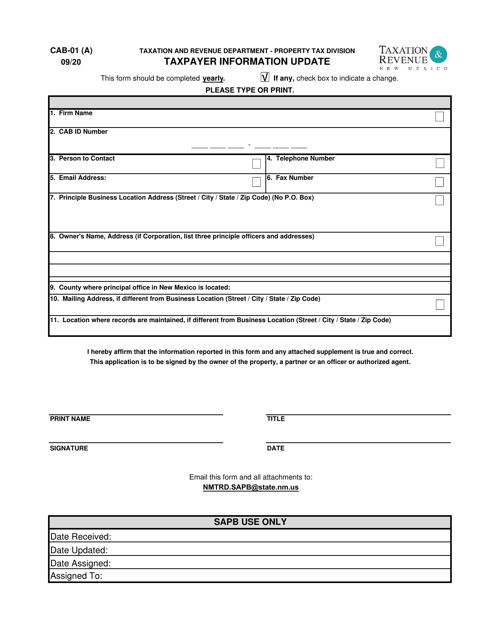

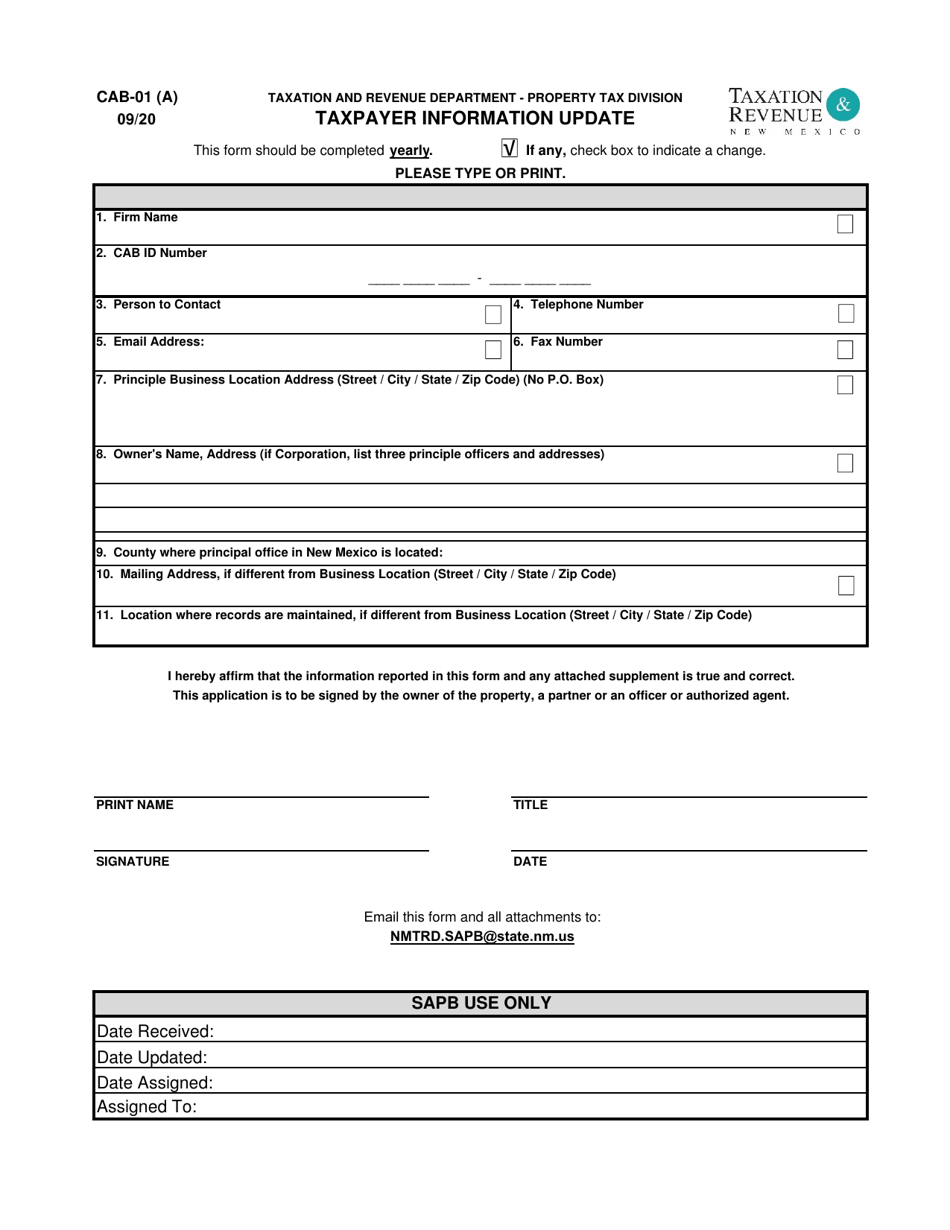

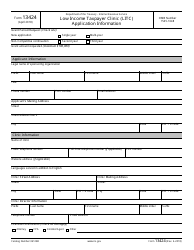

Form CAB-01 (A) Taxpayer Information Update - New Mexico

What Is Form CAB-01 (A)?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CAB-01 (A)?

A: Form CAB-01 (A) is a Taxpayer Information Update form specific to New Mexico.

Q: Who needs to fill out Form CAB-01 (A)?

A: Any taxpayer in New Mexico who needs to update their taxpayer information.

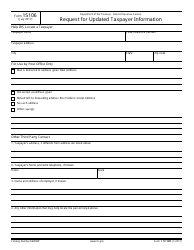

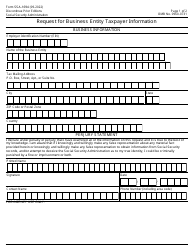

Q: What information is updated on Form CAB-01 (A)?

A: Form CAB-01 (A) is used to update various taxpayer information, such as address, contact details, or business information.

Q: Is Form CAB-01 (A) for individuals or businesses?

A: Form CAB-01 (A) can be used by both individuals and businesses in New Mexico.

Q: Is there a deadline to submit Form CAB-01 (A)?

A: There is no specific deadline mentioned for submitting Form CAB-01 (A). However, it is recommended to update taxpayer information promptly.

Q: Are there any fees associated with Form CAB-01 (A)?

A: There are no fees associated with submitting Form CAB-01 (A) to update taxpayer information.

Q: Is support available if I have questions about Form CAB-01 (A)?

A: Yes, you can contact the New Mexico Taxation and Revenue Department for support or clarification regarding Form CAB-01 (A).

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-01 (A) by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.