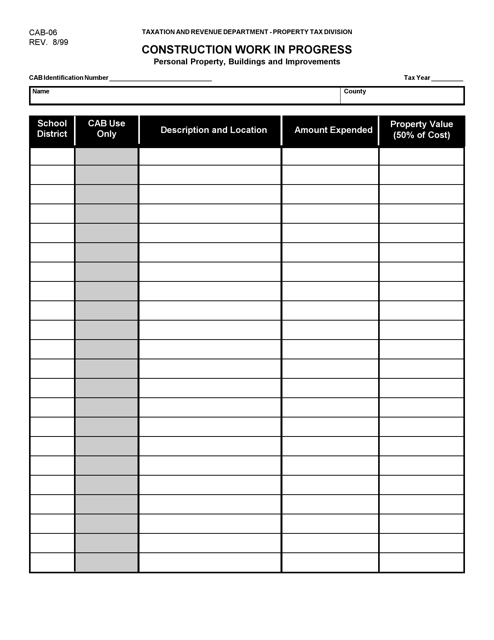

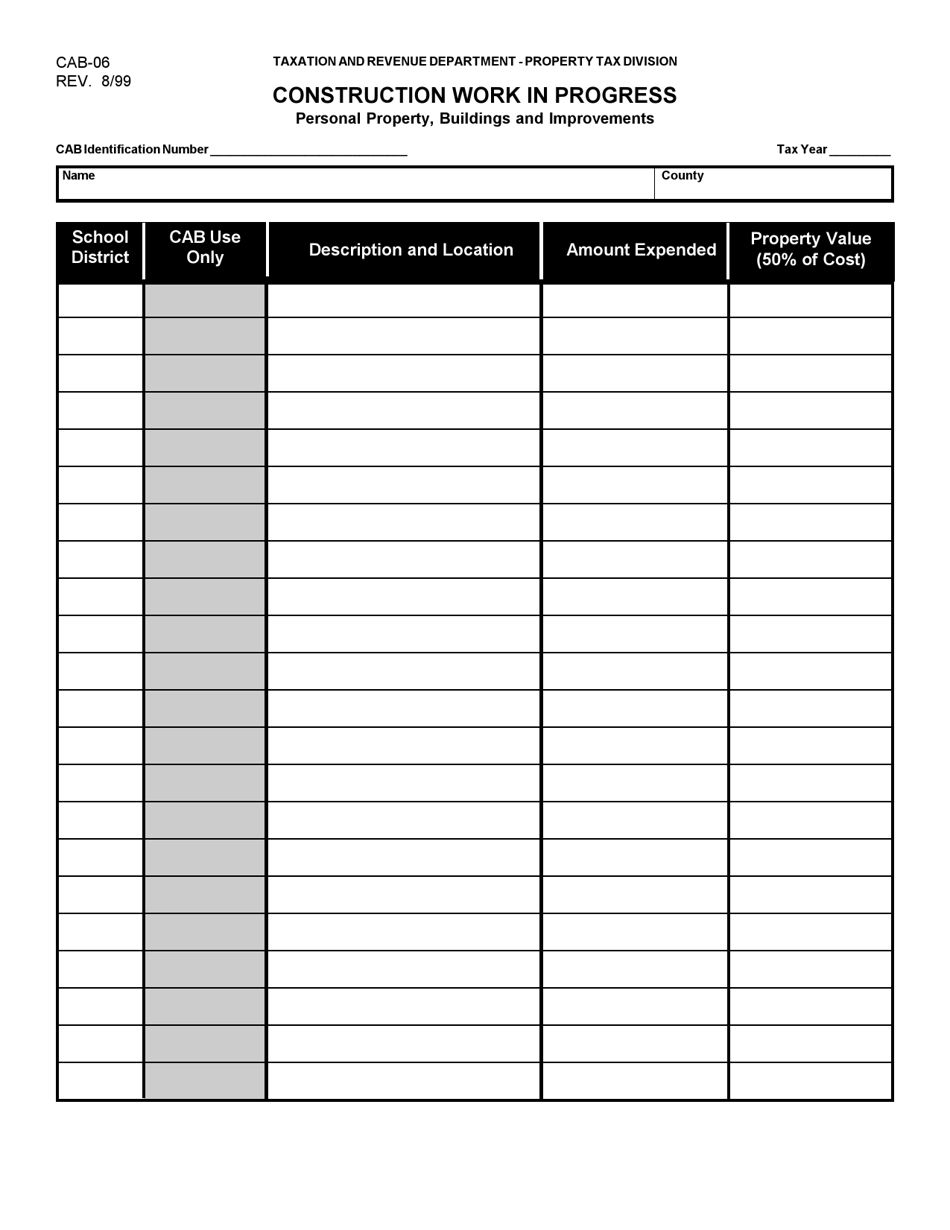

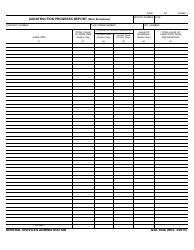

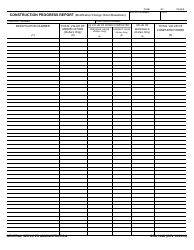

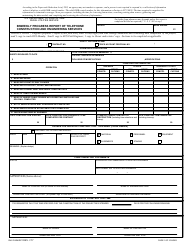

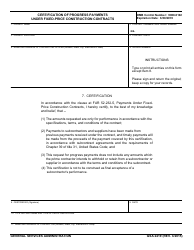

Form CAB-06 Construction Work in Progress - New Mexico

What Is Form CAB-06?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CAB-06 form?

A: The CAB-06 form is a document used for reporting construction work in progress in New Mexico.

Q: Who needs to fill out the CAB-06 form?

A: Contractors and subcontractors involved in construction projects in New Mexico typically need to fill out the CAB-06 form.

Q: What information is required in the CAB-06 form?

A: The CAB-06 form typically requires information such as a description of the construction project, the estimated completion date, and the amount of construction work completed to date.

Q: When is the deadline for filing the CAB-06 form?

A: The deadline for filing the CAB-06 form varies depending on the project, but it is typically due within a specified number of days after the construction project is completed.

Q: Are there any penalties for not filing the CAB-06 form?

A: Yes, there may be penalties for not filing the CAB-06 form, including potential fines or other legal consequences.

Q: Is the CAB-06 form specific to New Mexico?

A: Yes, the CAB-06 form is specific to construction work in progress in New Mexico.

Q: Is there a fee for filing the CAB-06 form?

A: No, there is no fee for filing the CAB-06 form.

Q: Can I get an extension to file the CAB-06 form?

A: Yes, you may be able to get an extension to file the CAB-06 form by contacting the New Mexico Taxation and Revenue Department.

Q: What should I do if I made a mistake on the CAB-06 form?

A: If you made a mistake on the CAB-06 form, you should contact the New Mexico Taxation and Revenue Department to correct the error.

Q: How long should I keep a copy of the CAB-06 form?

A: It is recommended to keep a copy of the CAB-06 form and related documentation for at least three years.

Q: Can I use the CAB-06 form for multiple construction projects?

A: No, each construction project requires a separate CAB-06 form.

Q: Is the CAB-06 form confidential?

A: The confidentiality of the information provided in the CAB-06 form may vary, so it is important to review the instructions and regulations related to the form.

Q: What other documents may be required in addition to the CAB-06 form?

A: Additional documents that may be required in addition to the CAB-06 form include supporting documentation for the construction project, such as invoices, receipts, or contracts.

Q: Can I make changes to the CAB-06 form after it has been submitted?

A: Changes to the CAB-06 form after submission may be possible, but you should contact the New Mexico Taxation and Revenue Department for guidance on how to proceed.

Q: What happens if I don't have the CAB-06 form?

A: If you need the CAB-06 form but don't have it, you should contact the New Mexico Taxation and Revenue Department to obtain a copy or guidance on alternative options.

Q: Is the CAB-06 form only for contractors or subcontractors?

A: The CAB-06 form is primarily for contractors and subcontractors, but other parties involved in the construction project may also need to provide relevant information.

Q: Is the CAB-06 form used for all construction projects in New Mexico?

A: The CAB-06 form is typically used for construction projects that meet certain criteria, so it may not be required for all construction projects in New Mexico.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-06 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.