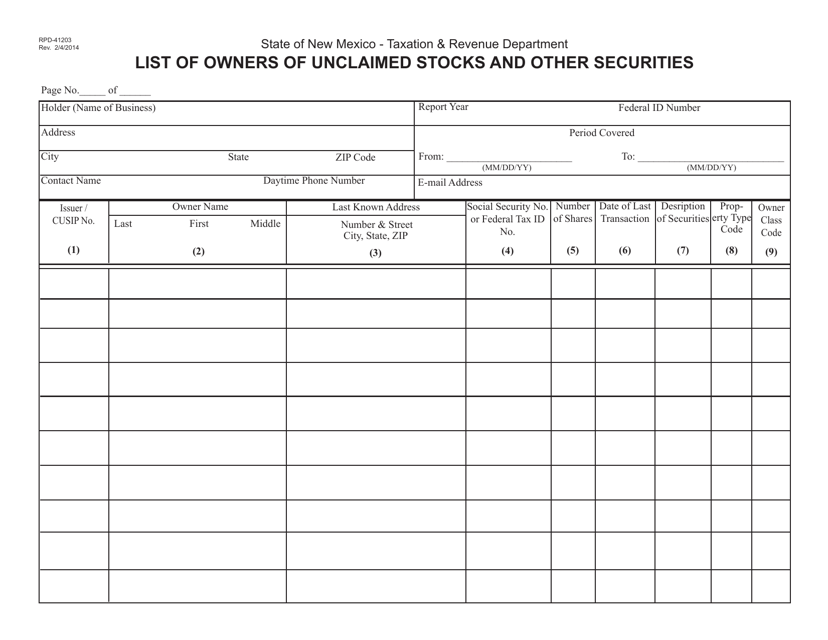

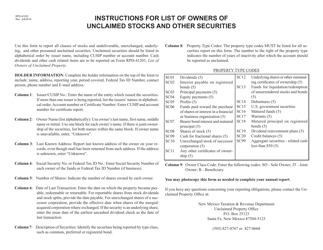

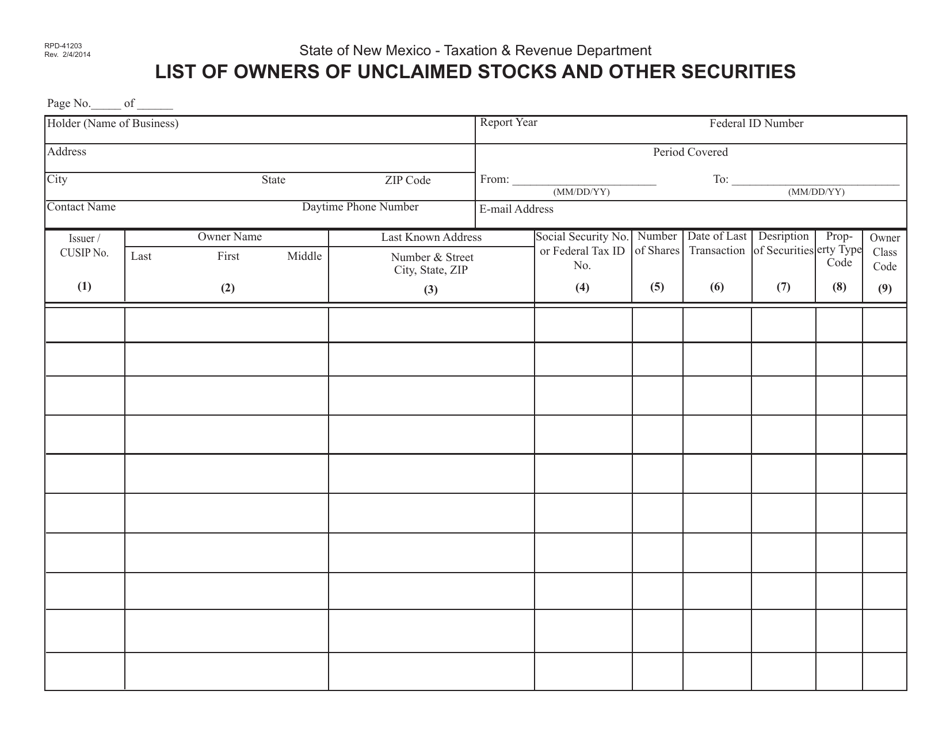

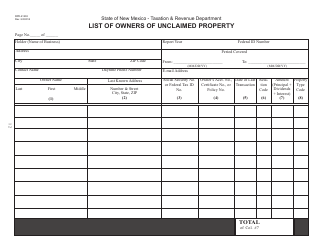

Form RPD-41203 List of Owners of Unclaimed Stock and Other Securities Form - New Mexico

What Is Form RPD-41203?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RPD-41203 form?

A: The RPD-41203 form is the List of Owners of Unclaimed Stock and Other Securities Form.

Q: What is the purpose of the RPD-41203 form?

A: The purpose of the RPD-41203 form is to list the owners of unclaimed stock and other securities in New Mexico.

Q: Who needs to fill out the RPD-41203 form?

A: Individuals or entities holding unclaimed stock and other securities in New Mexico need to fill out the RPD-41203 form.

Q: Are there any filing fees for the RPD-41203 form?

A: No, there are no filing fees for the RPD-41203 form.

Q: When is the deadline to submit the RPD-41203 form?

A: The deadline to submit the RPD-41203 form is usually specified on the form itself or by the New Mexico Taxation and Revenue Department.

Q: What should I do if I have unclaimed stock or other securities in New Mexico?

A: If you have unclaimed stock or other securities in New Mexico, you should fill out the RPD-41203 form and submit it to the New Mexico Taxation and Revenue Department.

Q: What happens if I fail to submit the RPD-41203 form?

A: Failing to submit the RPD-41203 form may result in penalties or legal consequences as per the laws and regulations of New Mexico.

Q: Is the RPD-41203 form only for individuals or entities in New Mexico?

A: Yes, the RPD-41203 form is specifically for individuals or entities holding unclaimed stock and other securities in New Mexico.

Form Details:

- Released on February 4, 2014;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41203 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.