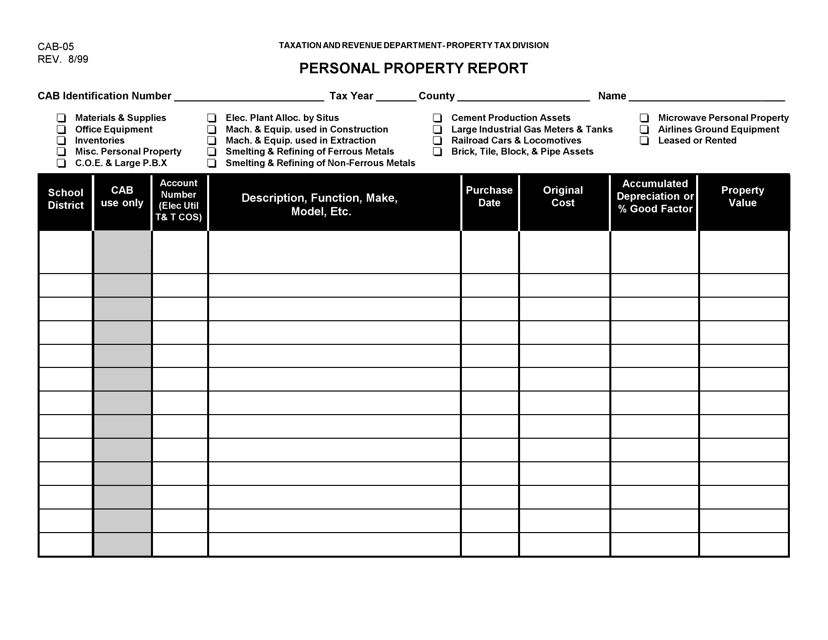

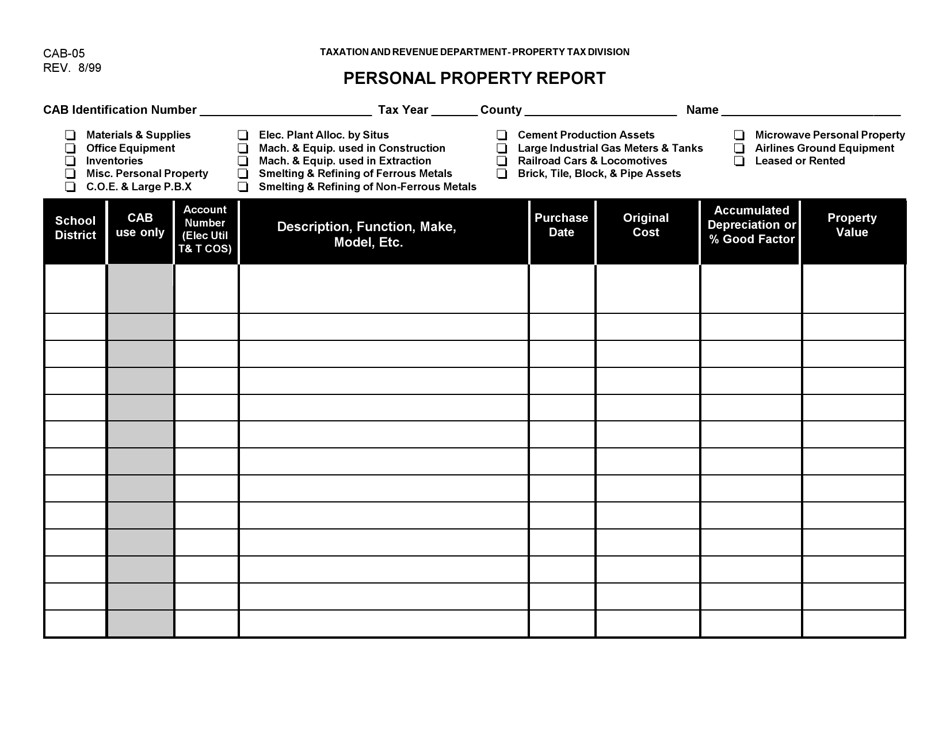

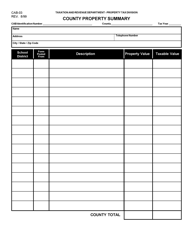

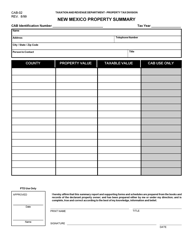

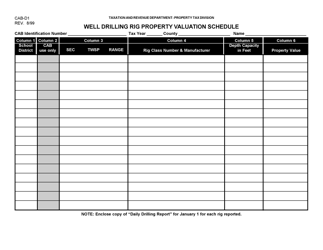

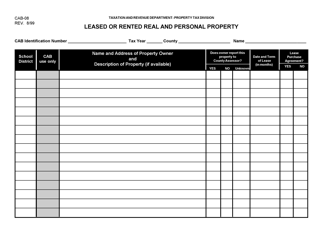

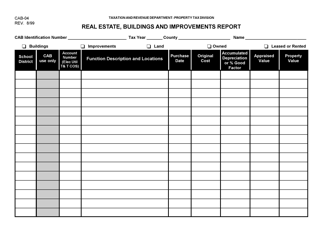

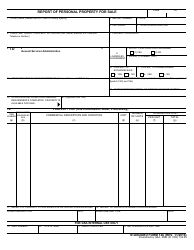

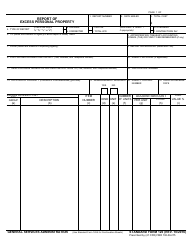

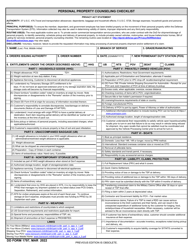

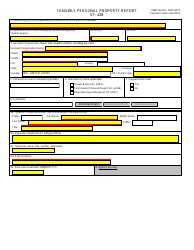

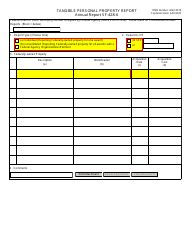

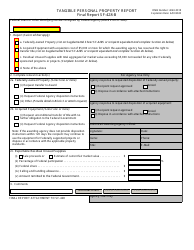

Form CAB-05 Personal Property Report - New Mexico

What Is Form CAB-05?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CAB-05?

A: Form CAB-05 is the Personal Property Report for the state of New Mexico.

Q: What is the purpose of Form CAB-05?

A: The purpose of Form CAB-05 is to report personal property in New Mexico.

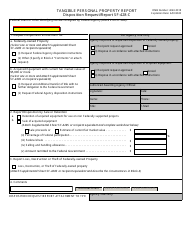

Q: Who needs to complete Form CAB-05?

A: Anyone who owns personal property in New Mexico needs to complete Form CAB-05.

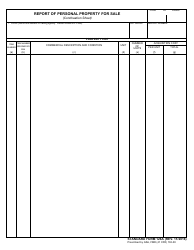

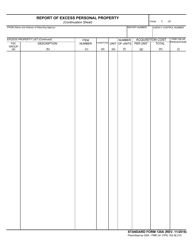

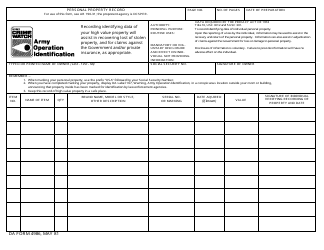

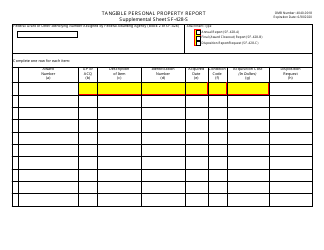

Q: What information is required on Form CAB-05?

A: Form CAB-05 requires information about the owner, property description, and property value.

Q: When is Form CAB-05 due?

A: Form CAB-05 is due by April 1st of each year.

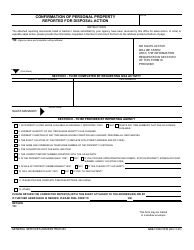

Q: Are there any penalties for not filing Form CAB-05?

A: Yes, failing to file Form CAB-05 may result in penalties and interest.

Q: Can I request an extension to file Form CAB-05?

A: Yes, you can request an extension to file Form CAB-05.

Q: Who should I contact if I have questions about Form CAB-05?

A: For questions about Form CAB-05, you should contact the New Mexico Taxation and Revenue Department.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-05 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.