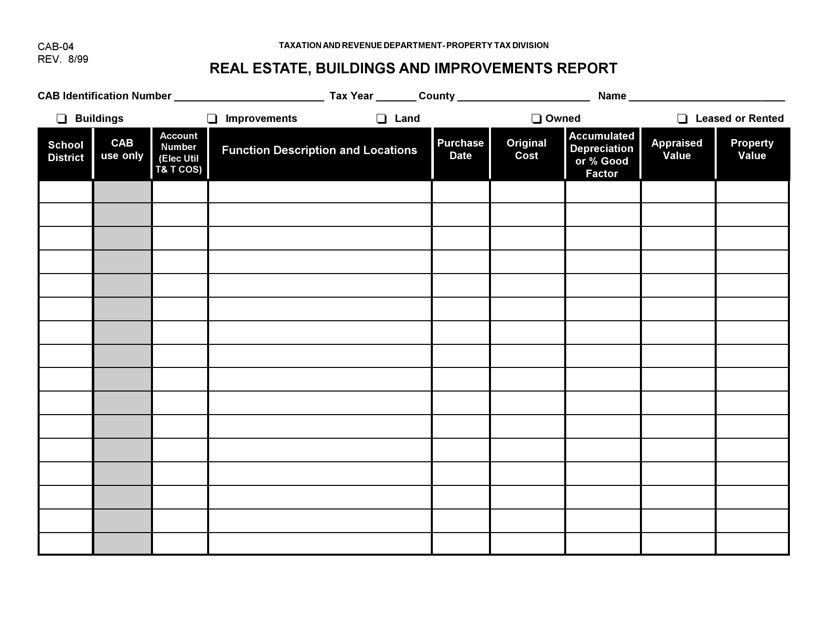

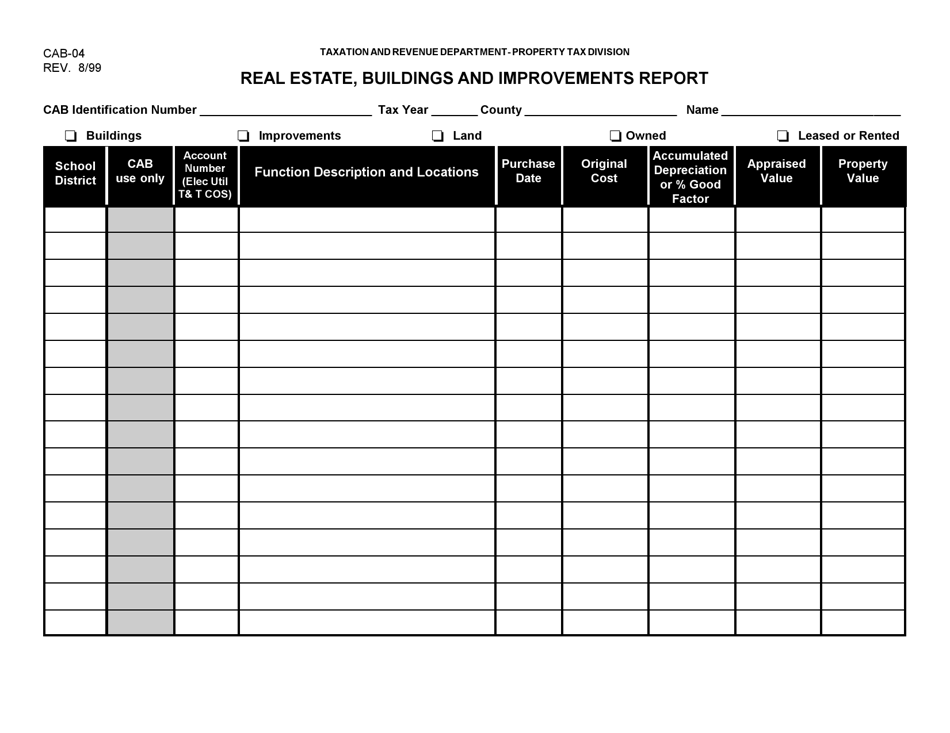

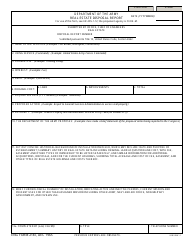

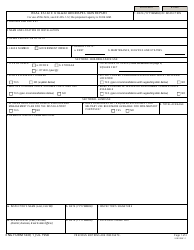

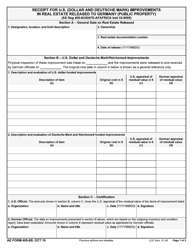

Form CAB-04 Real Estate, Buildings and Improvements Report - New Mexico

What Is Form CAB-04?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB-04?

A: CAB-04 is a Real Estate, Buildings, and Improvements Report form.

Q: What is the purpose of CAB-04?

A: The purpose of CAB-04 is to report information about real estate, buildings, and improvements in New Mexico.

Q: Who needs to use CAB-04?

A: Anyone who owns or manages real estate, buildings, or improvements in New Mexico may need to use CAB-04.

Q: What information needs to be reported on CAB-04?

A: CAB-04 requires information such as the property's legal description, physical condition, and assessed value.

Q: Do I need to submit CAB-04 annually?

A: The frequency of submitting CAB-04 may vary based on local regulations. Contact the relevant government office for more information.

Q: Are there any fees associated with CAB-04?

A: There may be fees associated with submitting CAB-04. Contact the appropriate government office for details.

Q: What happens if I don't submit CAB-04?

A: Failure to submit CAB-04 may result in penalties or legal consequences. It is important to comply with local regulations.

Q: Is CAB-04 specific to New Mexico?

A: Yes, CAB-04 is specific to real estate, buildings, and improvements in New Mexico.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-04 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.