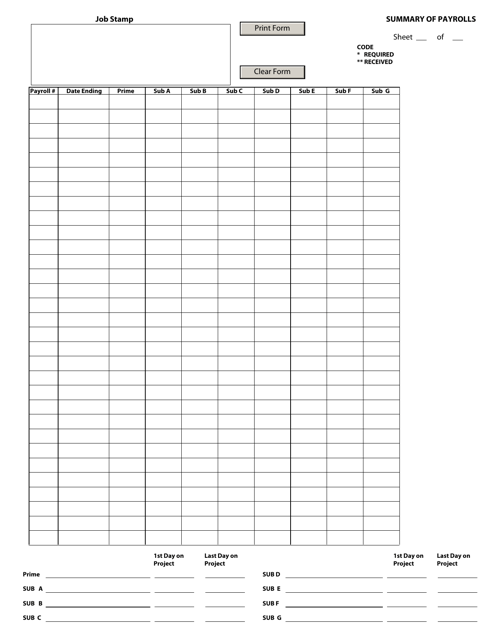

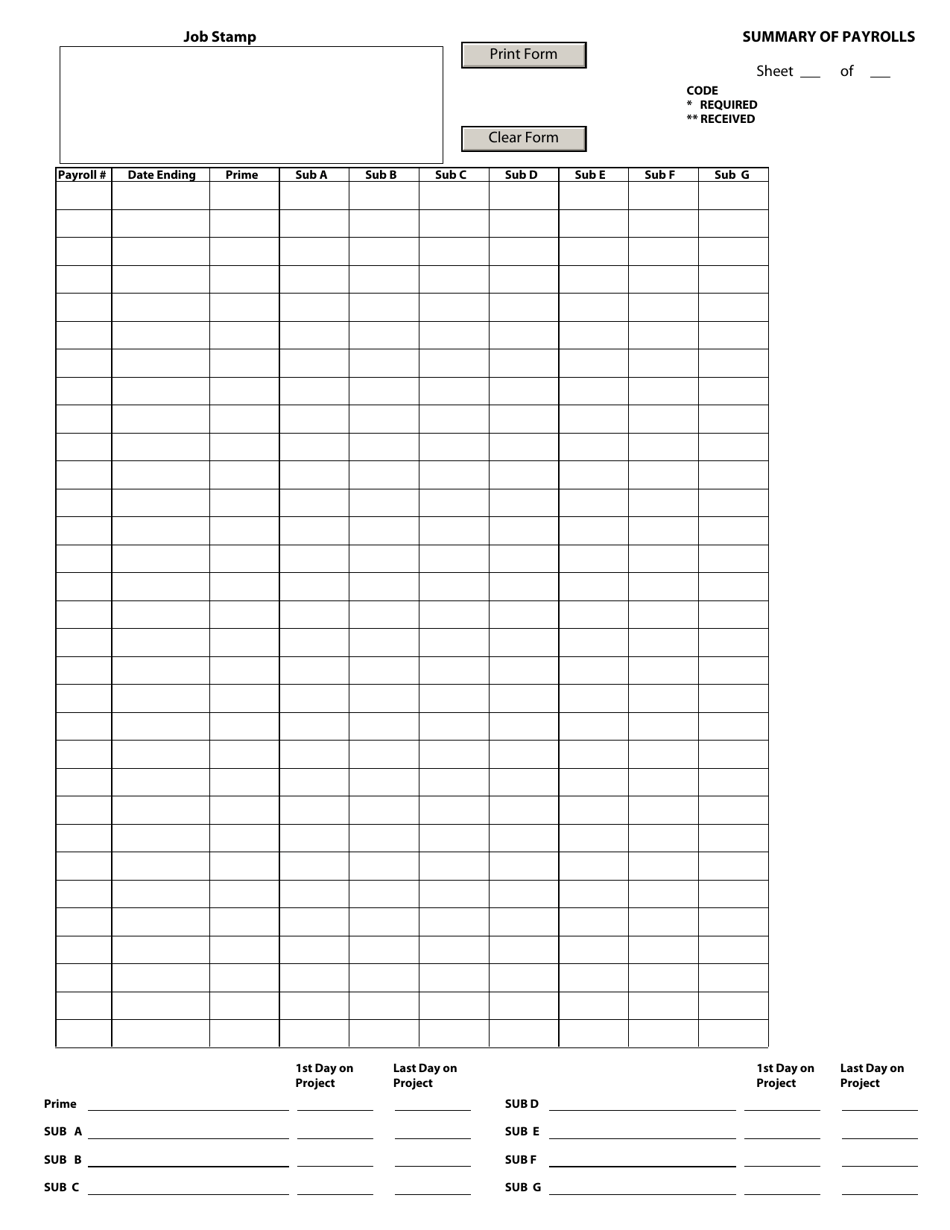

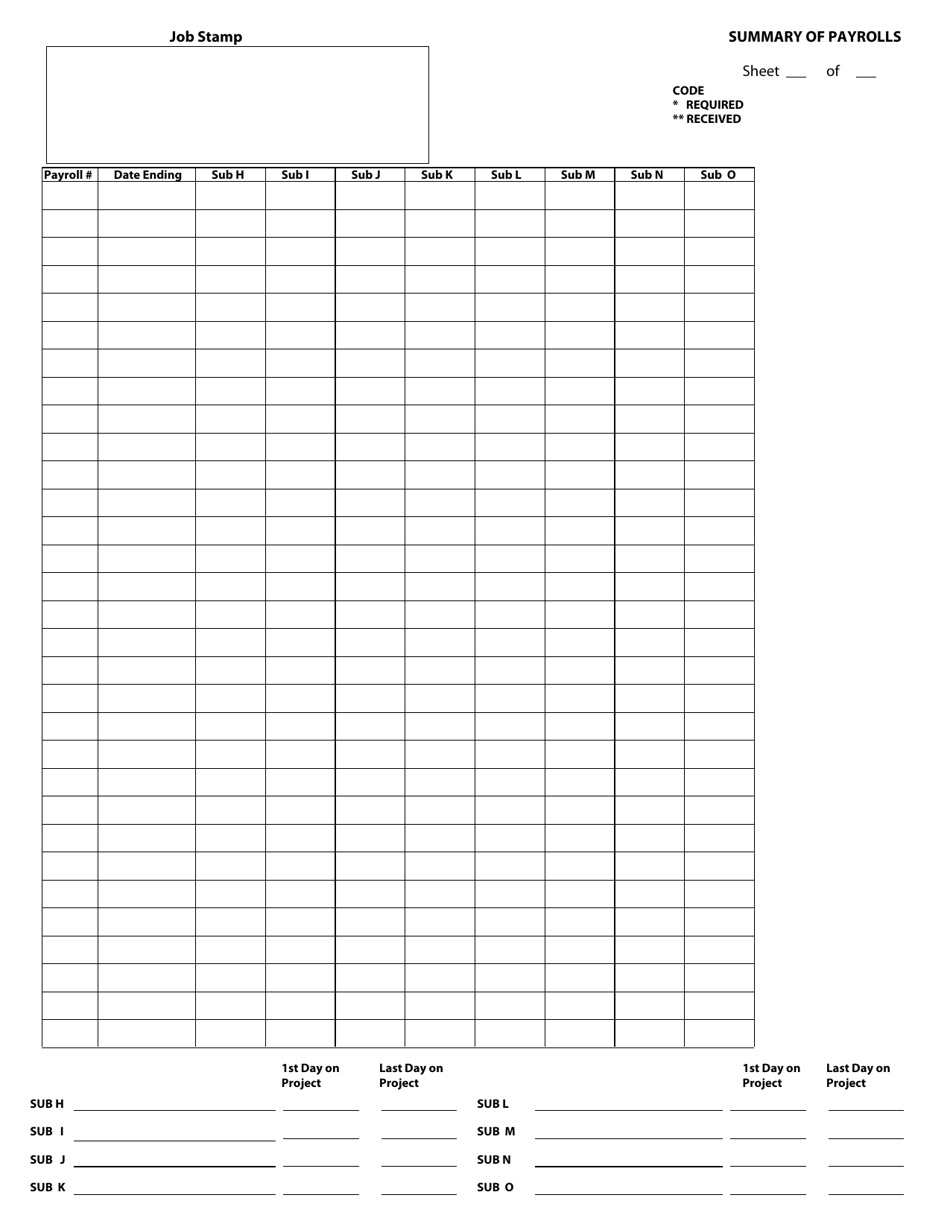

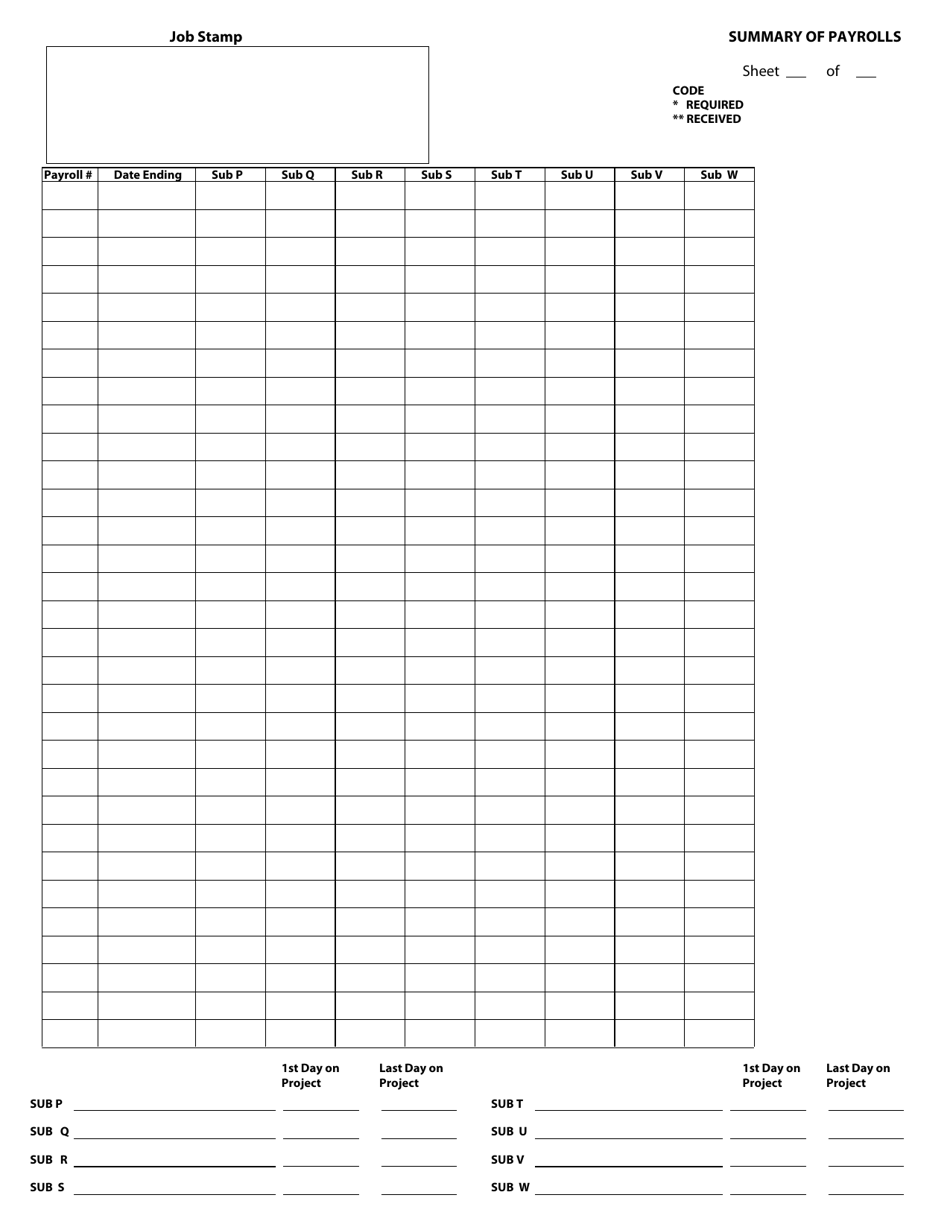

Summary of Payrolls - New York

Summary of Payrolls is a legal document that was released by the New York State Department of Transportation - a government authority operating within New York.

FAQ

Q: What is a payroll?

A: A payroll is a list of employees and the amount of money they are paid by their employer.

Q: Why is payroll important?

A: Payroll is important because it ensures that employees are paid accurately and on time.

Q: Who is responsible for payroll?

A: The employer or the HR department is typically responsible for payroll.

Q: What information is included in a payroll?

A: A payroll includes information such as employee names, hours worked, wages, and deductions.

Q: What is the minimum wage in New York?

A: The minimum wage in New York is $15 per hour for most employees.

Q: Are employers required to provide paid sick leave in New York?

A: Yes, employers in New York are required to provide paid sick leave to their employees.

Q: What is the overtime rate in New York?

A: The overtime rate in New York is 1.5 times the employee's regular rate of pay for hours worked over 40 in a workweek.

Q: What are payroll taxes?

A: Payroll taxes are taxes that are deducted from an employee's wages to fund government programs such as Social Security and Medicare.

Q: What is the payroll tax rate in New York?

A: The payroll tax rate in New York varies depending on the employee's income and the specific tax programs.

Q: Can payroll be outsourced?

A: Yes, many companies choose to outsource their payroll functions to third-party payroll service providers.

Q: What are the penalties for payroll mistakes?

A: Penalties for payroll mistakes can vary, but they can include fines, penalties, and potential legal action.

Form Details:

- The latest edition currently provided by the New York State Department of Transportation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Transportation.