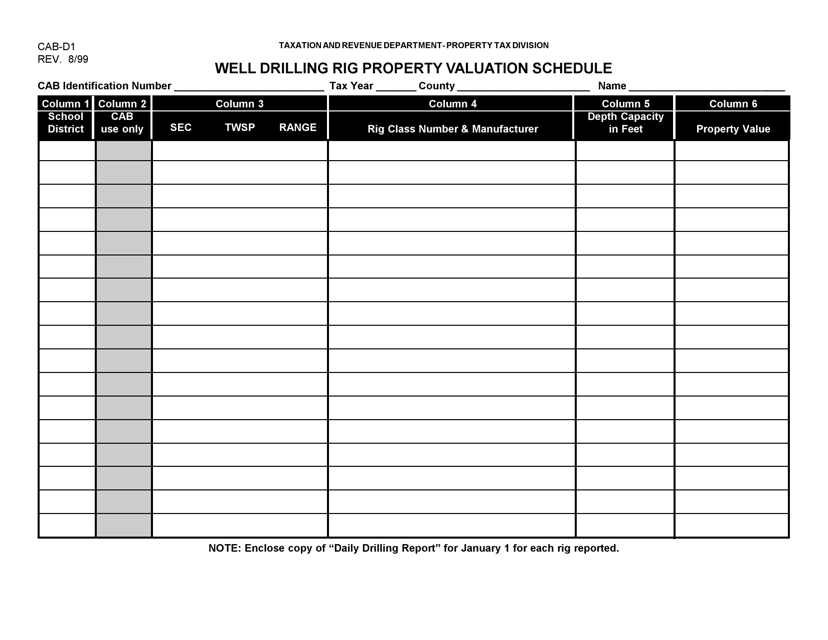

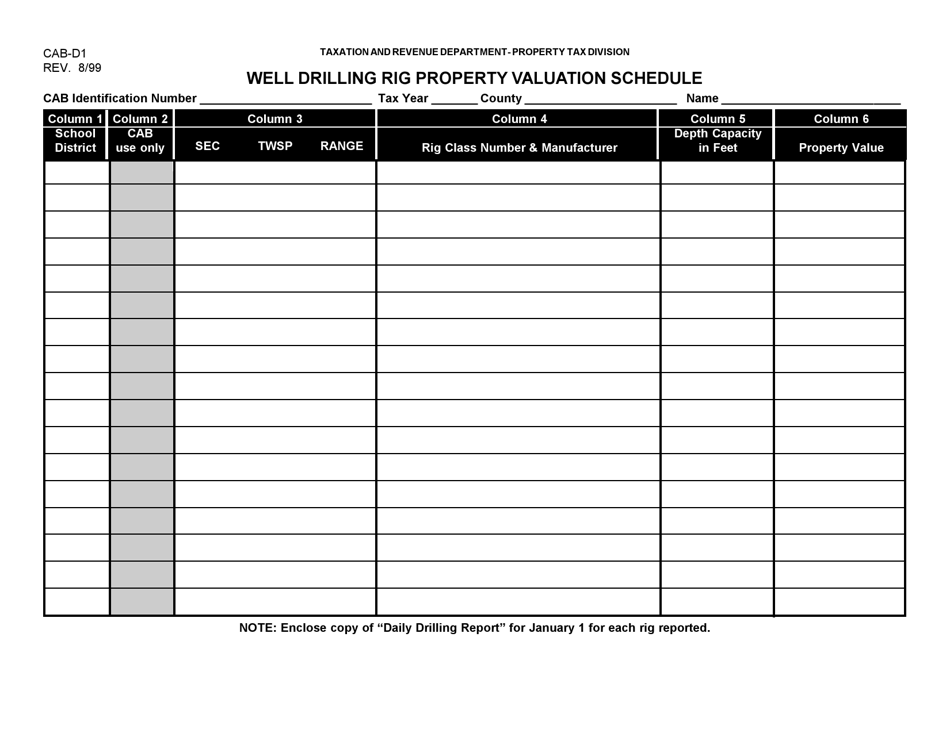

Form CAB-D1 Well Drilling Rig Property Valuation Schedule - New Mexico

What Is Form CAB-D1?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CAB-D1 Well Drilling Rig Property Valuation Schedule?

A: The CAB-D1 Well Drilling Rig Property Valuation Schedule is a form used for assessing the value of well drilling rigs in New Mexico.

Q: Who uses the CAB-D1 Well Drilling Rig Property Valuation Schedule?

A: This form is used by the assessors and appraisers in New Mexico to determine the tax assessment for well drilling rigs.

Q: How does the CAB-D1 Well Drilling Rig Property Valuation Schedule work?

A: The CAB-D1 form provides a standardized way to evaluate the value of well drilling rigs based on factors such as age, condition, and market value.

Q: Why is the CAB-D1 Well Drilling Rig Property Valuation Schedule important?

A: The CAB-D1 form ensures a fair and consistent assessment of well drilling rigs, which helps in determining the appropriate tax liability for the owners.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-D1 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.