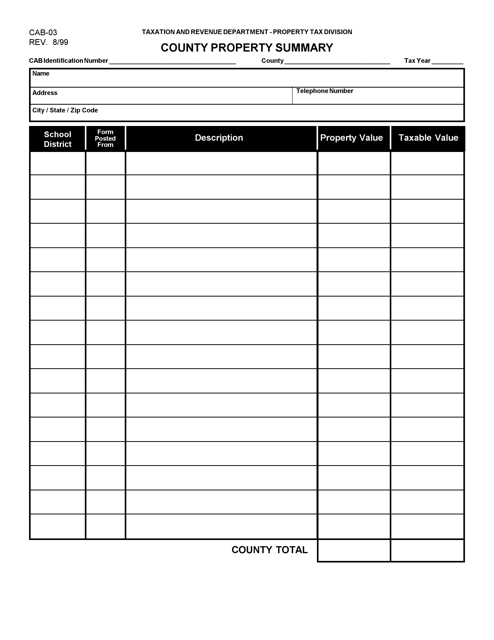

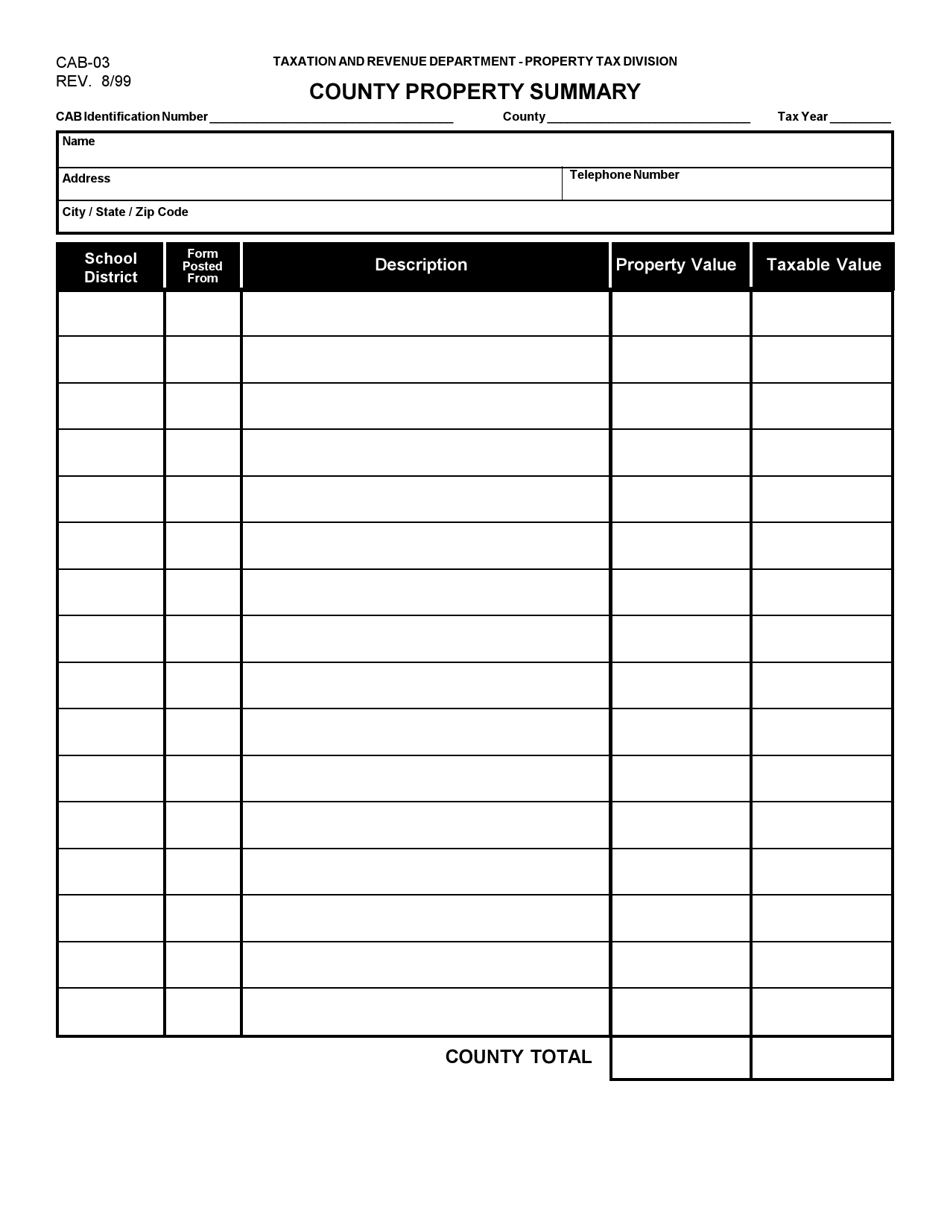

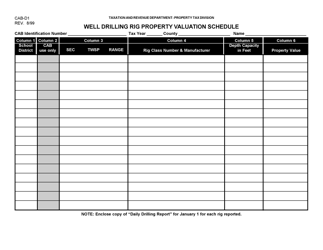

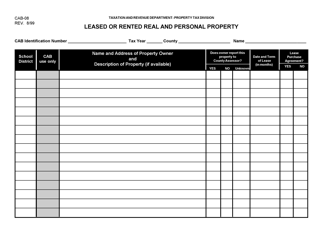

Form CAB-03 County Property Summary - New Mexico

What Is Form CAB-03?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB-03?

A: CAB-03 is a form used for County Property Summary in New Mexico.

Q: What information does CAB-03 include?

A: CAB-03 includes a summary of county property details in New Mexico.

Q: Who fills out CAB-03?

A: County authorities or officials are responsible for filling out CAB-03.

Q: What is the purpose of CAB-03?

A: The purpose of CAB-03 is to provide a summary of county property information.

Q: Is CAB-03 specific to New Mexico?

A: Yes, CAB-03 is specific to New Mexico and its county properties.

Q: Can individuals fill out CAB-03?

A: No, CAB-03 is meant to be filled out by county authorities only.

Q: Are there any fees associated with CAB-03?

A: There may be fees associated with submitting CAB-03, depending on county regulations.

Q: What happens after CAB-03 is submitted?

A: After submitting CAB-03, it is reviewed by county authorities for property assessment purposes.

Q: Is CAB-03 confidential?

A: CAB-03 may contain confidential information and is treated as such by county authorities.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-03 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.