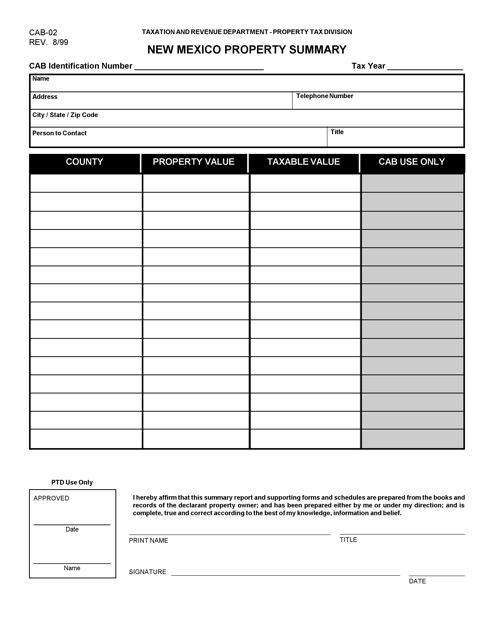

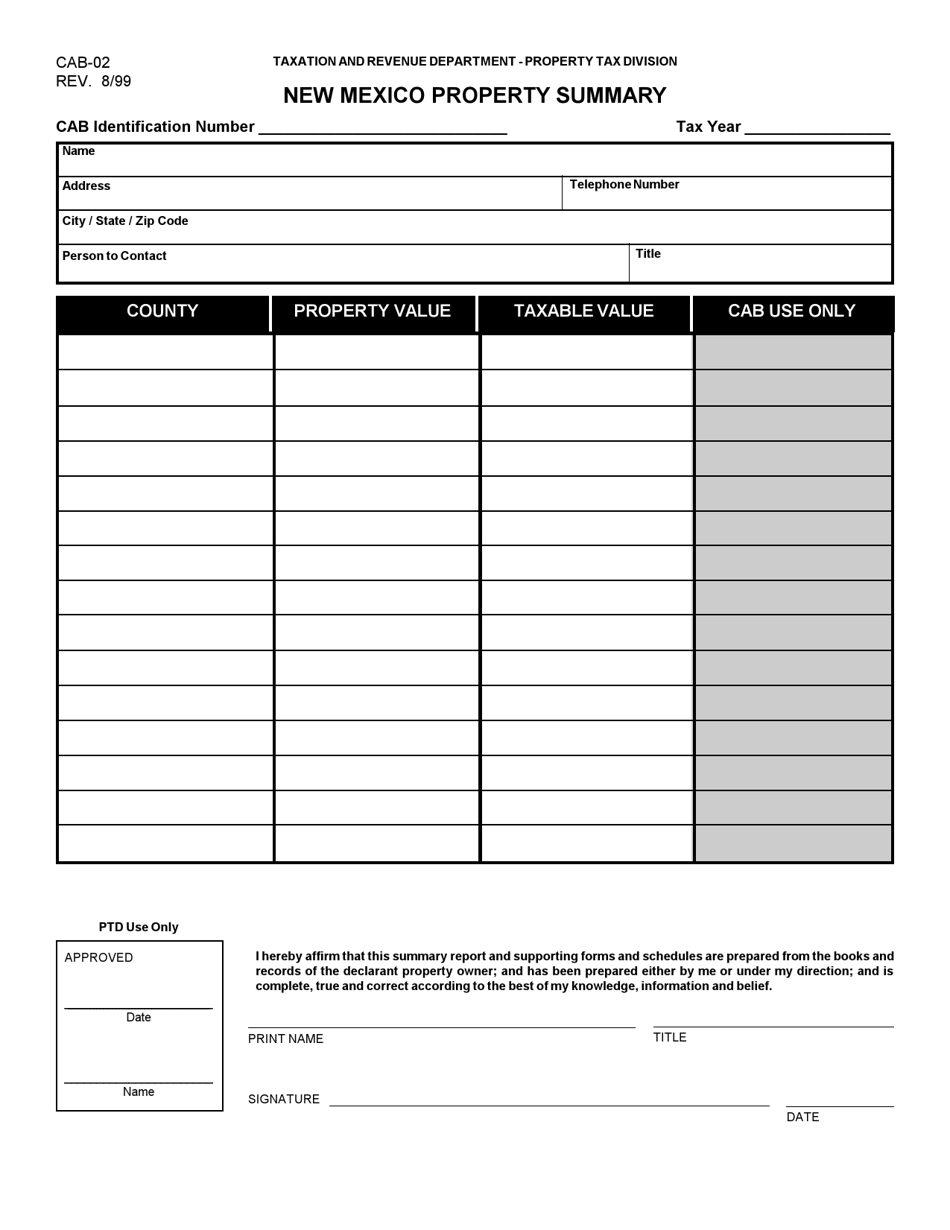

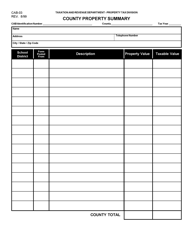

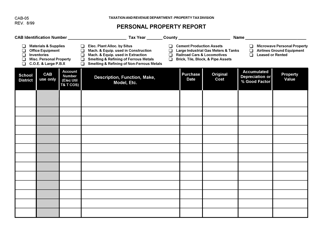

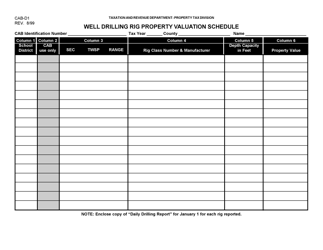

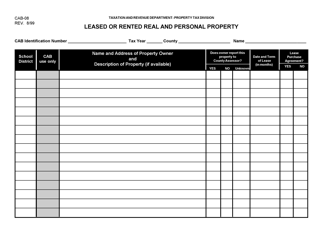

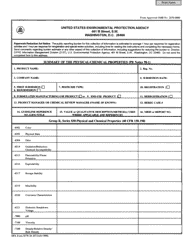

Form CAB-02 New Mexico Property Summary - New Mexico

What Is Form CAB-02?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB-02?

A: CAB-02 is a New Mexico Property Summary form.

Q: What is the purpose of CAB-02?

A: CAB-02 is used to summarize information about a property in New Mexico.

Q: Who uses CAB-02?

A: CAB-02 is used by property owners, real estate agents, and other individuals involved in property transactions.

Q: What information is included in CAB-02?

A: CAB-02 includes details such as property address, legal description, assessed value, and tax information.

Q: Is CAB-02 mandatory?

A: CAB-02 may be required by certain entities involved in property transactions, but it is not mandatory for all property owners.

Q: Can I use CAB-02 for properties in other states?

A: No, CAB-02 is specific to properties located in New Mexico.

Q: Is there a fee for obtaining a CAB-02 form?

A: There may be a small fee for obtaining a CAB-02 form, depending on the source.

Q: Can I submit CAB-02 electronically?

A: The availability of electronic submission may vary depending on the county and specific requirements.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-02 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.