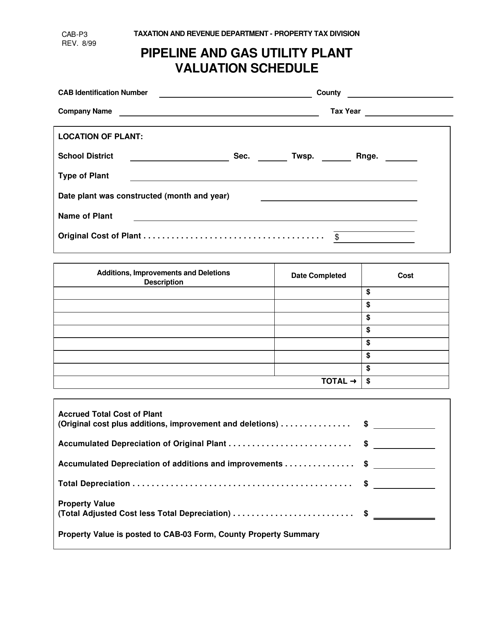

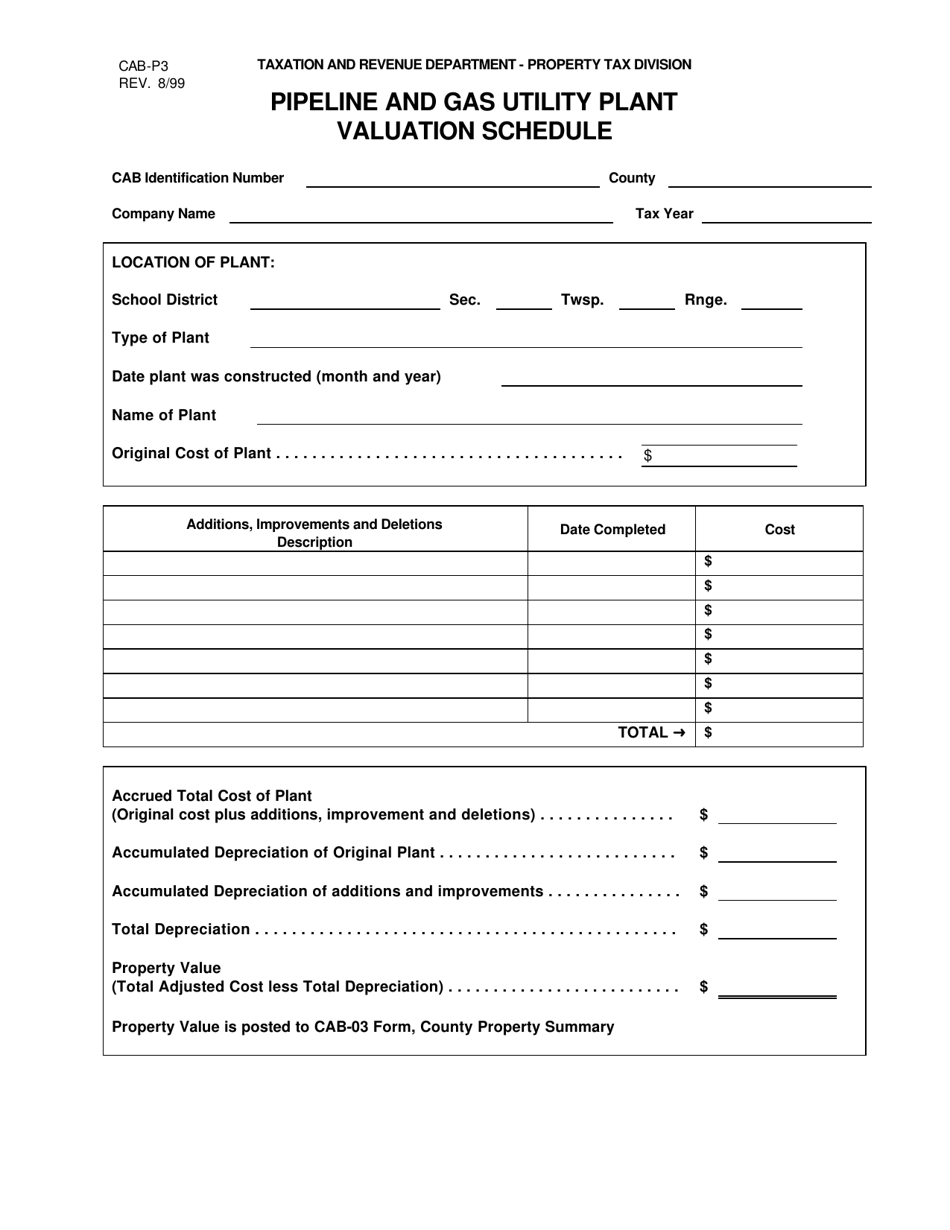

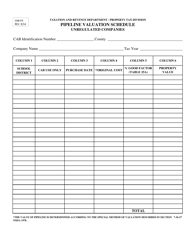

Form CAB-P3 Pipeline and Gas Utility Plant Valuation Schedule - New Mexico

What Is Form CAB-P3?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CAB-P3 Pipeline and Gas Utility Plant Valuation Schedule?

A: The CAB-P3 Pipeline and Gas Utility Plant Valuation Schedule is a document used in New Mexico to assess the value of pipeline and gas utility plants.

Q: What is the purpose of the CAB-P3 Pipeline and Gas Utility Plant Valuation Schedule?

A: The purpose of the schedule is to determine the assessed value of pipeline and gas utility plants for property tax purposes in New Mexico.

Q: Who uses the CAB-P3 Pipeline and Gas Utility Plant Valuation Schedule?

A: The schedule is used by assessors and tax officials in New Mexico to assess the value of pipeline and gas utility plants.

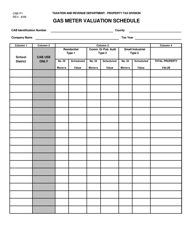

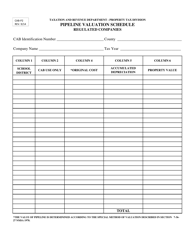

Q: What information is included in the CAB-P3 Pipeline and Gas Utility Plant Valuation Schedule?

A: The schedule includes information about the pipeline and gas utility plants, such as their location, construction cost, depreciation, and other relevant factors that affect their value.

Q: How is the value of the pipeline and gas utility plants determined?

A: The value is determined by considering factors such as the original cost of construction, depreciation, and other factors that may impact the value of the plants.

Q: Why is the value of pipeline and gas utility plants assessed?

A: The value is assessed for property tax purposes, so that the owners of these plants can be taxed accordingly based on the value of their properties.

Q: Are pipeline and gas utility plants subject to property tax in New Mexico?

A: Yes, pipeline and gas utility plants are subject to property tax in New Mexico, and the assessed value is determined using the CAB-P3 Schedule.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-P3 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.