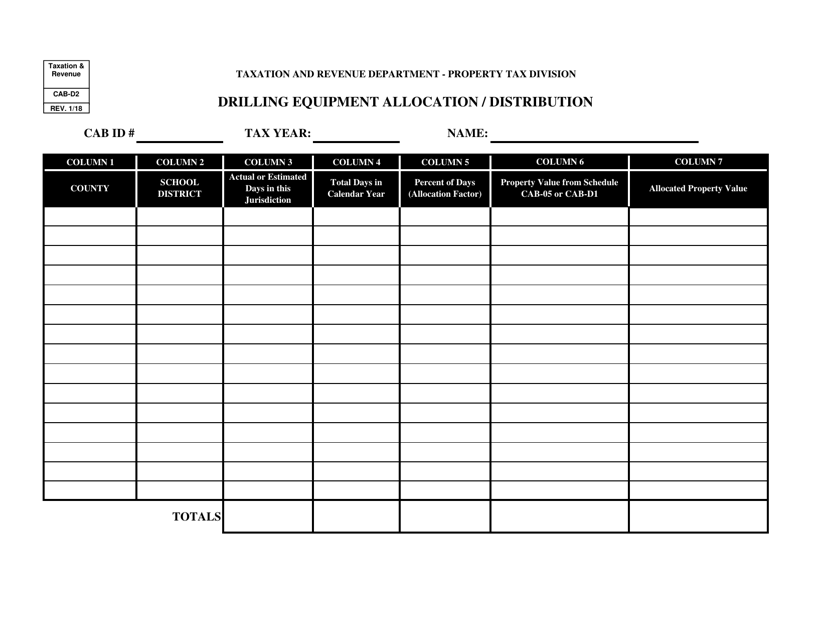

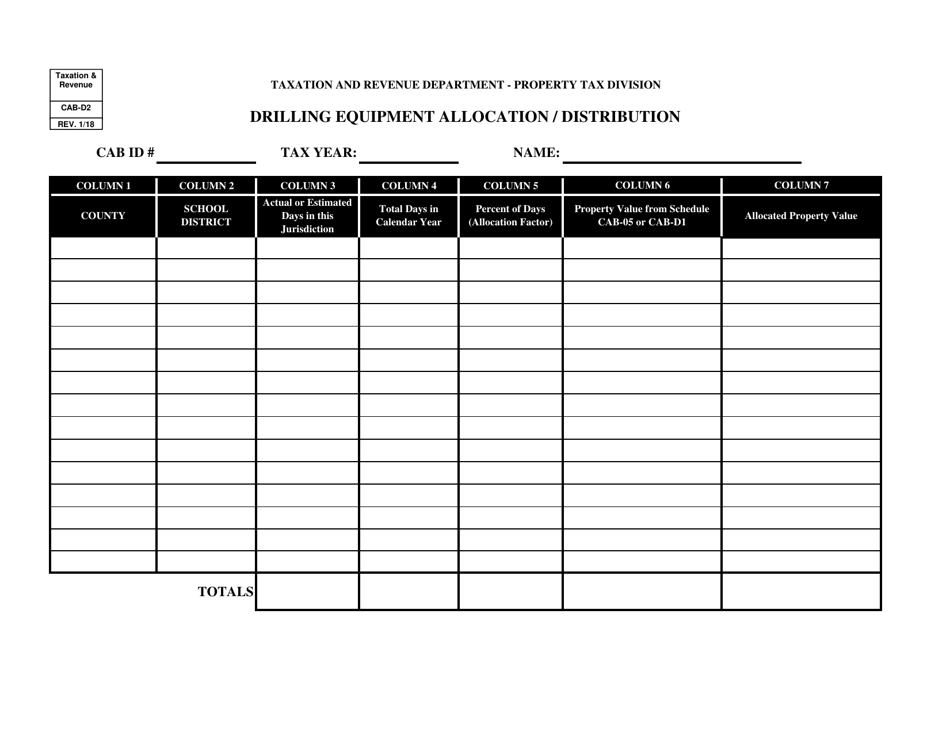

Form CAB-D2 Drilling Equipment Allocation / Distribution - New Mexico

What Is Form CAB-D2?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB-D2?

A: CAB-D2 refers to a form used for drilling equipment allocation/distribution in New Mexico.

Q: Who is required to fill out the CAB-D2 form?

A: The drilling equipment owner or operator is required to fill out the CAB-D2 form in New Mexico.

Q: What does the CAB-D2 form entail?

A: The CAB-D2 form requires information about the drilling equipment such as identification numbers, location, and allocation details.

Q: Why is the CAB-D2 form important?

A: The CAB-D2 form is important for tracking the allocation and distribution of drilling equipment in New Mexico.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-D2 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.