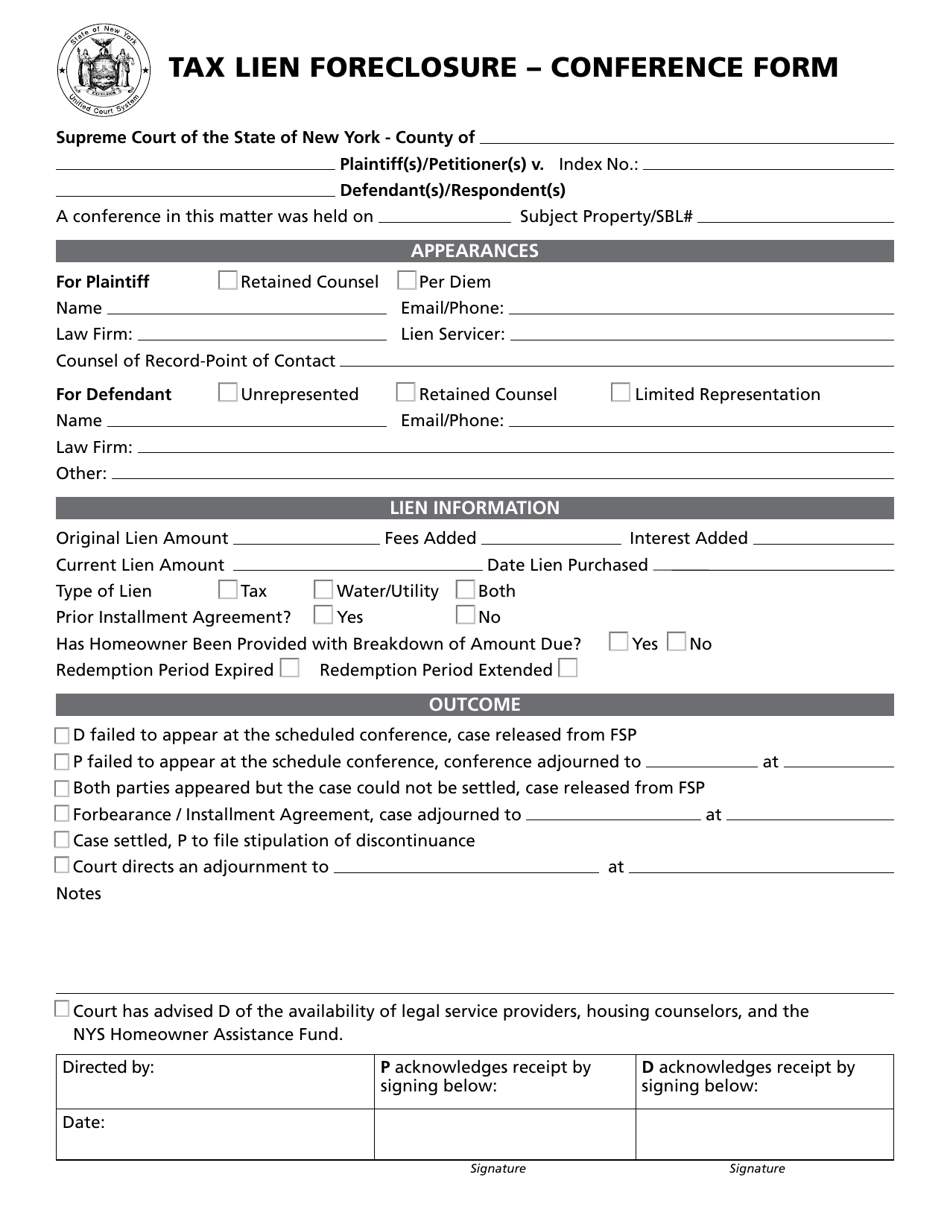

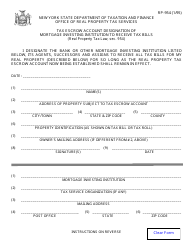

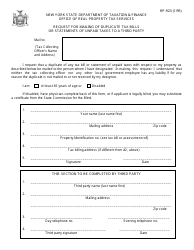

Tax Lien Foreclosure - Conference Form - New York

Tax Lien Foreclosure - Conference Form is a legal document that was released by the New York Supreme Court - a government authority operating within New York.

FAQ

Q: What is tax lien foreclosure?

A: Tax lien foreclosure is a legal process where a property is auctioned off to satisfy unpaid property taxes.

Q: What is a tax lien?

A: A tax lien is a legal claim by the government on a property due to unpaid property taxes.

Q: What happens during a tax lien foreclosure?

A: During a tax lien foreclosure, the property with unpaid taxes is auctioned off to recover the unpaid tax debt.

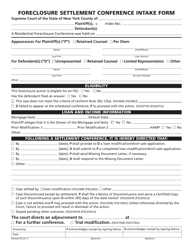

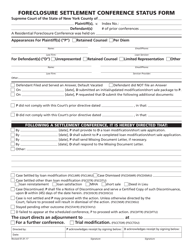

Q: What is the Conference Form in a tax lien foreclosure in New York?

A: The Conference Form is a document used in the tax lien foreclosure process in New York. It is filled out by the interested parties to request a conference with the court to discuss the foreclosure case.

Q: Who can fill out the Conference Form?

A: The interested parties, such as the property owner or lien holders, can fill out the Conference Form in a tax lien foreclosure in New York.

Q: What is the purpose of the conference in a tax lien foreclosure?

A: The purpose of the conference is to provide an opportunity for the interested parties to discuss the tax lien foreclosure case with the court before a judgment is made.

Q: Can the conference help resolve the tax lien foreclosure case?

A: Yes, the conference can be an opportunity for the parties to reach a settlement or agreement that may resolve the tax lien foreclosure case.

Q: Is attendance at the conference mandatory?

A: Yes, attendance at the conference is generally mandatory for the interested parties in a tax lien foreclosure case in New York.

Q: What happens if a party fails to attend the conference?

A: If a party fails to attend the conference, the court may proceed with the tax lien foreclosure case and make a judgment based on the available information.

Q: What is the next step after the conference in a tax lien foreclosure?

A: The next step after the conference is usually the court making a judgment regarding the tax lien foreclosure case.

Form Details:

- The latest edition currently provided by the New York Supreme Court;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York Supreme Court.